Gross sales income measures the earnings introduced in by the corporate’s core enterprise actions. However whereas the definition could also be simple, calculating gross sales income requires some extra thought.

Learn this information to learn to calculate gross sales income. We’ll additionally share examples that’ll remodel you right into a gross sales metrics celebrity.

There are two forms of gross sales income: gross and internet. You would possibly see each on an earnings assertion. Nonetheless, every metric is calculated distinctly and has its personal distinctive enterprise implication.

Product sales income is the entire of all gross sales of products and companies with out considering any returns, reductions, or allowances. This determine signifies a enterprise’ skill to promote its services or products. It doesn’t essentially reveal its skill to generate revenue.

Internet gross sales income is product sales income minus any returns, reductions, or allowances. Internet gross sales is a extra correct illustration of the money an organization brings in from clients.

You could be questioning, what are returns, reductions, and allowances?

Returns are frequent within the retail enterprise and are exactly what you anticipate. A return is when the corporate permits a buyer to return the product they bought for a full refund.

Reductions are additionally self-explanatory. A reduction is a discount within the primary worth of products and companies.

Allowances are worth reductions that the client initiates due to a problem with their order. That may vary from issues with high quality, incorrect gadgets, or longer than anticipated delivery occasions.

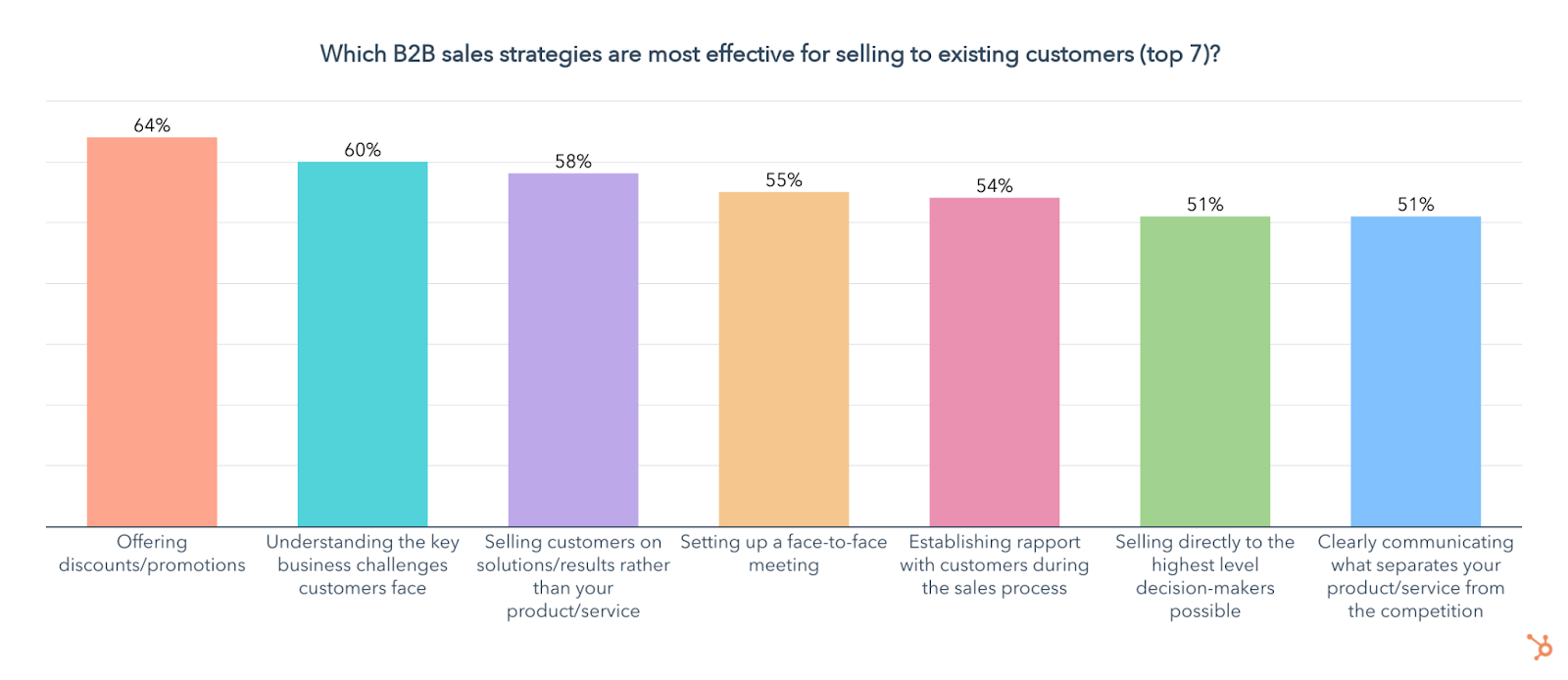

Two out of three salespeople provide reductions and promotions. You would possibly marvel, “Why would they try this? It detracts from gross sales income!” Nonetheless, providing reductions ends in main advantages, like elevated gross sales and buyer loyalty.

The simplest types of reductions for changing new clients are bundling a set of merchandise, in addition to providing free trials, loyalty applications, offers for best-fit clients, and sign-up promotions. Despite the fact that it’s subtracted out of your gross sales income, don’t be afraid of reductions. They’ll enhance your complete variety of gross sales, leading to increased gross sales income.

How you can Calculate Gross sales Income [Formula]

Gross sales income is calculated in another way if your organization sells services or products, however the primary idea stays the identical/a>.

Use one of many following formulation to calculate gross sales income.

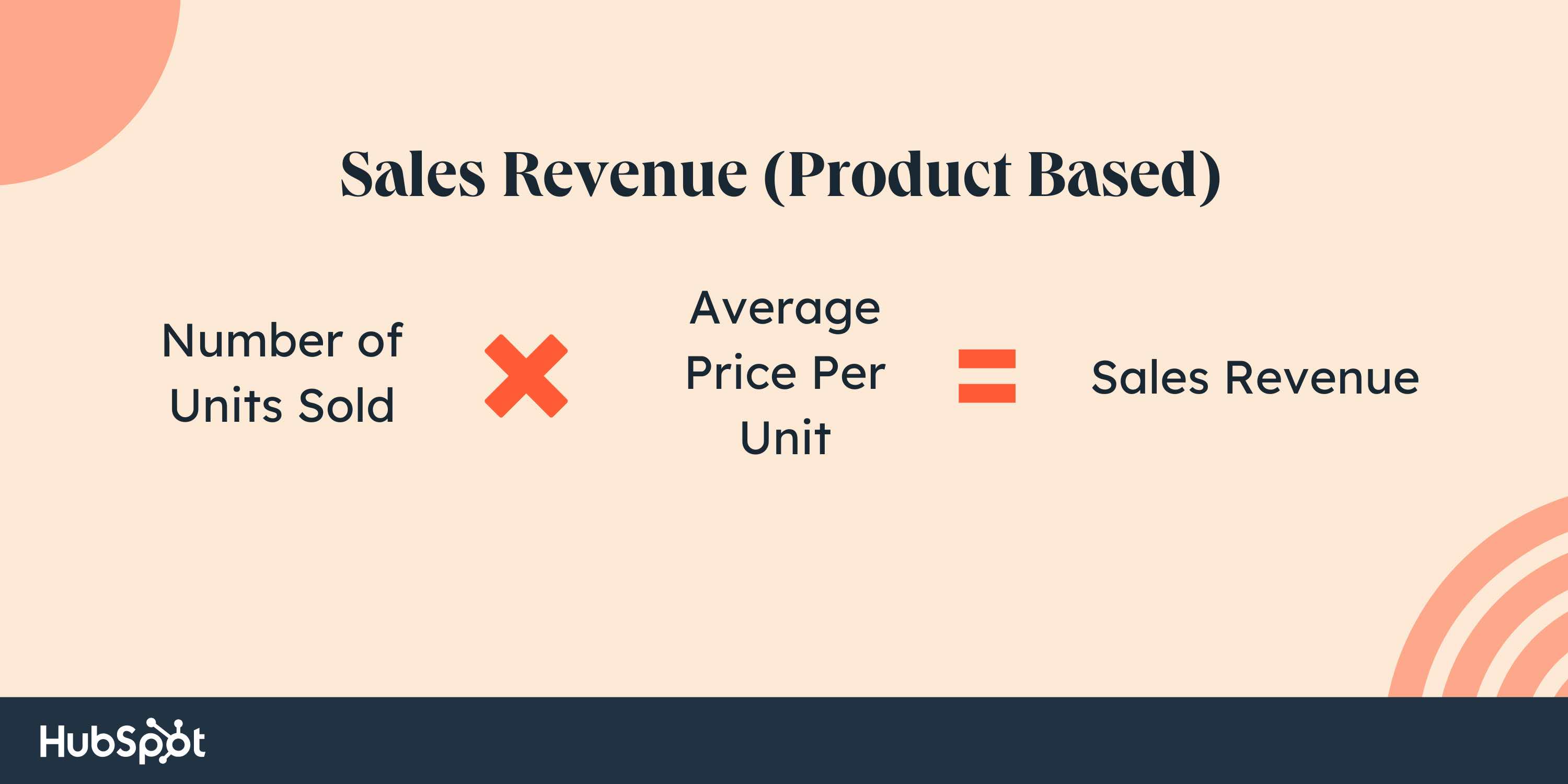

Gross sales Income for Product-Primarily based Firms

Variety of Models Bought x Common Worth = Gross sales Income

Gross sales Income for Service-Primarily based Firms

.jpg?width=3000&height=1500&name=sales-revenue-service%20(1).jpg)

Variety of Clients x Common Worth of Providers = Gross sales Income

Some gross sales professionals would possibly use the phrases “income” and “gross sales” interchangeably in informal dialog, however you must differentiate between these two accounting phrases.

- Gross sales are all the cash an organization receives by promoting services or products.

- Income consists of all the cash an organization takes in, interval.

Any cash coming in from outdoors of core enterprise operations (promoting services and products) is taken into account nonoperating earnings and is included in income however not gross sales.

Briefly, income can come with out gross sales, however all gross sales are inherently income.

Gross sales Income Examples

Calculating Product Income

Let’s say that within the month of September, the boutique handmade scrunchie firm Sunday Scrunch bought the next:

- 100 medium blue scrunchies for $3.50/unit.

- 150 small cheetah-print scrunchies for $3.00/unit.

- 50 giant neon orange scrunchies for $4.00/unit.

What’s their gross sales income for September? Let’s do some math.

- Small Scrunchies: 150 bought x $3.00 = $450

- Medium Scrunchies: 100 bought x $3.50 = $350

- Massive Scrunchies: 50 bought x $4.00 = $200

Then add all of those values collectively.

- $450 + $350 + $200 = $1,000

Sunday Scrunch’s September gross sales income can be $1,000.

Calculating Service Income

If your organization sells companies versus merchandise, the calculation is simply as easy.

Let’s say that Elite Consulting Providers had 250 clients in September, with their common worth of companies being $20,000. What’s their month-to-month gross sales income? Test it out.

Gross sales Income = Variety of Clients x Common Worth of Providers

- Variety of Clients = 250

- Common Worth of Providers = $20,000

- 250 x $20,000 = $5 million

Elite Consulting Providers’ September income can be $5 million.

Not a foul month!

Why Is Gross sales Income Necessary?

Gross sales income is the primary metric reported on an earnings assertion — and for an excellent motive. It represents the start line for corporations to find out their internet earnings. Your internet earnings is the idea for business-critical calculations and reviews, together with earnings per share and money circulate statements.

To get from gross sales income to internet earnings, you first subtract the price of items bought from gross sales income to seek out gross revenue.

- Gross Revenue = Gross sales Income – Price of Items Bought

Then, subtract any depreciation and SG&A (promoting, common, and administrative) bills from gross revenue to seek out the working margin — additionally known as earnings earlier than curiosity and taxes or EBIT. SG&A can embody lease, utilities, advertising and marketing and promoting, salaries, and different working prices.

- Working Margin (EBIT) = Gross Revenue – Depreciation – SG&A

Subsequent, subtract curiosity bills from the working margin to seek out pretax earnings.

- Pretax Revenue = Working Margin (EBIT) – Curiosity Bills

Lastly, subtract taxes from pretax earnings to reach at internet earnings.

- Internet Revenue = Pretax Revenue – Taxes

Internet earnings is a necessary metric for gauging the well being of a enterprise and planning for its future, and all of it begins with everyone’s favourite accounting determine: gross sales income.

Gross sales income has earned its place on the prime line of all earnings statements. It is without doubt one of the most influential metrics in enterprise evaluation and forecasting. In truth, different figures are sometimes expressed as a proportion of gross sales income.

Lengthy story brief, gross sales income is a massively essential determine in figuring out the well being and way forward for your small business. Now you recognize what it’s, why it’s so beloved, and find out how to calculate it. Completely happy accounting and glad gross sales!

![]()