The EminiFX Receiver has secured court-approval to dump 3680 BTC.

The EminiFX Receiver has secured court-approval to dump 3680 BTC.

The overwhelming majority of the bitcoin (3658 BTC), was recovered from CoinPayments in November.

The Receiver filed an software high dump the bitcoin on December ninth.

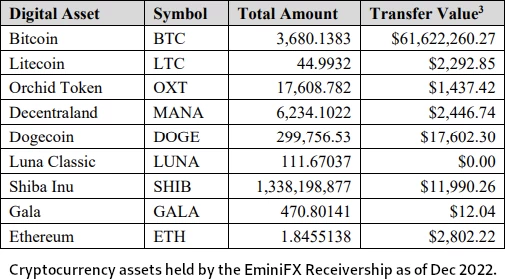

Since October, the property has acquired over 3,680 Bitcoin (BTC) valued at over $60 million, in addition to further digital belongings valued at round $50,000.

The Receiver believes it’s in the perfect curiosity of the property to promote the property’s cryptocurrency in a managed course of.

The proposed “managed course of” would see the Obtain rsell of 500 BTC each fortnight. This may happen over 4 months, with the goal of

minimiz(ing) the market impression on promoting these belongings, reduc(ing) the impression of the value volatility of Bitcoin on the property, and reduce(ing) the potential draw back danger of holding cryptocurrency for an prolonged time frame.

As a part of the approval course of, EminiFX traders got the chance to supply suggestions.

Between December ninth and December twenty first, the EminiFX Receivership acquired “over a thousand emails from 930 distinctive e-mail addresses”.

Nearly all of emails (744) had been a kind template or variation thereof. The shape was offered to traders by way of a Telegram group run by EminiFX’s high net-winners.

As you’d count on, the shape template was the same old refusal to acknowledge EminiFX was a Ponzi scheme and complaints concerning the Receivership.

The scammers working the EminiFX Telegram group have a vested curiosity in thwarting EminiFX regulatory proceedings. Sadly they proceed to feed traders misinformation.

Different suggestions from traders bemoaned bitcoin tanking from ~$40,000 to ~$17,000 as of December 2022.

Bitcoin worth is down. Not a great time to promote.,We’ll free thousands and thousands. [sic]

One widespread proposal put forth was not promoting the bitcoin, with the goal of ultimately making distribution funds in bitcoin itself.

I want to request to the Receiver and the Federal Authorities to permit traders or those that chooses to, to obtain their investments again as bitcoin digital foreign money because it as soon as was when It was acquired by Eminifx.

On December twenty second, the CFTC filed a reply in assist of the Receiver’s software.

Tthe Fee’s investigation decided that EminiFX clients and potential clients had been advised, previous to the purchasers’ making deposits, that they might obtain assured returns of no less than 5% “each single week” on their contributions.

Subsequently, clients contributed funds to EminiFX after representations that they had been making a secure funding and that their cash wouldn’t be in danger.

The Fee didn’t uncover proof that clients had been advised that their cash could be held in risky digital belongings that might probably lose a lot or all of their worth.

As a result of clients contributed to EminiFX after being advised that their cash could be secure, the Fee helps inserting property belongings right into a secure funding car till they are often distributed.

The CFTC additionally addressed widespread complaints and misconceptions raised by EminiFX traders.

Feedback from clients asking the Receiver to retain the property’s digital belongings, although they characterize the vast majority of the feedback acquired by the Receiver, characterize solely a small fraction of the 62,000 EminiFX clients.

And in any occasion, these feedback suggesting that the Receiver maintain the digital belongings after which “promote excessive” ask the unattainable—the Receiver can not probably know whether or not the property’s digital belongings will admire or depreciate sooner or later.

The Fee additionally needs to reply to criticisms and obvious misconceptions within the buyer Kind Letter and different buyer feedback.

First, the Kind Letter accuses the Receiver of dropping “over $50 million {dollars} of our crypto foreign money worth” by way of his “choices and indecision” about investments.

Respectfully, this isn’t correct. It was Defendants (EminiFX), not the Receiver, who selected to build up bitcoin within the winter and spring of 2022 when bitcoin was at its all-time highs above $40,000, and to put that bitcoin in a overseas digital asset alternate from which it couldn’t be shortly withdrawn by the Receiver.

By the point the Receiver was appointed on Might 12, 2022, bitcoin had already fallen under $29,000—a drop of greater than 38% from its all-time excessive.

The Receiver labored diligently to achieve entry to the digital belongings, and finally succeeded on November 20, 2022.

The Receiver isn’t liable for the decline in bitcoin costs earlier than he was appointed or whereas he diligently sought to acquire entry to the digital belongings.

Second, the Kind Letter and different feedback indicate that the Receiver is liable for Mr. Alexandre not having the facility to manage and commerce EminiFX funds.

Once more, it is a false impression. It was the Fee that moved for a statutory restraining order appointing the Receiver and requiring him to “[a]ssume full management of [EminiFX] by eradicating Defendant Eddy Alexandre,” which the Courtroom granted.

Thereafter, the Defendants, together with Mr. Alexandre, agreed to a preliminary injunction that, amongst different issues, prohibited Mr. Alexandre from working any pooled funding car like EminiFX or coming into into trades of commodity pursuits.

Thus, Mr. Alexandre was faraway from his place of management of EminiFX not by the Receiver’s whim, however by the Courtroom’s orders, which had been entered on the Fee’s request and (within the case of the preliminary injunction) with Mr. Alexandre’s settlement.

The Receiver filed a response to investor issues on December twenty second, noting “at this level, the losses because of the decline within the worth of Bitcoin are a sunk price.”

In an order issued on January 4th, the court docket granted the EminiFX Receiver’s software.

The Courtroom agrees with the CFTC and the Receiver that as a result of cryptocurrencies are extremely risky and since the holdings of the Property will ultimately must be transformed to foreign money to be distributed to traders, essentially the most prudent strategy is to divest from Bitcoin and different cryptocurrencies.

Whereas the Courtroom is sympathetic to the issues of EminiFx traders that their investments have, on web, misplaced worth as the value of Bitcoin has fallen, this loss highlights the riskiness of Bitcoin as an funding car and demonstrates the necessity to transfer these extremely risky digital belongings into dollar-denominated, low-risk belongings.

Neither the Courtroom, the Receiver, nor the traders can know what the long run will carry for the worth of Bitcoin or the opposite cryptocurrencies from now till the Property is distributed to the traders.

Thus, the Receiver’s movement to approve the proposed digital asset administration protocol is GRANTED.

As reviewed right here on BehindMLM in March 2022, EminiFX was a foreign exchange themed Ponzi scheme.

In parallel legal proceedings, EminiFX founder Eddie Alexandre stays scheduled to face trial on March twenty seventh, 2023.