A stability sheet provides you an summary of your small business’ monetary standing.

If you happen to run your individual enterprise or are simply stepping into accounting, you’ve seemingly seen one earlier than. Creating one may appear a bit troublesome and daunting, so, on this put up, we’ll focus on:

What’s a stability sheet?

A stability sheet is a monetary assertion that reveals an organization’s belongings, liabilities, and shareholder’s fairness, or how a lot shareholders have invested.

Line objects on both sides of your stability sheet are listed so as of liquidity, with the extra liquid objects (e.g., money and stock) listed earlier than accounts which can be extra illiquid (e.g., plant, property, and gear).

Line objects on both sides of your stability sheet are listed so as of liquidity, with the extra liquid objects (e.g., money and stock) listed earlier than accounts which can be extra illiquid (e.g., plant, property, and gear).

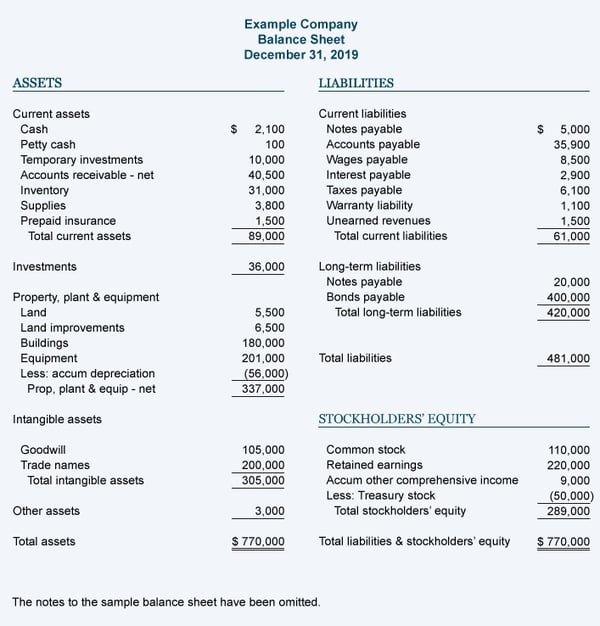

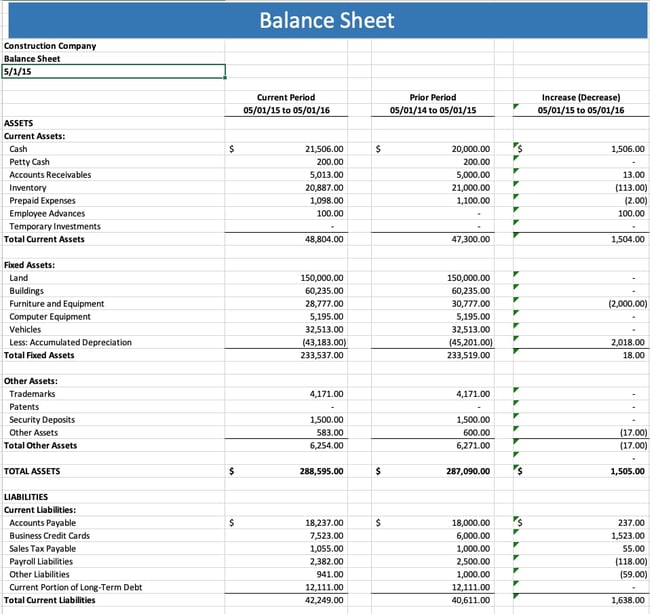

Right here’s an instance of what that appears like:

Why is the stability sheet essential?

A stability sheet is essential as a result of it reveals enterprise homeowners and buyers what an organization owns and owes throughout a selected interval. A stability sheet for a typical accounting interval (12 months) would replicate the variety of belongings and liabilities when the interval ends.

Steadiness sheets are usually used to trace earnings and spending however also can present the profitability of a enterprise to these considering shopping for shares.

Steadiness Sheet Equation

A stability sheet equation reveals what an organization owns (belongings), how a lot it owes (liabilities), and the way a lot stake or shares homeowners have within the enterprise (shareholder’s fairness). You’ll be able to calculate it utilizing the next accounting system:

Property = Liabilities + Shareholders’ Fairness

Let’s check out every one in every of these in additional element.

Three Parts of a Steadiness Sheet

A stability sheet consists of three elements: belongings, liabilities, and shareholders’ fairness. Let’s go over these one after the other.

A stability sheet consists of three elements: belongings, liabilities, and shareholders’ fairness. Let’s go over these one after the other.

1. Property

Investopedia defines an asset as “Something of worth that may be transformed into money.” In different phrases, an asset gives financial worth to companies and organizations. Property embody each present belongings and glued belongings.

- Present belongings: money and money equivalents (e.g., short-term authorities bonds, treasury payments, and cash market funds), accounts receivable, and stock.

- Fastened belongings: property, plant, gear, long-term investments, and intangible belongings (e.g., patents and licenses).

2. Liabilities

Liabilities are the other of belongings. It’s something that can incur an expense or price sooner or later — a debt or quantity owed is a legal responsibility. Each present and non-current liabilities are included within the liabilities part of the stability sheet.

- Present liabilities: accounts payable, notes payable due inside the yr, and present maturities of long-term debt.

- Non-current liabilities: long-term notes payable, deferred tax liabilities, bonds payable, and long-term debt.

3. Shareholders’ Fairness

Shareholders’ fairness, also referred to as stockholders’ fairness, is the sum of money the homeowners have invested within the enterprise. It consists of:

- Share capital: the sum of money an organization receives from its shareholders for enterprise functions.

- Retained earnings: the quantity of an organization’s income that are not distributed to shareholders as dividends — the funds are reinvested within the enterprise as an alternative.

With this info in thoughts, let’s go over the step-by-step course of of making a stability sheet.

The best way to Create a Steadiness Sheet

- Decide the time interval you are reporting on.

- Establish your belongings as of your reporting date.

- Establish your liabilities as of your reporting date.

- Calculate shareholders’ fairness.

- Examine complete belongings towards legal responsibility and fairness.

1. Decide the time interval you are reporting on.

Step one is to decide on the reporting date, or once you’re compiling the report, and a reporting interval, which is the time period you’re reporting on. A reporting interval normally has already handed.

For instance, in case your reporting interval is Q1 (January 1 – March 31), your reporting date could also be April 1 of the identical yr. Reviews are normally created on an ongoing foundation, normally on a quarterly frequency.

2. Establish your belongings as of your reporting date.

Arrange your belongings into two classes — present and glued — and characterize every asset as a line merchandise inside the applicable class. Then, subtotal your classes and complete them collectively.

3. Establish your liabilities as of your reporting date.

These can even be represented as particular person line objects inside present and noncurrent classes. Then, you will subtotal and complete these the identical manner you probably did along with your belongings.

4. Calculate shareholders’ fairness.

You will then wish to incorporate the share capital you obtain from buyers in addition to retained earnings. It’s possible you’ll want to think about in case your state of affairs requires you to think about any of the next components:

- Widespread inventory

- Most popular inventory

- Treasury inventory

5. Examine complete belongings towards legal responsibility and fairness.

On the stability sheet, belongings equal liabilities plus shareholders’ fairness. You will need your stability sheet to incorporate this calculation to offer insights into your financials.

Steadiness Sheet Instance

The picture under is an instance of a stability sheet.

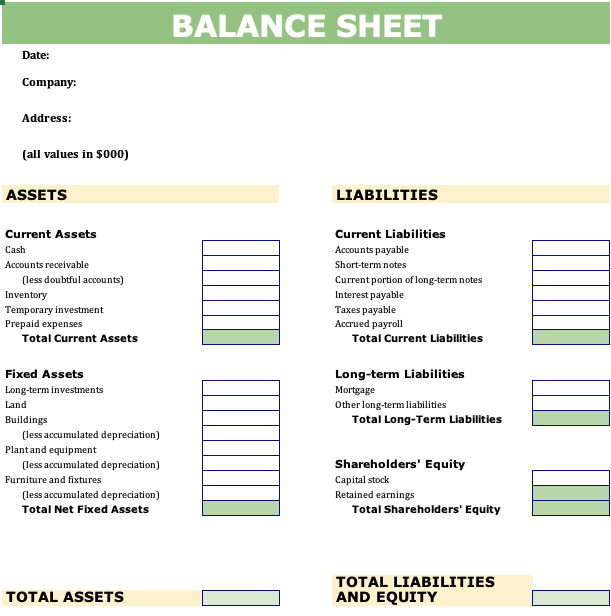

Whenever you’re prepared to start the method, the templates under may help you begin.

Steadiness Sheet Templates

Beneath are stability sheet templates that you need to use with Microsoft Excel to create one for your small business.

1. Toggl Steadiness Sheet Template

What we like:

Toggl’s stability sheet template provides an summary of your balances in a single single view. It additionally has pre-set objects for present belongings, fastened belongings, present liabilities, and long-term liabilities so, you received’t have so as to add them in your self.

2. QuickBooks Steadiness Sheet Template

What we like:

QuickBooks’ stability sheet templates permit for the entire customizations you must make to tailor it to your individual enterprise. It additionally comes with “Notes on Preparation” suggestions that can assist you work by means of the particular template, and hovering over particular column objects brings up directions to make sure you enter the suitable knowledge.

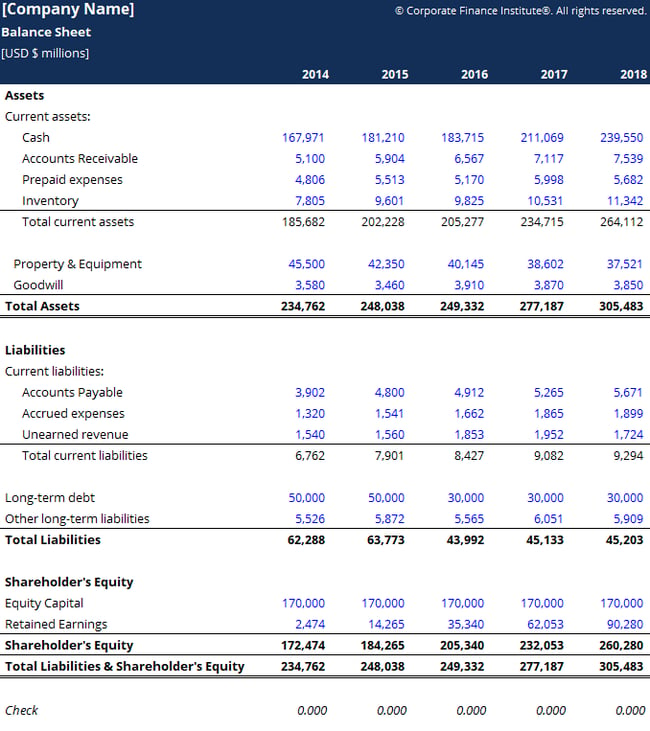

3. Company Finance Institute Steadiness Sheet Template

What we like:

This stability sheet template from Company Finance comes with preset objects to fill out for your small business and an instance stability sheet that you need to use as a reference when filling one out to your personal enterprise.

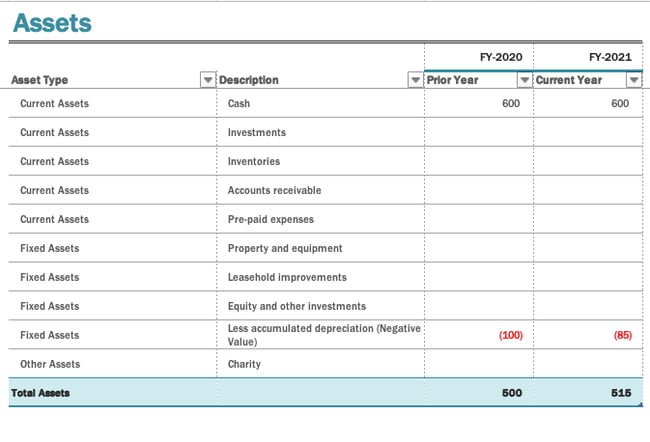

4. Microsoft Workplace 365 Steadiness Sheet Template

What we like:

What we like:

Microsoft’s stability sheet divides your sheet into three key tabs: abstract, belongings, and liabilities. This helps you retain calculations separate to eradicate confusion and to provide you an summary of balances within the abstract tab.

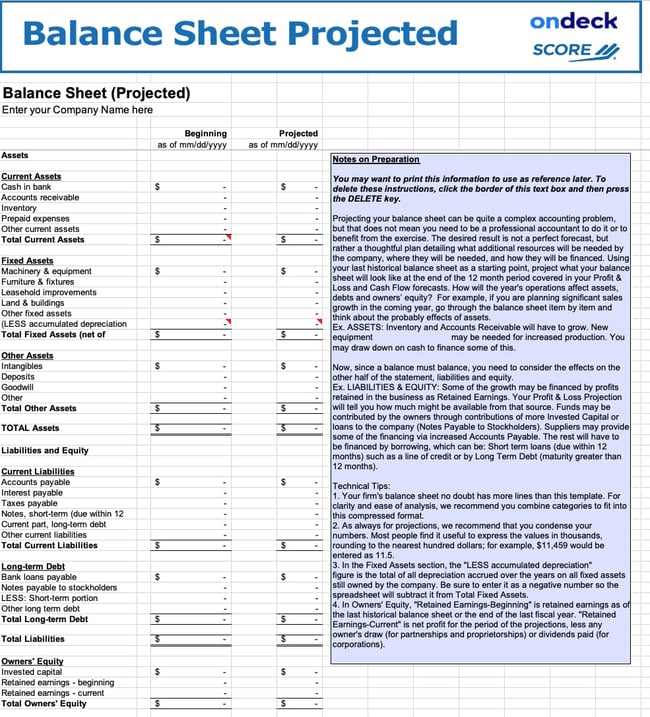

5. Rating.org Steadiness Sheet

What we like:

This stability sheet consists of notes for preparation to information you thru the arrange and calculation course of. It additionally consists of an extra class named “Different Property,” the place you may consider your small business’s intangible belongings and deposits.

Now that you just’ve created your stability sheet, how do you go about analyzing it? Let’s have a look.

Steadiness Sheet Evaluation

A stability sheet helps you establish your small business’ liquidity, leverage, and charges of return. When your present belongings are better than your liabilities, your small business is probably going in a very good monetary place and is ready to cowl your short-term monetary obligations.

A stability sheet evaluation helps you get a way of your present standing, and step one is to take a look at your stability sheets from two or extra accounting durations. In case your outcomes present that, say, there’s a big p.c lower in your organization’s money, you may be experiencing monetary issues.

You must also take a look at:

- Leverage ratio: A leverage ratio is how a lot of firm’s capital comes from debt. How does the stability sheet impression a enterprise’ leverage? One of many leverage ratios, the debt to fairness ratio, divides liabilities from shareholder’s fairness to point out the worth of a enterprise in comparison with its debt.

- Return on fairness: Return on fairness tells you the share of returns from fairness investments. To get an ROE proportion, you’d divide web earnings by the overall shareholders’ fairness.

- Return on belongings: Return on belongings reveals you the worth or profitability of a enterprise in relation to its belongings. To get a ROA proportion, you’d divide web earnings by common belongings.

These formulation inform buyers whether or not or not they may get a return on the cash they spend money on your organization.

A Steadiness Sheet Will Assist Your Enterprise Develop

The stability sheet gives an summary of your small business’ monetary standing. If your small business is doing properly, buyers can take a look at your stability sheet and see you probably have a worthwhile enterprise they’d wish to spend money on. It will possibly additionally aid you diagnose issues, pinpoint monetary strengths, and preserve observe of your small business’ monetary efficiency over time.

Editor’s word: This put up was initially printed in January 2019 and has been up to date for comprehensiveness.