Estimated learn time: 2 minutes, 58 seconds

This text comprises details about FastSpring’s present SEPA Direct Debit help. If you wish to know extra about SEPA and the way it works, learn our put up on that matter right here.

While you’re promoting software program internationally, it’s very important to provide your patrons cost strategies which might be each acquainted and handy to them. This eliminates friction within the buying expertise, resulting in elevated buyer acquisition and income.

FastSpring helps sellers do that globally with a variety of cost strategies. One such cost methodology — one of the vital broadly used within the European Union — is SEPA Direct Debit. Not solely does this assist to simplify funds throughout borders within the EU, nevertheless it additionally helps scale back the probability of failed cost transactions.

With FastSpring’s new SEPA Direct Debit options, sellers at the moment are in a position to not solely acquire funds throughout the SEPA area, however additionally they have entry to chargeback administration and might present refunds by means of the FastSpring utility.

Trying to check out SEPA Direct Debit with the premier service provider of report available in the market? Join a demo or take a look at the platform your self.

Already a FastSpring vendor and need to allow SEPA Direct Debit for your corporation? Submit a help ticket from contained in the platform or from our help portal.

SEPA (Single Euro Funds Space) is a system of transactions applied within the EU and some surrounding international locations that enables shoppers and companies to make cashless euro funds through credit score switch and/or direct debit to anyplace throughout the SEPA area.

Anybody throughout the SEPA area could make direct debit funds in Euros — irrespective of the forex their native checking account is in. This simplifies and reduces prices associated to cross-border transactions.

With a SEPA Direct Debit transaction, purchasers are sending cash in a bank-to-bank transaction — much like ACH (Automated Clearing Home) in North America. Often, this clears inside two to 5 enterprise days and permits for simple, unobtrusive funds for each companies and people.

Why Ought to I Use SEPA Direct Debit?

As SEPA providers greater than 529 million residents, any enterprise desirous about increasing their international presence could be remiss to not provide SEPA transactions to their potential prospects.

To make use of SEPA Direct Debit with FastSpring, sellers merely must put in a request inside our help portal, and inside two enterprise days, it may be stay on their storefront.

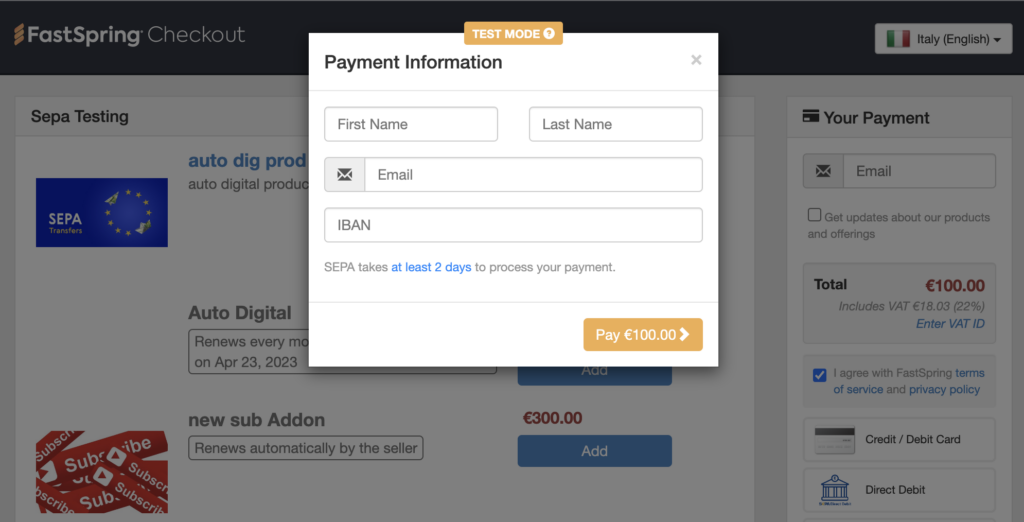

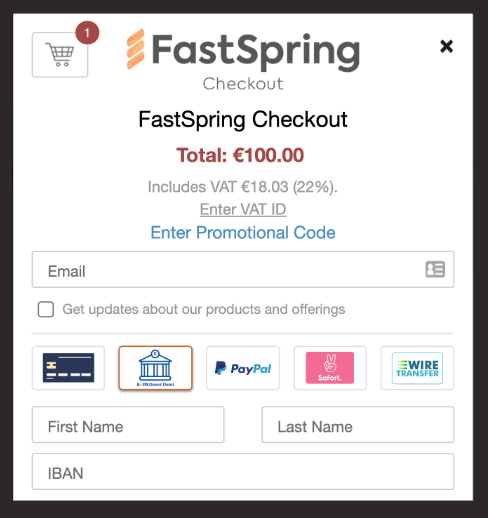

From there, gathering funds from prospects is similar as different transactions. For the purchasers, SEPA Direct Debit might be displayed if they’re in any of the lined areas as listed in our documentation. They choose the cost methodology, enter their info, they usually’re good to finish their transaction.

Not solely is it straightforward to arrange SEPA Direct Debit from the vendor portal, nevertheless it provides a number of advantages to sellers who need to develop their enterprise into the worldwide market:

- Broader attain to greater than 550 million potential prospects within the EU.

- Elevated conversion charge by making purchases simpler for European prospects, since lower than half of European prospects don’t use bank cards.

- Decreased cost failure charges because of the bank-to-bank reference to SEPA Direct Debit.

- Elevated retention by eliminating failed funds because of bank card expiry or cancellation.

As with all our cost strategies, we’re always in search of different avenues for enchancment with SEPA Direct Debit, together with extra help for international locations throughout the SEPA area. Have questions or need to see for your self? Join a demo or examine us out your self.