John Dalli is a former EU Commissioner for well being. He’s additionally Malta’s former Minister of Finance and Economic system.

John Dalli is a former EU Commissioner for well being. He’s additionally Malta’s former Minister of Finance and Economic system.

In what isn’t a lot of a shock, Dalli is without doubt one of the faces selling the QuickX Ponzi scheme.

Dalli (proper) resigned as well being commissioner again in 2012, following an anti-fraud investigation into tobacco associated bribery.

Dalli (proper) resigned as well being commissioner again in 2012, following an anti-fraud investigation into tobacco associated bribery.

That case is ongoing, with Dalli pleading not responsible final month.

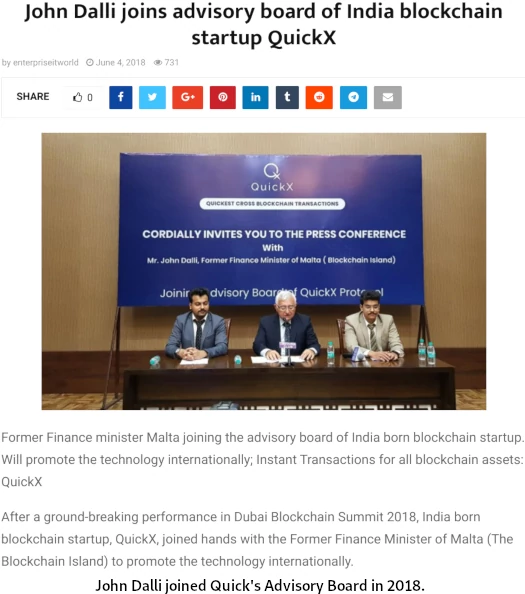

In 2018 Dalli was appointed to QuickX’s Advisory Board.

QuickX is an crypto Ponzi scheme run from India by Kshitij and Vaibhav Adhlakha.

BehindMLM first got here throughout QuickX by Crypto Recommendation in 2019.

Crypto Recommendation was a Ponzi scheme constructed round QuickX’s QCX token.

The rip-off was fronted by Boris CEO Jordan Lucas…

…however believed to be operated from India by the Adhlakha brothers.

Probably tying in to Dalli, Crypto Recommendation was arrange as a Maltese shell firm.

In 2021 BehindMLM reviewed Riseoo, one other MLM crypto Ponzi confirmed to be run by the Adhlakha brothers.

Crypto Recommendation has collapsed and its web site is lengthy gone. Riseoo’s web site continues to be up however recruitment has collapsed outdoors of Algeria.

Now not tracked on any public change by CoinMarketCap, QCX token additionally seems to have collapsed.

QuickX’s former FaceBook web page has been deleted. The QuickX Twitter profile was deserted in December 2021.

Once more, tying into Dalli, QuickX operates by the Maltese shell firm QuickX Restricted. The Maltese tackle used to register QuickX belongs to Dalli.

Registered in 2018, QuickX Restricted to this point has did not file any annual or monetary stories.

Dalli’s ties to QuickX was not too long ago reported on by The Shift Information. A November sixth report additionally reveals the Malta Monetary Companies Authority not too long ago issued a QuickX securities fraud warning.

The Shift Information has been making an attempt to get the MFSA to take motion on QuickX and Dalli since early 2021.

The Shift has been engaged on the story for months. Questions had been despatched to the MFSA in January 2021, however the one reply acquired was that the Authority was trying into the case.

Greater than a 12 months later, the MFSA has issued a warning when issues had gone too far, and quite a lot of folks had suffered as a result of regulator’s lack of motion.

That is an all too acquainted story.

Previous to getting concerned in crypto fraud, Dalli was tied to

an operation scamming Christian believers out of their financial savings by persuading them to place their cash into her nonexistent scheme to ‘assist small-time gold-miners in Thailand’.

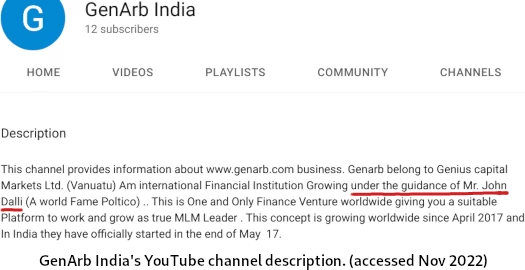

Dalli’s first crypto fraud scheme was Genius Capital Markets (Gen Arb), a collapsed Ponzi scheme Dalli heaped reward on in 2017.

According to the state of MLM associated securities fraud regulation throughout Europe, Dalli’s first QuickX advertising and marketing speech noticed him converse on

how cryptocurrencies will permit folks to shift cash round with out being “spied upon” by legislation enforcement.

QuickX itself acknowledged in a press-release that

Dalli’s presence on the QuickX advisory board, based on the corporate, “…can’t be understated because it might permit the start-up to acquire unequalled entry to authorities regulators – minimising regulatory uncertainty for the corporate”.

“Presently you’ll be hard-pressed to seek out token gross sales which were green-lighted by an institution participant.

That is what makes QuickX’s token sale [ICO] so distinctive, because it has the backing of Malta’s former finance minister John Dalli.”

Apart from MFSA’s “after the actual fact” warning, Maltese authorities have taken no motion in opposition to QuickX, Dalli or the Adhlakha brothers.

BehindMLM has lengthy lamented on the failure of European authorities to successfully fight MLM associated securities fraud.

An ex-Finance Minister and former EU Commissioner overtly defrauding customers by Ponzi schemes, whereas not shocking, displays extraordinarily poorly on Maltese authorities.