Learn how to Dissolve an LLC in Idaho

You place your greatest effort into making what you are promoting profitable, so dissolving your Idaho LLC might be bittersweet. Whether or not you resolve to promote what you are promoting or just want to shut because of monetary challenges, taking the right steps to dissolve your LLC is necessary.

Within the put up that follows, you possibly can be taught concerning the ins and outs of dissolving an LLC in Idaho, in addition to the particular steps you’ll have to observe in your finish.

Fundamentals of LLC Dissolution

Earlier than we dive right into a step-by-step information to LLC dissolution in Idaho, it may be useful to know what dissolution is, what it entails, and what the several types of dissolution are.

Legally talking, once you dissolve an LLC, which means you’re successfully canceling the impartial authorized standing of what you are promoting with the Idaho Secretary of State. When your LLC is dissolved, what you are promoting is closed.

Every state units its personal necessities and processes for LLC dissolution—so to make sure issues go as easily as attainable in your finish, it’s crucial that you just observe all steps required to dissolve an LLC in your state. This contains not solely submitting a dissolution software, however notifying your collectors, paying off current money owed, and distributing any remaining property.

Varieties of LLC Dissolution

There are three forms of LLC dissolution in Idaho. Administrative and judicial dissolution are involuntary and may usually be averted by enterprise house owners. Should you’re seeking to dissolve your individual LLC, then voluntary dissolution is what you’ll need.

Administrative dissolution

When an LLC goes via administrative dissolution, the state itself takes measures to take away its LLC protections. Most frequently, this happens when the enterprise has failed to fulfill sure administrative necessities, corresponding to paying state franchise taxes or submitting an annual report.

Judicial dissolution

Judicial dissolution, alternatively, is carried out by the courts. There are lots of causes as to why the court docket could order an LLC’s dissolution, together with:

-

Breach of fiduciary obligation by an LLC proprietor/member. -

An proprietor or member’s lack of ability to meet enterprise obligations because of sickness or demise. -

Situations of fraud or mismanagement by an LLC proprietor/member. -

Inner disagreements amongst LLC house owners/members which might be unable to be resolved.

Voluntary dissolution

When an LLC is voluntarily dissolved, the choice has been carried out by its members or house owners themselves. If there are a number of house owners, then a majority vote in favor of dissolution is required earlier than the method can start.

There may be an exception to this, nevertheless. When an LLC is began, its members should draft a doc often called a enterprise working settlement. This doc can lay out conditions or “triggers” that will represent dissolving the LLC with out the necessity for a vote, corresponding to if an proprietor passes away.

If an LLC’s working settlement doesn’t embrace stipulations relating to voluntary dissolution, nevertheless, a majority vote amongst members will probably be required to maneuver ahead by way of Idaho state legislation.

Dissolving Your LLC in Texas

Now that you’ve got a greater concept of the forms of LLC dissolution and what they entail, right here’s what it is advisable do to get the ball rolling by yourself LLC dissolution course of in Idaho.

Step 1: Vote to dissolve the LLC

When an LLC is being voluntarily dissolved, its house owners/members have to be in settlement or a set off from the LLC’s working settlement have to be activated.

Dissolution guidelines in your LLC working settlement

Earlier than you get began, it’s a good suggestion to assessment the working settlement that was drafted on your LLC once you first began what you are promoting. Look particularly to see if there may be something written within the doc pertaining to dissolution. It isn’t unusual, for instance, for these paperwork to incorporate plans for discharging and settling money owed upon closing, dividing property, and canceling current enterprise contracts.

Idaho-Particular guidelines for voting to dissolve your LLC

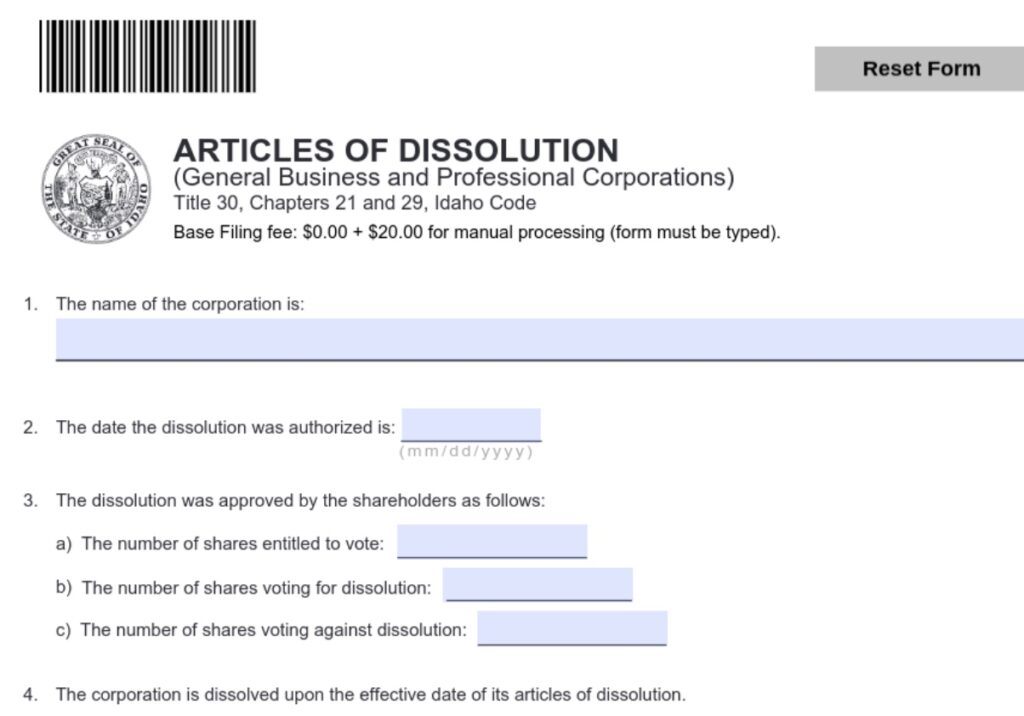

In case your LLC’s dissolution will come all the way down to a proper vote, you’ll have to set a date on your house owners to vote on the dissolution and document it in writing. The Idaho Secretary of State web site provides an “Articles of Dissolution” kind the place you possibly can document the variety of shares entitled to vote, the variety of shares that voted for dissolution, and the variety of shares voting towards it.

Step 2: Wind up all enterprise affairs and deal with every other enterprise issues

After your LLC’s house owners have reached an settlement relating to dissolution, it’s time to wrap up what you are promoting affairs and put together for the ultimate closure of the enterprise itself.

You probably have a registered agent, the very first thing you’ll need to do is notify them of your intent to dissolve the enterprise. From there, you’ll additionally need to formally cancel any recurring enterprise licenses and permits via the state of Idaho.

Different folks or entities you might need to inform of your resolution to dissolve embrace:

-

Your staff -

Suppliers -

Prospects/purchasers -

Your small business banks (particularly if it is advisable shut any accounts)

Step 3: Notify collectors and claimants about your LLC’s dissolution, settle current money owed, and distribute remaining property

One widespread false impression on the subject of dissolving an LLC is that the legal responsibility safety you loved whereas your LLC was in enterprise will prolong and “erase” any money owed remaining when what you are promoting closes.

In actuality, dissolution doesn’t cancel out any remaining money owed. You’ll nonetheless want to fulfill any excellent monetary obligations, whether or not you owe cash to collectors, suppliers, or anyone else.

As you put together to dissolve your LLC, this implies you may have an obligation to inform collectors of your impending closure, repay all current money owed, and/or arrange fee plans to repay excellent loans/money owed. If there are any remaining enterprise property, these needs to be distributed appropriately amongst house owners.

Step 4: Notify tax businesses and settle remaining taxes

Simply as your monetary obligations don’t finish once you dissolve your LLC, the identical applies to what you are promoting tax obligations. Earlier than your LLC might be dissolved, you’ll want to succeed in out to the state and repay any excellent taxes which might be due upfront. This may occasionally embrace revenue state, unemployment insurance coverage tax, and franchise taxes.

LLCs making use of for dissolution in Idaho will not be required to acquire formal tax clearance, however house owners should file all ultimate tax returns by way of IRS Kind 1065 or Kind 1120.

Step 5: File an announcement of dissolution with the Secretary of State

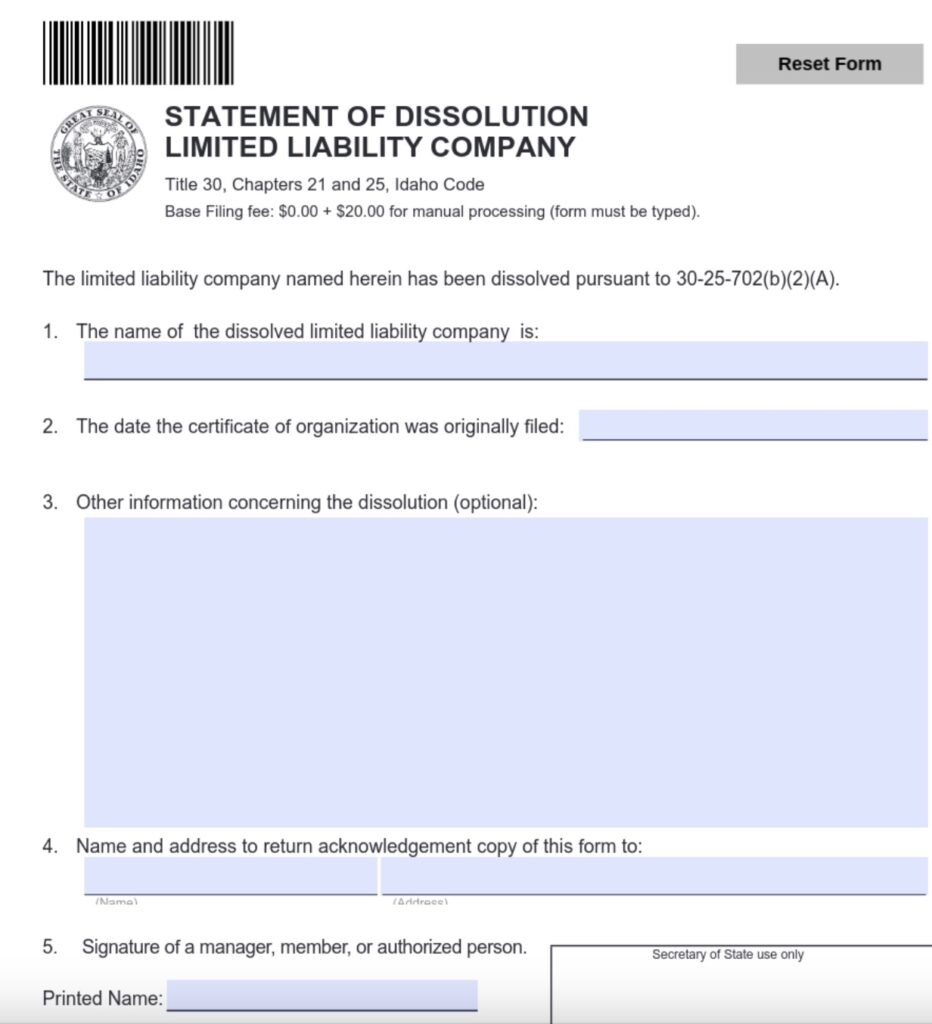

In Idaho, companies are required to file a assertion of dissolution with the Secretary of State’s workplace. This doc names the LLC being dissolved, its authentic group’s submitting date, and different related info in regards to the dissolution. This doc should even be signed by a certified supervisor or proprietor of the LLC.

Assertion of dissolution kinds needs to be mailed or delivered on to the Idaho Secretary of State. Mail-in paperwork can go to:

P.O. Field 83720

Boise, ID 83720-0080

Paperwork being hand delivered needs to be taken to the Idaho Workplace of the Secretary of state on the following handle:

450 North 4th Road

Boise, ID 83720-0080

Make sure you enclose the right fee along with your documentation. The bottom price is $20, although expedited service is offered for an extra $40. For same-day processing, an extra $100 have to be enclosed.

As soon as the state approves the dissolution, a replica of the shape (together with a certificates of dissolution) will probably be mailed again.

Conclusion

The method of submitting for voluntary dissolution of an LLC in Idaho might be considerably difficult. Nevertheless, so long as you fastidiously observe the steps outlined right here, you ought to be in fine condition. And naturally, as soon as what you are promoting is formally dissolved, you possibly can transfer onto your subsequent enterprise with peace of thoughts and confidence.

Nonetheless searching for steerage with something LLC-related? Try the Tailor Manufacturers weblog for useful assets, guides, and extra. You may also attain out to be taught extra about our LLC and different enterprise providers that may prevent time, stress, and problem.

FAQs

There are lots of potential causes to dissolve an LLC, together with:

-

Ongoing disputes between house owners/members that can not be resolved.

-

Promoting what you are promoting or having it acquired by one other enterprise.

-

Points with money circulation or funds.

-

Elevated market competitors or different financial components.

Whenever you file your assertion of dissolution with the Idaho Secretary of State, the bottom submitting price is $20. Nevertheless, if you need expedited or same-day submitting, you should pay an extra $40 or $100, respectively.

When you can acquire the kinds that it is advisable apply for dissolution on-line, you will want to bodily mail or ship all documentation to the Idaho Secretary of State’s workplace. There may be at present no possibility for on-line submitting.

This may differ, however most LLC dissolutions are accepted inside seven enterprise days (assuming the method was adopted accurately). Nevertheless, expedited and same-day service are additionally out there for many who pay the suitable charges.

Should you fail to dissolve your Idaho LLC and easily cease submitting your annual reviews or following different necessities, what you are promoting will ultimately be positioned underneath administrative or judicial dissolution. This may end up in further penalties and charges, so it is usually greatest to be proactive and deal with voluntary dissolution your self.

Whereas an LLC can technically be shaped in any state (together with in multiple state concurrently), it usually makes probably the most monetary sense for enterprise house owners to solely register and function out of 1 state at a time. If it is advisable transfer your LLC to a different state, you are able to do this with out having to dissolve and re-register in one other state.

This portion of our web site is for informational functions solely. Tailor Manufacturers will not be a legislation agency, and not one of the info on this web site constitutes or is meant to convey authorized recommendation. All statements, opinions, suggestions, and conclusions are solely the expression of the writer and offered on an as-is foundation. Accordingly, Tailor Manufacturers will not be liable for the data and/or its accuracy or completeness.

The put up Learn how to Dissolve an LLC in Idaho appeared first on Tailor Manufacturers.