Globally, 88% of shoppers say “seasonal reductions set off me to make extra on-line purchases”, however is value discounting the most effective technique in 2022? Outcomes from the 2021 Black Friday season recommend “premiumization” or upselling is tapping into shoppers’ need for worth for cash (versus ‘low-cost’) and a unbroken give attention to enhancing the ‘at dwelling’ expertise.

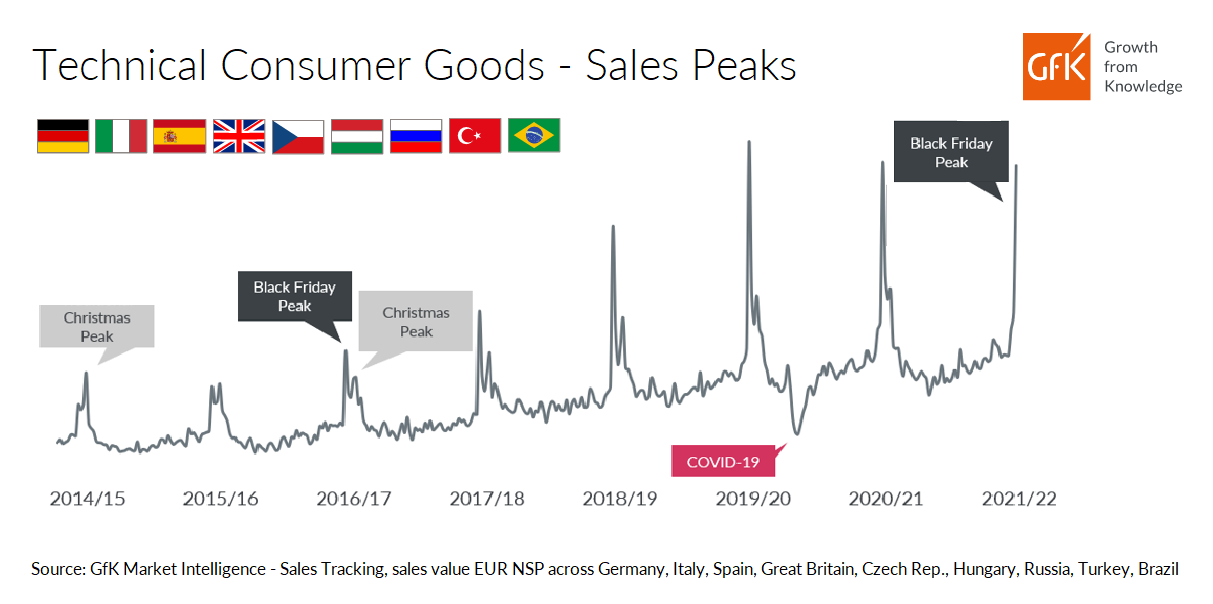

One of the vital constant drivers bringing a surge of consumers to retailers 12 months after 12 months is seasonal promotion. For the final six years, Black Friday peak gross sales for Client Expertise and Durables (T&D) have commonly outstripped Christmas peak gross sales. For 2021, Black Friday season (weeks 45 – 47) even managed so as to add +1% worth progress in comparison with 2020, regardless of the problem of 2020 being a strong-performing interval itself. It isn’t all excellent news, nonetheless. Final 12 months was the second 12 months in a row of decreasing progress for Black Friday week (week 47) in comparison with the common week – doubtlessly giving us an early signal of shopper saturation with seasonal promotions and the chance to draw their spending extra evenly throughout the 12 months.

Whereas Black Friday season stays an necessary promotion peak for retailers outdoors China, counting on seasonal promotions that concentrate on enticing reductions generally is a double-edged sword for producers and retailers who additionally must safe margins and purpose to keep away from a ‘warfare of costs’.

One reply is to construct a technique that focuses on upselling with both temperate discounting or affords akin to prolonged warranties or free set up, and so forth. This mixture faucets into a number of the core attitudes to life that customers globally say are most necessary to them and affect the best way they stay and the alternatives they make. Particularly, shoppers imagine that “an important factor a couple of model is that it affords good worth for cash.” This can be a completely different mindset to being motivated purely by a low value band and, in 2021, shoppers ranked it third out of 41 attitudes to life that GfK tracks throughout 18 core nations worldwide. That is down only one rank from 2nd place in 2020, having been overwhelmed by “my house is a personal retreat the place I can loosen up and get away from all of it” and “manufacturers and firms must be environmentally accountable as of late” – making this a key motivator.

The significance of stressing worth for cash in any provide is underlined by the truth that shoppers’ perception that ‘you will need to indulge or pamper myself frequently’ has dropped from 18th in 2019 to twenty fourth in 2021. The drop means that consumers are reacting to the growing value of residing and tough financial instances and changing into extra cautious about what they’re prepared to spend their cash on.

Shoppers trending in the direction of high quality over amount

As explored intimately in our State of Expertise & Durables Report 2021 (obtain free right here), final 12 months noticed a rise in shoppers deciding on high-end producers recognized for high quality and good design. The explanations for this are quite a few, together with parts akin to further disposable revenue as a consequence of discount in spending on areas akin to leisure journey and commuting, an appreciation of the significance of Client Tech and Durables in folks’s new home-centric life, but additionally an appreciation of getting high quality for one’s cash.

These elements have meant that premium manufacturers – these with a value index of above 150, calculated by nation and product group – accounted for almost 1 / 4 of final 12 months’s T&D gross sales globally. This pattern for premium items was unfold fairly evenly throughout the 12 months, somewhat than being confined to seasonal occasions (the 7 months Jan–Jul 2021 noticed 43% 12 months on 12 months worth progress) and was significantly excessive in APAC and LATAM with 53% worth progress for premium items in each areas, in comparison with simply 16% (APAC) and 30% (LATAM) for extra budget-friendly items.

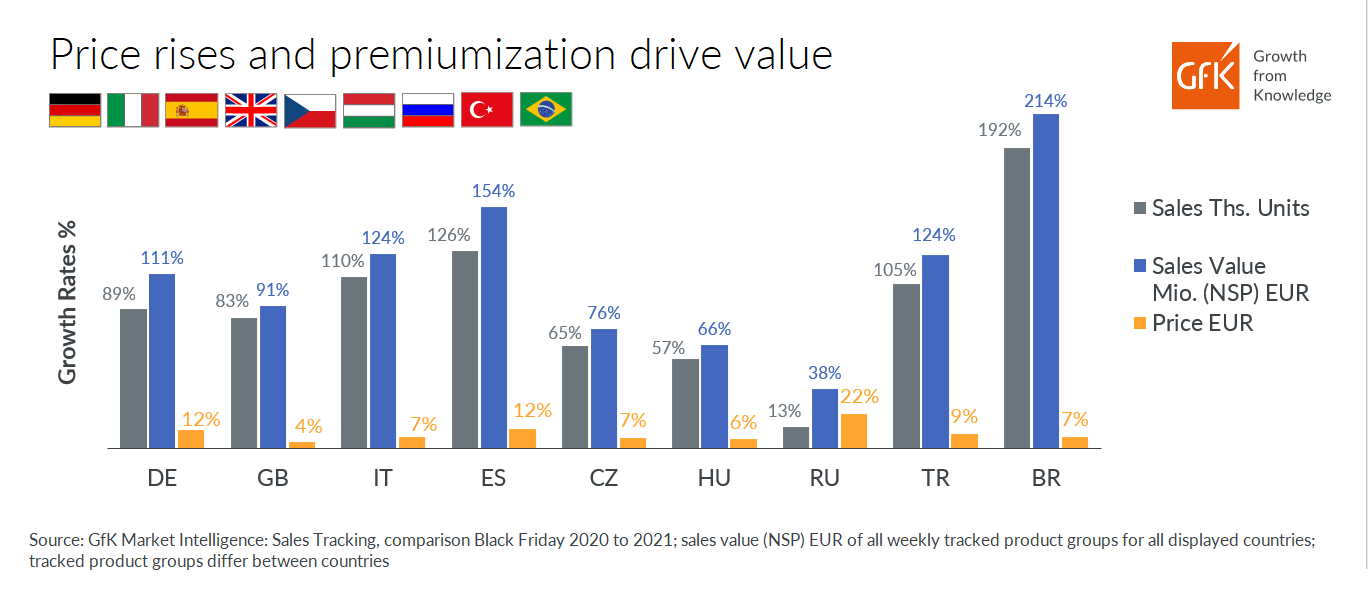

Evaluation of the 2021 Black Friday efficiency bears out this growing shopper attraction for premium merchandise, with the expansion in gross sales worth for shopper T&D items throughout plenty of key nations being pushed up by greater costs of products purchased, greater than the variety of gadgets bought.

This turned out to be a lifeline for producers and retailers, given the lowering progress for Black Friday week gross sales in comparison with a median week – seen in each 2020 and 2021 throughout plenty of nations. The long-term image is that consumers are turning to high quality over amount – and types in a position to tailor their 2022 technique to cater to this mindset may gain advantage from the elevated margins that higher-end items provide.

“This shift from discounting to premiumization generally is a game-changer for Tech and Durables corporations who uncover what motivates shoppers in particular markets”, says Louisa Hyperlink, GfK’s business account director in North America. “The retail setting on this class is ripe for innovation. Shoppers are displaying us they need worth for his or her cash – particularly in key important classes.”

Outlook on premiumization in 2022

Client stress on companies to maintain costs down won’t ever subside – however that is unlikely to cease the rising prices of operations and uncooked materials being handed on to consumers. As manufacturers look to justify greater costs, this may occasionally effectively drive a supply-side transfer in the direction of premiumization that may run alongside the demand-side shopper preferences. Add this to the truth that premium merchandise typically carry greater margins, and the attraction of a give attention to premiumization as a technique for 2022 is evident.

In fact, a serious menace to the continued shopper attraction in the direction of premium merchandise is the excessive inflation throughout many markets. If the rising value of day by day residing begins to steadiness out the financial savings from diminished commuting prices and restricted abroad journey and so forth, the pattern in the direction of premiumization could endure successful for a big portion of the worldwide inhabitants. Nonetheless, the chance stays for producers and retailers to focus this technique on shopper teams which have a larger tolerance for inflationary spikes, in comparison with these with much less disposable revenue. It’s due to this fact important for manufacturers to know the detailed make-up and weight of related shopper teams and plan their technique accordingly.

“Our evaluation throughout markets suggests persons are able to make a aware effort to avoid wasting their funds to allow them to afford to put money into premium manufacturers. The give attention to enhancing the house setting for each work and leisure will proceed, though with indicators of saturation in sure product teams. Individuals don’t simply need merchandise to do what they’re presupposed to do, they need to get that sturdy feeling of worth gained. Meaning upgrading to home equipment and merchandise for the house which are effectively designed, superbly crafted, and seamless to make use of – and supplied with a bundle that the buyer sees as worth for cash. That doesn’t essentially imply value alone; enhanced worth may also come by way of affords akin to prolonged warranties, free supply or set up, or customization choices,” says GfK Chief Advertising and marketing Officer Gonzalo Garcia Villanueva.

The vital issue for fulfillment lies in the truth that, whereas premiumization affords the potential to drive income progress for producers and retailers, rolling out a premiumization technique in France is completely different than rolling one out in Poland. Each market has its personal nuances and variations in what is going to set off consumers inside completely different product teams. To remain profitable, your technique should be constructed on correct, updated and complete market and shopper intelligence.

Be taught extra in regards to the present state of Client Expertise and Durables market and our 2022 projections