![]() LSG Monetary manufacturers itself as a monetary agency.

LSG Monetary manufacturers itself as a monetary agency.

LSG is an internet monetary establishment. We assist you to plan your monetary targets and suggest good funding decisions, so that you just save time and acquire peace of thoughts, realizing that your cash is working for you.

The corporate’s title incorporates “Liam, Sachwell & Galahad”. Sometimes surnames, no proof is offered to substantiate these are precise folks.

Actually LSG Monetary supplies no details about firm possession or its executives.

LSG Monetary’s web site area (“lsgfinancial.com”), was privately registered on June seventh, 2021.

SimilarWeb’s monitoring reveals visitors to LSG Monetary’s web site was lifeless till late August 2022. Prime sources of LSG Monetary web site visitors are Belgium (51%) and the Netherlands (49%).

This even cut up strongly suggests whoever is operating LSG Monetary relies out of Europe.

No concept if it’s official or not however a personal FaceBook group named “LSG Monetary” was created on August tenth, 2022. This coincides with visitors to LSG Monetary’s web site growing.

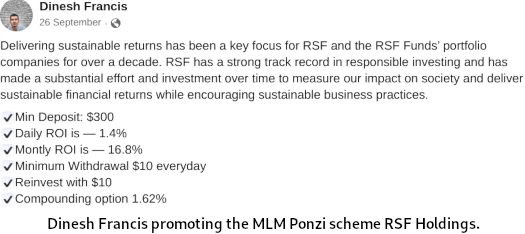

The 2 admins of the LSG Monetary FaceBook group are Dinesh Francis and Freek Otf Andringa.

Francis seems to be selling a number of Ponzi schemes:

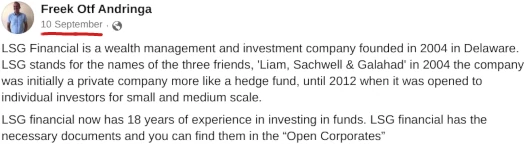

Andringa represents he’s based mostly out of the Netherlands.

Opposite to Andringa’s claims above, LSG Monetary didn’t exist until 2021.

Previous to LSG Monetary, Andringa promoted the EvoRich Ponzi scheme.

Following the arrest of proprietor Andrey Khovratov, EvoRich collapsed earlier this 12 months.

One other chance is LSG Monetary is run by Russians. That is based mostly on the inclusion of Yandex Translate on LSG Monetary’s web site.

Yandex is a Russian search engine that sometimes no one outdoors of Russia makes use of.

As all the time, if an MLM firm isn’t overtly upfront about who’s operating or owns it, assume lengthy and onerous about becoming a member of and/or handing over any cash.

LSG Monetary’s Merchandise

LSG Monetary has no retailable services or products.

Associates are solely in a position to market LSG Monetary affiliate membership itself.

LSG Monetary’s Compensation Plan

LSG Monetary associates make investments funds on the promise of a day by day return:

- Security Web – make investments $100 to $9999 and obtain 0.8% to 0.85% a day

- Fairness Pool – make investments $10,000 to $24,999 and obtain 1% to 1.05% a day

- ETF – make investments $25,000 to $49,999 and obtain 1.6% to 1.65% a day

- Mounted Earnings – make investments $50,000 to $99,999 and obtain 1.9% to 1.95% a day

- Balanced Fund – make investments $100,000 or extra and obtain 1.9% to 1.95% a day

- Retirement Fund – make investments $100,000 or extra and obtain 1.5% to 1.7% a day

As per LSG Monetary’s funding plans, Retirement fund pays out lower than Steadiness Fund. Why anybody would make investments on the Retirement Fund tier is unclear.

Be aware that LSG Monetary Funding plans are legitimate for 12 months, after which new funding is required to proceed incomes.

The MLM facet of LSG Fund pays commissions on recruitment of affiliate traders.

LSG Monetary pays referral commissions on invested funds down three ranges of recruitment (unilevel):

- degree 1 (personally recruited associates) – 10%

- degree 2 – 5%

- degree 3 – 3%

Becoming a member of LSG Monetary

LSG Monetary affiliate membership seems to be free.

A minimal $100 preliminary funding is required to take part within the hooked up revenue alternative.

LSG Monetary Conclusion

Though LSG Monetary markets itself as a monetary agency, in actuality it’s a easy Ponzi scheme.

Regardless of clearly providing securities by means of operating a passive funding scheme, LSG Monetary isn’t registered to supply securities in any jursidictions.

As an alternative, gullible traders in Europe are fed this baloney:

LSG affords recommendation as a fiduciary, and we assist you to handle your cash.

We do that work as two authorized entities—LSG Monetary LSC which is an Michigan LARA (Michigan Division of Licensing and Regulatory Affairs)-registered funding advisor, and LSG Monetary Companies, an SEC-registered broker-dealer, regulated by Michigan CSCL (Firms, Securities and Industrial Licensing Bureau).

LSG Monetary is registered SEC entity.

That is from an LSG Monetary 10-Ok Annual Report, filed with the SEC in April 2022:

Lode-Star Mining Inc. was included within the State of Nevada on December 9, 2004 for the aim of buying and exploring mineral properties.

On December, 28, 2021, we entered into an settlement with Sapir Prescribed drugs, Inc. to accumulate the entire property.

Additional to a Mineral Possibility Settlement (the “Possibility Settlement”) dated October 4, 2014, on December 5, 2014, we entered right into a subscription settlement (the “Subscription Settlement”) with Lode-Star Gold INC., a personal Nevada company (“LSG”) during which we agreed to challenge 35,000,000 shares of our frequent inventory, valued at $230,180, to LSG in alternate for an preliminary 20% undivided useful curiosity in and to LSG’s Goldfield property, which made LSG our largest and controlling shareholder.

The SEC registered LSG Monetary Companies pertains to “Lode-Star Gold”. Extra importantly, it’s a non-profitable firm.

Now we have no revenues, have losses since inception, and have been issued a going concern opinion by our auditor.

We’re relying upon loans and/or the sale of securities to fund our operations. Now we have no workers and count on to make use of outdoors consultants, advisors, attorneys and accountants as vital for the following twelve months.

So how is an organization with no income paying out as much as 1.95% a day?

They aren’t. The SEC registered LSG Monetary Companies has nothing to do with LSG Monetary the MLM firm.

The scammers behind LSG Monetary the MLM firm have simply stolen the title and faked affiliation.

However LSG Monetary hasn’t caught on within the US. LSG Monetary isn’t registered to supply securities in both Belgium or the Netherlands.

The scammers operating LSG Monetary do their greatest to cover the Ponzi scheme, with no particular funding particulars offered on their public-facing web site.

As with all MLM Ponzi schemes, as soon as affiliate recruitment runs dry so too will new funding.

It will starve LSG Monetary of ROI income, ultimately prompting a collapse.

The maths behind MLM Ponzi schemes ensures that after they collapse, nearly all of members lose cash.