There’s quite a lot of bearish vitality on the market proper now. Even the Fed appears to be calling for a recession… and the specialists who aren’t apprehensive a few recession are apprehensive about stagflation. (For anybody who’s a couple of years faraway from Econ 101, that is the one the place we now have sticky excessive inflation AND rising unemployment.) And but, a fast look on the inventory market would make you assume blissful occasions are right here once more. Which aspect is true? Learn on to search out out my decide….

(Please get pleasure from this up to date model of my weekly commentary initially printed April 13th, 2023 within the POWR Shares Beneath $10 publication).

Let’s run by means of a couple of the reason why persons are bearish.

– Banking chaos + tighter credit score may spur an enormous drop in U.S. financial exercise

– Unemployment extra prone to worsen than higher

– Potential for greater rates of interest as subsequent Fed assembly approaches

– Seemingly drop in Q1 earnings progress

– Shares largely buying and selling at lofty multiples

– We nonetheless have not revisited the lows from October

– Inflation remains to be greater than double the Fed’s goal fee

And listed here are a couple of the reason why persons are bullish.

– As a result of everybody else is bearish

Now, I am sort of joking, however I am additionally sort of not.

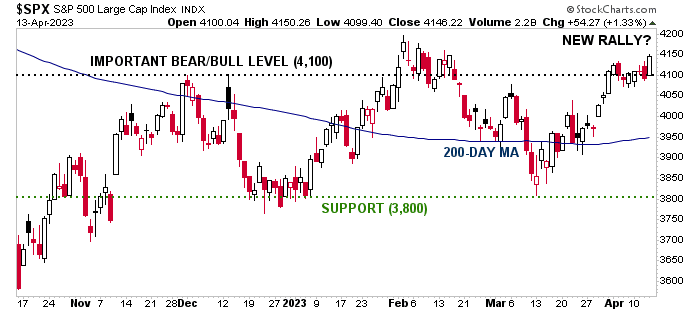

Sure, there are some technical indicators which can be bullish – like the truth that the S&P 500 is holding above 4,100 and appears to be on the verge of breaking above the 4,200 degree, which might mark the start of a brand new bull market.

There are additionally a lot of buyers who’re looking forward to a time when the Federal Reserve pauses its fee hike technique, which needs to be quickly based mostly on their preliminary terminal goal fee.

And there is undoubtedly some fact to the concept when everybody else is bearish, the market turns bullish.

As soon as everybody and their canine has bought all their inventory… and there aren’t any extra sellers left out there… which means the one course left for the market to go is up. (Or sideways.) It is your complete motive why contrarian investing is a method.

And talking of the Fed, even they’re bearish… and so they’re those orchestrating this complete factor.

Based on the minutes from the Fed’s March assembly, “Given their evaluation of the potential financial results of the current banking-sector developments, the employees’s projection on the time of the March assembly included a light recession beginning later this yr, with a restoration over the next two years.”

That does not often bode nicely for shares. However simply look how nicely issues turned out for the bears on Q1. After some chop, the S&P 500 (SPY) and Nasdaq managed to beat the naysayers and put in a achieve.

Personally, I am nonetheless extra bearish than bullish, which I do know appears to be the favored alternative.

However I am nonetheless a robust advocate for our “market of shares” technique that appears for stable corporations poised to realize no matter what the market is doing.

In actual fact, barring any main adjustments, I’ve a couple of extra picks heading your approach tomorrow.

Conclusion

We will preserve cautiously shopping for for now. We do not wish to get to the tip of this yr and look again on all of the good points we may have missed sitting on the sidelines, ready for the right alternative to get in.

However we’re going to regulate the bearish motion/fundamentals to verify we do not get mauled.

What To Do Subsequent?

If you would like to see extra prime shares underneath $10, then it is best to take a look at our free particular report:

3 Shares to DOUBLE This 12 months

What provides these shares the precise stuff to change into massive winners, even on this brutal inventory market?

First, as a result of they’re all low priced corporations with probably the most upside potential in right this moment’s risky markets.

However much more essential, is that they’re all prime Purchase rated shares in accordance with our coveted POWR Scores system and so they excel in key areas of progress, sentiment and momentum.

Click on beneath now to see these 3 thrilling shares which may double or extra within the yr forward.

3 Shares to DOUBLE This 12 months

All of the Finest!

Meredith Margrave

Chief Progress Strategist, StockNews

Editor, POWR Shares Beneath $10 E-newsletter

SPY shares closed at $412.46 on Friday, down $-1.01 (-0.24%). 12 months-to-date, SPY has gained 8.26%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Meredith Margrave

Meredith Margrave has been a famous monetary skilled and market commentator for the previous twenty years. She is at present the Editor of the POWR Progress and POWR Shares Beneath $10 newsletters. Study extra about Meredith’s background, together with hyperlinks to her most up-to-date articles.

The submit Bullish or Bearish…You Determine appeared first on StockNews.com