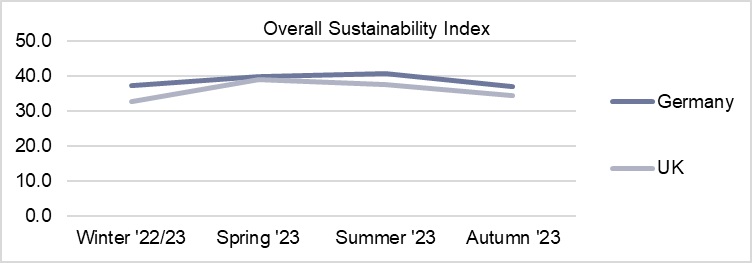

Consumers’ propensity to make purchases which have sustainability in thoughts has elevated within the UK and held regular at an already stronger degree in Germany over the course of 2023.

UK buyers’ sustainability index ranking – Autumn 2023

UK buyers began 2023 with an total Sustainability Index ranking of 32.7 (out of a doable 100). After a peak in the course of the spring and summer season surveys, that has now settled at 34.6 within the newest autumn outcomes.

The Sustainability Index is a measure that mixes three components:

- buyers’ precise purchases made within the final 12 months that took sustainability facets under consideration,

- their deliberate purchases over the following 12 months that can take sustainability facets under consideration

- and their willingness to pay extra for these deliberate purchases if the gadgets are made in a sustainable means.

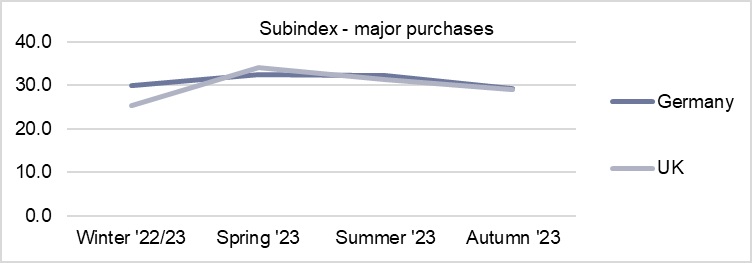

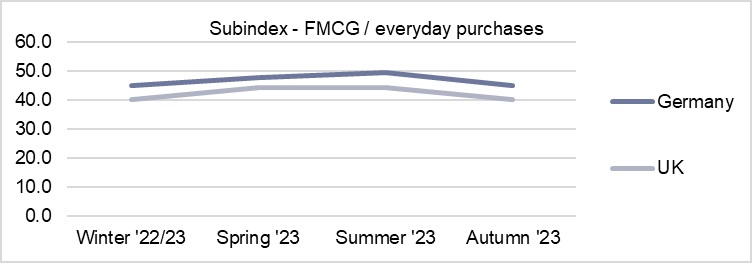

The index additionally breaks down this ranking for 2 kinds of buy – main gadgets, akin to main home home equipment or automobiles, and so forth, and every day use gadgets, akin to groceries and FMCG.

For UK buyers, their propensity to take sustainability components under consideration for main merchandise purchases has jumped from 25.3 in the beginning of the yr to twenty-eight.9 now. For on a regular basis purchases, this propensity began larger – at 40.0 in January – and has held regular at that degree, at the moment standing at 40.2.

German buyers’ sustainability index ranking – Autumn 2023

Consumers in Germany present a sightly larger propensity than within the UK to take sustainability components under consideration throughout their purchases.

Initially of the yr, the general sustainability index ranking in Germany was 37.4; barely larger than UK buyers. There was a slight rise over the spring and summer season, though not as sharp because the rise seen within the UK, earlier than settling again to 37.2 within the newest autumn survey.

In terms of main purchases, Germany’s buyers have held fairly regular – beginning the yr at 30.0 and falling solely barely to 29.3 now. For on a regular basis purchases, there may be additionally a gradual panorama, rising barely from 44.8 in January to 45.0 now.

GfK’s Sustainability Index – Autumn 2023 – Germany and UK

Supply: GfK Sustainability Index | Autumn 2023

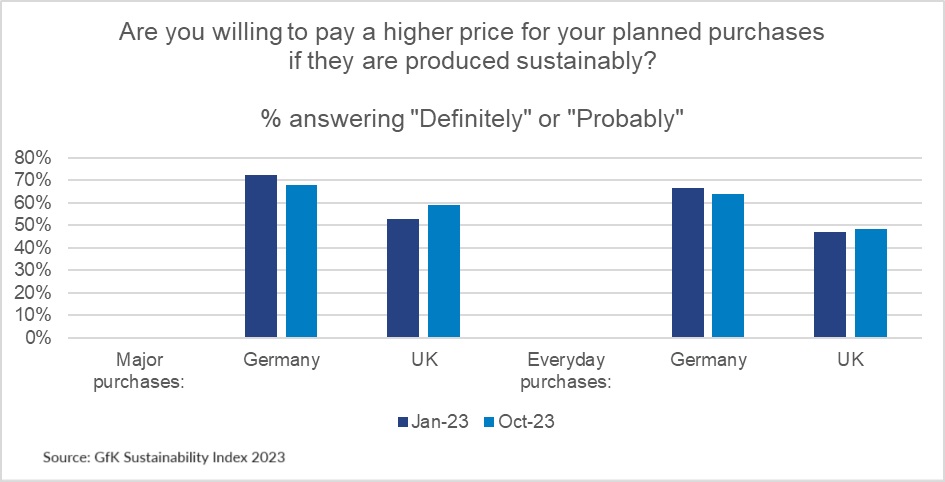

Willingness to pay extra if gadgets are produced sustainably.

Within the UK, somewhat beneath two thirds (59.0%) of buyers at present say they’re keen to pay extra for the foremost purchases they plan to make within the subsequent 12 months, if the product is produced in a sustainable means – and almost half (48.4%) say the identical for his or her on a regular basis purchases. That’s up on each counts for the reason that begin of this yr.

In Germany the image is barely completely different. Right here, a larger proportion say they’re keen to pay extra – 68.1% for deliberate main purchases, and 64.1% for on a regular basis purchases – however this has fallen barely for the reason that begin of the yr.

Manufacturers can focus their technique round two key areas that help buyers’ eco-spending intentions:

1. Belief in eco-credentials

In terms of values-based buy, customers’ expectations are increasing. In Germany, solely 20% of individuals imagine the claims that firms make about their environmentally pleasant actions.

To interrupt by this scepticism round ‘greenwashing’, manufacturers should talk a full-spectrum eco focus that includes every thing from the suppliers they work with; to their merchandise’ materials, packaging, transportation, sturdiness, recyclability, in addition to their manufacturers’ help of environmental or humanitarian causes.

This can be a pure enlargement of what we’re already seeing at product degree. Within the EU5’s extremely aggressive smartphone, cell and phablet market two-thirds of gross sales income in H1 this yr got here from merchandise which have 3 or extra eco-claims. With a progress price of +22%, these things are considerably out-performing merchandise which might be making just one or 2 eco-claims.

2. “Inexpensive premium”

For giant-ticket purchases particularly, customers are working inside a price range, however are prone to hunt down the best worth replacements they’ll afford inside that. Client tech & durables producers and retailers may help drive curiosity in ‘inexpensive premium’ vary merchandise by advertising and marketing that highlights the extra features and options, alongside promotion of the long-term cash saving enabled by ‘product lifetime price’ options akin to power effectivity, sturdiness and repair-ability.

Maintain exploring how environmental considerations affect client attitudes and shopping for behaviors:

![]()