One of many perks of an eCommerce enterprise is you can usually get began with little or no upfront prices. However sooner or later, almost everybody with a rising enterprise has to contemplate financing. A financial enhance empowers you to put money into important sources to your firm, comparable to stock, advertising and marketing, and expertise.

With out enough financing, your eCommerce enterprise might wrestle to compete or fail to succeed in its full potential. On this article, we’ll discover the fundamentals of financing for eCommerce companies, what financing choices are on the desk, and once you would possibly use every of those financing choices that will help you develop.

TLDR for Financing

For those who’re in search of the quick and candy reply there are some guidelines of thumb which can assist:

When Is it Time to Pursue Financing Choices?

Earlier than you pursue financing, it’s best to decide if it’s the fitting time to your firm.

Search Financing When Your Enterprise Is Established

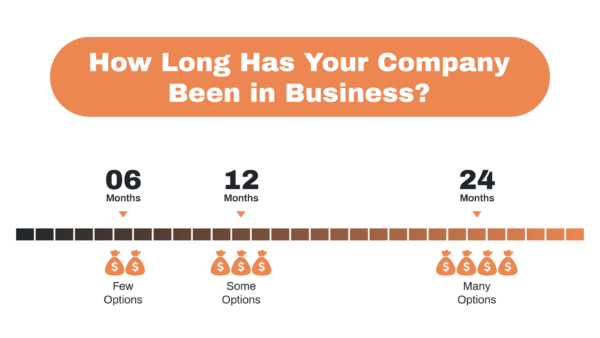

If you wish to entry capital, your corporation wants to have the ability to present progress and ideally revenue. The longer your organization has been working and creating wealth, the higher. If your corporation is lower than six months outdated, it will likely be tough to safe financing. However should you’ve been working for greater than two years, you’ll have a better time accessing a number of financing choices for eCommerce companies.

It’s higher to have a mixture of financing choices obtainable to you, as choices can abruptly grow to be unavailable or change considerably. For instance, a financial institution that gives small enterprise loans might exit of enterprise, or a bank card firm might change its phrases and rates of interest.

We had our [line of credit] pulled in September 2020 with zero discover […] Fortunately, we had been capable of purchase a while, get an SBA 7a mortgage to pay it off, and get away unscathed aside from numerous stress and wasted time.

-An ECF Discussion board member

Search Financing When You Have Time To Pursue It

Financing is commonly a trade-off between the cash you’ll get and the work it takes to safe it. Low-cost financing choices, comparable to loans from conventional banks, require important effort and time to safe, together with detailed enterprise plans, monetary projections, and private ensures.

Then again, bank cards or service provider money advances, could also be simpler to acquire however include increased charges and rates of interest. In consequence, eCommerce companies should weigh the prices and advantages of various financing choices and select the one that most closely fits their wants and objectives.

Banks, Credit score Unions, and SBA Loans

Native banks and credit score unions are sometimes the most suitable choice for low-cost and dependable financing. These establishments usually supply a spread of financing choices, together with time period loans, strains of credit score, and entry to Small Enterprise Administration (SBA) loans.

Whereas it could take a while to discover a financial institution or credit score union that understands the distinctive wants of an eCommerce enterprise, the trouble is normally price it. Native banks and credit score unions usually have extra versatile lending standards and higher phrases than bigger, nationwide banks. They’re additionally extra more likely to work with eCommerce retailers to tailor a financing answer to their particular wants.

Banks and credit score unions supply 4 frequent financing choices for eCommerce retailers:

- Time period Loans: The lender supplies a lump sum of cash that have to be repaid over a hard and fast time frame, usually with fastened month-to-month funds.

- Line of Credit score: The lender supplies a most amount of cash the borrower can entry and use as wanted. Curiosity is charged solely on the quantity borrowed.

- SBA Mortgage: The lender facilitates a mortgage offered by the Small Enterprise Administration

- Asset-based lending: The lender makes use of the borrower’s belongings, comparable to stock or accounts receivable, as collateral to safe the mortgage.

Time period Mortgage vs. Line of Credit score

When deciding between a time period mortgage and a line of credit score, retailers ought to take into account their particular wants and objectives.

A time period mortgage is an effective choice for retailers who want a selected amount of cash to fund a selected venture or buy, comparable to transferring to a brand new warehouse or shopping for new tools. This kind of financing supplies a lump sum of cash that have to be repaid over a hard and fast time frame, usually with fastened month-to-month funds.

Some time period loans from ECF members:

| Financial institution | Charge | Restrict |

| Chase | Prime + 2-3% | 100k |

A line of credit score is an effective choice for retailers who want ongoing entry to funds to cowl variable bills or benefit from alternatives as they come up. This kind of financing supplies a most amount of cash that the borrower can entry and use as wanted.

Curiosity is simply charged on the quantity borrowed. For those who don’t draw from the road of credit score, then you definately received’t pay any curiosity, which is extremely useful when money movement turns into tight.

The most effective time to get a financial institution LOC is once you don’t want it (severely).

-An ECF Discussion board Member

Some strains of credit score from ECF members:

| Financial institution | Charge | Restrict |

| Financial institution of America | Prime + 4% | 500k |

| PNC Financial institution | Prime + 4.5% | 5M |

| Truist | Prime + 0.75% | 175k |

| Fifth Third | 3.26% | 500k |

SBA Loans

The Small Enterprise Administration (SBA) provides a number of various kinds of loans:

- 7(A)

- CDC – 504

- CAP Strains

- Export Loans

- Microloans

- Catastrophe Loans

The 7(A) mortgage is the preferred choice. It supplies working capital of as much as $5 million for companies which have a good credit score rating and might present a down cost of 10-20%. It may be used for quite a lot of functions, together with buying tools, refinancing debt, bettering a enterprise, or shopping for a enterprise.

The Group Growth Company or CDC/504 mortgage is particularly designed to buy owner-occupied actual property. The phrases of this mortgage require the borrower to occupy at the least 51% of the area for his or her enterprise, and the mortgage is often structured with the financial institution lending as much as 50%, the group growth company lending as much as 40%, and the borrower offering the remaining 10% as a down cost.

The SBA CAP Line is a line of credit score of as much as $5 million that can be utilized along side a 7(A) or 504 mortgage. These strains of credit score are helpful for eCommerce retailers who must finance seasonal working capital or buy orders.

The SBA Export Mortgage is a mortgage of as much as $5 million that’s particularly designed to assist American companies export their merchandise abroad. These loans have a few of the finest charges and phrases obtainable by the SBA.

The SBA Microloan is a small mortgage of as much as $50,000, with the typical mortgage being $13,000. These loans are designed to offer eCommerce retailers with entry to capital for small-scale initiatives or purchases.

Lastly, the SBA Catastrophe Mortgage is obtainable to companies in declared catastrophe areas to assist them get better from the consequences of the catastrophe.

Discovering and Securing an SBA Mortgage

Not all banks course of SBA loans. You should use the SBA’s lender stories web site to discover a record of banks which have made SBA loans prior to now and begin contacting them.

It is very important keep in mind that the SBA mortgage course of will be very time-consuming and require detailed documentation, so you will need to begin early and be ready. One ECF member mentioned this:

At occasions, it felt like a 2nd job to get it performed.

For those who do get turned down for an SBA mortgage it signifies that particular financial institution didn’t wish to take the danger. You possibly can all the time apply once more by one other financial institution.

Some SBA loans from ECF members:

| Sort of Mortgage | Charge | Restrict |

| 504 | 2-3% | 810k for 25 years |

| 504 | 2.9% | 1.6M for 25 years |

Asset Based mostly Lending

Asset-based lending is a sort of financing that makes use of the belongings of a enterprise as collateral for a mortgage. With asset-based lending, the lender evaluates the worth of a enterprise’s belongings (comparable to stock, tools, and accounts receivable) to find out the mortgage quantity the enterprise can qualify for.

With asset based mostly lending your most quantity of capital modifications usually alongside along with your belongings and accounts receivable. Some banks would require updates in your stock each month. This kind of lending is advantageous in case you have a rising enterprise, because the most quantity of capital will develop with you.

Andrew interviewed David Golob about The World of Asset Based mostly Lending on the podcast. Give it a hear if you wish to study extra. 🎧

Some asset based mostly lending loans from ECF members:

| Charge | Restrict |

| Prime + 0.5% | 3.5M |

| 4% | 1.5M |

Credit score Playing cards

A really polarizing financing choice for eCommerce companies are bank cards. They’re handy, versatile, and might normally be secured in just a few days or perhaps weeks.

Along with the financing advantages, many bank cards additionally supply rewards that may present enterprise house owners with priceless perks, comparable to money again and journey rewards.

Bank cards additionally give you a chance to delay cost utilizing their grace interval also called the float.

Favourite Credit score Playing cards from the ECommerce Gasoline Group

There are just a few bank cards the ECF group loves.

Chase Ink Enterprise: 3x factors for each buy spent on journey and transport

American Categorical Enterprise Gold: 3x factors on a single class of your selection. Enroll in FedEx open financial savings for five% assertion credit on FedEx fees

Capital One Spark Enterprise: Simple on the spot approvals and flat 2% money again on all the pieces

Parker: No collateral, no private assure, 60 day float

Some bank card charges from ECF members:

| Title | Charge | Restrict |

| Financial institution of America Enterprise Card | 13% APR | 70k |

| Chase Ink Most well-liked | 45k | |

| Capital One Spark Enterprise | 65k |

Credit score Card Rewards Wizardry

As somebody who doesn’t play the bank card sport I can solely name it what it seems to be wish to me: wizardry. 🪄

Once you get good at maximizing bank cards you may get some severe rewards. One dialogue on the ECF Discussion board was about combining the rewards from two Amex playing cards:

For those who spend $50k a month on transport and promoting on an Amex Gold Card, due to the 4x multiplier with the NEW gold playing cards that’s 200k factors monthly.

You possibly can switch Amex factors to Schwab with [Amex Platinum Charles Schwab] card the place every level is became $0.0125. Out of your Schwab account you may clearly money this out or use it to speculate.

If I spend $50k to get 200k factors and I switch these factors into Schwab, I get $2500 (200,000 x .0125). $2500 / $50,000 is 5%. So, basically, I’m getting a 5% money rebate on my transport and promoting spend.

With out this wizardry you would get a 2% money again return with the Capital One Spark Enterprise card. However through the use of a bit of savvy and planning you may get a 5% money again return. Once you’re spending tens of hundreds on transport and promoting that may be a enormous distinction.

Enterprise Credit score Card Protections

It will be important for enterprise house owners to remember that enterprise bank cards aren’t protected by the Credit score Card Act. The Credit score Card Act is a federal regulation that gives protections to customers. These protections do not apply to enterprise bank cards so purchaser beware.

Low Credit score Rating / New Enterprise Choices

ECommerce enterprise house owners with low credit score scores or very new firms might have issue accessing conventional types of financing, like financial institution loans. So let’s discover the choice financing choices for these sorts of eCommerce companies.

Crowdfunding

Crowdfunding platforms, like Kickstarter or Indiegogo permit companies to lift funds from numerous particular person traders. This can be a nice choice in case you have a brand new product that you just wish to launch. You possibly can safe the funding upfront to make merchandise for precisely the individuals who need them.

Enterprise Grants

Grants are financial awards from non-public organizations or authorities entities. They don’t include monetary strings – which suggests you received’t need to pay curiosity.

Nevertheless, the applying course of will be prolonged and really aggressive. Additionally, you will need to do a big quantity of analysis to seek out grants your particular enterprise sort is certified for.

However there are definitely grant choices for eCommerce enterprise. For instance, the Enterprise Growth Financial institution of Canada is giving $15,000 to digitize your corporation. And also you additionally get entry to a $100,000 mortgage with 0% curiosity. This could possibly be a significant boon if your corporation meets the entire standards.

Service provider Money Advances & Income Based mostly Financing

Service provider money advances present companies a lump sum of money in trade for a share of future gross sales. This generally is a good choice for eCommerce companies which have a gradual stream of incoming gross sales and wish entry to money rapidly.

When you begin making gross sales, platforms like Amazon, PayPal, Shopify, or Wayflyer make it simple to request funding to develop your corporation. Nevertheless, these charges are structured in another way from the normal annual share charge (APR) you get from a bank card or financial institution mortgage.

For those who’re not cautious, service provider money advances can eat up a big quantity of your income.

One ECF discussion board consumer posted about their expertise with a service provider money advance:

We now have an impressive mortgage with Wayflyer now. We expect they’re pretty respectable. Not as low cost as a financial institution, however we’re paying shut to twenty% curiosity when adjusted for APR.

A frequent visitor on the ECF Podcast, Invoice D’Alessandro, shared a calculator that reveals how a 9% fixed-fee mortgage seems to be a 44% APR.

And right here is one other consumer’s sincere opinion of their service provider money advance:

The cash was wanted, I used to be grateful it was obtainable, however holy crap the curiosity nearly ate us alive and saved us within the money crunch manner longer than we wanted to be in it.

Attempt to finance your organization’s progress with conventional financing choices. However should you’re nonetheless quick and wish money movement to keep up momentum, then a service provider money advance may be your best choice.

On-line Lending

It’s price mentioning that some on-line banks sit between a service provider money advance and a time period mortgage from an area brick and mortar financial institution. Two such examples are On Deck and Kabbage.

The charges are advanced and tough to match in opposition to a standard APR charge. However usually they’re simpler to safe than a time period mortgage from a financial institution and cheaper than a service provider money advance.

Ultimate Ideas on Financing Your Enterprise

You desire a rising, thriving eCommerce enterprise. However progress usually comes with an elevated want for money. Whether or not you’re investing in a prolonged utility and assessment course of for low rates of interest, or choosing quick money with increased rates of interest, be sure to make your best option to your firm’s wants – and continue to grow!

In order for you extra suggestions and sources to assist develop your eCommerce enterprise, be part of our group of 7-8-figure model house owners. All our members are vetted practitioners – not distributors or novices – guaranteeing everybody has a deep, significant eCommerce expertise to share. Sound attention-grabbing? Apply for membership and be part of us right now.