![]() Enigma Community launched in late 2021. BehindMLM printed its Enigma Community overview on January 18th, 2022.

Enigma Community launched in late 2021. BehindMLM printed its Enigma Community overview on January 18th, 2022.

In reviewing Enigma Community, we discovered an MLM alternative offering entry to an automatic buying and selling bot.

Though Dave Wiltz was credited as Enigma Community’s founder and President, J. Joshua Beistle and Doug Wellens have been behind the corporate.

I can’t inform you precisely when Enigma Community collapsed however its official FaceBook web page was deserted in Could 2022.

SimilarWeb additionally tracks negligible visitors to Enigma Community’s web site over the previous three months.

Enigma Community’s collapse has prompted the launch of BFX Commonplace, primarily the identical scheme with a distinct identify.

Of notice is a shakeup of Enigma Community’s company lineup, particularly Richard Anzalone.

Anzalone was indicted in 2017 on legal fees associated to Infinity2Global.

Anzalone pled responsible to these fees in Could 2022, believed to be across the time Enigma Community collapsed.

Anzalone has but to be sentenced however, until he plans to take part from jail, I don’t consider he’s a part of BFX Commonplace.

One other important occasion that occurred in Could was the 2022 Terra/Luna collapse, which led to a ~66% crypto market dump.

Whether or not that was a contributing issue to Enigma Community collapsing stays unclear.

Enigma Community represented it was primarily based out of Texas. BFX Commonplace seems to be integrated as a Wyoming shell firm, presumably additionally run out of Texas.

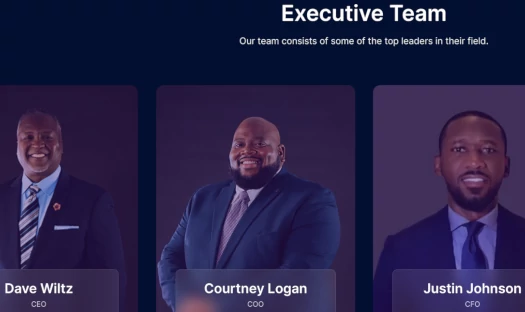

BFX Commonplace’s company lineup is Dave Wiltz as CEO, Courtney Logan as COO and Justin Johnson as CFO.

Courtney Logan rode the non-public growth grift till he bought into crypto circa 2017.

By late 2017 Logan had joined iMarketsLive.

The CFTC fined iMarketsLive for commodities fraud in 2018.

Having learnt all the pieces about foreign exchange from a pyramid scheme committing commodities fraud in just some quick months, Logan went on to begin promoting foreign exchange masterclasses.

Beneath the manufacturers US30 Academy and RFX Academy, Logan charged hundreds of {dollars} for his newly acquired foreign exchange experience.

As we speak SimilarWeb tracks negligible visitors to each US30 Academy’s and RFX Academy’s web sites. This probably led to Logan signing on with BFX Commonplace.

Of notice is RFX Academy being considered one of Enigma Community’s merchandise and persevering with over to BFX Commonplace.

I wasn’t capable of put collectively an MLM historical past on Justin Johnson. Like Dave Wiltz, Justin seems to be a no one previous to BFX Commonplace.

J. Joshua Beistle’s MLM historical past of Ponzi and pyramid schemes was lined in BehindMLM’s Enigma Community overview.

Curiously, I haven’t seen Doug Wellens in any of BFX Commonplace’s advertising and marketing. I’m unsure if he’s nonetheless with the corporate or if he’s cashed out.

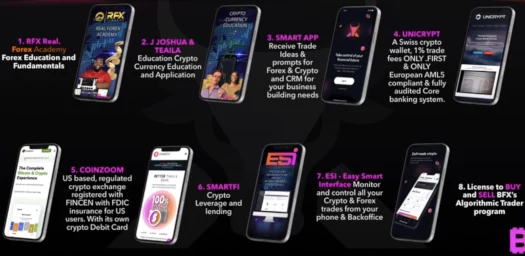

Like Enigma Community, BFX Commonplace pitches an app-based crypto and foreign currency trading platform, powered by “A.I. algorithms”.

That is from an official BFX Commonplace advertising and marketing video on their web site:

Included in our cryptocurrency buying and selling module is a robust A.I. algorithm, that comes with 4 years of documented market success and (is) utilized by a billion greenback hedge fund with placing outcomes.

Naturally, and in violation of securities and commodities legislation within the US, BFX Commonplace fails to supply shoppers with proof of its advertising and marketing claims.

As with Enigma Community, the automated buying and selling facet of BFX Commonplace can also be powered by the corporate’s undisclosed algorithms:

BFX members can select to take part in day by day market trades developed by this wonderful A.I. know-how.

In what seems to be an try at pseudo-compliance, BFX Commonplace has affiliate buyers swipe on an app to provoke automated algorithm buying and selling.

This isn’t the equal of manually performing on a obtained buying and selling sign. It’s turning an automatic buying and selling bot on and off.

From the identical BFX Commonplace prelaunch occasion that Courtney Logan spoke at, J. Joshua Beistle touted a 268% annual ROI via his buying and selling algorithm.

Let’s check out the place we’re for … 2021. We’re up between 135% and 147%.

Now, that is all what I name easy returns. I need to present you now what occurs with compounding.

If you happen to regularly commerce the up or down quantity, that’s compounding, you’re going to see that 147% for final yr really goes as much as 268%.

If we have a look at compounding …. beginning January 1st of final yr via to at the moment’s date, you’re up about 640%.

Beistle claims his buying and selling bot is “up 70% yr to this point for 2022”.

Once more, no proof by the use of audited monetary reviews are offered.

The remainder of BFX Commonplace’s providing is padding round their automated buying and selling app platform.

Right here At BFX Commonplace, You Will Have The Alternative To Meet With Actual Educators In Actual Time In accordance To Your Schedule, Which Will Assist Complement Your Academy Expertise And Training.

We Supply A Selection Of Cryptocurrency And Foreign exchange Training.

Our Educated Professionals Enable You To Peek Over Their Shoulders Throughout Market Hours In Dwell Coaching Classes, Making It Extraordinarily Straightforward For You To Observe Alongside From The Consolation Of Any Good Gadget.

One other part of BFX Commonplace is what seems to be a partnership with SmartFi.

On their web site SmartFi advertises a 12% annual ROI on invested cryptocurrency.

SmartFi will not be registered with the SEC.

This yr particularly US authorities have gone after crypto funding schemes committing securities fraud. Notable examples embody BlockFi and Nexo.

I haven’t seen something particular on BFX Commonplace’s compensation plan. They did point out “day by day and weekly pay”, so I consider it’s not considerably completely different to that of Enigma Community (scroll all the way down to “Enigma Community’ Compensation Plan”).

As to BFX Commonplace pricing, once more I haven’t seen that disclosed.

For reference, Enigma Community charged

- $99 for 4 months entry to the foreign exchange or crypto bot;

- $999 for annual entry to the foreign exchange or crypto bot; or

- $2499 for annual entry to the foreign exchange and crypto bot

Enigma Community affiliate membership was $15 a month with a doable necessary $60 preliminary spend.

Regardless of providing passive returns via A.I. buying and selling bots, neither BFX Commonplace, Dave Wiltz or J. Joshua Beistle are registered with the SEC.

In providing passive returns via foreign currency trading, BFX Commonplace can also be required to be registered with the CFTC.

BFX Commonplace will not be registered with the CFTC.

For his or her half, BFX Commonplace company seem well-aware of regulatory authorized necessities.

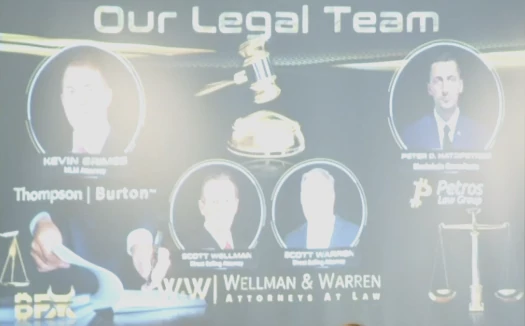

When BehindMLM reviewed Enigma Community, the corporate was represented by Wellman and Warren.

With BFX Commonplace the corporate has expanded its authorized group:

Addressing authorized compliance, David Wilx had this to say at a BFX Commonplace occasion, believed to have been held in late September:

We’ve layered ourselves with legal professionals. We’ve got our compliance over right here. We’ve got the group.

And we’re gonna comply with it to the “T” as a result of we need to ensure that all the pieces we do is authorized throughout the board.

After Wilx spoke, Courtney Logan gave his tackle BFX Commonplace’s compliance;

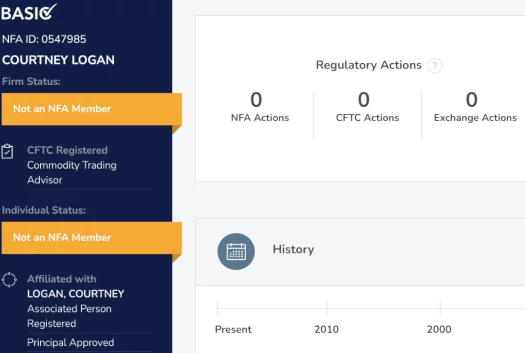

So my background is in legislation. I’m a foreign exchange dealer. I’ve a Sequence 3, a Sequence 34 and I’ve one other licensed CTA.

I used to be simply right here to provide schooling after which as I bought to be taught Dave and I bought to be taught the group, that kinda grew, due to my authorized background, into changing into a guide for the corporate.

“Sequence 3” and “Sequence 34” consult with NFA exams administered by FINRA.

Logan isn’t NFA registered however, as of April 2022, is registered with the CFTC as a Commodity Buying and selling Advisor.

Logan’s registration is as a sole proprietor and has nothing to do with BFX Commonplace. Moreover, the buying and selling facet of BFX Commonplace is run by J. Joshua Beistle, not Logan.

I’m citing Logan’s CFTC registration although as a result of just a few weeks in the past he shared this on Instagram:

Between his CFTC registration and Sequence 3 examination rating of 97% rating on laws (Logan failed this explicit check sitting), believable deniability goes out the window.

Getting again to Logan’s compliance speak;

And considered one of my roles was to assist be certain that the muse from a authorized perspective was intact, with the intention to be certain that we had a compliant firm. And that was quite a lot of work.

One of many issues that we did, was we went out and we bought assist.

Whenever you don’t know precisely what to do, you go rent legislation companies. And also you go rent advisors to help and assist you.

One of many legislation companies that we went and bought is Armstrong Teasdale. You’ll be able to Google them. You’ll be able to look them up.

Extra particularly, the rationale I engaged with Armstrong Teasdale is as a result of they’ve a accomplice, who’s one of many head legal professionals on the agency, who was the director of the SEC for the state of Missouri. Who is without doubt one of the lead counsels for our authorized group.

That was essential for me as a result of we’re in blockchain. We’re in crypto. And as a few of you recognize, possibly you don’t know, the SEC is the regulatory company over quite a lot of the cryptocurrency that’s out within the present house.

So we went and bought a agency. Extra importantly we went and bought the lawyer that used to run a complete state of the SEC.

They usually’re additionally serving to us with our CFTC work, which is the work finished on the foreign exchange facet.

However we didn’t cease there … we don’t have one lawyer that does all of it. We’ve got a group of legal professionals that do various things for us.

We’ve got trademark attorneys. We’ve got belief legal professionals. We’ve got Kevin Grimes who’s our FTC lawyer, who’s serving to us be certain that our direct gross sales mannequin is authorized and compliant.

We even have Robust & Hanni out of Utah, who’re additionally FTC attorneys as nicely. Which might be serving to us to make sure that our direct gross sales mannequin is compliant.

That is necessary to me as a lawyer. It’s essential to me as an ex-prosecutor.

As a result of the one factor I don’t need to occur, is I don’t need us to begin down this street of what we consider to be a very, actually superior firm, and it will get shut down.

As beforehand acknowledged, BFX Commonplace isn’t registered with the SEC or CFTC.

As an alternative of registering with monetary regulators, submitting audited monetary reviews and working legally, BFX Commonplace pretends it’s not doing the factor it’s doing:

If BFX Commonplace’s compensation plan differs considerably from Enigma Community, BehindMLM will contemplate publishing a standalone overview.

Failing which, whether or not BFX Commonplace lasts longer than Enigma Networks’ ~6 months stays to be seen.

Replace eighth October 2022 – Some additional particulars on the price and compensation facet of BFX Commonplace:

- $150 to join a “Expertise Cross”, then $60 a month.

- Affiliate members is $150 after which $75 a month

- 3 months crypto or foreign currency trading bot entry is $299

- 12 months crypto or foreign currency trading bot entry is $999

- 12 months crypto and foreign currency trading bot entry is $2499 (4 automated buying and selling accounts)

- commissions are paid on bot subscriptions from retail clients and recruited associates

- 3 month pays $60, $999 annual pays $200 and $2499 annual pays $500

- all the pieces else seems to be the identical as Enigma Community