Sustainability has turn into a main focus of corporations around the globe—due to client expectations, in fact, but in addition as a enterprise technique to construct stakeholder belief that can strengthen resilience. However to the latter level, new analysis from management consultancies Diligent Institute and Spencer Stuart exhibits that almost half (45 %) of company administrators globally say they want better perception into how their firm’s sustainability targets really hyperlink to company technique.

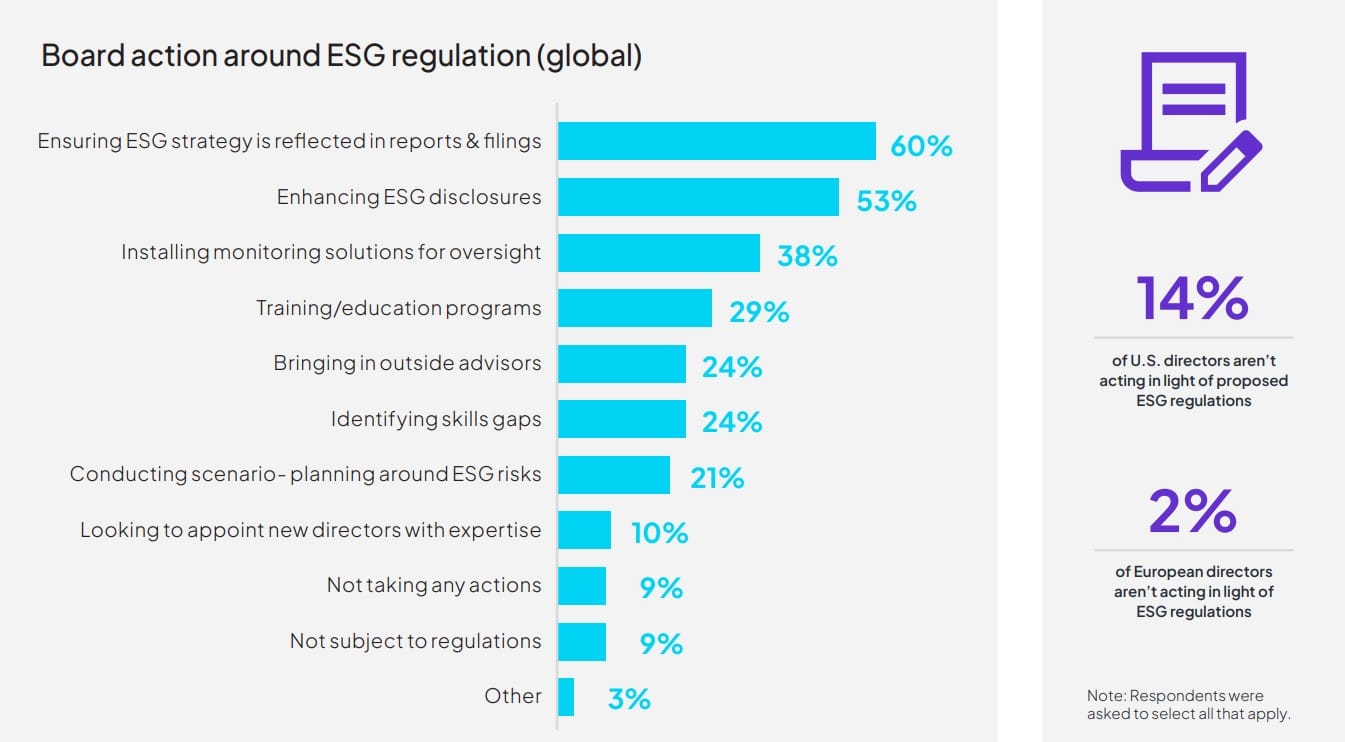

The corporations’ second annual Sustainability within the Highlight report, based mostly on a survey of almost 1,000 company administrators globally, additionally notes that this name for readability on what environmental, social and company governance (ESG) means for the enterprise comes amid heightened disclosure expectations and necessities, with 60 % of administrators taking motion to make sure their ESG technique is mirrored in annual experiences, and 53 % enhancing ESG disclosures.

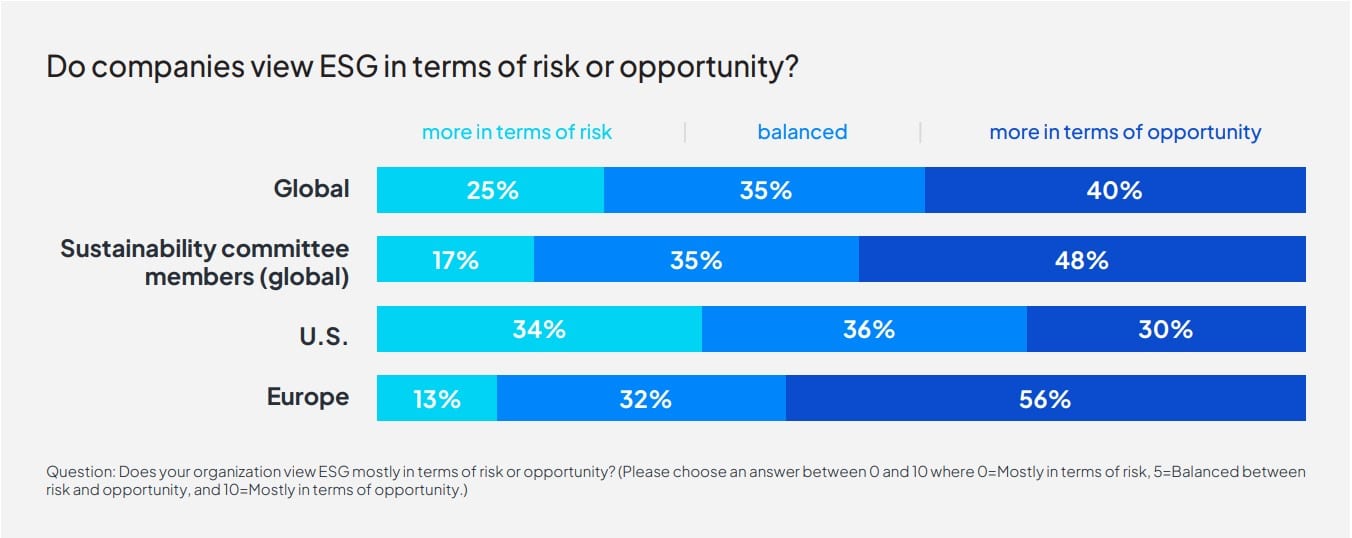

Regardless of ongoing technique challenges, the report reveals that almost all corporations globally view ESG by way of alternative than danger—however there’s a geographical divide, as European corporations had been discovered to be extra prone to view ESG as a chance in comparison with their U.S. counterparts (56 % in comparison with 30 %). In actual fact, U.S. corporations usually tend to view ESG as a danger than European corporations (34 % in comparison with 13 %).

“Whether or not you deal with ESG as a danger or alternative, or each, profitable organizations want to know their knowledge to make sure they’re staying compliant with disclosure necessities and assembly the expectations of shareholders and stakeholders,” mentioned Lisa Edwards, govt chair of Diligent Institute, in a information launch. “These findings recommend that boards are taking sustainability severely, and on the lookout for better readability into the way it elements into their total company technique.”

Different findings from the report embody:

The largest obstacles to ESG progress middle on technique

- 22 % of administrators point out competing enterprise or strategic subjects on the board agenda, and the identical quantity report a lack of readability for what ESG means to the enterprise.

- Solely 2 % of administrators establish public backlash towards ESG as being one of many largest obstacles to ESG technique and implementation.

Many organizations report plans to strengthen their deal with ESG within the subsequent 5 years

- 90 % of organizations have integrated environmental targets or metrics into their enterprise, and 87 % have finished the identical for social targets/metrics.

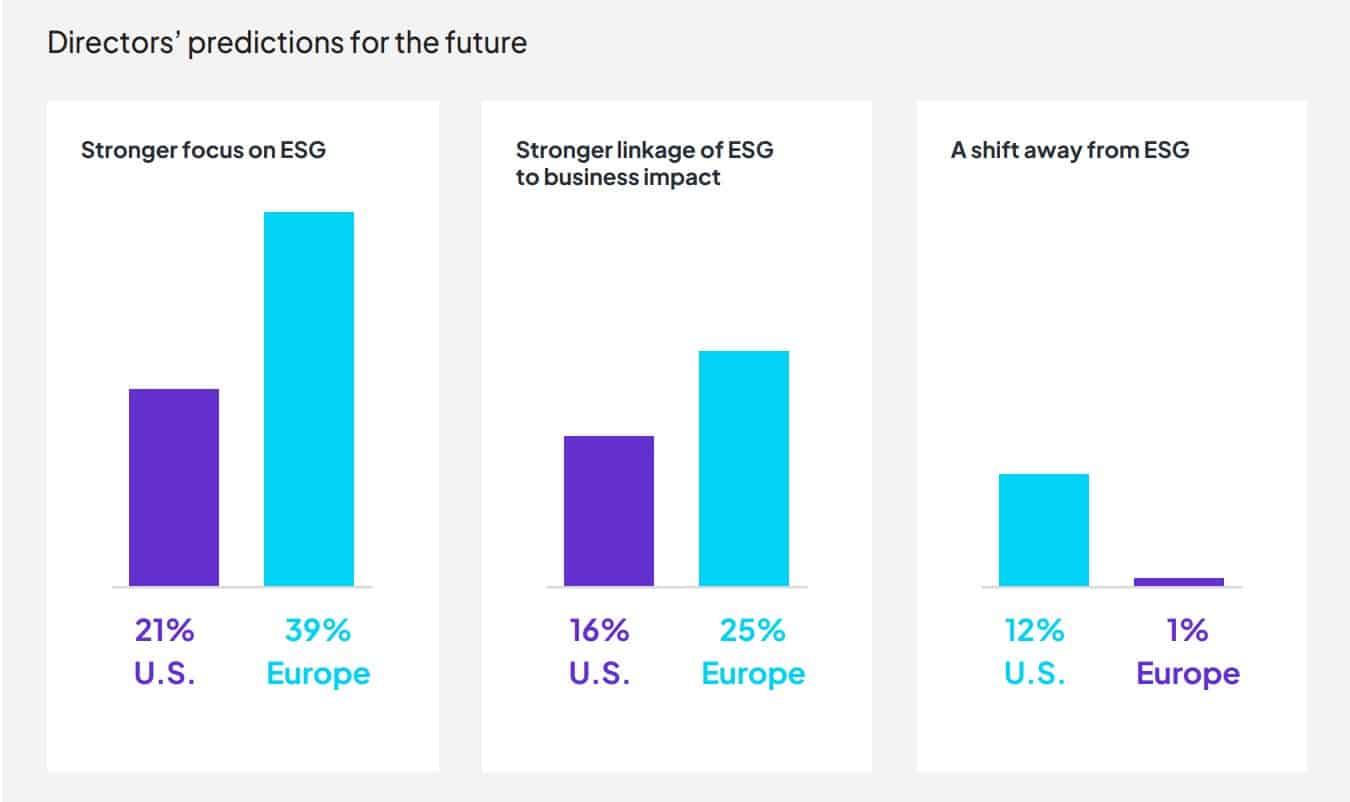

- 29 % predict a extra concerted effort on ESG initiatives within the subsequent 5 years, and 18 % predict stronger linkage between ESG initiatives and enterprise influence.

ESG is a worldwide concern, however European boards are extra engaged and optimistic about ESG points than these within the U.S.

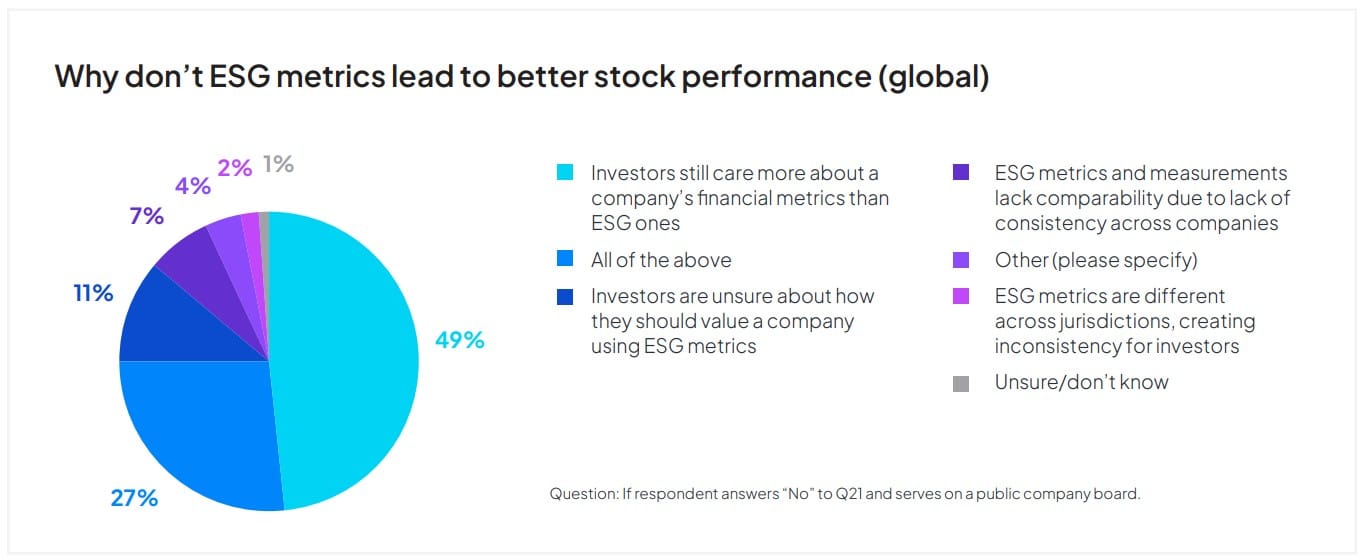

- 63 % of European boards consider progress on ESG targets and techniques on a quarterly foundation or extra, in comparison with 44 % of U.S. boards. Moreover, 34 % of European boards really feel ESG metrics led to higher efficiency of their inventory, in comparison with simply 15 % of U.S. boards.

- Within the U.S., solely 25 % of administrators imagine their organizations have efficient management and excessive ambition throughout each environmental and social points, in comparison with 50 % of administrators in Europe.

The boardroom has heightened focus and power on reporting

- 60 % are taking further care to make sure that their ESG technique is sufficiently mirrored in annual experiences/filings.

- 53 % of administrators say their organizations are enhancing present ESG disclosures.

“Our survey exhibits that many boards have made nice strides in formalizing their method to sustainability by defining oversight tasks and establishing sustainability metrics in lots of elements of the enterprise,” mentioned Jason Baumgarten, head of Spencer Stuart’s international CEO and Board Observe and the agency’s sustainability initiatives, within the launch. “Corporations that go additional and rigorously outline sustainability methods that hyperlink to their enterprise mannequin have the chance to unlock great worth and unleash the following wave of progress.”

Obtain the complete report right here.

Diligent Institute and Spencer Stuart surveyed 992 board members from April 13 to Might 3, 2023, spanning public/listed, pre-IPO and different non-public corporations throughout industries. U.S.-based corporations account for 44% of the respondents, 34% signify corporations based mostly within the European Union or the U.Okay., and the rest signify corporations based mostly elsewhere throughout the globe.