Almost two thirds of senior resolution makers really feel their group is underprepared to fulfill their environmental, social, and governance objectives and regulatory reporting mandates, in accordance with a brand new international survey launched by Workiva. Additional, 72 p.c don’t have faith within the information presently being reported to stakeholders, regardless of 68 p.c of companies having appointed an ESG-specific function to supervise reporting.

These and different findings of the survey examined 1,300 organizations’ present processes, collaboration and confidence of their ESG reporting. Respondents concerned of their firm’s ESG reporting and technique had been polled from throughout finance, ESG, sustainability, HR, compliance, operations, and legislative affairs.

“ESG reporting necessities are always evolving and companies are confronted with growing complexity and threat when consolidating disparate monetary and non-financial information to cohesively report on their ESG efficiency to stakeholders,” stated Julie Iskow, president & COO at Workiva, in a information launch. “The survey outcomes point out how ESG practitioners from a variety of industries throughout North America, Europe, and APAC are tackling the challenges and alternatives round ESG reporting.”

Evolution of ESG reporting

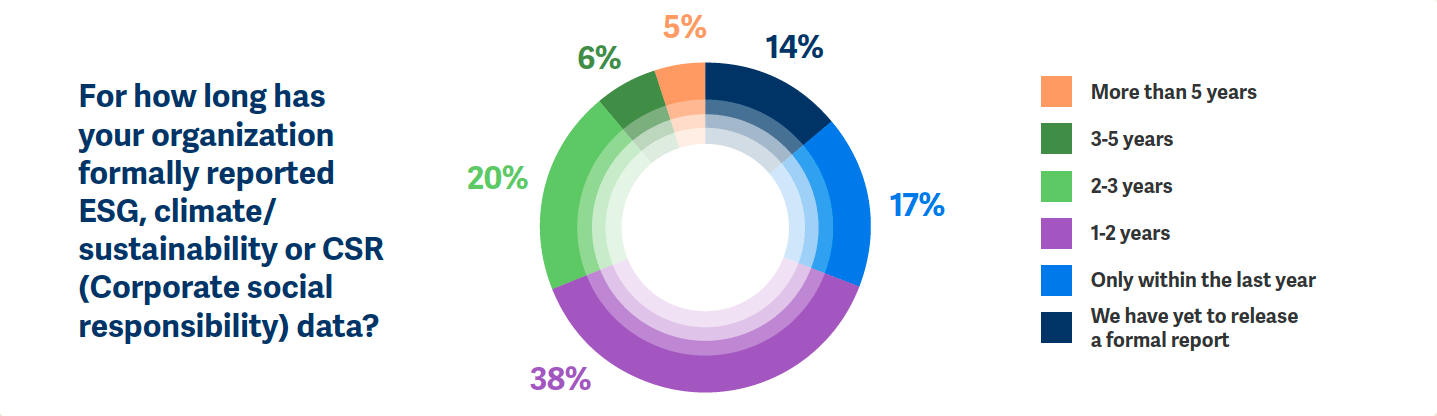

ESG reporting was famous to be a comparatively latest enterprise for many corporations, with 58 p.c of these surveyed confirming their group started formally reporting ESG, local weather/ sustainability or company social accountability information within the final 1-3 years, whereas 14 p.c flagged that their group had but to launch a proper report.

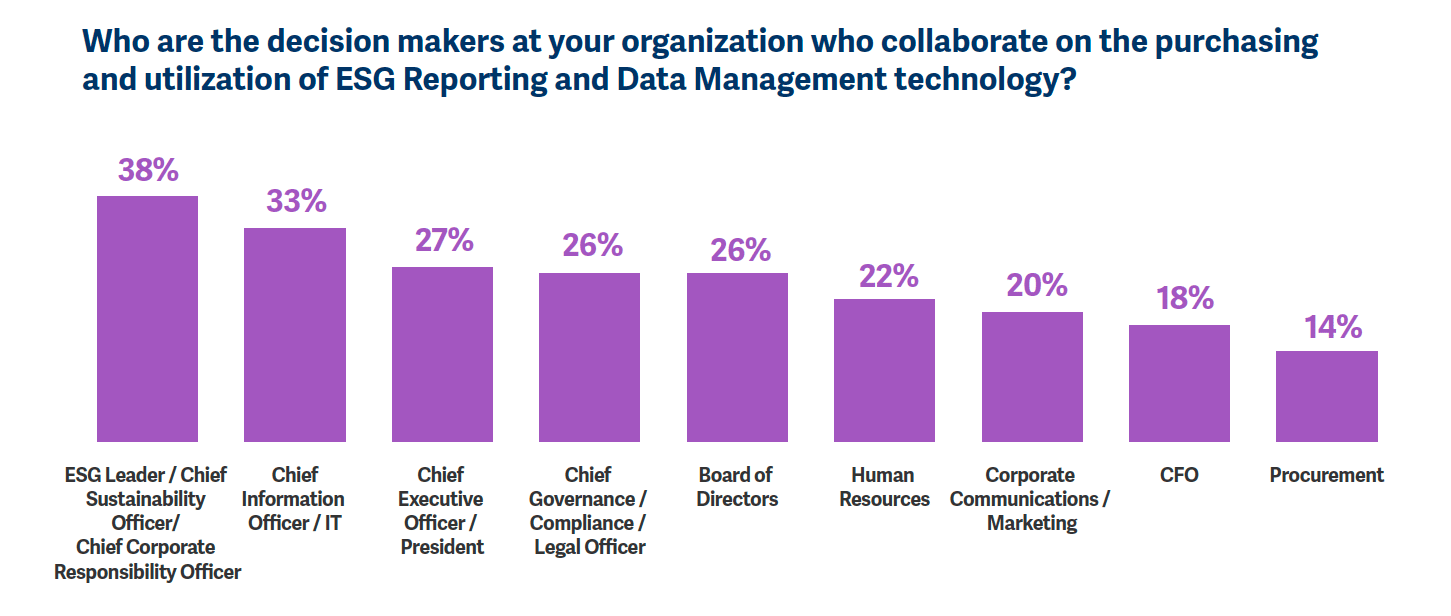

Based on the findings, ESG reporting is being dealt with by a variety of departments inside organizations, signaling the necessity for vital cross-team collaboration. Over a 3rd of respondents famous ESG reporting and technique is led by the ESG/Chief Sustainability Officer (35 p.c) and Operations & Services (35 p.c), adopted by Finance (30 p.c) and Human Assets (28 p.c). Different departments that respondents recognized as taking part in an vital function in ESG reporting included investor relations, advertising/comms, procurement, and authorized/compliance.

Formal ESG stakeholder engagement is an ongoing and vital course of for his or her organizations in accordance with respondents, with virtually half (49 p.c) of respondents confirming that they overview their materiality points each 3-6 months and 29 p.c stating it happens yearly. Nearly two thirds (63 p.c) state that formal stakeholder engagement informs ESG materiality to a big extent.

Apprehension across the ‘E’ in ESG

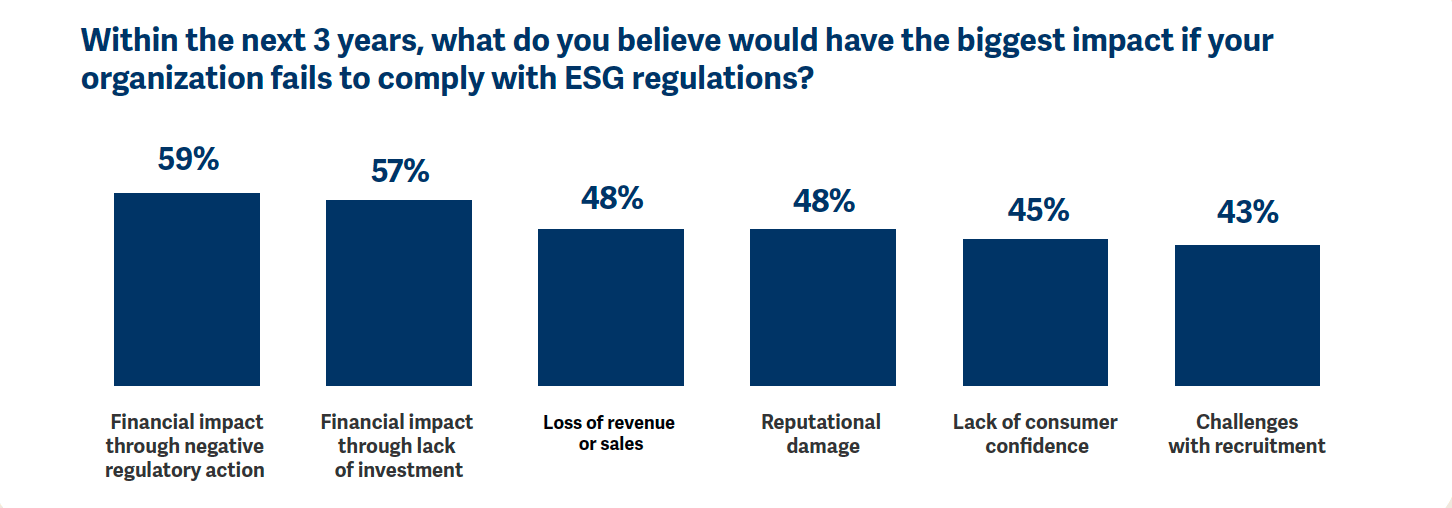

Whereas progress is required throughout all sides of ESG, tackling the ‘E’ is a serious focus for organizations. Respondents predicted that over the following 12-18 months, 43 p.c of their group’s inside ESG funds shall be dedicated to Environmental components, 29 p.c to Social, and 28 p.c in areas of Governance.

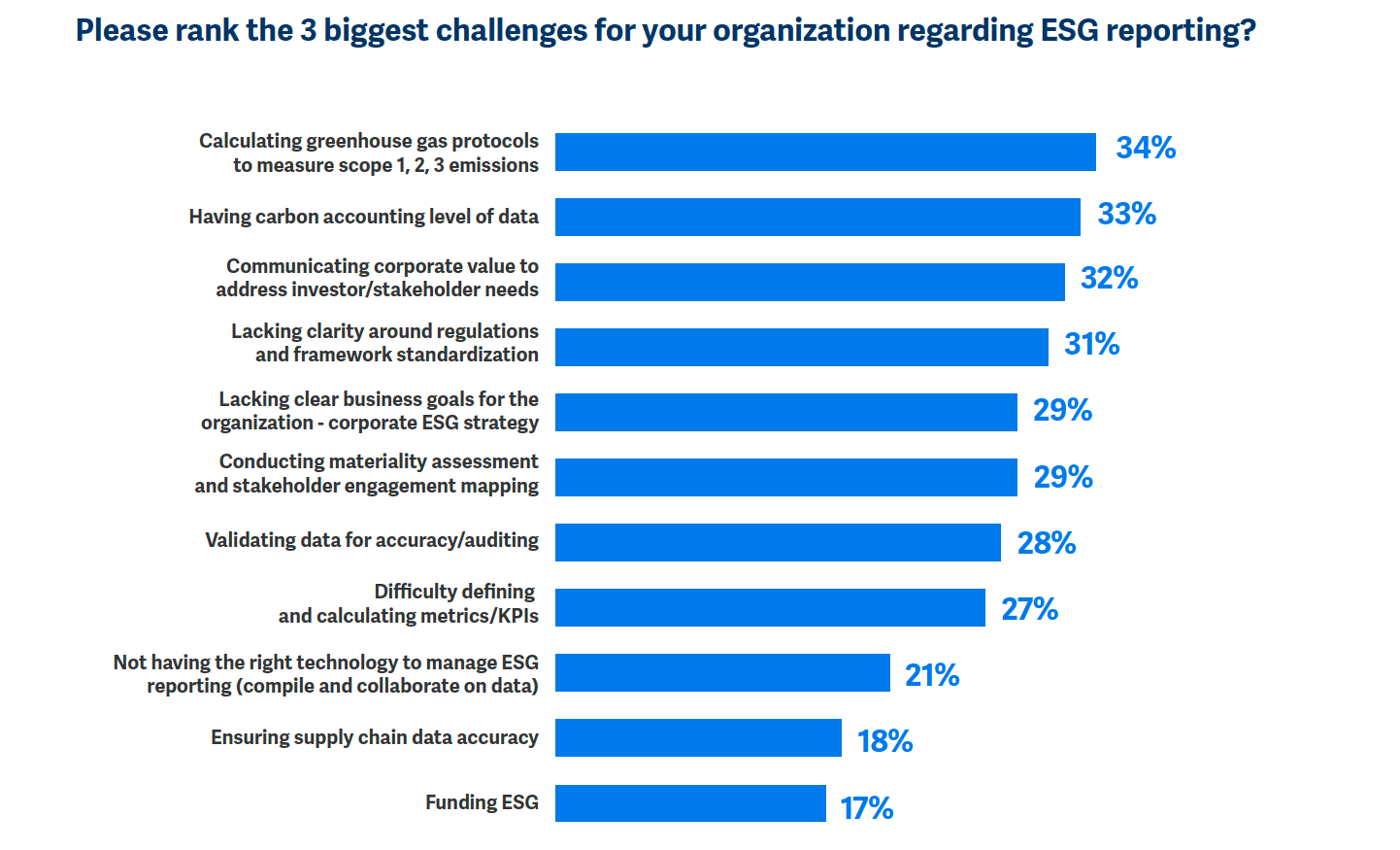

The elevated proportion of funds put aside to give attention to environmental components displays respondents’ issues across the reporting challenges they face. These surveyed, who maintain a variety of positions from C-suite, VP, Director and Supervisor to particular person contributors at these organizations said that two of the largest challenges concerning ESG reporting are calculating greenhouse fuel protocols to measure scope 1, 2 and three emissions and reaching investor-grade carbon disclosures.

“Stakeholders are calling for extra detailed and uniform information associated to ESG. With the latest Sustainable Finance Disclosure Regulation (SFDR) directive in Europe, the ESG disclosure rule proposed by the SEC within the U.S., and the Singapore Trade’s advisable 27 core ESG metrics, the ESG reporting surroundings is changing into extra advanced for organizations,” stated Mandi McReynolds, head of World ESG at Workiva, within the launch. “Specifically, we’re seeing corporations grapple with how you can precisely meet these required disclosures across the ‘E’ in ESG to report GHG emissions with carbon stage accounting information.”

Expertise is required to advance ESG reporting

Given the growing significance of delivering clear, correct information to key stakeholders, there’s a clear want for ESG reporting to be simplified by way of expertise. Globally, three out of 4 respondents famous that expertise was vital for compiling and collaborating on ESG information, in addition to validating information for accuracy (80 p.c) and mapping disclosures to rules and framework requirements (85 p.c). Regardless of this, half of respondents don’t really feel particular person departments inside their group have the programs mandatory to supply information for ESG reporting.

In truth, one in 5 reported that their group doesn’t make use of expertise appropriate for managing the ESG reporting course of and program initiatives. Thirty p.c of these respondents famous that their legacy IT programs are incompatible with new required expertise and 27 p.c said they don’t absolutely perceive what expertise is offered or wanted. Solely a 3rd of general respondents stated their group makes use of expertise and information very nicely to make selections on advancing ESG technique, indicating there may be vital scope to enhance efficiencies and efficiency on this space.

“To navigate this period of change in ESG, companies have to be forward-looking and versatile of their planning. Regulators, traders, prospects, and different stakeholders have recognized what’s important now, however that is solely half of what’s going to be important for tomorrow’s reporting,” added Iskow. “Expertise, which permits seamless integration between groups in a single centralized platform, shall be key to streamlining the reporting course of long run and delivering clear reviews that may meet these evolving calls for to additional enhance worker, investor, and wider stakeholder belief.”

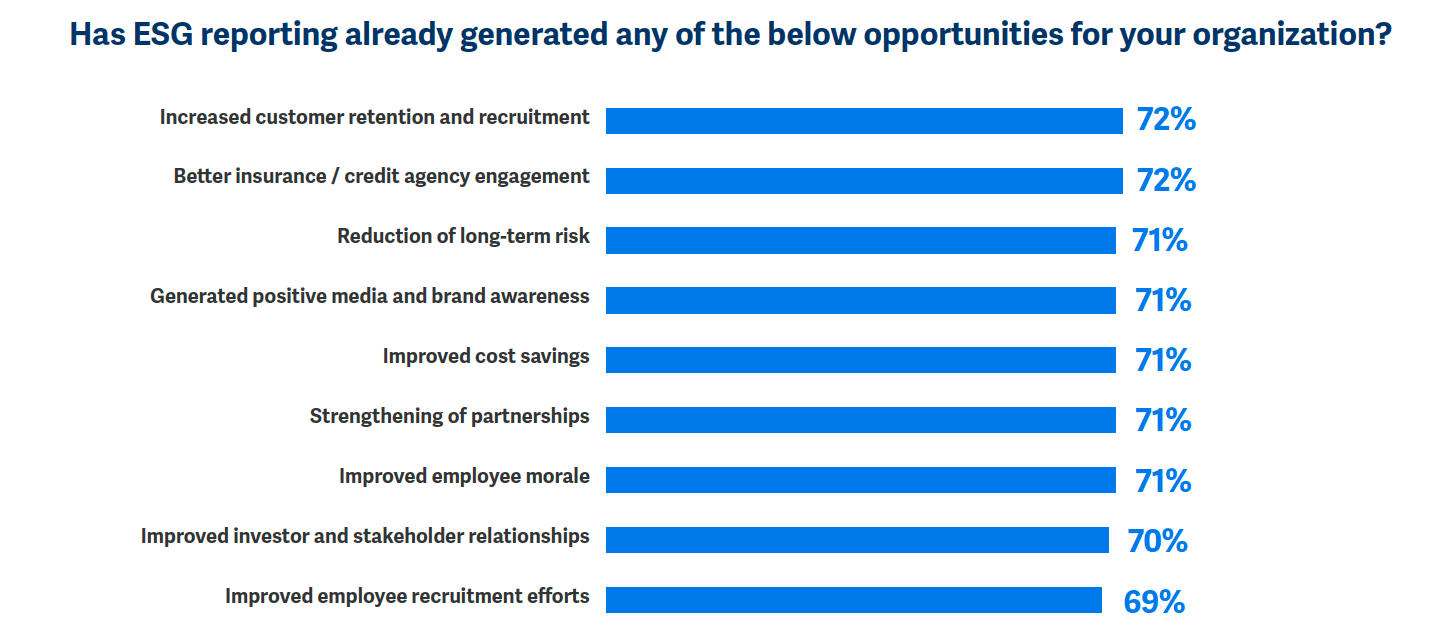

ESG reporting delivers constructive enterprise worth

The survey revealed that corporations are seeing enterprise worth of their present ESG reporting. Seven in 10 respondents said that their group’s ESG reporting has already generated a constructive impression throughout buyer retention and recruitment (72 p.c), price financial savings (71 p.c), insurance coverage/credit score company engagement (71 p.c), and resulted in a discount of long-term threat (71 p.c). The vast majority of respondents additionally famous that ESG reporting has improved worker morale (71 p.c), worker recruitment efforts (69 p.c), in addition to investor and stakeholder relationships (70 p.c).

“Whereas challenges round speaking ESG company worth to stakeholders nonetheless exist, the findings present clear constructive outcomes for companies who prioritize ESG reporting,” added Iskow. “Organizations should implement actions that enable them to maintain tempo with the present and future calls for from regulators, traders, and different stakeholders for trusted, clear information and ESG forward-looking enterprise objectives.”

Obtain the total report right here.

Workiva commissioned Coleman Parkes, an impartial analysis company specializing in B2B expertise, to conduct major analysis amongst companies within the vitality (together with oil & fuel), monetary companies, manufacturing, retail & wholesale, meals & beverage, building, expertise, telecoms, skilled companies, actual property, and transportation industries by way of an internet survey. Respondents had been surveyed between April 14 – Might 6, 2022, and resided in 13 international markets, together with US, UK, Germany, France, Spain, Sweden, Netherlands, Denmark, Norway, Italy, Switzerland, Austria, and Singapore (with an excellent break up of 100 surveys in every market).