Estimated learn time: 9 minutes, 26 seconds

Get the most recent from FastSpring’s Assist leaders about essential tax updates, fraud and chargeback methods, our new Changelog, and extra.

Want FastSpring help? Go to our Assist web page.

FastSpring offers an all-in-one cost platform for SaaS, software program, and digital merchandise companies, together with VAT and gross sales tax administration, cost localization, and client help. Arrange a demo or attempt it out for your self.

Discover the Energy of Changelog Integration in Our Documentation

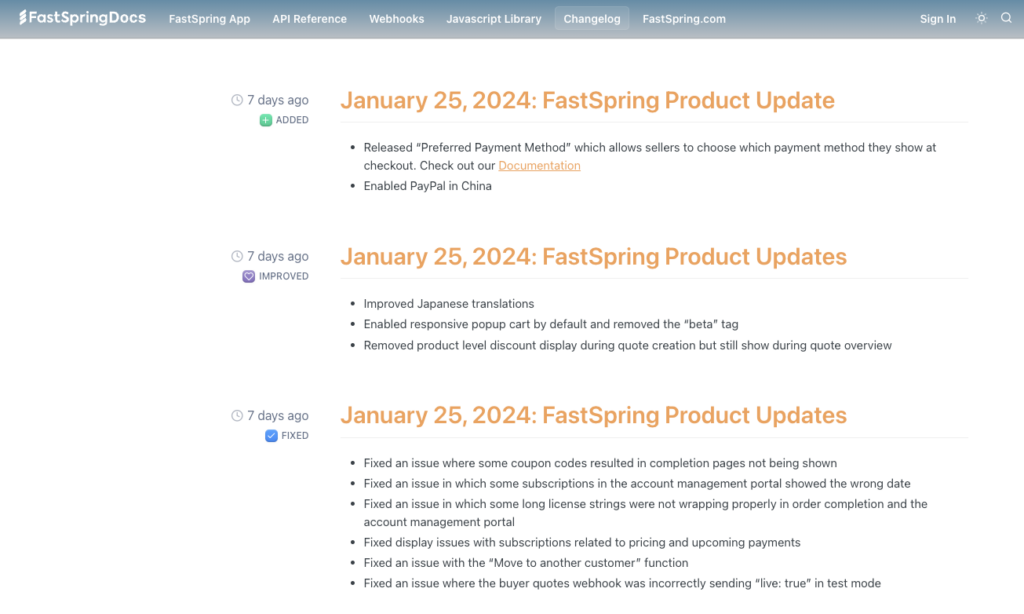

In our steady efforts to boost consumer expertise and preserve you knowledgeable in regards to the newest updates to our platform, we’re excited to announce a big change to changelog accessibility. We are actually integrating our Changelog straight into our Documentation Website, offering you with a seamless expertise to remain updated with all the most recent releases and enhancements.

Staying knowledgeable in regards to the adjustments to our platform is essential for a number of causes:

- Improved Efficiency: Keep forward of the curve by leveraging the most recent options and optimizations for a smoother and extra environment friendly consumer expertise.

- Bug Fixes and Enhancements: Our dedication to offering a seamless expertise means common bug fixes and enhancements. Maintaining with updates ensures you profit from these enhancements.

Learn how to Entry the Changelog

To entry the Changelog, you may have two choices:

- Direct Entry: Go to https://developer.fastspring.com/changelog to succeed in the Changelog straight.

Please remember that we’re transitioning away from the present Changelog web site at changelog.fastspring.com. Whereas this web site will nonetheless be accessible alongside the brand new Changelog for a restricted time, we encourage you to begin utilizing the up to date hyperlinks supplied above. - FastSpring Docs: Click on on the “Changelog” hyperlink positioned on the prime of the touchdown web page inside FastSpring Docs.

Changelog updates will show with the latest updates on the prime.

Changelog posts from 2015-2020 can be found on the archived put up positioned on the backside of the changelog posts displayed.

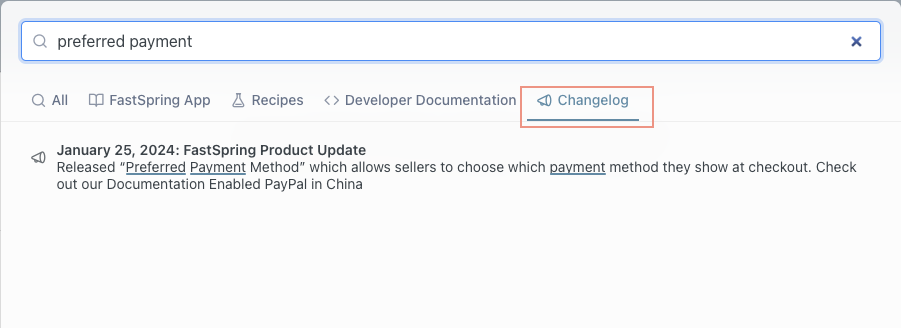

Learn how to Seek for Changelog Gadgets

- Click on on the Search icon in FastSpring Docs.

- Click on on the Changelog filter.

- Enter your search textual content, and search outcomes for Changelog will likely be displayed.

Now you can simply seek for particular launch objects or flick through the complete changelog to discover current updates.

By no means miss a beat with our platform updates through the use of the RSS feed for our Changelog. Right here’s how one can set it up:

- Comply with FastSpring’s changelog RSS feed by simply including .rss to the tip of the changelog URL: https://developer.fastspring.com/changelog.rss

- Upon getting your URL, you need to use any RSS feed widget/device to enter the URL and generate HTML to embed it.

With these adjustments, we intention to make it simpler so that you can keep knowledgeable, engaged, and empowered with the most recent updates to our platform. Discover the Changelog on FastSpring Docs and subscribe to the RSS feed for a seamless and proactive replace expertise!

Navigating the Tax Panorama: Key Adjustments That Demand Your Consideration in 2024

As we embark on a brand new 12 months, it’s essential to remain knowledgeable in regards to the newest updates relating to taxation and world VAT charges. Listed below are some essential highlights for the quarter:

12 months-Finish Tax Types for 2023 Exercise

We now have been busy making ready and mailing all required tax paperwork previous to the January 31, 2024 deadline for all sellers assembly the required standards.

In case you are a US vendor with proceeds exceeding $20,000 and fascinating in 200 or extra transactions through the 12 months, it’s best to have acquired IRS Type 1099-Ok, Cost Card and Third Social gathering Community Transactions.

International sellers incomes US supply revenue topic to withholding will obtain IRS type 1042-S, International Individual’s US Supply Revenue Topic to Withholding. Nevertheless, it’s price noting that this can be a uncommon incidence.

Please keep watch over your mailbox for these essential paperwork if relevant to you.

Delayed Implementation of the $600 Threshold

The IRS has postponed the implementation of the diminished $600 threshold till 2024. In case your 2023 exercise didn’t surpass $20,000 and 200+ transactions, you’ll not obtain Type 1099-Ok.

To make sure correct year-end reporting, please verify your tax standing or replace your mailing deal with info by finishing the W8/W9 digital questionnaire right here.

Understanding Gross Proceeds

It’s important to differentiate between gross proceeds and earnings. Bear in mind, you pay taxes in your earnings, not your gross proceeds. Gross proceeds are used to compute your revenue, factoring in returns, allowances, working bills, and extra. For extra steering, seek advice from our FastSpring assist paperwork on info reporting.

World VAT Charge Adjustments — Efficient January 1, 2024

Keep knowledgeable about current adjustments in world VAT charges:

- Singapore GST charge elevated to 9%.

- Switzerland VAT charge elevated to eight.1%.

- Estonia VAT charge elevated to 22%.

- Luxembourg’s short-term 1% VAT charge discount, which expired on the finish of final 12 months, is again as much as 17%.

We perceive that these adjustments might influence your enterprise, and staying knowledgeable is essential for clean operations. You probably have any questions or want help, our help group is right here to assist.

Wishing you a affluent 12 months forward!

Beth Thorpe

Senior Platform Assist Specialist

Quarterly B2B Onboarding Replace: Your Full Information to Seamless Transactions!

As we kick off the brand new quarter, we’re thrilled to current our up to date B2B Onboarding Reality Sheet — a complete information crafted to streamline ecommerce transactions in your B2B consumers.

Whether or not you’re a seasoned vendor or new to our platform, our up to date B2B Onboarding Reality Sheet is the go-to useful resource to assist your purchaser by means of the seller setup and ecommerce transaction course of. The included info might be imported into buyer-specific doc codecs or to buyer onboarding portals as you assist them full any distinctive buying necessities to make sure a clean and environment friendly vendor setup course of.

Obtain the very fact sheet right here or level your consumers to our Buyer Assist Portal to the Checkout and Buying > Arrange FastSpring as a Provider menu, the place they’ll entry it straight.

Thanks for selecting FastSpring as your trusted enterprise companion. We sit up for persevering with to serve you and your consumers with excellence.

Beth Thorpe

Senior Platform Assist Specialist

Fraud, Chargebacks, and Mitigation Methods

As Benjamin Franklin correctly famous, “In life, there are two constants – demise and taxes.”

Within the realm of e-commerce, a 3rd fixed arises: fraud.

Fraud encompasses deceitful actions to illicitly purchase items, providers, or monetary benefits.

As a service provider of document (MoR), FastSpring handles cost processing whereas carrying the accountability of making certain legit transactions. FastSpring has applied the next efforts to successfully detect and mitigate fraudulent actions:

- Rigorous fraud prevention measures, together with collaboration with superior third-party programs.

- Continuous monitoring.

- Common updates and verification of purchaser identities.

- Upkeep of safe cost processing programs.

Chargebacks

On this planet of on-line transactions, a chargeback refers back to the reversal of a credit score or debit card cost initiated by the cardholder’s financial institution. This reversal is often triggered when a cardholder alleges {that a} transaction resulted from fraud or abuse. The implications of chargebacks might be detrimental each within the brief and long run.

FastSpring’s devoted Threat group diligently displays chargebacks and takes a proactive strategy by conducting thorough assessments earlier than deciding to combat the chargeback. This cautious consideration is a part of our dedication to supporting our prospects in managing and mitigating the influence of chargebacks successfully.

FastSpring Instruments

The Chargeback Overview Dashboard is offered on FastSpring’s Contextual platform for a fast snapshot of your chargeback metrics, together with present chargeback charge, chargebacks by cost technique, and far more!

Chargeback Mitigation Methods

Outlined beneath are eight steps that we recommend implementing to help you in minimizing potential chargebacks and establishing lasting buyer safety.

1. Implement Clear Insurance policies and Communication Channels

To cut back chargebacks, you could set up clear refund insurance policies, prominently featured in your web sites and in buyer communications. Offering finish customers with a refund choice mitigates chargeback probability. Moreover, guarantee accessibility to your Buyer Assist by clearly displaying contact particulars, providing a number of communication channels (e-mail, cellphone, stay chat), and promptly responding to inquiries.

2. Proactive Buyer Communication

Common communication with prospects, together with order updates and automatic notifications at numerous buy levels, minimizes misunderstandings. If attainable, look into using e-mail or SMS alerts for order and supply confirmations, fostering transparency and wonderful buyer satisfaction.

3. Present Glorious Buyer Assist

Equip your Buyer Assist group with the data and instruments crucial to deal with buyer issues promptly and professionally. Coaching is vital to resolving points effectively and sustaining a constructive buyer expertise.

4. Doc and Observe Buyer Interactions

Preserve an in depth document of buyer interactions by means of a CRM system (or comparable device). This can assist observe communications and supply precious insights into recurring points.

5. Examine and Reply to Chargebacks

Upon receiving a chargeback notification, it’s best to promptly examine the case, accumulating related proof resembling order particulars, communication historical past, and proof of supply. Ought to this occur to you, please attain out to threat[at]fastspring.com.

6. Collaboration is Key

Set up a relationship with the FastSpring Buyer Assist group, ensuring you keep knowledgeable by using our documentation and subscribing to our changelog. Search steering on efficient chargeback navigation, and keep knowledgeable about any updates which will influence your chargeback administration technique.

7. Analyze Chargeback Traits

Frequently evaluate your Chargeback Overview Dashboard within the FastSpring platform to determine traits. Share insights with related stakeholders, and collaborate with the FastSpring Assist group to arrange webhooks for well timed alerts.

8. Repeatedly Enhance

Conduct periodic assessments of your chargeback administration course of, searching for suggestions out of your buyer group and from prospects themselves. Determine areas for enchancment and implement methods to boost the general buyer journey, finally lowering chargebacks and fostering a constructive relationship along with your prospects. For subscription administration, yow will discover out extra info from Visa and Mastercard on cost reminders.

Comply with the above eight steps to guard your enterprise from fraud and chargebacks whereas constructing sturdy buyer relationships. Implement clear insurance policies, talk proactively, provide wonderful buyer help, and repeatedly assess and enhance. FastSpring is dedicated to supporting your journey for sustainable development and top-notch buyer satisfaction within the ever-evolving ecommerce panorama.

Fraud, Chargebacks, and Mitigation FAQ

Q: How is my chargeback charge calculated?

A: Your chargeback charge is the variety of chargeback transactions through the given interval divided by the overall variety of transactions throughout the identical interval.

Mastercard calculates their chargebacks barely in another way — complete variety of first chargebacks this month / earlier month’s complete variety of gross sales transactions.

Q: What number of chargebacks are thought of too many?

A: Your chargeback charge mustn’t exceed 0.90%, which you’ll be able to see in your Chargeback Overview Dashboard within the FastSpring platform. FastSpring has an early warning threshold of 0.65% to make sure your chargeback charge is beneath management as quickly as attainable if it does start to rise.

Q: Can my finish customers get banned for submitting too many chargebacks?

A: Easy reply: Sure, they’ll. Chargeback knowledge is mechanically fed into the FastSpring fraud engine, and this serves as a key sign for all sellers throughout the FastSpring platform.

Gareth Earney

Buyer Success Supervisor

FastSpring offers an all-in-one cost platform for SaaS, software program, and digital merchandise companies, together with VAT and gross sales tax administration, cost localization, and client help. Arrange a demo or attempt it out for your self.