Envi FX fails to offer firm possession and govt data on its web site.

Envi FX fails to offer firm possession and govt data on its web site.

Envi FX’s web site area (“envifx.com”), was first registered in 2020. The non-public registration was final up to date on July twenty third, 2022.

As all the time, if an MLM firm just isn’t overtly upfront about who’s working or owns it, assume lengthy and exhausting about becoming a member of and/or handing over any cash.

Envi FX’s Merchandise

Envi FX has no retailable services or products.

Associates are solely capable of market Envi FX affiliate membership itself.

Envi FX’s Compensation Plan

Envi FX associates make investments cryptocurrency on the promise of passive returns.

Envi FX’s returns are dressed up as foreign currency trading, with commissions paid on simulated buying and selling quantity by recruited associates.

Envi FX pays commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel group, with each personally recruited affiliate positioned instantly underneath them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel group.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Envi FX caps payable unilevel group ranges at 5.

Commissions are paid per lot commerce quantity throughout these 5 ranges as follows:

- degree 1 (personally recruited associates) – $1.50 per lot

- ranges 2 to five – 75 cents per lot

Loads is usually 100,000 items of the bottom foreign money being traded. How this components into Envi FX’s simulated buying and selling is unclear.

Excessive Rise and Prime Heavy ranked Envi FX associates obtain larger fee charges:

- Excessive Rise ranked associates earn $2 on degree 1, $1 on degree 2, 95 cents on degree 3, 30 cents on degree 4 and 25 cents on degree 5

- Prime Heavy ranked associates earn $2.50 on degree 1, $1.50 on degree 2 and 50 cents on degree 3

Be aware that Excessive Rise and Prime Heavy rank qualification standards just isn’t supplied.

Becoming a member of Envi FX

Envi FX affiliate membership seems to be free. No minimal funding quantities are specified.

Envi FX solicits funding in varied cryptocurrencies.

Envi FX Conclusion

Envi FX’s web site overloads guests with buying and selling data and choices. That is an try and make the positioning appear to be a respectable buying and selling dealer.

All anybody cares about is the passive funding alternative, which Envi FX clothes up as Share Allocation Administration Module (PAMM) accounts.

Your first pink flag with Envi FX is you don’t know who’s working it. This isn’t how respectable corporations asking you for cash function.

Your second pink flag with Envi FX is solicitation of funding in cryptocurrency to foreign exchange commerce with.

Your third pink flag is Envi FX committing securities fraud.

Envi FX associates make investments crypto with nameless randoms, do nothing and accumulate a each day ROI. Sound acquainted?

Envi FX operates a passive funding alternative. This requires it to be registered with monetary regulators.

Envi FX supplies no proof it has registered with monetary regulators and filed legally required audited monetary studies.

Envi FX associates are supplied simulated buying and selling studies of their backoffice. This isn’t substitute for registration with monetary regulators.

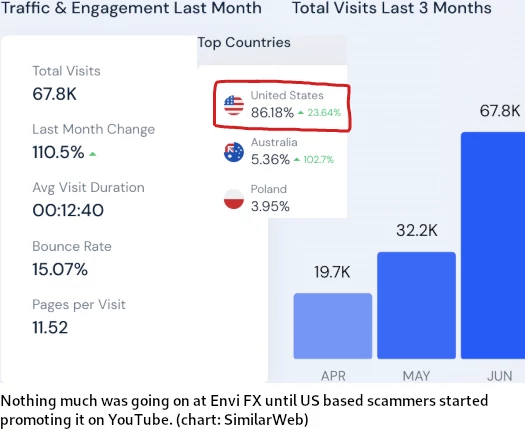

Reasonably than function legally, Envi FX presents up the next pseudo-compliance:

This web site just isn’t directed at or supposed to elicit residents and/or residents of the USA.

As we will see over at SimilarWeb, that is baloney:

86% of Envi FX’s web site site visitors originates from the US.

A search of the SEC’s Edgar database reveals Envi FX just isn’t registered to supply securities within the US. They aren’t registered to supply securities anyplace on the planet.

Be aware that as well as Envi FX committing securities fraud, anybody selling can be committing securities fraud. Promotion of unregistered securities can be unlawful the world over.

Lastly, by providing a foreign currency trading funding alternative to US residents, simulated or in any other case, Envi FX must be registered with the CFTC.

A search of the NFA register confirms Envi FX isn’t registered with the CFTC. It is a violation of the Commodities and Alternate Act.

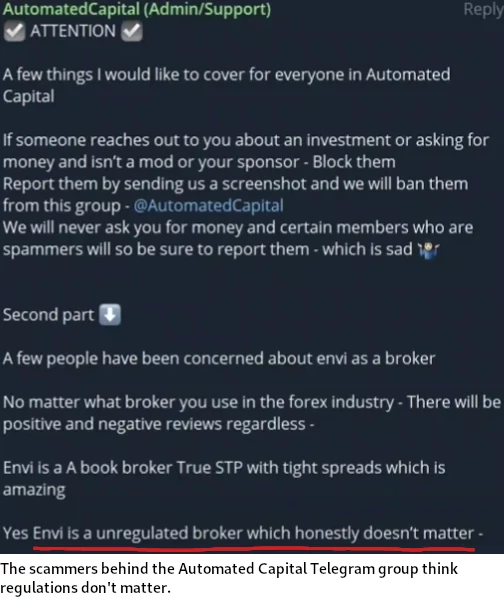

Whereas we don’t know who’s working Envi FX, they’re working the scheme and speaking to traders by way of the “Automated Buying and selling” Telegram group (an MLM firm being run by way of Telegram is one other pink flag).

Whereas we don’t know who’s working Envi FX, they’re working the scheme and speaking to traders by way of the “Automated Buying and selling” Telegram group (an MLM firm being run by way of Telegram is one other pink flag).

In a message posted to the Automated Buying and selling Telegram group mid July, traders have been informed Envi FX committing monetary fraud “doesn’t matter”.

The admin of Automated Buying and selling refers to founders of the scheme as “Kyle and I”.

MLM corporations commit monetary fraud and function illegally as a result of they aren’t doing what they declare to be. With Envi FX, this could be foreign currency trading to generate exterior ROI income.

If Envi FX isn’t buying and selling, what are they doing?

They’re working a Ponzi scheme.

New crypto is available in and Envi FX makes use of it to pay early investor withdrawals. That is dressed up as buying and selling, full with simulated backoffice buying and selling studies and lot commissions.

It’s all theater and is totally disconnected from Envi FX shuffling round invested crypto to pay returns.

As with all MLM Ponzi schemes, as soon as Envi FX recruitment dries up so too will new funding.

This can starve Envi FX of ROI income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that after they collapse, nearly all of contributors lose cash.