Tori Belle has filed for Chapter 11 chapter.

Tori Belle has filed for Chapter 11 chapter.

BehindMLM beforehand reported Tori Belle submitting for Chapter 11 chapter in August 2022.

That submitting pertaining to mum or dad firm LashLiner, which technically is a separate entity. Virtually talking although, each LashLiner and Tori Belle are the identical entity run by the identical folks.

The courts acknowledged this and so we simply labeled LashLiner and Tori Belle as one and the identical.

It took a yr, however nonetheless we now have Tori Belle itself having filed for Chapter 11.

A Revenue and Loss Assertion filed with Tori Belle’s chapter reveals an $456,867 operational loss as April 2023.

Tori Belle claims to have $4.6 million in property, $4.5 million of which is unsold stock.

On June twenty sixth Tori Belle filed a movement searching for permission to dump its property.

Tori Belle filed this continuing as a result of continued operations haven’t been worthwhile and a sale in bulk of most of its property whereas working will generate a larger return than a wholesale liquidation.

Tori Belle’s property include :

• Tori Belle web pages and content material

• Gross sales and advertising collateral

• Product information

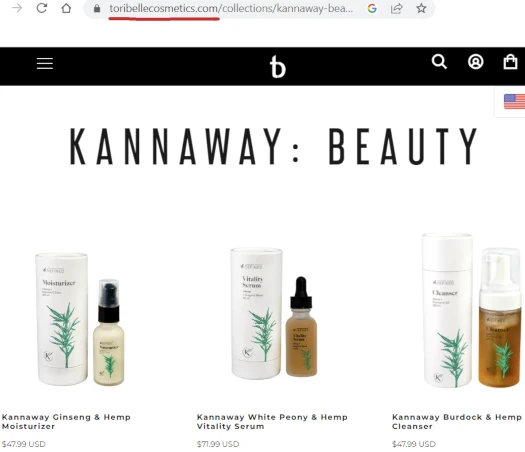

The client of the property was Kannaway.

Tori Belle, topic to Courtroom approval, has entered right into a multi-party Property and Stock Buy and Licensing Settlement, between LashLiner, Tori Belle; Laura Hunter and Bob Kitzberger, on one hand, with LashLiner and Tori Belle collectively known as “Sellers,” and Kannaway USA, LLC, on one other hand as a “Purchaser.”

Kannaway was ready to buy sure Tori-Belle non-inventory property for $1.5 million.

In trade, Tori Belle would obtain

10% of month-to-month product sales by Purchaser of Tori Belle merchandise throughout all Purchaser’s markets worldwide, payable month-to-month (the “Gross sales Override”) and can obtain proceeds from the month-to-month consigned gross sales of its Stock at Price.

I don’t know what settlement Tori Belle and Kannaway have already entered into, however I do observe that Kannaway’s merchandise are presently accessible by way of Tori Belle:

Following a listening to on July seventh, the courtroom denied Tori Belle permission to promote its property to Kannaway.

I’m probably not certain what this implies for Tori Belle going ahead. I figured CEO Laura Hunter would have addressed the brand new chapter, as she did the unique chapter final yr.

Tori Belle did host a stay on its FaceBook web page on June sixteenth, the identical day Tori Belle filed for Chapter 11.

Within the video although Hunter didn’t tackle Tori Belle’s chapter. The chapter wasn’t addressed the next week both (Hunter appears to host a stay Tori Belle broadcast as soon as per week).

It’s unclear whether or not Tori Belle distributors have been knowledgeable of current developments concerning the enterprise.

To distinguish between Tori Belle’s two bankruptcies, I’ll be referring to the unique one because the LashLiner chapter going ahead.

On LashLiner’s chapter, the court-appointed Trustee filed a movement requesting LashLiner’s Chapter 11 be transformed to a Chapter 5 on July nineteenth.

A Chapter 11 chapter permits for a enterprise to restructure its debt. A Chapter 7 is a simple liquidation.

In submitting her movement, the Trustee cited a breach of the accredited reorganization plan.

Tori Belle has didn’t make its Might, June and July 2023 funds to Creditor PIRS Capital and Lashliner didn’t docket this default as required by the Plan.

It’s my enterprise judgment that the conversion to Chapter 7 at this level is extra prone to end in a distribution to Collectors, quite than dismissal of the case. I hereby respectfully request conversion of this case from Chapter 11 to Chapter 7.

A listening to on the Trustee’s movement has been scheduled for August eleventh.

Chapter proceedings do are inclined to get complicated however we’ll do our greatest to maintain you posted.