Fusion Xperience fails to supply possession or govt info on its web site.

Fusion Xperience fails to supply possession or govt info on its web site.

I’m conscious of two web site domains hooked up to Fusion Xperience:

- “fusionprotocol.io” – privately registered on June twelfth, 2022

- “fusionexchange.io” – privately registered on June twelfth, 2022

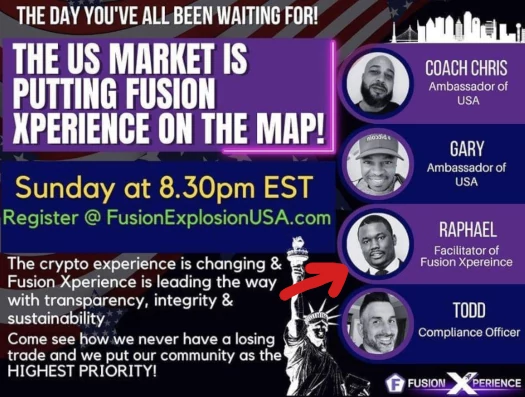

Fusion Xperience cites Raphael Peter (aka Raphael Peters) as “facilitator” of the corporate.

Peter relies out of Texas within the US and, so far as I can inform, is working Fusion Xperience.

Different names tied to Fusion Xperience embody:

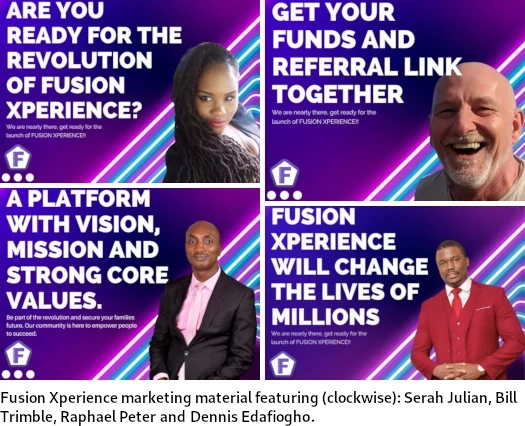

- Serah Julian (aka Sassy Entrepreneur, Miss Sassy) in Jamaica

- Invoice Trimble within the UK

- Dennis Edafiogho in Nigeria

- “Mr. Bobby” – cited as Fusion Xperience’s lead developer

- Rashid Gary within the US

- Chris Clark (aka Coach Chris) within the US

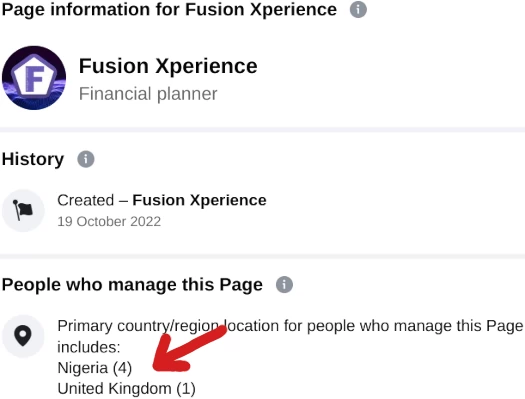

Whereas Raphel Peter is working Fusion Xperience, its FaceBook web page is primarily managed from Nigeria and the UK:

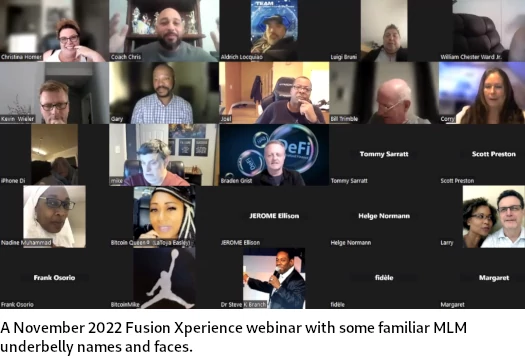

Circa 2018 Peter was selling the burden loss MLM Whole Life Adjustments. By late 2020 Peters had begun selling fraudulent funding alternatives:

That leads into Peter launching Fusion Xperience in late 2022.

Regardless of advertising and marketing efforts, Fusion Xperience solely seems to have taken off within the US.

SimilarWeb tracks a couple of thousand visits to “fusionprotocol.io” a month (5100 visits in November down from 10,700 visits in September).

Prime sources of visitors to “fusionprotocol.io” are at present the UAE (34%), Ukraine (34%) and Denmark (31%).

SimilarWeb tracked 88,200 visits to “fusionexchange.io” in November, up from 2600 in October.

65% of web site visitors to “fusionexchange.io” originates from the US. Canada and Nigeria path behind at 11% and 9% respectively.

As all the time, if an MLM firm isn’t overtly upfront about who’s working or owns it, suppose lengthy and arduous about becoming a member of and/or handing over any cash.

Fusion Xperience’s Merchandise

Fusion Xperience has no retailable services or products.

Associates are solely in a position to market Fusion Xperience affiliate membership itself.

Fusion Xperience’s Compensation Plan

Fusion Xperience associates make investments $10 or extra in tether (USDT). That is performed on the promise of a passive day by day variable ROI.

Notice that Fusion Xperience associates solely have a 20 minute window to withdraw. There’s a international day by day $10,000 withdrawal restrict.

The MLM aspect of Fusion Xperience pays on recruitment of affiliate traders.

Referral Commissions

Fusion Xperience pays referral commissions on day by day returns paid down three ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 20%

- stage 2 – 10%

- stage 3 – 5%

Management Rewards

Fusion Xperience rewards associates for producing downline funding quantity as follows:

- generate $500,000 USDT funding quantity throughout three unilevel group ranges and obtain $5000 a month

- generate $1,000,000 in USDT funding quantity throughout three unilevel group ranges and obtain $10,000 a month

- generate $2,000,000 in USDT funding quantity throughout three unilevel group ranges and obtain $20,000 a month

- generate $3,000,000 in USDT funding quantity throughout three unilevel group ranges and obtain $30,000 a month

Becoming a member of Fusion Xperience

Fusion Xperience affiliate membership is $1.

Full participation within the hooked up earnings alternative requires a minimal $10 funding in USDT.

Fusion Xperience Conclusion

Fusion Xperience is your typical “buying and selling bot” MLM Ponzi scheme.

For no less than simply $10 you will get began. Our in-house bots that had been constructed with the most recent AI know-how will scan 24/7 for the most effective trades and you’ll revenue from them day by day.

Returns are purportedly 25% of day by day returns generated by Fusion Xperience’s “in-house bots”.

No particular details about Fusion Xperience’s “in-house bots”, together with who created them, is supplied. This can be a main crimson flag.

On the regulatory entrance Fusion Xperience states;

Fusion Xperience is registered in USA and Nigeria, whereas registration in different areas are on-going, taking cognisance of regulatory and coverage points.

In a November thirtieth advertising and marketing video uploaded to Fusion Xperience’s official YouTube channel, “Mr. Bobby” gives shell firm incorporation particulars for Fusion Xperience World LTD in Nigeria.

Fusion Xperience World LTD has purportedly additionally been registered with Nigeria’s Particular Management Unit Towards Cash Laundering.

For the aim of MLM due-diligence, each these paperwork are meaningless.

Fusion Xperience’s passive funding alternative constitutes a securities providing.

This requires Fusion Xperience to register with monetary regulators.

Within the US that is the SEC. In Nigeria it’s the Nigerian SEC.

Fusion Xperience gives no proof it has registered with the Nigerian SEC.

Within the US, the SEC’s Edgar database is publicly searchable. Neither Fusion Xperience or Raphael Peter are registered with the SEC.

Why does this matter? For starters it means Fusion Xperience are committing securities fraud. MLM firms committing securities fraud achieve this as a result of they aren’t doing what they declare to be.

On this case that’s Fusion Xperience utilizing buying and selling income to pay returns.

Moreover registering with monetary regulators requires Fusion Xperience to file periodic monetary audits. That is the one method to confirm buying and selling income is getting used to fund withdrawals.

Fusion Xperience hasn’t registered with monetary regulators as a result of it’s working a Ponzi scheme. New associates make investments and Fusion Xperience makes use of that tether to repay earlier traders.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Fusion Xperience of ROI income, ultimately prompting a collapse.

Fusion Xperience’s exit-scam of alternative seems to be their yet-to-be-launched FUSN token.

FUSN token particulars aren’t supplied however there’s a defunct hyperlink to “purchase FUSN” on Fusion Xperience’s web site.

Presumably FUSN might be launched at a later date. When the time comes, withdrawals might be converted to FUSN – in the end leaving traders bagholding yet one more nugatory Ponzi coin.

The maths behind Ponzi schemes ensures that after they collapse, nearly all of traders lose cash.