Saskatchewan’s Monetary and Client Affairs Authority has requested GSPartners buyers get in touch.

Saskatchewan’s Monetary and Client Affairs Authority has requested GSPartners buyers get in touch.

Traders are requested to contact the FCAA’s Securities Division if they’ve invested with GSPartners. At all times verify registration first earlier than investing.

As above, the FCAA’s request was made on their public Twitter profile on June fifteenth. It follows the FCAA issuing a GSPartners securities fraud warning on June 1st;

The Monetary and Client Affairs Authority of Saskatchewan (FCAA) warns buyers of the web entity GSPartners.

This entity claims to supply Saskatchewan residents a chance to put money into crypto belongings.

GSPartners just isn’t registered to commerce or promote securities or derivatives in Saskatchewan.

The FCAA cautions buyers and customers to not ship cash to corporations that aren’t registered in Saskatchewan, as they will not be reliable companies.

Along with Saskatchewan, Alberta (GSTrade, G999 and GSPartners), Quebec and British Columbia have additionally issued comparable GSPartners associated securities fraud warnings.

The Central Financial institution of the Comoros additionally issued a GSB Gold Commonplace Financial institution fraud warning in June 2022.

Within the midst of Canadian regulatory fraud warnings, GSPartners rebranded to Swiss Valorem Financial institution final month.

As of Could 2023, SimilarWeb tracked Canada because the second largest supply of site visitors to GSPartners’ web site.

The overwhelming majority of GSPartners web site site visitors originates from the US (66%). Authorities there have but to make any investigations into GSPartners public.

By way of cryptocurrency “certificates”, Swiss Valorem Financial institution provides buyers passive returns of as much as 5% per week for 52 weeks.

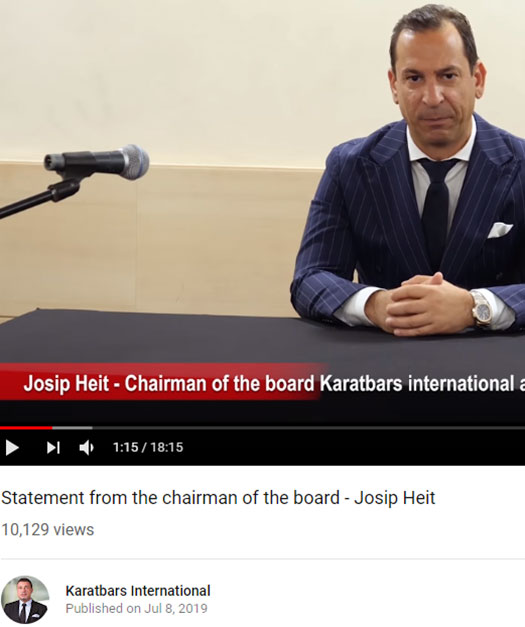

Neither GSPartners, Swiss Valorem Financial institution or proprietor Josip Heit are registered to supply securities in any jurisdiction.

The SEC advises that securities fraud and cryptocurrency is a powerful indicator of a Ponzi scheme.

We’re involved that the rising use of digital currencies within the world market could entice fraudsters to lure

buyers into Ponzi and different schemes by which these currencies are used to facilitate fraudulent, or just

fabricated, investments or transactions.The fraud can also contain an unregistered providing or buying and selling platform. these schemes typically promise excessive returns for getting in on the bottom flooring of a rising Web phenomenon.

Federal and state securities legal guidelines require sure funding professionals and their companies to be licensed or registered.

Many Ponzi schemes contain unlicensed people or unregistered companies.

GSPartners and Swiss Valorem Financial institution are run by former Karatbars Worldwide govt Josip Heit.

Heit, initially from Croatia however believed to carry a German passport, runs GSPartners and Swiss Valorem Financial institution from Dubai.