UEZ Markets fails to supply possession or govt info on its web site.

UEZ Markets fails to supply possession or govt info on its web site.

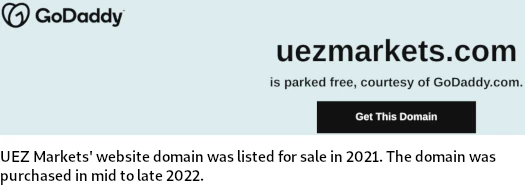

UEZ Markets’ web site area (“uezmarkets.com”), was registered again in December 2020. The personal registration was final up to date on November twenty fifth, 2022.

By means of the Wayback machine we be taught “uezmarkets.com” was up on the market since 2021.

The area was ultimately bought by UEZ Markets’ proprietor(s) in late 2022. It needs to be famous that UEZ Markets’ area seems to have been offered together with numerous social media profiles.

These area bundle gross sales usually are not unusual. UEZ Market’s bought social media profiles creates the phantasm that the corporate, as introduced at the moment, is older than it’s.

Regardless of solely current for barely over a month, UEZ Markets falsely claims it has a “5+ yr historical past”.

Additional blowing a gap in how lengthy UEZ Markets has been round is the area “uezmarkets.sc”:

As you possibly can see this can be a clone of UEZ Markets’ main web site.

“Uezmarkets.sc” was privately registered on December nineteenth, 2022. Regardless of this, the web site states;

UEZ Markets Restricted was based and included within the Republic of Seychelles in 2015.

Whether or not UEZ Markets Seychelles has been arrange as a backup for the first web site, or whether or not it was an meant various branding, is unclear.

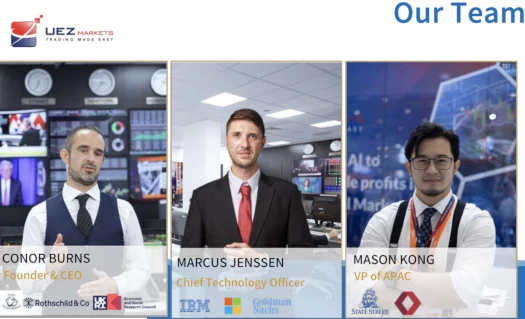

UEZ Markets advertising materials cites “Conor Burns” as founder and CEO of the corporate.

Marcus Jenssen and Mason Kong are cited as UEZ Markets’ CTO and VP of APAC respectively.

None of those folks exist outdoors of UEZ Markets’ advertising materials. This contains social media profiles arrange as bogus digital footprints.

A January thirteenth advertising video on UEZ Markets’ YouTube channel depicts a Boris CEO occasion held in Kuala Lumpur Malaysia.

UEZ Markets additionally has an official Bilibili account:

Bilibili is a Chinese language YouTube clone.

Placing all of this collectively, UEZ Markets seems to be run by scammers working out of south-east Asia.

Primarily based on the Mason Kong actor’s accent and Malaysian occasion, I’d guess UEZ Markets is being run from Singapore, Malaysia or each international locations.

In an try at respectable, UEZ Markets offers shell firm particulars within the Cayman Islands, Switzerland and Australia.

For the aim of MLM due-diligence, shell firm incorporation in any jurisdiction is meaningless.

As all the time, if an MLM firm just isn’t overtly upfront about who’s operating or owns it, assume lengthy and laborious about becoming a member of and/or handing over any cash.

UEZ Markets’ Merchandise

UEZ Markets has no retailable services or products.

Associates are solely in a position to market UEZ Markets affiliate membership itself.

UEZ Markets’ Compensation Plan

UEZ Markets associates make investments $1000 or extra on the promise of an marketed passive return:

- Flexi Managed Account – 2% to three% a month

- Time period Managed Account – 6% to eight% a month however funds are locked up for 3 months (18% penalty if funds are withdrawn prior to three months)

Flexi Managed Account investments are in a position to be transformed into Time period Managed account investments “at any level of time”.

On the finish of the three months, all Time period Managed Account investments are “robotically transformed” into Flexi Managed Account investments.

The MLM facet of UEZ Markets pays on returns paid to recruited associates.

UEZ Affiliate Ranks

There are seven affiliate ranks inside UEZ’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- Member – join as a UEZ Markets affiliate

- Supervisor – generate $50,000 in unilevel group funding quantity

- Supervisor – generate $250,000 in unilevel group funding quantity and have 3 Supervisors in your downline

- Advertising and marketing Supervisor – generate $1,500,000 in unilevel group funding quantity and have 3 Managers in your downline

- Regional Supervisor – generate $8,000,000 in unilevel group funding quantity and have 3 Advertising and marketing Managers in your downline

- Director – generate $30,000,000 in unilevel group funding quantity and have 3 Regional Managers in your downline

- International Director – generate $70,000,000 in unilevel group funding quantity and have 3 Administrators in your downline

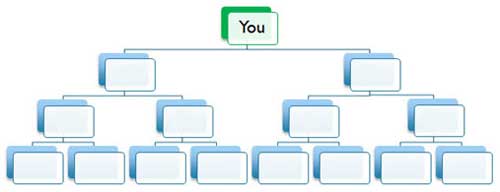

A unilevel compensation construction locations an affiliate on the high of a unilevel group, with each personally recruited affiliate positioned immediately below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel group.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

For the aim of rank qualification, funding quantity generated on the strongest unilevel group leg is excluded.

Rank-required recruited downline associates should even be in separate unilevel group legs.

ROI Match

UEZ Markets pays a ROI match on returns paid to personally recruited associates.

- Members earn a 30% ROI match

- Supervisors earn a 50% ROI match

- Managers and better earn a 100% ROI match

Residual ROI Match

UEZ Markets pays a residual ROI match by way of a 2×20 matrix.

A 2×20 matrix locations an affiliate on the high of a matrix, with two positions immediately below them.

These two positions kind the primary degree of the matrix. The second degree of the matrix is generated by splitting these first two positions into one other two positions every (4 positions).

Ranges three to twenty of the matrix are generated in the identical method, with every new degree housing twice as many positions because the earlier degree.

Be aware that though a 2×20 matrix has twenty ranges, UEZ Markets solely pays the residual ROI match on even-numbered matrix ranges.

Referral commissions are paid as a share of returns paid to associates throughout these twenty ranges as follows:

- recruit 1 affiliate and obtain a 4% ROI match on degree 2

- recruit 2 associates and obtain a 4% ROI match on ranges 2 and 4

- recruit 3 associates and obtain a 4% ROI match on ranges 2, 4 and 6

- recruit 4 associates and obtain a 4% ROI match on ranges 2, 4, 6 and eight

- recruit 5 associates and obtain a 4% ROI match on ranges 2, 4, 6, 8 and 10

- recruit 6 associates and obtain a 4% ROI match on ranges 2, 4, 6, 8, 10 and 12

- recruit 7 associates and obtain a 4% ROI match on ranges 2, 4, 6, 8, 10, 12 and 14

- recruit 8 associates and obtain a 4% ROI match on ranges 2, 4, 6, 8, 10, 12, 14 and 16

- recruit 9 associates and obtain a 4% ROI match on ranges 2, 4, 6, 8, 10, 12, 14, 16 and 18

- recruit 10 associates and obtain a 4% ROI match on ranges 2, 4, 6, 8, 10, 12, 14, 16, 18 and 20

Administration Revenue Sharing

Administration Revenue Sharing is a rank-based bonus paid on returns paid to an affiliate’s complete downline.

- Supervisors obtain a 5% Administration Revenue Sharing bonus

- Managers obtain a ten% Administration Revenue Sharing bonus

- Advertising and marketing Managers obtain a 15% Administration Revenue Sharing bonus

- Regional Managers obtain a 20% Administration Revenue Sharing bonus

- Administrators obtain a 25% Administration Revenue Sharing bonus

- International Administrators obtain a 30% Administration Revenue Sharing bonus

Similar Rating and Over Rating Bonus

The Similar Rating and Over Rating bonuses look like paid on returns paid to associates on the similar or greater rank, beginning at Supervisor.

- Managers and better obtain a 2% Similar Rating Bonus on personally recruited Managers and two further ranges of recruited Managers

- Advertising and marketing Managers obtain a 2% Over Rating bonus on personally recruited associates at the next rank and any associates they’ve recruited additionally at the next rank

Buying and selling Lot Revenue Sharing

The Buying and selling Lot Revenue Sharing bonus rewards Supervisors and better for producing $500 in downline funding.

- Supervisors obtain $3 per $500 in downline funding generated

- Managers obtain $7 per $500 in downline funding generated

- Advertising and marketing Managers obtain $11 per $500 in downline funding generated

- Regional Managers obtain $15 per $500 in downline funding generated

- Administrators obtain $18 per $500 in downline funding generated

- International Administrators obtain $20 per $500 in downline funding generated

Be aware that whereas Buying and selling Lot Revenue Sharing is paid on a number of $500, UEZ Markets tracks the bonus per each $1000 invested.

Becoming a member of UEZ Markets

UEZ Markets affiliate membership is free.

Full participation within the hooked up earnings alternative requires a minimal $1000 funding.

UEZ Markets seems to solicit funding by way of financial institution wire and tether (USDT).

UEZ Markets Conclusion

UEZ Markets’ web site is draped in buying and selling jargon. What you gained’t discover are any particulars in regards to the firm’s executives or its compensation plan.

That’s as a result of, regardless of representations, UEZ Markets has nothing to do with buying and selling.

With crypto ruses dying out scammers have turned to AI.

This once more has nothing to do with UEZ Markets’ MLM alternative.

UEZ Markets is clearly providing securities by its passive funding alternative.

This requires registration with monetary regulators and submitting of audited monetary stories.

The one monetary regulator UEZ Markets has registered with is the Australian Securities and Investments Commissions (ASIC).

UEZ markets Pty Ltd was registered with ASIC on november seventh, 2022. No monetary stories have been filed.

ASIC is hopeless at regulation of securities fraud regulation. Because of this ASIC is a favourite amongst scammers trying to seem respectable.

Finest case situation, ASIC registration covers UEZ Markets soliciting funding from inside Australia. It doesn’t cowl funding outdoors of Australia.

UEZ Markets hasn’t been round lengthy sufficient but for us to get an correct image on which international locations they’re soliciting funding in.

Because it stands, the one verifiable income getting into UEZ Markets is new funding.

Utilizing new funding to pay associates a month-to-month return makes UEZ Markets a Ponzi scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This may starve UEZ Markets of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that once they collapse, nearly all of contributors lose cash.