It’s the start of a brand new yr. Which suggests should you haven’t begun evaluating your companies’ funds on the finish of 2022, you’re doing so now.

Applicable administration of money circulate is crucial for the success of any enterprise. For eCommerce startups and small companies, nevertheless, a wholesome money circulate can imply the distinction between survival and chapter.

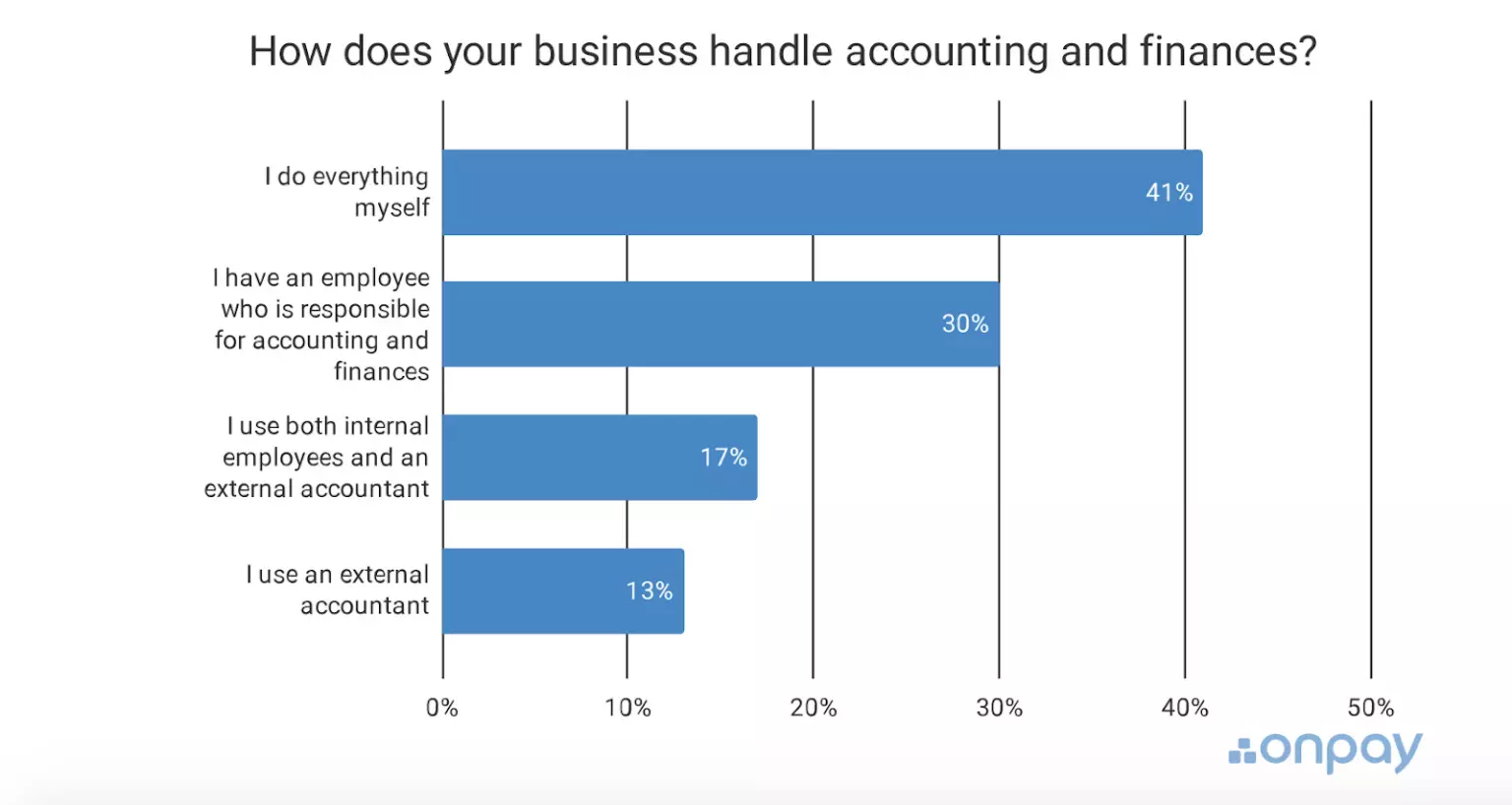

When you’re one of many 41% of small eCommerce enterprise homeowners who do their very own accounts, this text is for you.

What’s eCommerce Accounting?

At its most elementary degree, accounting refers to bookkeeping duties like recording transactions or dealing with payroll. However accounting goes additional than bookkeeping and should you’re operating a small enterprise, you’ll must deal with these duties as effectively:

- Making ready and analyzing stability sheets

- Reporting revenue for tax functions and calculating tax liabilities

- Making ready monetary statements and stakeholder experiences

- Conserving information in keeping with auditing necessities

- Analyzing monetary knowledge for danger evaluation and forecasting

Good money circulate administration begins with good bookkeeping. Step one is to precisely report the money flowing out and in of what you are promoting. There are two predominant accounting strategies that eCommerce companies use to maintain observe of money circulate.

Money Foundation Accounting

The cash-based technique is the start line for many small eCommerce companies. That is whenever you report money actions out and in of your checking account as they occur. So, you report expenditure when it leaves what you are promoting and revenue when it clears.

Which means that on your end-of-year taxes, you don’t must report anticipated revenue or pending funds. Companies have a tendency to start out right here due to the simplicity of the system. It’s tough to scale when firms develop and begin working with a number of accounts, although.

This technique is appropriate for a small eCommerce retailer or a enterprise promoting by means of a bigger web site like Amazon. Money foundation accounting gives you a transparent image of how a lot money you’ve available day-to-day or month-to-month.

Accrual Accounting

Bigger companies want an answer that may account for payables and receivables the place cash hasn’t modified fingers. This is named accrual accounting. On this technique, you report transactions as they’re agreed upon, no matter cash being acquired/paid.

This implies you’ll be able to embody issues like long-term contracts with staged funds. Knowledge from the accrual technique will help you make monetary forecasts. You get an image of your money circulate within the coming months or years, permitting you to regulate your funds plans accordingly.

Many bigger establishments would consider this because the default technique of accounting. Small companies ought to be cautious of beginning right here, although. Specializing in future revenue and expenditure can obscure your view of the prepared money in what you are promoting.

Areas of Emphasis in eCommerce Accounting

As we talked about above, accounting has quite a lot of totally different functions. It may be tough to know the place to start out should you’re new to monetary administration. These are the 4 predominant areas to give attention to to maintain money circulate wholesome whereas making ready correct accounts.

Tax Administration

As the top of the monetary yr approaches, taxes are a excessive precedence for small companies. Improper reporting can result in penalties and bills {that a} startup can’t afford. But, tax is a sophisticated topic. Whole accounting corporations exist to deal with company tax reporting.

As a small enterprise proprietor, you’re most likely used to deciphering the tax code, preserving correct information, and ensuring end-of-year filings are right. Even so, an accessible self-assessment software program answer will help you observe your funds and arrange your information extra effectively.

For probably the most profit, discover one which comes with 24/7 buyer assist, so assistance is at all times at hand. That approach, you don’t should deal with each drawback your self.

Budgeting

Conserving observe of your money circulate in actual time will show you how to create money circulate forecasts. You need to use your forecasted knowledge to assist plan your budgets. This may be particularly helpful for brand spanking new companies as you’ll be able to plan your expenditures round your obtainable liquid money.

Bookkeeping

Conserving good information isn’t simply helpful for tax functions. Transaction knowledge can be utilized for audit trails, evaluation, and forecasting. You’ll additionally want it to assist with buyer assist points like returns. On high of that, traders and collectors will need to see detailed accounts earlier than they put cash into what you are promoting.

Scaling

When you begin your small eCommerce enterprise, the target after survival is at all times development. A superb accounting system will show you how to spot strengths in your services and products. It is going to additionally show you how to determine your largest expenditures and pinpoint alternatives to cut back prices.

5 Tricks to Ace eCommerce Accounting

Now you already know what accounting means to an eCommerce enterprise. Which means you’re prepared for our 5 finest tricks to get on high of your small enterprise accounts.

Perceive Price of Items Offered (COGS)

When you’re new to accounting, value of products bought (COGS) is a crucial idea to know. That is how a lot it prices you to promote objects, and also you want this determine to work out your revenue margin.

Right here’s a fast instance. Let’s say you promote all of your inventory of 1 merchandise for $5,000. It prices you $1000 to purchase the products, $1000 to retailer them, $1000 to ship them, and $1000 to pay your staffing prices. Your complete COGS is $4000, so your revenue margin is $1000.

Preserve Monitor of All Bills

We stored the instance above easy, however you already know that actual enterprise bills are extra complicated. Conserving observe of all of your bills will show you how to monitor how adjustments have an effect on your revenue. That is the way you determine what bills are vital to income technology.

Run Common Reconciliation Stories

These experiences allow you to determine and clarify any discrepancies between budgetary objects and accounts. Primarily, these experiences show you how to observe whether or not your forecasting and budgets match up along with your precise spending, in addition to assist preserve stock and payroll information.

Monitor Your Income Earlier than Tax

Tax liabilities can change primarily based on bodily location or buying and selling location. That signifies that preserving observe of pre-tax revenue is a good suggestion. That approach, should you uncover further necessities or tax financial savings, you’ll be able to precisely refer again to the unique figures.

Make the most of Cloud Accounting Software program

Cloud-based accounting software program will help small eCommerce companies maintain skilled, audit-ready accounts. It’s comparatively inexpensive in contrast with contracting accountants and saves time by automating processes and doing calculations for you.

Many accounting software program choices additionally include superior capabilities like sale forecasting, superior experiences, and stock administration to assist develop what you are promoting. Take the time to decide on one that can finest fulfill what you are promoting wants and can present further options as and whenever you want them.

Let’s recap: Begin with good bookkeeping, monitor your money circulate, and use the assistance of accounting software program. Sticking to those suggestions will show you how to get began with managing your small enterprise’s funds.