Working a enterprise is difficult. Working a cash-intensive enterprise like eCommerce is even tougher. Many eCommerce companies shut store not as a result of they aren’t promoting merchandise however as a result of they run out of money and might’t order extra stock.

Small companies have a restricted funds, so each greenback you spend issues. By having a strong monetary understanding of what you are promoting you’ll be able to be sure you’re spending {dollars} the place they’re most useful. That’s precisely what accounting will allow you to do.

Let’s discover the necessities of eCommerce accounting and the way the appropriate monetary practices can develop your on-line enterprise.

What Is eCommerce Accounting?

eCommerce accounting is the vital apply of recording, organizing, and managing the entire monetary information and transactions related to an eCommerce firm.

When accomplished correctly, accounting tells you the way wholesome your eCommerce enterprise is. It may present you:

- Gross sales and Income Monitoring: Recording all incoming gross sales and income generated by on-line transactions.

- Stock Administration: Retaining observe of the inventory of merchandise on the market, guaranteeing correct valuation, and updating stock ranges in real-time as gross sales happen.

- Value of Items Bought (COGS): Calculating the direct prices related to producing or buying the merchandise which can be bought. This consists of prices like uncooked supplies, manufacturing bills, and transport prices.

- Cost Processing Charges: Monitoring charges charged by fee gateways and fee processors.

- Taxation: Complying with tax rules and calculating the taxes relevant to eCommerce transactions, which might be complicated because of totally different tax guidelines throughout areas and nations.

- Buyer Returns and Refunds: Dealing with accounting entries for product returns, refunds, and chargebacks, guaranteeing that the monetary data precisely replicate these actions.

- Monetary Reporting: Making ready monetary statements, similar to revenue statements, steadiness sheets, and money circulate statements, to evaluate the monetary well being of the eCommerce enterprise.

Correct, well timed, and complete eCommerce accounting is essential for making knowledgeable choices. By understanding the true state of what you are promoting you’ll be able to develop even with monetary constraints.

How Does an eCommerce Proprietor Be taught eCommerce Accounting?

If you wish to develop into an accounting grasp, you’re going to want to start out by changing into your personal greatest bookkeeper. When you will have clear, organized monetary documentation you’ll be in a greater place to know, interpret, and apply the data.

Step 0: Generate Monetary Paperwork

Earlier than you’ll be able to grasp eCommerce accounting you must get within the apply of manufacturing monetary paperwork and begin doing so every month.

The three main monetary paperwork for an eCommerce enterprise are:

- Revenue assertion – a snapshot of how a lot you’ve earned

- Steadiness sheet – the property what you are promoting owns and the quantity you owe to collectors

- Money circulate assertion – the amount of money getting into and leaving an organization

Step 1: Familiarize Your self with Main Monetary Paperwork

The revenue assertion, steadiness sheet, and cashflow assertion present a complete image of what you are promoting’s monetary well being.

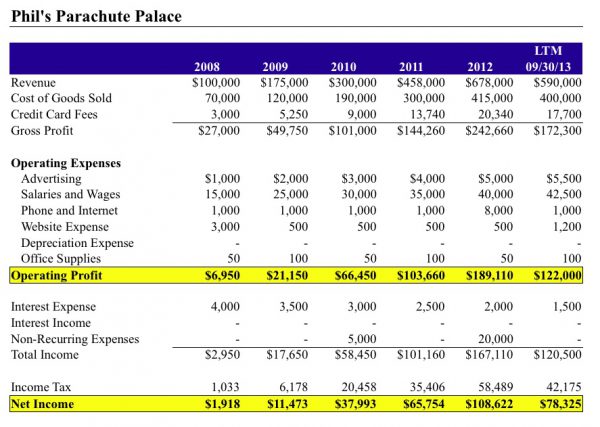

An revenue assertion, often known as a profit-and-loss (P&L) assertion, reveals what your organization earns, what it spends, and if it’s making a revenue over a selected time frame. An revenue assertion reveals the next:

- Income

- Value of products bought/value of gross sales

- Gross revenue or contribution margin

- Working bills or promoting, common and administrative bills (SG&A)

- Working revenue

- Non-operating gadgets

- Earnings earlier than taxes (EBT)

- Web revenue

The steadiness sheet reveals the property what you are promoting owns and the quantity you owe to collectors at a selected cut-off date. A steadiness sheet reveals the next:

- Present property

- Mounted property

- Present liabilities

- Lengthy-term liabilities

- Shareholders’ fairness

Lastly, the money circulate assertion is essential, particularly for inventory-based companies, because it tells you the way a lot money you’ve gained or misplaced for a sure interval. A money circulate assertion will observe the next:

- Receipts from gross sales of products and companies

- Curiosity funds

- Revenue tax funds

- Funds made to suppliers of products and companies

- Wage and wage funds

- Lease funds

- Different bills

These monetary stories let you establish main warning indicators and monitor the efficiency of what you are promoting.

For these keen to achieve extra information about these paperwork, a really helpful useful resource from the eCommerceFuel group is the e-book “Monetary Intelligence for Entrepreneurs.” 📚

Step 2: Do Your Personal Accounting

The second step includes doing your personal accounting for a number of months. It could be time-intensive and never essentially one of the best value-add exercise for many eCommerce entrepreneurs, however this course of permits you to perceive how these monetary paperwork come collectively and the way actual features of what you are promoting present up on these monetary paperwork.

Upon getting a strong grasp of those paperwork, it’s time to rent a bookkeeper to generate these on a month-to-month foundation. Having somebody do that for you’ll allow you to focus extra on advertising, operations, product improvement, and different vital features of your eCommerce enterprise.

Do You Want an Accountant or a Bookkeeper?

You don’t want both an accountant or bookkeeper. Nonetheless it’s common to rent a bookkeeper, at the very least half time, as what you are promoting grows.

Whereas an accountant and a bookkeeper each play important roles in managing your eCommerce funds, their duties differ.

What Does a Bookkeeper Do?

A bookkeeper gathers all of your monetary paperwork (like financial institution accounts and bank card statements), ensures their accuracy and completeness, then organizes them systematically in eCommerce accounting software program like Xero or QuickBooks (extra on software program under).

Reviewing your statements, they generate monetary paperwork similar to:

- Revenue statements

- Steadiness sheets

- Money circulate statements

In essence, bookkeepers are monetary organizers.

What Does an Accountant Do?

Fairly than merely accumulating monetary info, accountants allow you to interpret it. They usually help with tax planning, money circulate administration, and tax technique.

accountant helps you construction your funds and spending to attenuate your tax invoice. They may information you on making investments or making the most of tax applications or deductions that may cut back your tax legal responsibility.

In essence, accountants are monetary consultants.

Begin By Doing Your Personal Bookkeeping

Many small enterprise house owners select to deal with their very own bookkeeping, then hand it off to an accountant at tax time.

As what you are promoting grows and you’ve got increasingly monetary transactions you’ll need somebody to deal with the bookkeeping for you. An element-time bookkeeper is quite common within the eCommerceFuel group.

Planning for Development with an Accountant

As what you are promoting continues to develop, it would be best to deliver on an accountant that can assist you make extra essential monetary choices similar to which loans to take out and when.

One of many largest challenges for rising eCommerce companies is managing money circulate. accountant will help predict potential money shortfalls and advise on monetary choices to maintain progress.

How An Accountant Might Assist Your eCommerce Enterprise

What’s Money-Based mostly Accounting and How does it Differ From Accrual-Based mostly Accounting?

Money-basis accounting is the only kind of accounting, and is the place most eCommerce house owners begin. It merely tracks the money that comes out and in of what you are promoting.

Nonetheless, this simplicity comes with a draw back: it’s the least correct.

A extra correct image of the monetary well being of a enterprise might be obtained through the use of accrual-based accounting, which matches up the timing of gross sales with the associated prices, making an allowance for stock prices on the time of sale, moderately than on the time of buy.

💡 Tip: Accrual-based accounting is sort of required if you happen to’re going to promote what you are promoting. One of many members inside ECF shared this after promoting her enterprise (hyperlink for ECF members-only):

In case your financials aren’t correct, prepare for a world of damage. This might have an effect on your a number of, the money you expect from a sale, your stock numbers, the size of time it takes to shut, and many others… Ensuring your books are accrual based mostly and have correct COGS particularly are so essential.

Can an Accountant Forecast Main Bills? AKA Money Circulation Administration

Forecasting main bills is an important side of eCommerce accounting. Homeowners will usually wish to order giant portions of stock for higher bulk-pricing and environment friendly transport prices. However it may be arduous to know precisely how a lot you’ll be able to afford to attempt to hit these bulk-pricing reductions.

Accountants can create monetary projections that can assist you visualize the monetary breakpoints, how a lot debt you’d tackle, and the way a lot you’d need to pay every month for these giant stock purchases.

Accountants may also allow you to arrange separate enterprise financial institution accounts for several types of purchases. It’s frequent to have a separate account to save lots of up for giant capital expenditures. This helps preserve funds organized and makes it simpler to identify crucial quantities.

Can An Accountant Estimate and Pay Taxes?

For those who’re working a profitable eCommerce retailer you need to already pay quarterly tax estimates to the federal government. To do this precisely you want a tough concept of your gross sales tax fee, how briskly your revenues and bills are rising, and the way a lot you’ll owe in taxes.

You’ll be able to rent an accountant for this round tax time, or a part-time accountant in your group can preserve your estimated funds up to date as you undergo the 12 months.

Discovering the Proper eCommerce Accounting Help for Your Enterprise

Finding the appropriate accountant or bookkeeper is usually a powerful endeavor. Phrase-of-mouth referrals from friends in related companies is usually a incredible useful resource on this regard.

Moreover, communities of like-minded members, similar to eCommerceFuel or different eCommerce associations, may also present suggestions based mostly on private experiences.

It’s essential to do not forget that one of the best match for what you are promoting can change over time as what you are promoting grows and evolves. For those who discover that your present accountant isn’t as proactive or educated as your rising enterprise requires, don’t hesitate to hunt out different choices, even when it means spending somewhat extra.

Specialised eCommerce Accounting: A Worthy Funding?

Given the quite a few nuances in eCommerce, it’s useful to have interaction an accountant who specializes on this area. Having an accountant with a agency grasp of accrual accounting is usually a game-changer for inventory-based companies like eCommerce retailers.

eCommerce Accounting Software program

To have the ability to perceive the important monetary paperwork you want accounting software program that can assist you generate the appropriate monetary stories within the first place.

Selecting the right accounting software program to your eCommerce enterprise relies upon largely in your particular wants. Some in style choices embody A2X Accounting, QuickBooks, Xero, and others.

A2X Accounting serves as a bridge between your eCommerce platform (like Amazon or Shopify) and your accounting software program, guaranteeing your information is clear and arranged.

QuickBooks and Xero are complete cloud-based accounting platforms, each providing strong options to handle your books successfully.

TaxJar is one other useful gizmo for automating gross sales tax reporting and submitting, whereas instruments like Finale Stock and Stock Planner can considerably streamline your stock administration.

Within the age of automation, platforms like these can show to be very important parts of your monetary stack.

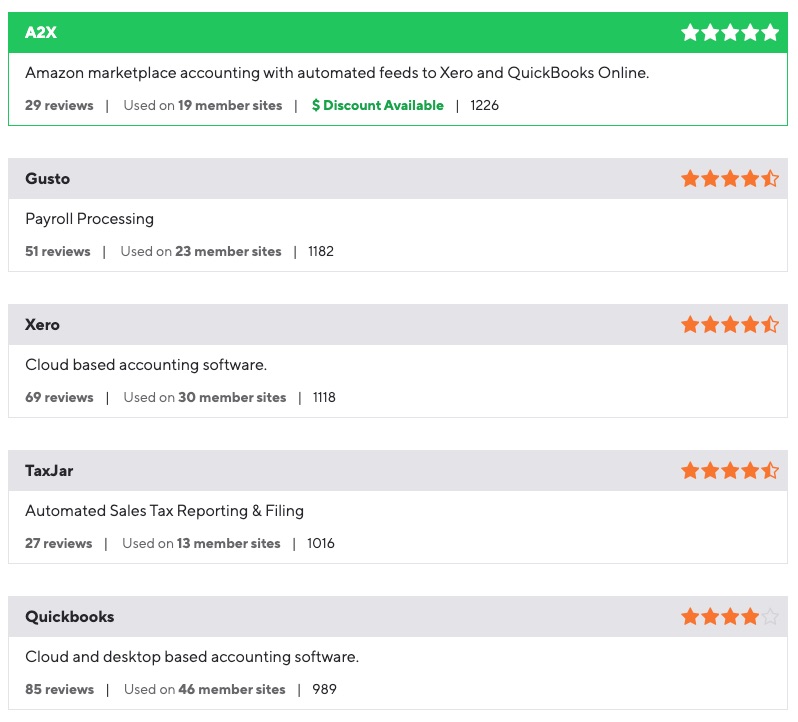

The eCommerceFuel group takes evaluations significantly. We evaluation software program particularly with the lens of serving to different eCommerce house owners make one of the best choices. Right here’s a sneak peak of our evaluation listing displaying the highest outcomes for accounting software program.

🙋♂️If you wish to learn the evaluations and see the websites that use these companies apply right this moment to develop into a member of the eCommerceFuel group.

Remaining Ideas: eCommerce Accounting

Strategic monetary administration is just not a luxurious however a necessity for each eCommerce enterprise. It’s a must to have somebody in your group who can allocate cash the place it grows what you are promoting shortly with out taking up an excessive amount of debt.

As an proprietor that could be your job though an accountant may also allow you to with that. A bookkeeper will allow you to preserve your monetary paperwork organized and correct.

With the appropriate steering, common monetary evaluations, and appropriate software program instruments, what you are promoting can’t solely maintain itself however thrive within the aggressive eCommerce panorama.