Estimated learn time: quarter-hour, 39 seconds

Most billing and subscription administration options allow you to:

- Construct numerous trial and subscription fashions (e.g., free or paid trial and usage-based or mounted worth subscriptions).

- Handle lively subscriptions (e.g., upgrades, downgrades, and including or eradicating merchandise).

- Ship invoices and/or cost notifications.

- Present your clients with a self-serve portal the place they will handle their account.

- View studies on the important thing efficiency indicators that drive income.

Nevertheless, most companies discover they want further software program for different elements of the cost lifecycle, comparable to:

- Fee processing

- Gathering gross sales tax and VAT

- Checkout translations

- Foreign money conversions

- Chargebacks

- And extra…

If you happen to want any of those options, you’ll want to ensure they’re supplied by billing software program you select (or simply combine with different software program options).

On this information, we examine 5 options by trying on the billing and subscription administration options they supply and the extra options they provide — beginning with a deep dive into our resolution for SaaS corporations, FastSpring.

Desk of Contents

FastSpring handles your entire month-to-month recurring billing course of from subscription administration to remitting end-of-year taxes for SaaS corporations. To be taught extra about how FastSpring will help you scale shortly, join a free account or request a demo right now.

1. FastSpring: Subscription Administration, Fee Processing, and A lot Extra for SaaS Firms

FastSpring provides a number of choices for subscription administration (which we focus on beneath), nonetheless, it’s greater than only a subscription administration platform — we’re the Service provider of Report (MoR) for software program corporations.

As MoR, we tackle transaction legal responsibility for you, which means we:

- Accumulate and remit the correct amount of gross sales tax, VAT, and GST for you.

- Be sure that the required procedures and documentation are in place to remain compliant with the transaction legal guidelines in each location you promote.

- We take the lead on audits.

Plus, FastSpring has complete options for your entire cost lifecycle together with:

- Localized checkout (i.e., forex conversions, language translations, customized designs, and extra)

- Worldwide cost processing (for dozens of most popular cost strategies)

- Fraud detection

- Chargebacks

- Reporting and analytics

- And rather more…

Within the following sections, we dig into just a few of those options and providers in additional element.

Customized Subscription and Recurring Billing Fashions for B2C or B2B

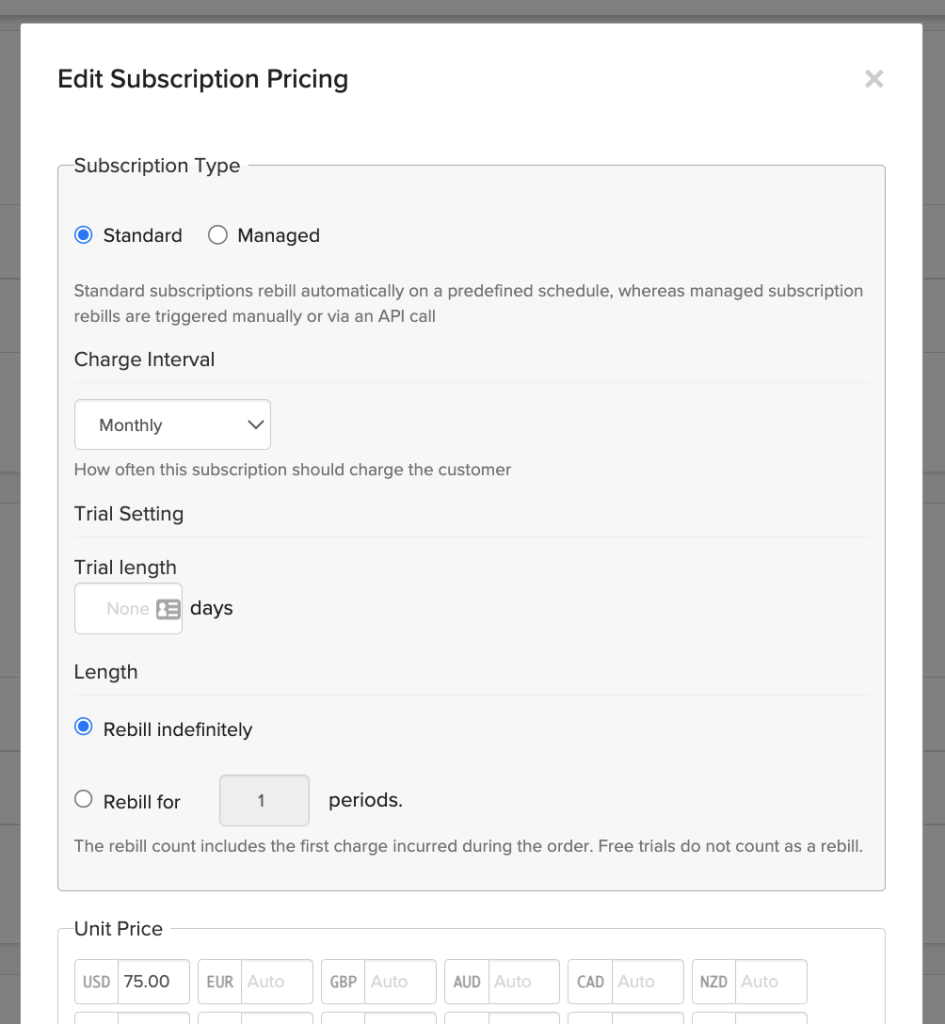

FastSpring makes it simple to arrange almost any subscription state of affairs with only a few clicks. You may arrange most subscription sorts with none code, however you can even create extra complicated subscription logic by way of our API and webhooks library.

Right here’s an outline of your choices:

Trials

Some subscription administration instruments will all the time accumulate cost particulars when potential clients join trials, even free trials. This will trigger some prospects to get chilly ft and never end the signup course of. FastSpring allows you to resolve whether or not or to not accumulate cost particulars for every trial.

You can too:

- Create trials of any size.

- Design free, paid, or usage-based trials.

- Select to mechanically invoice the consumer after the trial has ended or await them to manually begin a paid subscription.

- Permit subscribers to reactivate expired trial accounts.

- Select when FastSpring sends reminders of ending trials (e.g., three days earlier than the trial ends).

- Routinely detect when a single consumer tries to join a number of trials and solely enable one trial account.

- And rather more…

Subscriptions

Every enterprise and every product inside a enterprise might even see higher outcomes from completely different subscription fashions. For instance, low-tier merchandise might carry out higher if supplied as a month-to-month subscription, whereas top-tier merchandise might carry out higher if offered as an annual subscription.

Moreover, what was efficient at one cut-off date might not be the very best resolution sooner or later.

That’s why FastSpring allows you to:

- Select the subscription frequency and billing date (or let your clients select).

- Set subscriptions to auto-renew, require handbook renewal (i.e., clients should re-enter cost data every time they’re billed), or require your workforce to provoke the cost by way of the API (this can be a good possibility for usage-based billing).

- Supply reductions and coupons.

- Permit prorated billing if a buyer needs to improve, downgrade, or pause the service part-way by means of the billing cycle.

- Add one-time purchases to the preliminary invoice however not recurring billings.

- Handle upsell and cross-sell merchandise at checkout.

- Give clients the choice of whether or not or to not retailer cost data (or make the choice for all clients).

- Auto-renew sure subscriptions to completely different subscriptions (e.g., when retiring a service or product).

- And rather more…

Recurring Billing and Invoicing

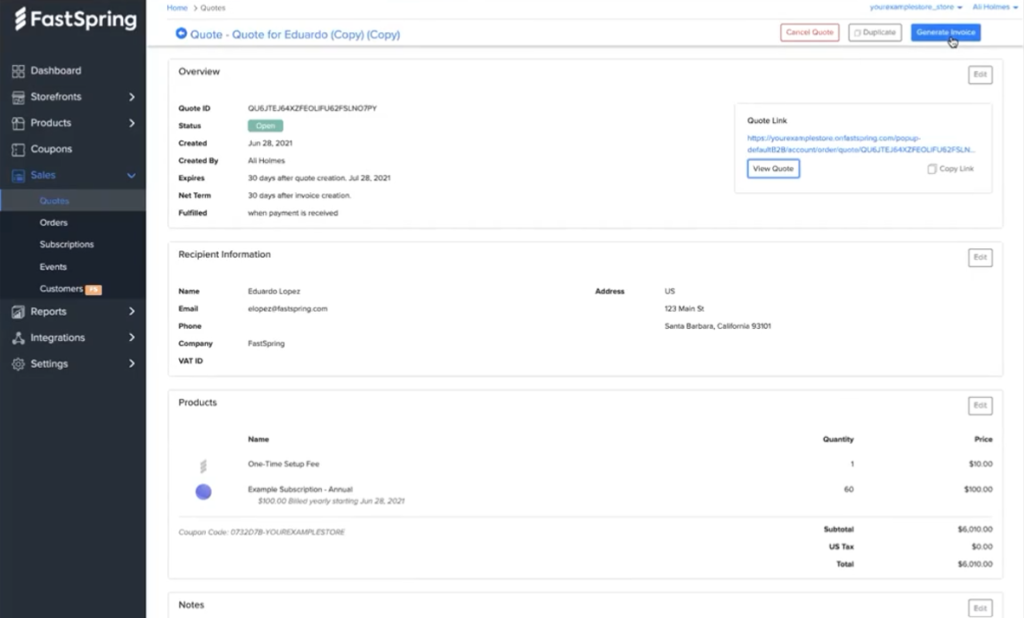

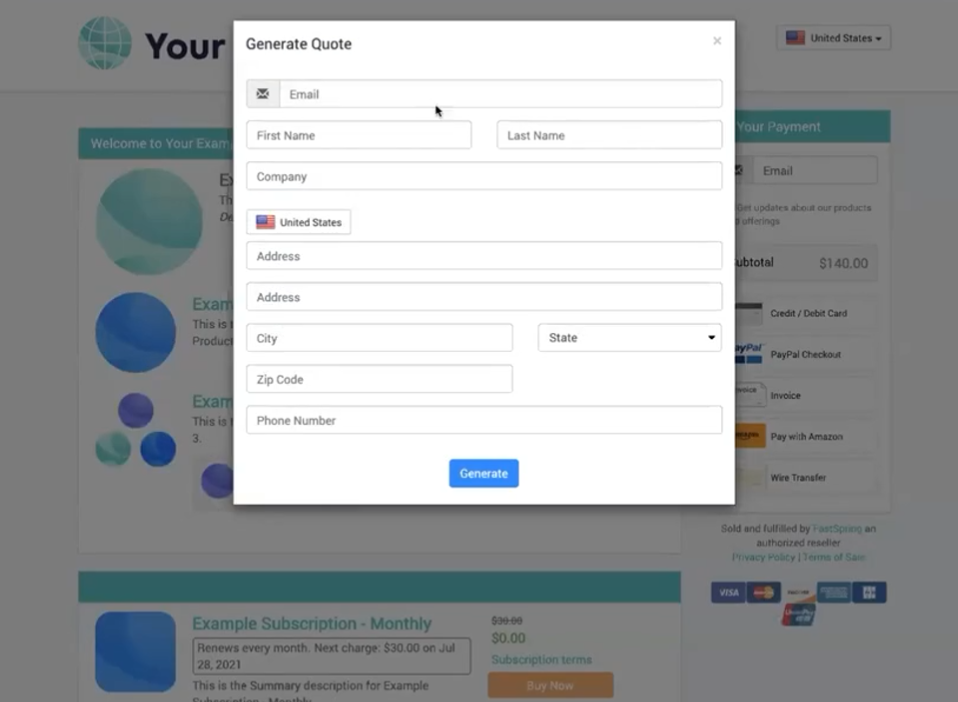

FastSpring allows you to handle B2B orders alongside B2C purchases with Digital Invoicing.

Digital Invoicing allows you to:

- Create and handle customized quotes in real-time (together with customized tags, coupons, reductions, and extra).

- Set expiration dates for quotes.

- Add notes on your buyer or prospect.

- And rather more…

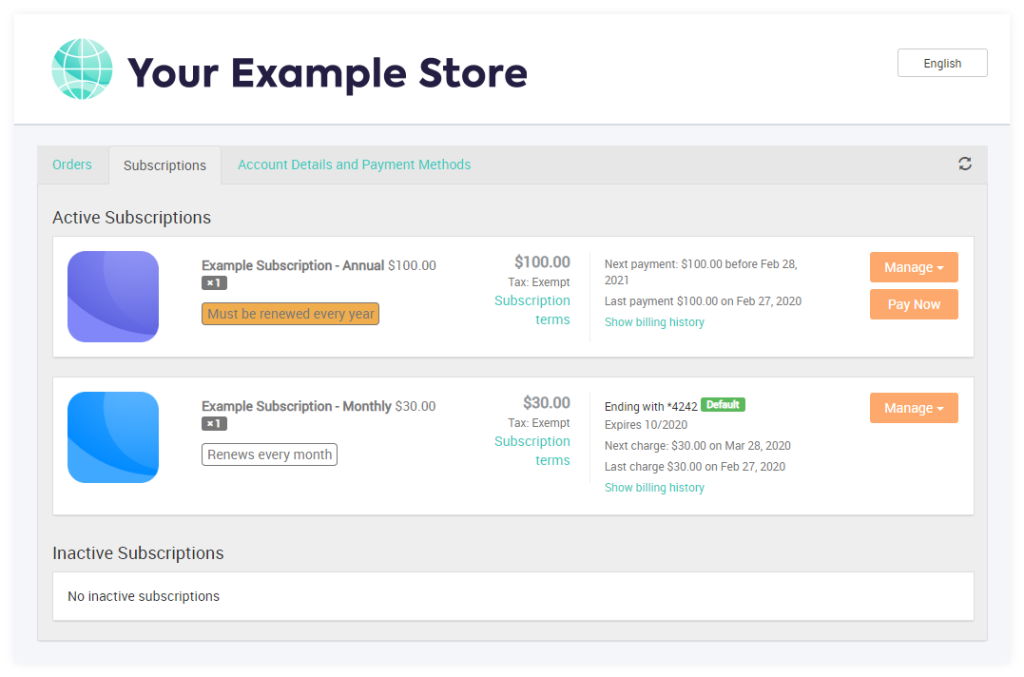

Totally Branded Self-serve Options for Your Clients

FastSpring supplies a self-serve portal the place your clients can:

- Renew subscriptions

- Handle billing intervals

- Replace cost data

- View cost historical past

- And rather more …

We handle all the backend upkeep for this portal so your workforce doesn’t should.

As your MoR, we handle your buyer’s billing inquiries, together with refund requests, billing points, questions on their subscriptions, and extra. Our platform additionally features a buyer portal that makes it simple on your clients to handle their subscriptions.

The picture beneath exhibits a easy instance of the self-service portal, nonetheless, for a extra seamless buyer expertise, your entire portal may be personalized to match your branding.

You can too allow buyer-generated quotes. This function permits clients to generate a quote from the contents of their cart with out contacting your gross sales workforce. This function may be very useful for attracting potential clients that want approval earlier than making a purchase order.

Native Transaction and Oblique Tax Compliance Made Easy

There are two fundamental elements of compliance relating to recurring transactions:

- Transaction compliance (i.e., the methods you might have in place for accumulating cost).

- Gross sales tax, VAT, and GST compliance (i.e., the way you accumulate and remit oblique tax).

To keep away from fines and penalties, it’s a must to take into account each transaction legal guidelines and tax legal guidelines for each jurisdiction you do enterprise in. Within the following sections, we cowl:

- Examples of transaction legal guidelines that have an effect on subscription-based corporations.

- Whether or not or not software program corporations have to gather gross sales tax, VAT, and GST.

- How FastSpring handles all of this for you.

Transaction Compliance

Every nation, state, and province has its personal legal guidelines and laws about how companies can accumulate cost and retailer buyer data. Most corporations are conscious of privateness laws comparable to GDPR, nonetheless, there are various transaction laws that aren’t as well-known.

For instance, in some nations, comparable to Canada and Korea, clients are eligible by regulation for a prorated refund in the event that they cancel their subscription earlier than the tip of the cost interval. This is only one instance for one side of the subscription lifecycle — and these legal guidelines and laws are consistently altering.

With most subscription administration options, you’ll be by yourself to study transaction legal guidelines and laws and implement the required procedures. Moreover, some subscription platforms gained’t provide the required choices to adjust to legal guidelines and laws (e.g., some platforms don’t assist prorated refunds).

However, FastSpring handles all of this for you. Our workforce of authorized consultants stays updated on all related transaction legal guidelines and laws and helps you implement the required procedures to make sure compliance. FastSpring additionally helps all needed subscription fashions for compliance.

Gross sales Tax, VAT, and GST Compliance

Software program corporations didn’t all the time have to gather gross sales tax, VAT, and GST, and in lots of jurisdictions, that’s nonetheless the case. Nevertheless, tax legal guidelines for digital items and providers are altering quick in lots of jurisdictions.

Increasingly nations are requiring software program corporations to gather some type of oblique tax. Plus, some nations are requiring digital corporations to file tax kinds even when they qualify for tax exemption.

Lastly, remitting gross sales taxes is commonly extra concerned than filling out a tax type and wiring the funds. Increasingly nations are mandating further necessities to remain compliant.

For instance:

- Nations comparable to Colombia, Japan, Mexico, Serbia, and others require native illustration, which means it’s a must to rent somebody with a bodily presence in that nation to be liable for your tax legal responsibility. This will value anyplace from $5k to $15k per yr.

- Nations comparable to Serbia, United Kingdom, Taiwan, and others require digital invoicing from any firm promoting of their nation. The EU is rolling out common digital invoicing necessities by 2028.

- Nations comparable to Taiwan, Indonesia, Nigeria, Vietnam, and others require you to file revenue tax as well as to oblique tax.

Only a few subscription billing platforms provide any options that can assist you accumulate tax. Even when they do, you’re nonetheless held accountable for ensuring you’re accumulating the correct amount. Plus, it’s a must to remit these taxes and deal with any further necessities.

FastSpring handles your entire technique of gathering and remitting gross sales tax, VAT, and GST for you.

We guarantee the correct quantity (and sort) of oblique tax is being collected at checkout (together with tax-exempt transactions within the US and 0% reverse costs when allowed internationally).

Then, our workforce remits these taxes for you and ensures all the required procedures are in place for full compliance.

Lastly, if a rustic or state approaches you about tax compliance, our workforce will usually present copy and paste responses.

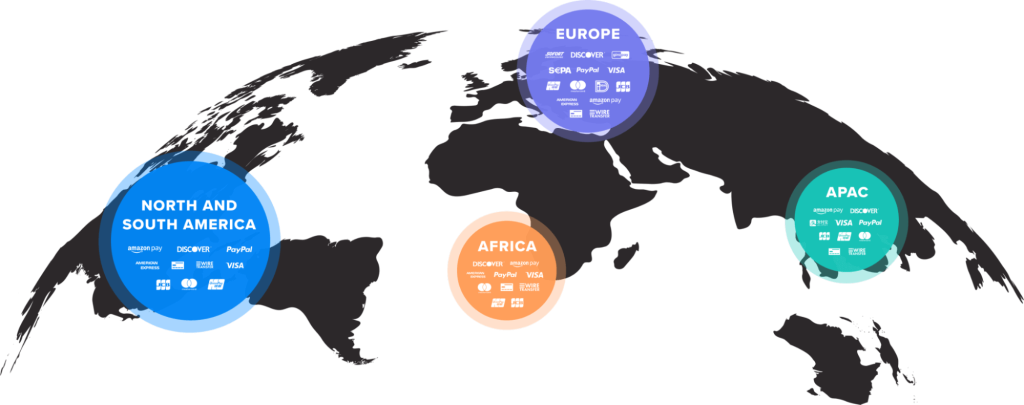

Worldwide Fee Processing for Dozens of Fee Strategies

Most cost processors focus their efforts on a selected area and all cost processors have a finite listing of cost strategies that they assist. For instance, some cost processors goal to assist transactions within the U.S. So, they’ll solely assist the cost strategies which can be common within the U.S. (e.g., Mastercard or Apple Pay) they usually gained’t assist one thing like UnionPay, which is often utilized in China.

Moreover, many cost processors will solely course of funds in sure nations and currencies. For instance, they might assist Amazon Pay however they gained’t course of funds from Turkey.

SaaS corporations that wish to settle for funds world wide have to attach with and handle a number of cost processors, which is usually a large process.

With FastSpring, SaaS corporations mechanically have entry to a number of cost processors specializing in worldwide funds. FastSpring maintains relationships with a number of cost processors and dozens of card networks so that you just don’t should. Merely activate our localized funds function and begin accepting worldwide funds instantly.

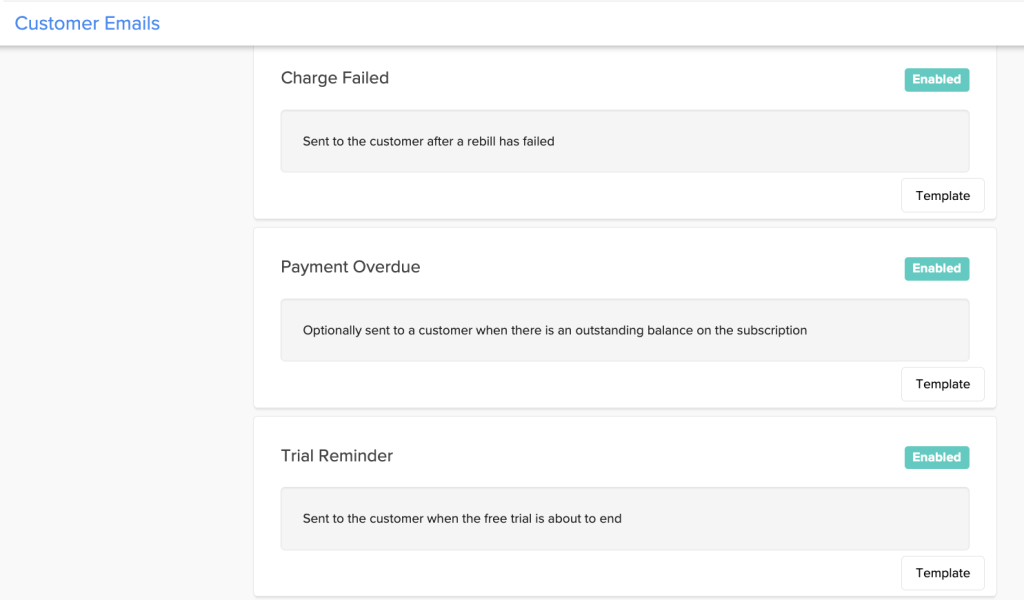

FastSpring additionally provides a number of options to assist guarantee profitable funds and scale back involuntary churn, together with:

- Native cost gateways: Transactions usually tend to be authorized if the cost gateway is in the identical location as the customer (e.g., a transaction originating from Germany goes by means of a cost gateway situated in Germany). FastSpring mechanically routes funds by means of the cost gateway with the very best authorization charges for that location.

- Fee gateway rerouting: If a cost fails on the primary try, FastSpring mechanically retries the cost utilizing a secondary gateway — all with out you or anybody in your assist workforce having to intervene. This usually solves cost failures because of connectivity or system points.

- Proactive cost reminders. If a buyer’s card is about to run out, FastSpring will notify the shopper earlier than the due date so that they have an opportunity to replace the cost data. You should utilize our pre-made notification template or customise your individual message.

- A number of follow-up notifications. If a recurring cost is declined, you’ll be able to schedule a number of cost failure notifications to be despatched two, 5, seven, 14, and 21 days after the preliminary failure. Earlier than sending out every reminder, FastSpring will retry the cost.

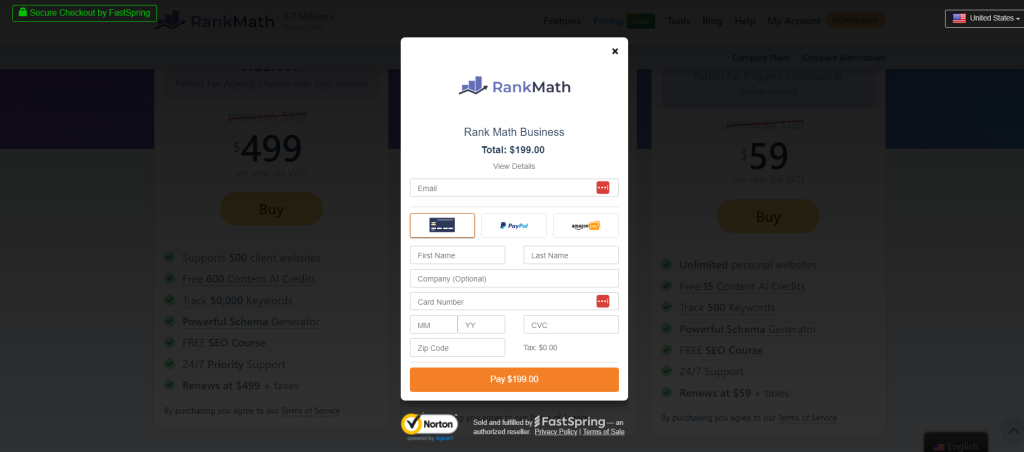

Tailor-Made Checkout to Replicate Your Visible Model

Most cost options provide a checkout module with just a few choices for personalisation comparable to including your emblem and selecting a shade palette. Nevertheless, these customization choices are not often sufficient to really mirror your visible model, create a seamless expertise on your clients, and optimize your checkout for conversions.

FastSpring supplies customized branding instruments and CSS overrides so that you’ve intensive customizations choices to manage the appear and feel of your checkout.

You’ll even have entry to our Retailer Builder Library — a JavaScript library which lets you customise the customer journey main as much as checkout.For instance, you’ll be able to create a cross-sell or upsell funnel. This allows you to optimize the customer expertise for larger conversions.

FastSpring checkout is available in three variations: embedded, popup, or as an online storefront. The online storefront redirects your clients to a separate web page hosted by FastSpring.

With any of those choices (together with the online storefront), you’ll be capable of customise the checkout circulation utilizing FastSpring branding instruments and CSS overrides to match your visible model.

Listed here are a number of different options that FastSpring provides that can assist you optimize your checkout:

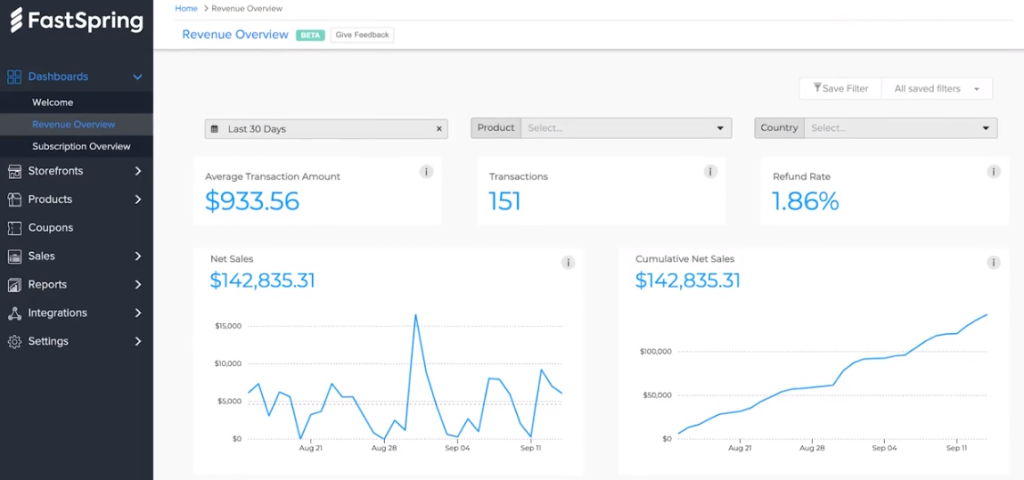

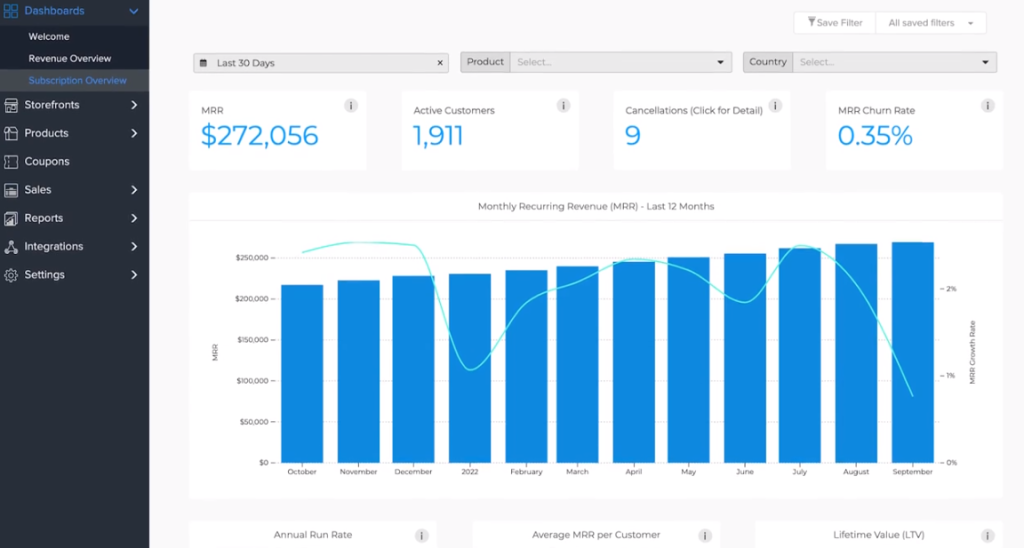

Complete Reporting and Analytics

FastSpring Analytics and Reporting mechanically tracks key metrics and places them in significant studies so you’ll be able to simply reply questions comparable to:

- The place are nearly all of my highest paying clients situated?

- Which merchandise are bringing in probably the most income?

- Which reductions are producing income vs. draining income?

- And lots of extra…

FastSpring studies are divided into two fundamental dashboards: Income Overview and Subscription Overview.

If you happen to don’t discover the report you want, you’ll be able to customise any report and reserve it to your dashboard. Our workforce is all the time obtainable that can assist you design customized studies to seek out the solutions you want.

Our information API and webhooks make it simple to drag in income and subscription information to no matter CRM or enterprise intelligence instrument you employ. Any report can be downloaded as a CSV, PNG, or XLSX file.

All-in-One Pricing (No Hidden Charges)

Many cost system suppliers will cost a base worth for cost processing and some core options, comparable to embeddable checkout. Nevertheless, you’ll sometimes should pay additional for different options comparable to forex conversions or fraud detection. Only a few cost platforms are a whole resolution, so most corporations want so as to add on further software program. This makes it troublesome to scale globally as your small business grows as a result of the associated fee will proceed to extend as you want extra options and software program.

FastSpring is a whole cost resolution for SaaS corporations with every thing included in a single flat-rate price primarily based on the amount of transactions you progress by means of FastSpring. Plus, you’ll solely be charged when transactions happen.

Attain out to our workforce to seek out the value that works for you or join a free account.

Subsequent, we cowl 4 extra cost platforms for subscription-based companies.

2. Chargebee

Chargebee is a widely known subscription and recurring billing system.They provide out-of-the-box integrations with many alternative software program that can assist you handle elements of the billing lifecycle that they don’t present an answer for (e.g., Stripe for cost processing). Additionally they provide integrations with common enterprise software program comparable to Salesforce.

Listed here are just a few highlights of Chargebee options:

- Utilization-based billing, automated invoicing, proration, and extra

- Automated processes for accounts receivable

- Compliant income recognition and subscription fashions

- Help for in-app purchases

- Self-service portal for purchasers

- Good dunning

You should utilize the Chargebee platform free of charge for the primary $100k in income earned. After that, they provide quite a lot of pricing plans for various ranges of month-to-month revenue.

Be taught extra: 8 Finest Chargebee Alternate options and Opponents (And How They’re Completely different)

3. Recurly

Recurly is a recurring billing platform constructed for optimizing your development technique. Recurly simply integrates with numerous cost gateways and service provider accounts, nonetheless, you continue to should handle and pay for these third-party providers on prime of your Recurly plan.

Listed here are just a few different highlights of Recurly’s options:

- Customizable subscription fashions

- Automated recurring invoicing

- Income restoration instruments

- Clever retention

- Buyer subscription analytics

Recurly provides three pricing packages, nonetheless, it’s a must to attain out to their workforce for particulars.

Be taught extra: Recurly Opponents and Alternate options: An In-Depth Evaluation

4. Chargify

Chargify is a subscription billing software program that’s within the technique of merging with SaaSOptics, a income administration platform. This merger will allow you to automate subscription administration, income and expense recognition, and SaaS metric monitoring from one income administration system.

Listed here are just a few highlights of the functionalities Chargify provides:

- Utilization-based and world billing

- Income recognition and billing administration instruments

- Billing system analytics and metrics

- Constructed-in integrations with numerous different software program (e.g., accounting software program like QuickBooks and Xero)

- Worldwide cost gateways

Chargify specifies a pricing plan for corporations incomes $75k per 30 days in billings, however, should you earn extra income or need entry to all options, you’ll should contact their workforce.

5. Zoho Subscriptions

Zoho Subscriptions is one piece of the Zoho platform (a collection of software program for each side of your small business, e.g., CRMs and ERPs). If you happen to’re already utilizing the Zoho platform, this might be possibility. Nevertheless, new customers sometimes discover it has a steep studying curve.

A couple of highlights of Zoho Subscriptions embody:

- A number of pricing fashions

- Customizable, tax-compliant invoices

- Multi-currency conversions

- 30+ pre-built studies to trace every stage of the subscription lifecycle

- Help for in-person money and verify funds (along with bank card funds)

- Out-of-the-box integrations with different billing options (e.g., Stripe, PayPal, and so forth.)

- Instruments to create customized workflow guidelines

Every side of the Zoho platform is priced individually — together with Zoho Subscriptions — which may make it troublesome and dear to construct an end-to-end cost resolution.

As a substitute of managing a big software program stack, let FastSpring deal with your entire cost lifecycle for you. If you happen to suppose FastSpring might be the very best recurring billing and subscription administration software program for your small business, join a free account or request a demo right now.