While you boil it down there may be actually simply 1 key indicator that may determine the bull vs. bear market debate as soon as and for all. Steve Reitmeister spells it out in his newest market commentary that shares a buying and selling plan to remain on the precise facet of the motion. Spoiler Alert: Odds level to the bear market reemerging with the S&P 500 (SPY) heading a lot decrease because the most certainly end result. Get the remainder of the story beneath.

It’s straightforward to get a case of “Data Overload” relating to investing.

So many financial experiences. A lot value motion. So many pundits with opinions flowing in each completely different route.

But as I take a look at our present state of affairs, I believe the bull/bear debate can be settled by 1 single issue. That being the well being of the employment image. Learn on beneath for extra perception and what it means for our buying and selling plans.

Market Commentary

The fake inventory rally put up 6/14 Fed assembly has already faltered. That was not so apparent at first because the S&P 500 (SPY) broke above 4,400. But below the floor, as soon as once more, it was a hole victory.

Which means that identical to the vast majority of 2023 the positive factors solely accrued to the standard suspects within the mega cap and tech house whereas on the similar time mid caps and small caps have been painted purple. That ache broadened out this week and even the big caps took it on the chin.

Probably a primary trigger was Powell being a bit extra sternly hawkish as he testified to the Home Monetary Companies Committee on Wednesday. In my e-book he caught to the standard speaking factors of much more work to be carried out and possibly 2 extra hikes together with a weakening of the employment image earlier than their work of taming inflation is completed.

These have been the identical factors as again on 6/14. But this time his tone higher matched the seriousness of his phrases.

Which means that again on 6/14 I assumed Powell’s was a bit too comfortable and thus didn’t match the stiff restrictions they’re ready to do. That is seemingly why some bulls hit the purchase button not appreciating how seemingly the Fed’s actions are to trigger a recession within the months forward. Every week afterward 6/21 extra traders acquired the memo on how it’s not so bullish for the economic system or inventory market.

At this stage traders are getting bored with phrases. They need proof constructive of the place issues stand to dictate their subsequent strikes.

This has us all on recession watch. That begins with a concentrate on the important thing financial indicators in manufacturing, providers, retail gross sales and many others.

Nonetheless, let’s keep in mind that Q1 of 2022 truly noticed unfavorable GDP and but was not a recession as a result of employment stayed sturdy. So, at this stage we have to have a concentrate on the roles market as an indicator as as to if a recession is lastly afoot.

The market will principally transfer primarily based upon the discharge of the Authorities Employment State of affairs report which is the primary Friday of each month (7/7). Gladly we don’t have to attend that lengthy for main indicators that might inform us if issues are getting worse.

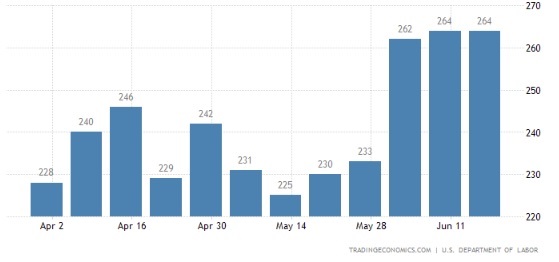

That investigation begins each Thursday with the discharge of the Jobless Claims report which has not too long ago jumped 15% to 264K per week. Observe that at 300K+ weekly claims usually factors to a interval by which the unemployment price will begin to rise.

Different locations with clues are the Employment elements of ISM Manufacturing (7/3) and ISM Companies (7/6). The latest readings in June got here in at 51.4 and 49.2 respectively (beneath 50 = contraction).

Each of those readings are anemic with the a lot bigger providers sector seeing a precipitous drop from 54 only a few months again. These readings inform you concerning the diminishing intention of employers to rent sooner or later.

Just like that is the protecting tabs on the NFIB Small Enterprise Optimism Index (7/12). The more serious these enterprise leaders really feel concerning the outlook for the economic system…the much less seemingly they are going to be to rent further workers. The final 2 months have supplied the bottom readings in a yr. That bodes poorly for future hiring plans.

Lastly is the JOLTs Job Openings (7/6) which measures the # of openings which are publicly posted. Think about that earlier than corporations begin letting go of workers, they first will cease hiring new ones.

This indicator has been at report ranges prior to now yr with over 11 million job openings. That has not too long ago dropped somewhat greater than 10% from current peaks, however nonetheless very excessive exhibiting strong job demand. Indicators of additional weak spot right here might be telling of future declines within the unemployment price.

Buying and selling Plan

My prediction of shares pausing at 4,400 with a 3-5% correction unfolding appears nicely timed. Think about this a brand new buying and selling vary and holding sample till traders assemble details on whether or not a recession is coming or if the Fed amazingly manufactures a comfortable touchdown.

Everybody is aware of their monitor report just isn’t nice. 12 of the final 15 price hike cycles have led to recession. Virtually each time they predicted a comfortable touchdown and but failed 75% of the time.

Now this go round they’re truly predicting a gentle recession. In order that would appear to tip the scales in a recessionary route. However when you think about the identical degree of overshoot…it most likely going to be extra extreme than only a gentle recession.

The important thing to the recession image, as shared above, is employment. Let’s hold our eyes on these main indicators to offer us a leg up in predicting what occurs subsequent.

While you boil it down it really works like this:

Rising unemployment = recession = bear market reawakens with shares tumbling decrease = get extra defensive in your portfolio

Secure employment = comfortable touchdown = new long run bull market ascends to new heights = get extra aggressive in your portfolio

Get these employment report dates in your calendar to maintain tabs of this important indicator. This provides you with a operating head begin on the remainder of traders who could solely react to the month-to-month Authorities Employment State of affairs report.

What To Do Subsequent?

Uncover my balanced portfolio method for unsure instances.

It’s completely constructed that can assist you take part within the present market atmosphere whereas adjusting extra bullish or bearish as obligatory within the days forward.

In case you are curious in studying extra, and wish to see the hand chosen trades in my portfolio, then please click on the hyperlink beneath to what 43 years of investing expertise can do for you.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $433.21 per share on Friday afternoon, down $3.30 (-0.76%). 12 months-to-date, SPY has gained 14.13%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up KISS Investing = Focus On… appeared first on StockNews.com