Estimated learn time: 13 minutes, 34 seconds

SaaS billing software program automates a number of of the varied points of the recurring billing course of — fee processing, success, dunning, and extra.

On this piece, we’ll be evaluating 7 SaaS billing options that we separate into three classes:

- Subscription administration: Such a software program permits you to automate free trials, recurring fee schedules, and the dunning course of. You’ll nonetheless want a separate resolution for fee processing, taxes, chargebacks, and extra.

- Fee processing: These options collect fee particulars and facilitate the transaction between two events. With many fee processors, you’ll want further software program to handle complicated recurring funds, taxes, chargebacks, dunning, and extra.

- Retailers of File (MoR): Having your billing resolution additionally act because the MoR means they maintain the whole SaaS billing course of for you, together with gathering and remitting native and worldwide taxes (corresponding to VAT and native gross sales tax), staying compliant with native legal guidelines and rules, chargebacks, and rather more. And not using a MoR, your organization must maintain observe of and guarantee compliance with all native taxes and rules in any nation or area the place you have got clients.

Desk of Contents

FastSpring handles every thing from subscription administration to worldwide fee processing for SaaS corporations. In case you suppose FastSpring may very well be the proper SaaS billing resolution for your enterprise, join a free account or request a demo right now.

FastSpring: Your MoR for All-in-One SaaS Billing

Right here’s an outline of what it seems to be like for FastSpring to behave as your MoR:

Your clients go to your web site to pick out their software program subscription plan. Then, after they go to checkout, FastSpring takes over the method and completes the transaction. It really works similar to most different widespread SaaS fee processors aside from one vital characteristic: Fastspring acts as your service provider of document.

The good thing about that is twofold:

- FastSpring relieves you of the burden of paying native consumption tax, staying updated with native transaction legal guidelines, managing subscriptions, fee processing, and extra. If one thing goes improper with taxes, native compliance, chargebacks, authorization charges, and so on., FastSpring takes the result in remedy the difficulty in your behalf.

- Your whole SaaS billing resolution may be dealt with from one place — your FastSpring dashboard. Plus, you’re solely charged one flat fee for all providers (extra on this later).

Subsequent, we’ll take a more in-depth have a look at how FastSpring helps you with each bit of the billing course of. Particularly:

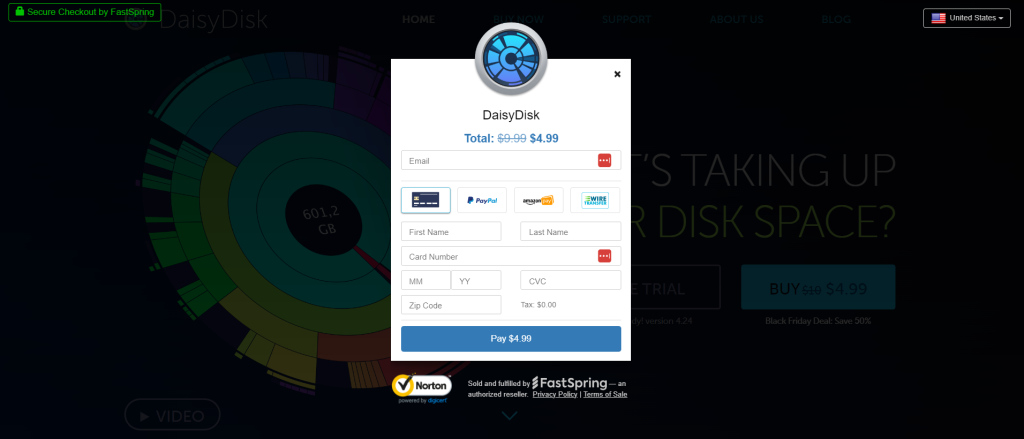

Checkout: Full Checkout Customization for Increased Conversions

Many corporations lose potential clients as a result of there’s an excessive amount of friction of their checkout course of. For instance, if the checkout display doesn’t visually match the branding of the remainder of the web site, the potential buyer is much less prone to belief that the checkout is safe. Or, a buyer could determine to not purchase since you don’t settle for the kind of fee technique they’ve accessible (an issue particularly widespread with worldwide clients).

Most fee processors will offer you checkout templates and permit for a couple of easy customizations corresponding to including your emblem. Nonetheless, these checkout templates not often present the customization skills it’s worthwhile to actually optimize your checkout for prime conversion charges.

FastSpring, alternatively, supplies branding instruments, CSS overrides, and a JavaScript library of widespread ecommerce options so you have got full management over every facet of your checkout.

Listed below are a couple of different options that FastSpring gives that can assist you optimize your checkout:

- Most well-liked fee strategies: Whereas Visa or PayPal could also be widespread within the U.S., different types of fee are in style in different nations. In case you don’t supply the popular fee technique that consumers are used to, you’ll convert fewer of them to clients. However it may be very time-consuming and a drain on sources so as to add new fee strategies. FastSpring makes it potential so that you can add tons of most popular fee strategies across the globe instantly (extra on this in a later part).

- Textual content translations: In case your checkout isn’t in the identical language as the remainder of your web site, it’s possible you’ll lose some clients. With FastSpring, you possibly can let clients select their most popular language at checkout or let FastSpring select the suitable language primarily based on their location.

- Native forex conversions: Some clients will probably be unwilling to buy in the event that they don’t know (or have to determine for themselves) what the software program will price of their native forex. FastSpring solves this by mechanically changing the value to the native forex at checkout. Alternatively, you possibly can set a customized value for every forex.

- Versatile integration choices: A part of selecting the best checkout movement is deciding whether or not to embed it in your web site or redirect clients to a separate web site. FastSpring supplies you with three choices: 1) Embed the checkout straight in your webpage, 2) insert a pop-up over your webpage, and three) redirect clients to a separate webpage that’s totally branded to your enterprise. The primary two choices solely require a couple of traces of HTML and Javascript and the third choice is hosted by FastSpring. We are going to host your whole storefront and checkout for you along with your branding.

- Personalised help: In case you want further help, our staff of software program engineers may also help design and develop the proper checkout for your enterprise (no matter how large or small your enterprise is).

Be aware: We additionally present a checkout template that has been optimized for conversions, nevertheless, many companies discover that it’s straightforward to implement a customized resolution with FastSpring.

DaisyDisk Case Research: Learn the way DaisyDisk used the FastSpring pop-up checkout to enhance the client expertise on this case examine.

Fee Processing: Enhance Authorization Charges With Localized Fee Gateways

Ceaselessly, clients attempt to purchase however the fee technique will get declined or takes too lengthy to finish so that they don’t observe by with the acquisition.

FastSpring helps enhance authorization charges so you possibly can earn extra income in a number of methods:

- Fee gateway rerouting: If a fee fails on the primary try, FastSpring mechanically retries the fee utilizing a secondary gateway — all with out you or anybody in your help staff having to intervene. This typically solves fee failures because of connectivity or system points.

- Managing most popular fee suppliers: As we talked about earlier, supporting new fee strategies generally is a big drain on sources. Every card community and issuing financial institution has totally different tolerance ranges for fraud and chargebacks and totally different guidelines for the way a transaction takes place. In case you aren’t in compliance with these necessities, the cardboard community will seemingly cease authorizing funds. FastSpring takes on the duty of staying compliant with numerous fee suppliers which implies we deal with fraud, chargebacks, and extra for you.

- Localizing fee processing: Card networks usually tend to authorize funds despatched by a neighborhood fee processor. For instance, if the customer is in Italy, the fee processor ought to have a authorized entity in Italy for increased authorization charges. FastSpring works with fee processors across the globe to make sure the vast majority of funds are localized.

Associated learn: Worldwide Recurring Funds (How We Deal with It for You)

Amassing and Remitting Consumption Tax: Broaden Globally With out Hefty Fines

Previously, many nations didn’t require consumption taxes on digital items. Because of this, SaaS companies didn’t want to fret about gathering and remitting consumption taxes, nevertheless, that’s not the case. Moreover, VAT and gross sales tax are nearly all the time calculated primarily based on the placement of the client, not the placement of the enterprise. Which means that SaaS corporations not solely have to gather VAT and gross sales tax, however in addition they should study the tax legal guidelines for each jurisdiction that their clients dwell in.

Some SaaS billing software program will enable you to acquire tax however, in the end, you’ll be chargeable for gathering and remitting the correct quantity on the proper time. It is a big job for any enterprise.

As a result of FastSpring acts as your MoR, we deal with all points of gathering and remitting consumption tax for you.

FastSpring mechanically calculates the proper sort and quantity of tax and provides it to the customer-facing value at checkout (we additionally help tax-exempt transactions and different particular circumstances). On the finish of every tax interval, we file taxes with every jurisdiction. We’ll additionally take the lead in audits.

FlowMapp Case Research: Learn the way FlowMapp greater than doubled its income by increasing globally with FastSpring.

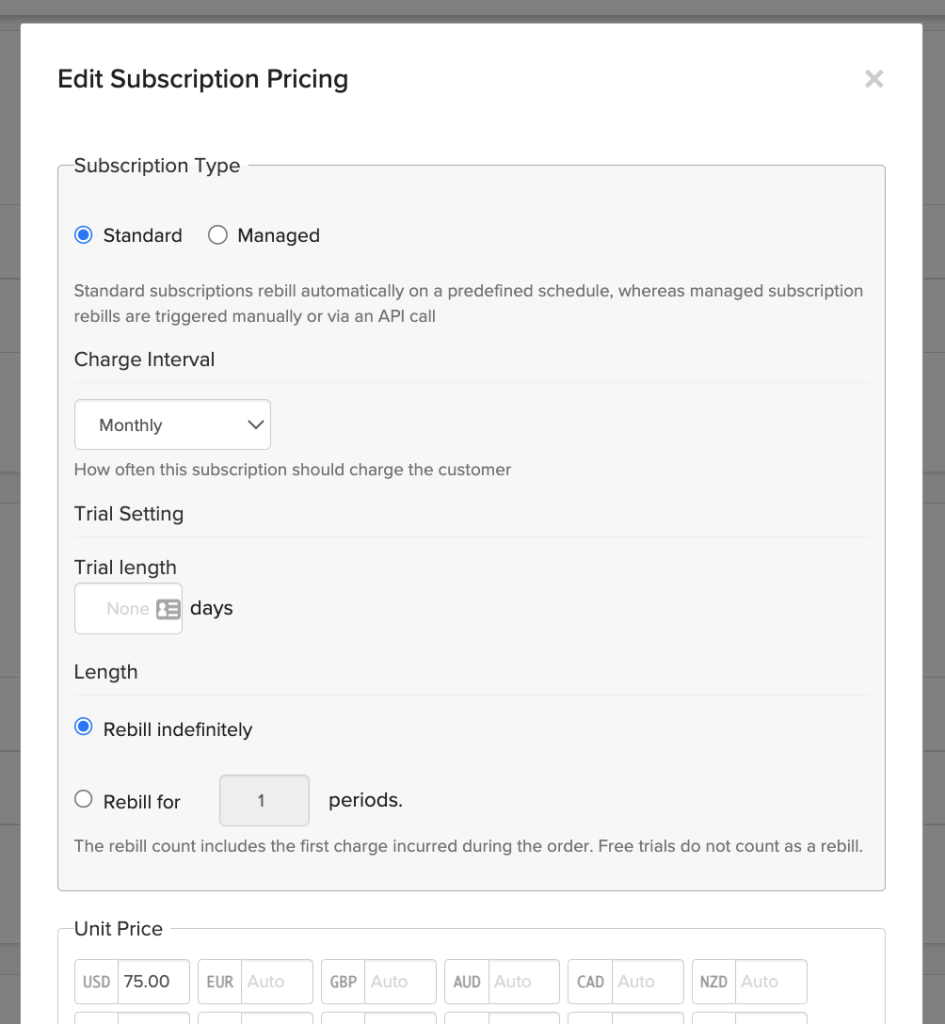

Subscription and Recurring Billing Administration: Create Customized Trials and Subscriptions Whereas Staying Compliant With Native Jurisdictions

There are various subscription administration software program accessible that provide versatile choices for creating trials and recurring subscription plans. With the proper trial and recurring billing mannequin, you possibly can win extra clients and improve income.

Nonetheless, your subscription plans will solely achieve success in the event that they adhere to native legal guidelines and rules. For instance, many states, provinces, and nations don’t permit auto-pay for transactions over a specific amount.

Most subscription administration options will notify you after they study modifications to legal guidelines and rules, however you’re in the end accountable. In case you don’t adhere to those ever-changing legal guidelines and rules, you could possibly face heavy fines or be prevented from transacting in that area.

FastSpring relieves you of this burden by taking full duty for adhering to native transaction legal guidelines and rules.

Our staff of authorized specialists keep updated on all related legalities and ensure all the mandatory procedures are in place for gathering funds. You can begin promoting in 200+ areas nearly immediately as a result of we’ve already established the mandatory processes in every area.

Moreover, FastSpring has a wide range of pre-configured trial and subscription choices so you possibly can create customized options with out code. Or, you should use the API and webhooks library to construct complicated subscription logic and integrations.

Listed below are a couple of examples of the kinds of trials and billing logic you possibly can create with FastSpring:

- Free or paid trials

- Trials with or with out gathering fee particulars

- Trials that mechanically renew to a paid plan

- Subscription intervals of any size

- Prorations mid-cycle

- One-time buy added to a recurring fee

- Upsells, cross-sells, reductions and extra

Retention Administration: Scale back Involuntary Churn With Proactive Dunning

Since involuntary churn is among the foremost methods subscription-based corporations lose clients, most SaaS billing software program gives fundamental retention administration options corresponding to retrying failed funds or electronic mail notifications despatched to clients after a failed fee. Nonetheless, these options are solely useful after a fee has failed.

FastSpring permits you to activate proactive notifications that remind the client to replace fee particulars earlier than the transaction takes place. In our expertise, these proactive reminders can considerably scale back the variety of funds that fail within the first place.

As soon as a fee has failed, you possibly can select to mechanically ship out reminders two, 5, seven, 14, and 21 days after a fee failure. In the course of the 21 days, your buyer’s service gained’t be disrupted. By sending out frequent reminders and persevering with the service, clients will probably be extra prone to replace their info which reduces involuntary churn.

FastSpring supplies a self-serve portal the place your clients can replace their info and improve or downgrade their subscriptions. By letting clients handle their very own accounts, there’s much less friction within the buyer expertise which implies extra income. The self-serve portal may be custom-made to match your model identification however it’s managed by our staff so your staff doesn’t have to fret about it.

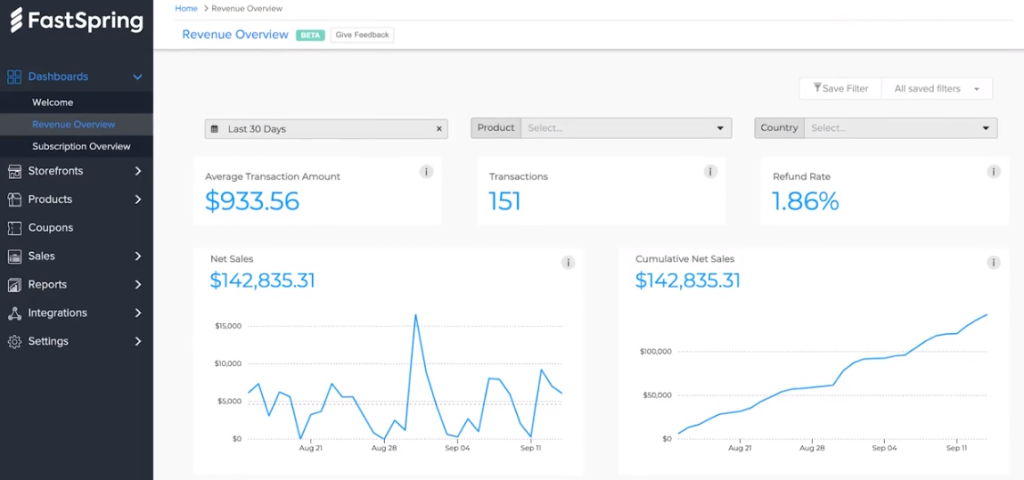

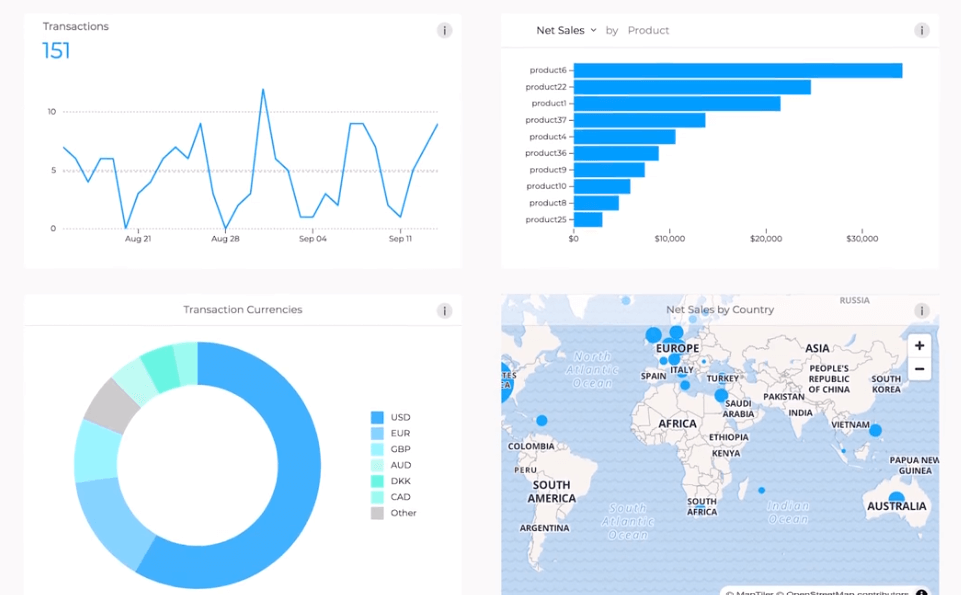

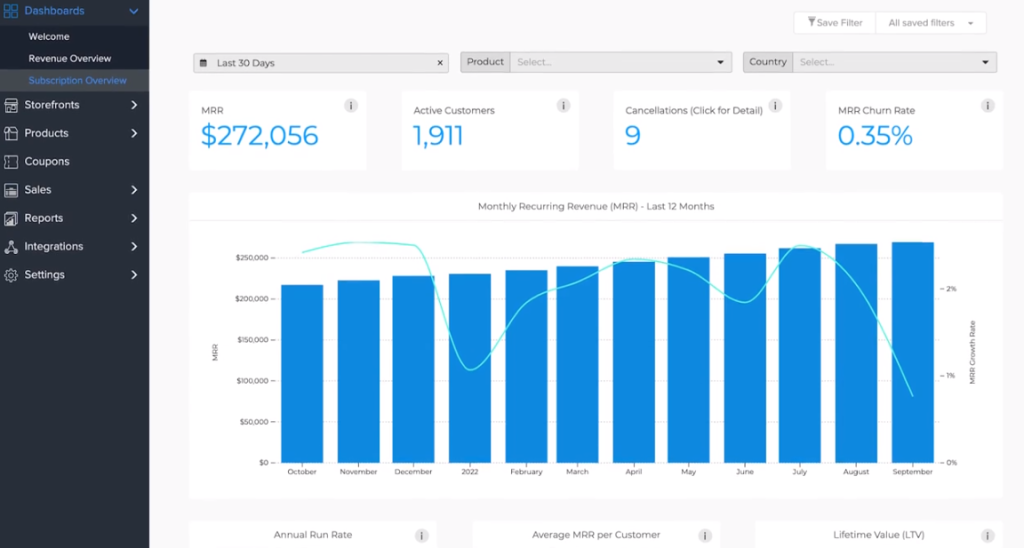

Analytics and Reporting: Simplify Enterprise Choices

FastSpring’s analytics and reporting characteristic permits you to perceive how every product contributes to your backside line, what coupons or promotions are working, which subscription fashions generate probably the most income, and rather more.

The income overview dashboard provides you a whole overview of money movement, together with:

- The place your clients are positioned

- What currencies and fee strategies clients desire

- Web gross sales by product

- Whole transactions by nation

- And extra

The subscription overview dashboard permits you to dig deeper into your month-to-month recurring income (MRR) and consists of SaaS metrics, corresponding to:

- Upsells, cross-sells, and add-ons

- Lengthy-term worth of every buyer

- Whole buyer churn

- When within the billing cycle churn occurs most frequently

- And extra

With FastSpring’s reporting characteristic, you possibly can create and save customized experiences which lets you have the information you want, while you want it. Our staff may also help you utilize these experiences to search out the solutions it’s worthwhile to develop and optimize your SaaS enterprise. Lastly, you possibly can share any report with key stakeholders by way of the FastSpring dashboard or as a CSV, PNG, or XLSX spreadsheet export.

SocialBee Case Research: Learn the way SocialBee doubled its MRR with FastSpring.

Plan for the Future With Flat-Price Pricing

With most SaaS billing software program, you’ll want so as to add on different software program options or improve to the costliest plan to get the functionalities you want.

Alternatively, FastSpring is a whole fee resolution so that you gained’t want any further billing software program. Plus, all of FastSpring’s providers are included in a single flat-rate value (with none migration charges).

Our staff works with you to search out an inexpensive value primarily based on the quantity of transactions you progress by FastSpring, and also you’ll solely be charged when transactions happen.

Join a free account or request a demo right now to see how FastSpring may also help you go additional, sooner.

3 Subscription Administration Platforms

Chargebee: Constructed for Advanced Subscription Logic

Chargebee is a well-liked alternative for subscription billing and income administration. Chargebee helps a number of fee varieties and fee gateways, nevertheless, you’ll be chargeable for partnering with and configuring each.

A few of Chargebee’s options embrace:

- Self-serve and automatic subscription fashions

- Automated billing and invoicing

- Versatile pricing plans

- Quote administration instrument

- Sensible dunning

- PCI-compliant checkout

Chargify: Subscription Administration for B2B SaaS

Chargify is subscription billing software program constructed particularly for B2B SaaS. On the time of writing, Chargify is within the technique of partnering with SaaSOptics to turn out to be a brand new software program firm, Maxio. By way of this partnership, Chargify clients can have entry to fee gateways, nevertheless, you’ll nonetheless want a separate resolution for taxes and authorized compliance.

Different notable Chargify options embrace:

- Dozens of trial and pricing fashions

- Customized join experiences

- Automated dunning

- Self-service analytics suite

- Income recognition

Recurly: Helps A number of Fee Gateways

Recurly is a subscription and billing platform for optimizing your development technique. Recurly advertises the flexibility to simply combine with numerous fee gateways and service provider accounts, nevertheless, you continue to should handle and pay for these third-party providers on prime of your Recurly plan.

Recurly’s choices embrace:

- Customizable subscription fashions

- Automated recurring invoicing

- Income restoration instruments

- Clever retention

- Subscription analytics

3 Fee Processors

Verifone: Fee Platform for Enterprises

Verifone (previously 2Checkout) permits you to select between a MoR mannequin and fee processing mannequin. Though startup corporations could possibly use their providers, Verifone is geared extra towards giant enterprises.

Verifone’s foremost options embrace:

- Reporting and analytics

- International tax and monetary providers

- Danger administration and compliance

- B2B quote builder

- Channel companion administration

Stripe: Nicely-Recognized Fee Processor

Stripe is a fee processor for on-line and in-person transactions. Though Stripe gives a couple of subscription administration options, they typically suggest integrating with Chargebee for extra strong recurring billing options — which implies you’ll should handle and pay for 2 platforms.

A few of Stripe’s different options embrace:

- Checkout

- Fraud and threat administration

- On-line funds

- In-person funds

- Subscription administration

- Digital and bodily card issuing

- Subscription enterprise spend administration

Braintree: PayPal’s Answer for SaaS

Braintree by PayPal is a fee processor that helps Venmo (within the US), Apple Pay, and Google Pay. Additionally they supply some SaaS subscription administration options.

Different notable choices by Braintree embrace:

- Service provider accounts

- Optimized checkout movement

- Versatile threat mitigation choices

- Analytics on the subscription lifecycle

- Third-party integrations for recurring billing, accounting, and extra

FastSpring is extra than simply billing software program — we’re your Service provider of File. In case you’d prefer to study extra about how one can handle subscription billing, fee processing, and extra from one platform, join a free account or request a demo right now.