On this weeks weblog, I’m going to cowl client confidence. I figured I’d make this the primary of quite a few financial indicator posts. We’re continuously bombarded by phrases like this and their “believed” have an effect on on the financial system. I determine, why not flush them out a bit extra and particularly how they have an effect on gross sales.

What’s the Client Confidence Index?

Client confidence is an financial indicator measuring how the overall populace feels in regards to the financial system and their very own particular person monetary scenario. The idea goes like this, if persons are optimistic or be ok with the financial system and their private scenario, they may spend extra and subsequently hold the financial system shifting. If they’re pessimistic, properly the idea is, folks will tighten their belts and financial progress will sluggish.

There are a number of client confidence monitoring indicators, nonetheless the 2 most generally adopted and used are the CCI or Client Confidence Index and the MCSI or The College of Michigan Client Sentiment Index.

The CCI surveys 5000 folks every month and asks them 5 questions from these areas:

- present enterprise situations

- present enterprise situations for the following 6 months

- present employment situations

- present employment situations for the following 6 months

- complete household revenue for the following 6 months

The Convention Board has been doing this on behalf of the USA since 1967.

The MCSI relies on a month phone survey of U.S. households. It additionally asks 5 questions:

- private monetary scenario now and a 12 months in the past

- private monetary scenario on 12 months from now

- general monetary situation of the enterprise for the following twelve months

- general monetary situation of the enterprise for the following 5 years

- present perspective towards shopping for main home items

There’s additionally the Bloomberg Client Consolation Index and the Client Confidence Common, however I’m not going to enter these. You get the purpose.

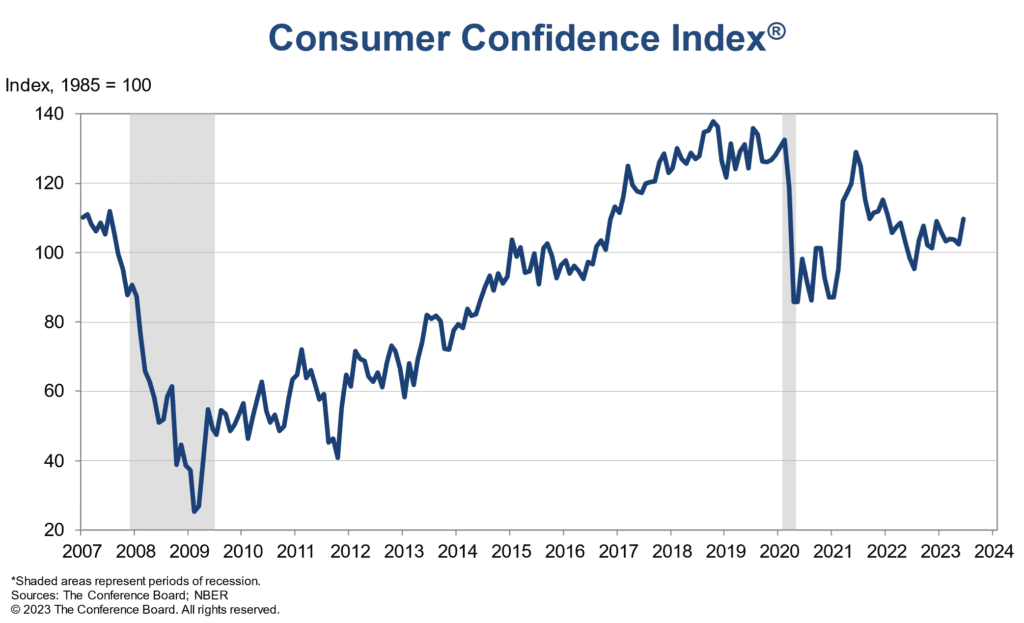

Here’s a graph of client confidence over the previous a number of years.

Discover how confidence drops simply earlier than a recession. Additionally discover how low it was throughout 2008 and 2009. Robust years. Though many name it a number one indicator, if you happen to discover on this chart client confidence not often leads a return to progress, however reasonably responds to it. In 1980, 1981, 1990, client confidence began falling after we entered a recession and didn’t begin shifting again up till after the recession was over. Not a lot of a number one indicator. That being mentioned, banks, retail, producers, authorities companies, and buyers use it for planning functions and to forecast downturns or will increase in client spending.

How does Client Confidence have an effect on Gross sales?

Like all issues related, when firms see client confidence fall they then pull again themselves, retail reduces stock, banks tighten lending, producers sluggish manufacturing, residence builders scale back development begins. All this pull again reduces the spend of those firms and it’s virtually at all times salespeople on the finish of the rope. In the event you promote to builders, they’re shopping for much less from you. In the event you promote to retailers, they’re tightening their belts. Quota simply turned a bit tougher. In the event you promote to banks, you higher begin getting inventive. Firms purchase from salespeople, once they cease spending it’s more durable so that you can make quota.

Client confidence isn’t going to make or break your online business, however following it may result in alternatives others aren’t in search of.

WITCE (What’s the Buyer’s Expertise) Client Confidence Index Questions:

- Does client confidence have an effect on your prospects shopping for habits?

- Are you aware how client confidence impacts your capacity to make quota?

- Do your prospects comply with the buyer confidence indexes and in that case, how do they incorporate the symptoms into their choice making?

- What occurs to your prospects enterprise if their is a decline in client confidence?

- Are there developments inside your prospects or prospects enterprise which are tied to client confidence?

- What would you do in case your buyer began to cut back their purchases and sluggish their shopping for due to the financial system? Would you already know what to do?

Client confidence supplies good perception into how folks really feel about their monetary properly being and their capacity to pay their payments, go on trip, hold their job and keep afloat. How good it’s at “indicating” the place the financial system is heading I couldn’t inform you. However figuring out what your prospects suppose and the way they view client confidence, that’s most likely a fairly good concept.