One of many perks of an eCommerce enterprise is that you could typically get began with little or no upfront prices. However in some unspecified time in the future, practically everybody with a rising enterprise has to contemplate financing. A financial enhance empowers you to spend money on important assets to your firm, comparable to stock, advertising and marketing, and expertise.

With out satisfactory financing, your eCommerce enterprise could battle to compete or fail to achieve its full potential. On this article, we’ll discover the fundamentals of financing for eCommerce companies, what financing choices are on the desk, and once you would possibly use every of those financing choices that can assist you develop.

TLDR for Financing

In the event you’re in search of the brief and candy reply there are some guidelines of thumb which is able to assist:

When Is it Time to Pursue Financing Choices?

Earlier than you pursue financing, you must decide if it’s the correct time to your firm.

Search Financing When Your Enterprise Is Established

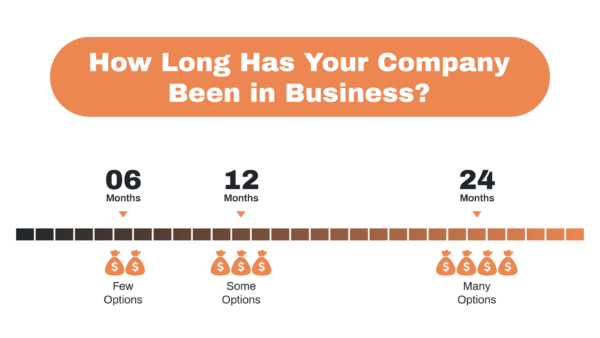

If you wish to entry capital, your small business wants to have the ability to present progress and ideally revenue. The longer your organization has been working and creating wealth, the higher. If your small business is lower than six months outdated, it will likely be difficult to safe financing. However for those who’ve been working for greater than two years, you’ll have a neater time accessing a number of financing choices for eCommerce companies.

It’s higher to have a mixture of financing choices out there to you, as choices can abruptly change into unavailable or change considerably. For instance, a financial institution that gives small enterprise loans could exit of enterprise, or a bank card firm could change its phrases and rates of interest.

We had our [line of credit] pulled in September 2020 with zero discover […] Fortunately, we had been capable of purchase a while, get an SBA 7a mortgage to pay it off, and get away unscathed aside from a variety of stress and wasted time.

-An ECF Discussion board member

Search Financing When You Have Time To Pursue It

Financing is usually a trade-off between the cash you’ll get and the work it takes to safe it. Low-cost financing choices, comparable to loans from conventional banks, require important effort and time to safe, together with detailed enterprise plans, monetary projections, and private ensures.

However, bank cards or service provider money advances, could also be simpler to acquire however include increased charges and rates of interest. In consequence, eCommerce companies should weigh the prices and advantages of various financing choices and select the one that most closely fits their wants and targets.

Banks, Credit score Unions, and SBA Loans

Native banks and credit score unions are sometimes the most suitable choice for low-cost and dependable financing. These establishments sometimes supply a variety of financing choices, together with time period loans, strains of credit score, and entry to Small Enterprise Administration (SBA) loans.

Whereas it could take a while to discover a financial institution or credit score union that understands the distinctive wants of an eCommerce enterprise, the trouble is often value it. Native banks and credit score unions typically have extra versatile lending standards and higher phrases than bigger, nationwide banks. They’re additionally extra prone to work with eCommerce retailers to tailor a financing answer to their particular wants.

Banks and credit score unions supply 4 frequent financing choices for eCommerce retailers:

- Time period Loans: The lender offers a lump sum of cash that have to be repaid over a hard and fast time period, sometimes with mounted month-to-month funds.

- Line of Credit score: The lender offers a most sum of money the borrower can entry and use as wanted. Curiosity is charged solely on the quantity borrowed.

- SBA Mortgage: The lender facilitates a mortgage supplied by the Small Enterprise Administration

- Asset-based lending: The lender makes use of the borrower’s belongings, comparable to stock or accounts receivable, as collateral to safe the mortgage.

Time period Mortgage vs. Line of Credit score

When deciding between a time period mortgage and a line of credit score, retailers ought to contemplate their particular wants and targets.

A time period mortgage is an effective choice for retailers who want a particular sum of money to fund a particular undertaking or buy, comparable to shifting to a brand new warehouse or shopping for new gear. This kind of financing offers a lump sum of cash that have to be repaid over a hard and fast time period, sometimes with mounted month-to-month funds.

Some time period loans from ECF members:

| Financial institution | Price | Restrict |

| Chase | Prime + 2-3% | 100k |

A line of credit score is an effective choice for retailers who want ongoing entry to funds to cowl variable bills or reap the benefits of alternatives as they come up. This kind of financing offers a most sum of money that the borrower can entry and use as wanted.

Curiosity is just charged on the quantity borrowed. In the event you don’t draw from the road of credit score, you then received’t pay any curiosity, which is extremely useful when money move turns into tight.

The very best time to get a financial institution LOC is once you don’t want it (significantly).

-An ECF Discussion board Member

Some strains of credit score from ECF members:

| Financial institution | Price | Restrict |

| Financial institution of America | Prime + 4% | 500k |

| PNC Financial institution | Prime + 4.5% | 5M |

| Truist | Prime + 0.75% | 175k |

| Fifth Third | 3.26% | 500k |

SBA Loans

The Small Enterprise Administration (SBA) presents a number of several types of loans:

- 7(A)

- CDC – 504

- CAP Strains

- Export Loans

- Microloans

- Catastrophe Loans

The 7(A) mortgage is the preferred choice. It offers working capital of as much as $5 million for companies which have an honest credit score rating and might present a down cost of 10-20%. It may be used for quite a lot of functions, together with buying gear, refinancing debt, bettering a enterprise, or shopping for a enterprise.

The Neighborhood Growth Company or CDC/504 mortgage is particularly designed to buy owner-occupied actual property. The phrases of this mortgage require the borrower to occupy at the very least 51% of the house for his or her enterprise, and the mortgage is often structured with the financial institution lending as much as 50%, the neighborhood improvement company lending as much as 40%, and the borrower offering the remaining 10% as a down cost.

The SBA CAP Line is a line of credit score of as much as $5 million that can be utilized along with a 7(A) or 504 mortgage. These strains of credit score are helpful for eCommerce retailers who have to finance seasonal working capital or buy orders.

The SBA Export Mortgage is a mortgage of as much as $5 million that’s particularly designed to assist American companies export their merchandise abroad. These loans have a few of the greatest charges and phrases out there by the SBA.

The SBA Microloan is a small mortgage of as much as $50,000, with the common mortgage being $13,000. These loans are designed to supply eCommerce retailers with entry to capital for small-scale initiatives or purchases.

Lastly, the SBA Catastrophe Mortgage is accessible to companies in declared catastrophe areas to assist them get well from the results of the catastrophe.

Discovering and Securing an SBA Mortgage

Not all banks course of SBA loans. You should use the SBA’s lender stories web site to discover a checklist of banks which have made SBA loans up to now and begin contacting them.

You will need to keep in mind that the SBA mortgage course of could be very time-consuming and require detailed documentation, so you will need to begin early and be ready. One ECF member mentioned this:

At occasions, it felt like a 2nd job to get it finished.

In the event you do get turned down for an SBA mortgage it signifies that particular financial institution didn’t need to take the danger. You may at all times apply once more by one other financial institution.

Some SBA loans from ECF members:

| Kind of Mortgage | Price | Restrict |

| 504 | 2-3% | 810k for 25 years |

| 504 | 2.9% | 1.6M for 25 years |

Asset Based mostly Lending

Asset-based lending is a sort of financing that makes use of the belongings of a enterprise as collateral for a mortgage. With asset-based lending, the lender evaluates the worth of a enterprise’s belongings (comparable to stock, gear, and accounts receivable) to find out the mortgage quantity the enterprise can qualify for.

With asset based mostly lending your most quantity of capital adjustments repeatedly alongside together with your belongings and accounts receivable. Some banks would require updates in your stock each month. This kind of lending is advantageous when you’ve got a rising enterprise, for the reason that most quantity of capital will develop with you.

Andrew interviewed David Golob about The World of Asset Based mostly Lending on the podcast. Give it a hear if you wish to be taught extra. 🎧

Some asset based mostly lending loans from ECF members:

| Price | Restrict |

| Prime + 0.5% | 3.5M |

| 4% | 1.5M |

Credit score Playing cards

A really polarizing financing choice for eCommerce companies are bank cards. They’re handy, versatile, and might often be secured in a number of days or even weeks.

Along with the financing advantages, many bank cards additionally supply rewards that may present enterprise homeowners with priceless perks, comparable to money again and journey rewards.

Bank cards additionally give you a chance to delay cost utilizing their grace interval also referred to as the float.

Favourite Credit score Playing cards from the ECommerce Gasoline Neighborhood

There are a number of bank cards the ECF neighborhood loves.

Chase Ink Enterprise: 3x factors for each buy spent on journey and transport

American Categorical Enterprise Gold: 3x factors on a single class of your selection. Enroll in FedEx open financial savings for five% assertion credit on FedEx expenses

Capital One Spark Enterprise: Simple prompt approvals and flat 2% money again on every thing

Parker: No collateral, no private assure, 60 day float

Some bank card charges from ECF members:

| Identify | Price | Restrict |

| Financial institution of America Enterprise Card | 13% APR | 70k |

| Chase Ink Most well-liked | 45k | |

| Capital One Spark Enterprise | 65k |

Credit score Card Rewards Wizardry

As somebody who doesn’t play the bank card recreation I can solely name it what it seems to be prefer to me: wizardry. 🪄

Once you get good at maximizing bank cards you will get some severe rewards. One dialogue on the ECF Discussion board was about combining the rewards from two Amex playing cards:

In the event you spend $50k a month on transport and promoting on an Amex Gold Card, due to the 4x multiplier with the NEW gold playing cards that’s 200k factors per thirty days.

You may switch Amex factors to Schwab with [Amex Platinum Charles Schwab] card the place every level is become $0.0125. Out of your Schwab account you’ll be able to clearly money this out or use it to speculate.

If I spend $50k to get 200k factors and I switch these factors into Schwab, I get $2500 (200,000 x .0125). $2500 / $50,000 is 5%. So, basically, I’m getting a 5% money rebate on my transport and promoting spend.

With out this wizardry you could possibly get a 2% money again return with the Capital One Spark Enterprise card. However through the use of a bit of savvy and planning you will get a 5% money again return. Once you’re spending tens of hundreds on transport and promoting that may be a big distinction.

Enterprise Credit score Card Protections

It is necessary for enterprise homeowners to bear in mind that enterprise bank cards usually are not protected by the Credit score Card Act. The Credit score Card Act is a federal legislation that gives protections to customers. These protections do not apply to enterprise bank cards so purchaser beware.

Low Credit score Rating / New Enterprise Choices

ECommerce enterprise homeowners with low credit score scores or very new firms could have issue accessing conventional types of financing, like financial institution loans. So let’s discover the choice financing choices for these sorts of eCommerce companies.

Crowdfunding

Crowdfunding platforms, like Kickstarter or Indiegogo enable companies to boost funds from numerous particular person buyers. This can be a nice choice when you’ve got a brand new product that you simply need to launch. You may safe the funding upfront to make merchandise for precisely the individuals who need them.

Enterprise Grants

Grants are financial awards from non-public organizations or authorities entities. They don’t include monetary strings – which implies you received’t should pay curiosity.

Nevertheless, the appliance course of could be prolonged and really aggressive. Additionally, you will should do a big quantity of analysis to search out grants your particular enterprise sort is certified for.

However there are actually grant choices for eCommerce enterprise. For instance, the Enterprise Growth Financial institution of Canada is giving $15,000 to digitize your small business. And also you additionally get entry to a $100,000 mortgage with 0% curiosity. This might be a serious boon if your small business meets all the standards.

Service provider Money Advances & Income Based mostly Financing

Service provider money advances present companies a lump sum of money in trade for a proportion of future gross sales. This is usually a good choice for eCommerce companies which have a gentle stream of incoming gross sales and wish entry to money rapidly.

When you begin making gross sales, platforms like Amazon, PayPal, Shopify, or Wayflyer make it straightforward to request funding to develop your small business. Nevertheless, these charges are structured otherwise from the standard annual proportion charge (APR) you get from a bank card or financial institution mortgage.

In the event you’re not cautious, service provider money advances can eat up a big quantity of your earnings.

One ECF discussion board consumer posted about their expertise with a service provider money advance:

We have now an excellent mortgage with Wayflyer now. We predict they’re pretty respectable. Not as low cost as a financial institution, however we’re paying shut to twenty% curiosity when adjusted for APR.

A frequent visitor on the ECF Podcast, Invoice D’Alessandro, shared a calculator that reveals how a 9% fixed-fee mortgage seems to be a 44% APR.

And right here is one other consumer’s trustworthy opinion of their service provider money advance:

The cash was wanted, I used to be grateful it was out there, however holy crap the curiosity nearly ate us alive and stored us within the money crunch approach longer than we would have liked to be in it.

Attempt to finance your organization’s progress with conventional financing choices. However for those who’re nonetheless brief and wish money move to take care of momentum, then a service provider money advance is perhaps the best choice.

On-line Lending

It’s value mentioning that some on-line banks sit between a service provider money advance and a time period mortgage from a neighborhood brick and mortar financial institution. Two such examples are On Deck and Kabbage.

The charges are complicated and troublesome to check in opposition to a conventional APR charge. However usually they’re simpler to safe than a time period mortgage from a financial institution and cheaper than a service provider money advance.

Remaining Ideas on Financing Your Enterprise

You need a rising, thriving eCommerce enterprise. However progress typically comes with an elevated want for money. Whether or not you’re investing in a prolonged software and evaluation course of for low rates of interest, or choosing quick money with increased rates of interest, be sure you make your best option to your firm’s wants – and continue to grow!

In order for you extra ideas and assets to assist develop your eCommerce enterprise, be a part of our neighborhood of 7-8-figure model homeowners. All our members are vetted practitioners – not distributors or newbies – guaranteeing everybody has a deep, significant eCommerce expertise to share. Sound attention-grabbing? Apply for membership and be a part of us at this time.