There are indicators that the S&P 500 (SPY) could lastly be prepared to interrupt out above 4,200 and declare the beginning of the brand new bull market. Sadly, the bears have motive to consider that the worst will not be but behind us with early Could financial stories looming massive in investor resolution making. Get Steve Reitmeister’s take with buying and selling plan and prime picks within the commentary beneath.

4,200 for the S&P 500 (SPY) is a crucial stage for the market. Above it lies a brand new bull market. Under it the bears can nonetheless declare victory.

Certainly, shares have been operating as much as that battle line as soon as once more this week.

Why? And what does that imply for the ultimate bull/bear end result for the market?

That would be the focus of this week’s commentary.

Market Commentary

On Thursday we came upon that Q1 GDP was a lot decrease than anticipated at solely +1.1% progress when 2.3% was anticipated. The first motive was that issues slowed down significantly in March.

On prime of that the Fed’s most well-liked inflation measure, Private Consumption Expenditures (PCE), was increased than feared at +4.2% versus the earlier studying of +3.7%. This could clearly have traders nervous concerning the Fed’s “increased charges for longer” stance as we roll into their subsequent announcement on Wednesday 5/3.

The truth is, the mix of slower progress and better inflation on Thursday had extra commentators speaking about Stagflation. That was an financial illness within the 1970’s that was a part of an extended secular bear market that didn’t actually take off till 1982 when inflation began to return down and the economic system acquired wholesome as soon as once more.

Seems like this might all equate to a different Threat Off day. NOPE…assume once more!

The consequence was a stunning +2% rally on Thursday with tech main the way in which because of the latest earnings success for Microsoft and Meta (Fb). After which almost one other 1% was tacked on Friday to shut on the highest stage since early February.

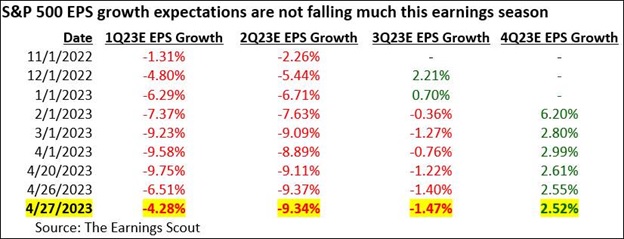

Gladly it’s not simply tech exhibiting promise this earnings season. Because the graphic beneath reveals that only a week again on 4/20 Wall Avenue anticipated Q1 earnings to be down -9.75% 12 months over 12 months. And but now with half of the businesses in S&P 500 reporting that has been greater than halved to solely -4.28%.

Earlier than you begin getting too bullish on this optimistic earnings pattern, sadly the dangerous information reveals up within the subsequent 2 columns. That being the place estimates are getting barely worse for the following 2 quarters. This coincides with the GDP report which reveals that softness began finish of Q1 and could also be accelerating.

That’s the reason estimates are nonetheless poor and why it might not essentially be time to rejoice the tip of the bear market. So at this stage the impetus from earnings season could have a contact extra upside as much as the road at 4,200.

To get a determined bullish break above 4,200 or to retreat again into bearish territory is awaiting the following spherical of catalysts. Like a few of the key financial stories on the docket for subsequent week:

5/1 ISM Manufacturing

5/3 ISM Providers, Fed Charge Resolution

5/5 Authorities Employment State of affairs

Be aware that the Chicago PMI report from Friday is taken into account the very best main indicator of the place ISM Manufacturing will land. In that case it was nonetheless in contraction territory at 48.6. Nonetheless, on the intense aspect that’s the highest studying since September 2022.

So directionally it might be learn that issues are enhancing. We’ll know if that can also be the case for ISM Manufacturing on Monday.

The purpose is that we’re coming as much as a second of reality. Do bulls have the required gasoline to interrupt above 4,200 and declare victory? Or does the specter of recession nonetheless loom massive sufficient to remain beneath that key stage?

It’s attainable that we’ve our reply by the tip of subsequent week given the three key stories famous above.

Sadly, we may have sufficient data to remain confused and in a limbo beneath 4,200 some time longer.

The buying and selling plan stays balanced close to 50% invested. If break bullish, then retaining including engaging Threat On positions to rise up nearer to 100% invested.

If break bearish, then scale back quantity invested with a really conservative mixture of Threat Off shares.

So let the chips fall the place they might and we are going to commerce accordingly.

What To Do Subsequent?

Uncover my balanced portfolio strategy for unsure occasions. The identical strategy that has overwhelmed the S&P 500 by a large margin thus far in April.

This technique was constructed based mostly upon over 40 years of investing expertise to understand the distinctive nature of the present market surroundings.

Proper now, it’s neither bullish or bearish. Fairly it’s confused…unstable…unsure.

But, even on this unattractive setting we will nonetheless chart a course to outperformance. Simply click on the hyperlink beneath to begin getting on the appropriate aspect of the motion:

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares fell $0.20 (-0.05%) in after-hours buying and selling Friday. 12 months-to-date, SPY has gained 9.17%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Is the New Bull Market at Hand? appeared first on StockNews.com