Liquidators in South Africa have issued a summons in opposition to eighteen of Mirror Buying and selling Worldwide’s high net-winners.

Liquidators in South Africa have issued a summons in opposition to eighteen of Mirror Buying and selling Worldwide’s high net-winners.

Collectively, the scammers are being held chargeable for R4.66 billion (~$244 million USD).

As reported by My Broadband’s Jan Vermeulen on Might tenth, liquidators arrived on the $244 million quantity “to cowl the scheme’s money owed – with 7% curiosity”.

In line with the liquidators, these people are “masterminds” of the scheme, and it has requested the Pretoria Excessive Court docket to carry them liable when it comes to the Firms Act.

They argue that Mirror Buying and selling Worldwide (MTI) was an illegal Ponzi scheme and factually bancrupt since inception.

The liquidators additionally contend that the defendants knew this.

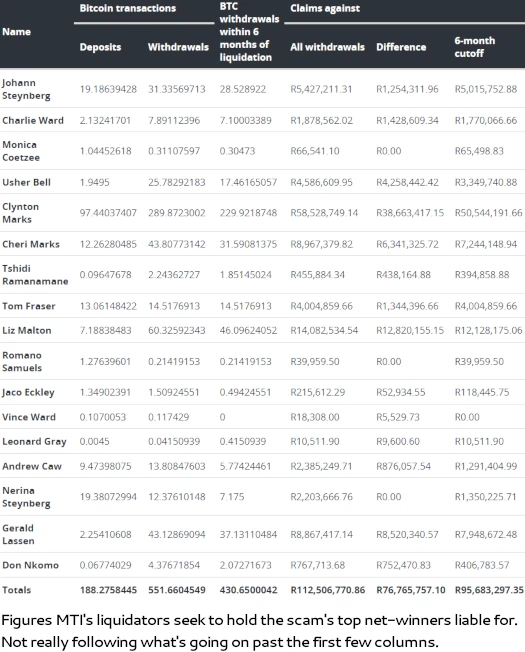

A chart supplied by My Broadband particulars how a lot every MTI net-winner is up for:

Names of significantly significance are:

- Clynton Marks (suspected MTI co-owner with spouse Cheri) – withdrew 289.8 BTC

- Cheri Marks (suspected MTI co-owner) – withdrew 43.8 BTC

- Johann Steynberg (MTI CEO and suspected frontman) – 31.3 BTC

- Andrew Caw (frontman of the Marks’ earlier Ponzi BTC World) – 13.8 BTC

Vermeulen acquired in contact with suspected Mirror Buying and selling Worldwide co-owner Cheri Marks (proper with Clynton) for remark.

Vermeulen acquired in contact with suspected Mirror Buying and selling Worldwide co-owner Cheri Marks (proper with Clynton) for remark.

Marks unsurprisingly trotted out the same old denials.

“There are some very regarding points of the applying,” Marks acknowledged.

“We now have all the time denied the rivalry that MTI was buying and selling fraudulently or recklessly with our data.”

She additionally maintains that MTI was by no means bancrupt.

Whereas it’s not nothing, the CFTC has pegged MTI as a $1.7 billion Ponzi scheme. The ~$242 million liquidators in South Africa have give you falls nicely in need of that quantity.

Round ~$57 million in recovered bitcoin has already been liquidated, however that doesn’t actually add a lot (~$300 million all up).

As to the remaining ~$1.4 billion unaccounted for, the majority of what wasn’t paid out is believed to have been stashed by Clynton and Cheri Marks.

Up to now no person appear to have been in a position to maintain them accountable. The CFTC solely sued Mirror Buying and selling Worldwide and Johann Steynberg. South African authorities have didn’t take any significant motion.

The Marks proceed to reside overtly on what they stole by way of Mirror Buying and selling Worldwide (and BTC World) in South Africa.