Insurance coverage gross sales is a extremely profitable business. Paul Moss, Founding father of HeyDriver and a 14+ years insurance coverage veteran, says, “There may be lots of cheddar to feed the mouths of insurance coverage professionals.” He provides that the business is definitely accessible to anybody.

With a diploma, you can begin working as an insurance coverage salesperson. Keep lengthy sufficient, and you could possibly get large outcomes. Take Cody Askins, as an example. He began working within the insurance coverage business at simply 20 years previous. He made a purpose to make 6-figures throughout his first 12 months, and in solely eight months, Cody remodeled $117,000.

The kicker: success on this business doesn’t come straightforward. Like Cody, you’ll get extra “no” than “sure.” However for those who can deal with many “no” with out faltering, you’ll do nice on this business. On this information, we’ll discover all the things about beginning a profession in insurance coverage gross sales, together with the professionals, cons, and ideas that will help you succeed.

Desk of Contents

As a licensed skilled, you’ll be able to work as a captive or unbiased agent. Captive brokers promote insurance coverage for just one firm. Unbiased brokers symbolize a number of insurance coverage firms.

The Professionals of Working in Insurance coverage Gross sales

Tony Caldwell, creator, speaker, and mentor within the business, says, “Working in insurance coverage affords large alternatives to construct a worthwhile, difficult, and satisfying skilled profession.” This is why.

Limitless Incomes Potential

Many insurance coverage gross sales brokers get commission-based revenue. So what you select to earn is totally as much as you. Offered you’re dedicated, you’ll be able to set your revenue bar at 5, six, seven, or eight figures. It’s also possible to earn passive revenue from the coverage renewals of shoppers.

Noble Occupation

Working as a salesman within the insurance coverage business helps you to make an actual distinction in folks’s lives. “Regardless of how shy you might be about promoting insurance coverage, you assist folks in methods they are going to by no means know except they get right into a life-changing accident,” says Paul Moss, Founding father of HeyDriver.

Wonderful Work-life Stability

Many insurance coverage firms supply versatile work preparations that offer you a great work-life steadiness. This helps you obtain elevated productiveness, makes you much less harassed, and offers you adequate time on your private or household life.

Job Safety

So long as folks drive vehicles, want medical care, make use of employees, run companies, and have a life, they’ll want insurance coverage. And meaning your job is safe even throughout recessions.

Cons of Working in Insurance coverage Gross sales

The insurance coverage gross sales business isn’t all sunshine and rainbows. Rejection is one factor that makes this career effing tiring. However listed here are others:

Fee-based Pay

Many insurance coverage gross sales brokers work as unbiased contractors. Working as one means you’ll file your taxes, pay your medical health insurance and advantages, and purchase your work instruments. Plus, you not often have a base wage. Even for those who’re fortunate to get a base wage, you should nonetheless hit your quotas. These underscore why realizing an organization’s compensation plan earlier than working with them is important.

Numerous Paperwork

Documentation is important to indicate the proof of a contract. And in insurance coverage gross sales, you’ll be doing a number of it.

Tony Caldwell, creator and creator of 250+ insurance coverage companies, says, “Insurance coverage gross sales require you to maintain up with administrative duties like paperwork.”

Although important, paperwork can be time-consuming, and lots of nice salespeople battle to maintain up. “Happily, tech instruments can simplify the method so you have got extra time to construct shopper relationships, as an alternative of punching in information,” provides Caldwell.

Excessive Failure Fee

In line with Investopedia, over 90% of latest life insurance coverage brokers stop throughout the first 12 months. The speed will increase to over 95% when prolonged to 5 years. Insurance coverage segments like well being should not have these excessive stop charges.

Generally, brokers stop as a result of they get burned out making an attempt to transform firm leads {that a} half-dozen ex-agents could have pitched. Different instances, they fight exhausting to seek out unique leads by way of methods like cold-calling.

To enhance your probability of success on this business, Veronica Moss, an insurance coverage dealer since 1999, recommends you totally understand how the business works. “If you do not know, ask for assist,” provides Veronica.

Entry Stage Insurance coverage Gross sales Roles

In the event you’re contemplating a profession in insurance coverage gross sales, exploring the varied entry-level positions within the business might be useful. These roles present a stable basis to develop your gross sales expertise, construct relationships with shoppers, and contribute to the expansion of insurance coverage firms.

This part highlights three entry-level insurance coverage gross sales jobs and descriptions their duties, {qualifications}, and common salaries.

By gaining perception into these roles, aspiring you’ll be able to higher perceive the alternatives that await you within the insurance coverage gross sales business and make knowledgeable selections about your profession path.

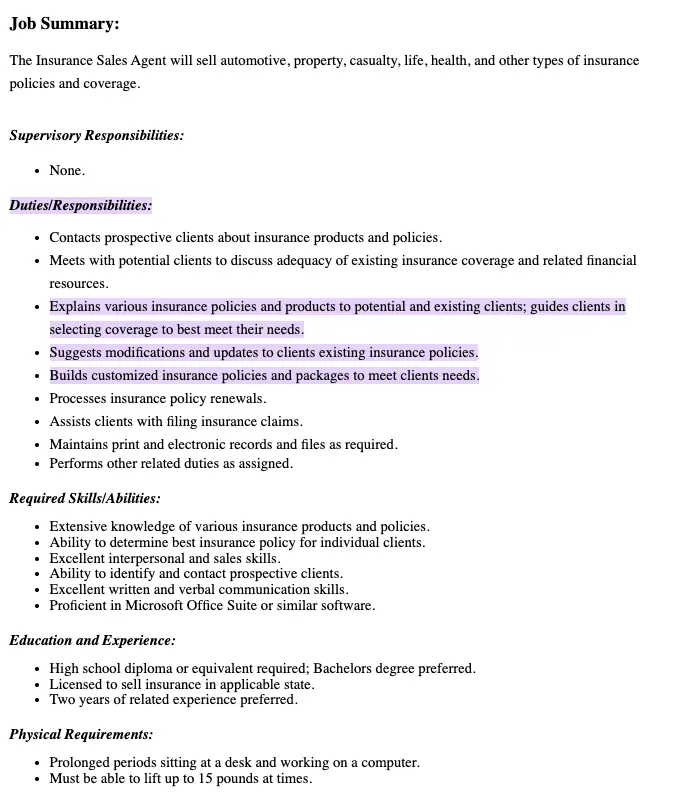

1. Insurance coverage Gross sales Agent

Obligations

- Figuring out potential shoppers and reaching out to them to supply insurance coverage insurance policies

- Conducting wants assessments and recommending appropriate protection choices to shoppers

- Explaining coverage options, advantages, and premium fee particulars

- Customizing insurance coverage packages to satisfy particular person shopper wants

- Producing leads by way of networking, referrals, and chilly calling

- Constructing and sustaining relationships with shoppers to foster loyalty and retain enterprise

{Qualifications}

- Highschool diploma or equal (some employers could want a bachelor’s diploma)

- Sturdy communication and interpersonal expertise

- Proficiency in gross sales methods and negotiation

- Good understanding of insurance coverage merchandise, insurance policies, and rules

- Skill to work independently and meet gross sales targets

Common Wage: In line with the U.S. Bureau of Labor Statistics (BLS), the median annual wage for insurance coverage gross sales brokers was $49,840 as of 2021. Nevertheless, salaries can range based mostly on components comparable to location, expertise, and fee construction.

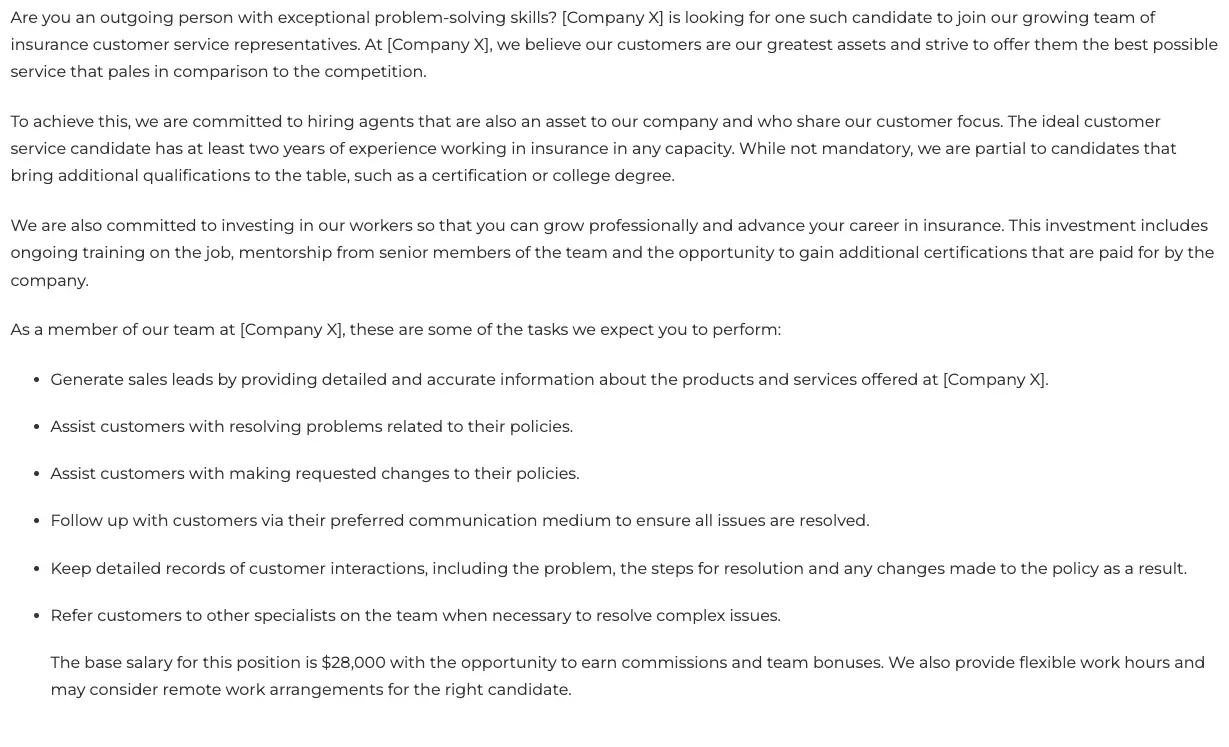

2. Insurance coverage Buyer Service Consultant

Obligations

- Helping shoppers with inquiries, coverage adjustments, and claims processing

- Offering distinctive customer support by addressing issues and resolving points

- Educating shoppers about coverage particulars, protection limits, and declare procedures

- Processing coverage renewals, endorsements, and cancellations

- Collaborating with insurance coverage brokers and underwriters to make sure correct coverage data

- Sustaining shopper information and updating databases

{Qualifications}

- Highschool diploma or equal (some employers could want an affiliate‘s or bachelor’s diploma)

- Wonderful customer support and problem-solving expertise

- Sturdy verbal and written communication talents

- Familiarity with insurance coverage terminology and insurance policies

- Proficiency in utilizing laptop techniques and related software program

Common Wage: The typical wage for insurance coverage customer support representatives varies relying on components comparable to location, expertise, and firm dimension. In line with wage information from PayScale, as of 2021, the common annual wage for this function ranged from $31,000 to $53,000.

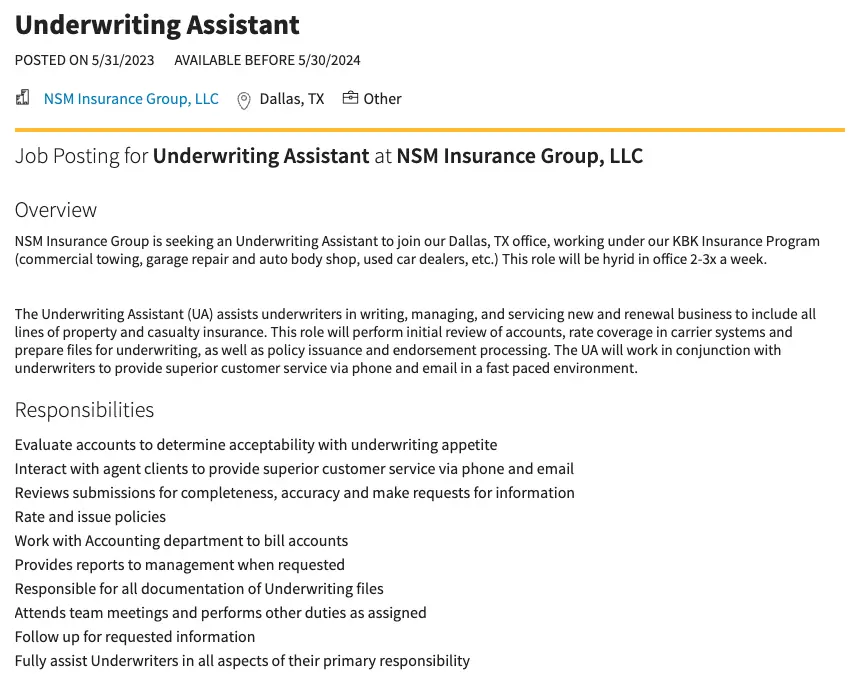

3. Insurance coverage Underwriting Assistant

Obligations

- Helping underwriters in evaluating insurance coverage purposes and figuring out threat ranges

- Gathering and analyzing applicant data, comparable to monetary information and medical historical past

- Conducting analysis and gathering information to assist underwriting selections

- Making ready quotes, insurance policies, and endorsement paperwork

- Reviewing coverage paperwork for accuracy and completeness

- Speaking with brokers, brokers, and shoppers to acquire essential data

{Qualifications}

- Bachelor’s diploma in enterprise, finance, or a associated area (some employers could settle for related work expertise in lieu of a level)

- Sturdy analytical and demanding pondering expertise

- Consideration to element and accuracy in information evaluation

- Proficiency in utilizing underwriting software program and instruments

- Information of insurance coverage business rules and insurance policies

Common Wage: The typical wage for insurance coverage underwriting assistants varies relying on components comparable to location, expertise, and firm dimension. In line with information from Wage.com, as of 2021, the median annual wage for this function ranged from $45,543 to $58,226.

6 Ideas for Working in Insurance coverage Gross sales

That will help you begin a profession within the insurance coverage gross sales business, comply with these tricks to improve your odds of success.

1. Learn to construct relationships.

Individuals have to belief you earlier than shopping for your insurance coverage product. Being pushy with the sale received’t minimize it. As an alternative, constructing a superb relationship by empathizing with shoppers helps you acquire their belief over time. It additionally makes your work really feel much less of a chore.

When conversing with shoppers, genuinely ask about their skilled and private pursuits. Utilizing this data to spark conversations lets shoppers know you pay attention they usually’ll belief you. This belief can result in the sale of your product and even up-sells and referral alternatives.

Belief additionally helps you finish objections like, “I need to give it some thought,” “I wish to discuss to my enterprise associate,” or “I don’t have the funds for this.”

2. Let shoppers take the motive force’s seat.

The flexibility to pay attention is a superpower of closers. When you’d need to lead the dialogue together with your shoppers, letting them take the motive force’s seat by speaking is greatest. It prevents you from turning off shoppers and hindering the sale.

Whenever you pay attention, you’ll know your shoppers’ wants, and also you’d have the ability to affect the sale of your product. However realizing your shopper’s wants doesn’t imply they’ll purchase. Why? They might not need your insurance coverage protection straight away. That’s the place asking good questions is available in.

These questions will show you how to lead the shopper to the result of not fulfilling their want. However with out listening, you’ll be able to’t even know these questions since you’ve been doing many of the speaking.

3. Grasp storytelling.

Storytelling is a robust software for delivering any message. We will’t overlook books like Hamlet by William Shakespeare, Frankenstein by Mary Shelley, and The Odyssey by Homer. In the event you don’t need shoppers to overlook about your product in a rush, inform tales.

When making an attempt to promote your product, inform tales of different shoppers who obtained the monetary help they desperately wished. Connecting with shoppers utilizing your individual story can be acceptable.

This story ought to relate to the unfavourable final result of not utilizing your product or the constructive final result of utilizing your product. Both method, the shopper will get the message, and also you’ll be one step nearer to successful the sale.

4. Exude confidence.

Confidence comes from information. The extra concerning the insurance coverage business, the much less the uncertainty, in your phrases. Shoppers want to purchase from an agent who doesn’t use phrases like “I believe, I assume, perhaps, maybe, most likely, or so far as I do know.”

These phrases present a insecurity and might crush a shopper’s belief in you and your product. To repair this, use phrases that present certainty. They show you’re educated concerning the business.

As Daniel Lettman, Enterprise Improvement Govt at Entry Insurance coverage, places it, “Be a sponge. Be taught, develop, and maintain creating your expertise.” This will help you alter a shopper’s thought from “I don’t determine on the primary day of studying about merchandise” to “let’s get my associate onboard.”

5. Leverage social proof.

Social proof is an unbelievable phenomenon the place folks assume an motion is appropriate as a result of different folks have taken the identical motion.

Whether or not you’re employed as a captive or unbiased agent, you will get social proof by asking your shoppers to write down opinions on your product on third-party assessment websites like Trustpilot. You possibly can go a step additional by asking your organization to characteristic your glad shoppers in a case research.

When discussing your product, present shoppers these testimonials or case research. Apart from convincing the shopper to make use of your product, these kinds of social proof will enhance your confidence since you’re sure your product works.

6. Community with friends within the business.

Networking together with your friends is a wonderful method to keep present and study new alternatives. You are able to do this by becoming a member of social media teams just like the Insurance coverage Professionals on LinkedIn or by attending networking occasions.

Websites like Eventbrite and Patch.com show you how to discover native insurance coverage occasions to socialize with different brokers, share your advertising technique, and refer enterprise to one another. You should definitely attend occasions early so you’ll be able to meet the organizers, join with them, and comply with them on their most well-liked social media channels.

Making use of for an Entry-level Insurance coverage Gross sales Job

Discovering a job in insurance coverage gross sales is simple. You are able to do this with platforms like Certainly, LinkedIn, and Glassdoor. That stated, you could assess an organization’s monetary well being earlier than accepting a suggestion. Websites like A.M. Finest present monetary well being particulars and present the corporate’s ranking based mostly on its dimension.

It doesn’t matter if the corporate is “large.” Some large firms is probably not the perfect firm.

Your state insurance coverage commissioner‘s web site is one other place to look. It accommodates the grievance historical past towards firms you’re contemplating. If an organization has a excessive variety of complaints, keep away from them. Working with an organization that has a poor repute may cause burnout and shortly grind your profession to a halt.

Beginning Your Insurance coverage Gross sales Profession

In case your purpose is to change into an entrepreneur, you’ll have a number of room to start a profession in insurance coverage gross sales and succeed. As an example, after staying within the insurance coverage enterprise for 14+ years, Paul Moss, the proprietor of Moss Company has efficiently generated over $600 million in premiums and $300 million in income.

Paul has an important success story. However right here’s the factor: his first few months within the business have been powerful. Yours will probably be as effectively. Nevertheless, for those who can set a purpose for your self, roll up your sleeves to construct relationships and deal with rejections with grace, you could possibly begin successful inside just a few months of becoming a member of the insurance coverage gross sales business.