Decide calls for extra proof in case in opposition to FES.

In recent times, the Federal Commerce Fee (FTC) has more and more focused firms within the direct promoting house, pursuing claims of emphasizing recruitment over product gross sales and questioning the legality of compensation plans. Whereas the channel has been diligent about defending itself in opposition to the allegations and impacted firms have proven outstanding resolve and adaptability find actionable treatments to the considerations, the ability of the FTC has made it troublesome to search out decision.

It’s a irritating scenario that has many executives within the channel involved. The facility of the FTC is simple, and by placing the trade in its crosshairs, it has compelled many firms within the channel to discover new compensation plans and double down on product gross sales and buyer acquisition efforts. These are welcome adjustments and have helped to modernize and legitimize the channel within the minds of many.

Sadly, these adjustments haven’t alleviated the depth of FTC scrutiny. However a latest ruling in a case might have signaled a change, at the least within the judiciary, to assist degree the enjoying subject.

At a preliminary injunction listening to June thirtieth within the U.S. District Court docket for the Japanese District of Michigan, federal district courtroom decide Bernard A. Friedman required the FTC to supply extra proof in its case in opposition to Monetary Schooling Providers (FES). FES is a direct promoting firm that provides credit score restoration providers, wills and dwelling trusts amongst different providers. The FTC had levied pyramid scheme prices in opposition to FES a month prior.

The decide additionally reversed his personal short-term restraining order issued a day after the FTC filed its grievance, primarily terminating an asset freeze and permitting FES to proceed working.

A First for this Trade

Larry Steinberg, chair of the Buchalter regulation agency’s MLM trade group, who was authorized counsel for BurnLounge in its landmark 2007 case with the FTC, was shocked when he heard that the decide on this case rescinded his personal order and requested the FTC to return again with extra proof. “That is the primary time to my data the place the FTC misplaced everything of its preliminary injunction movement, and lifted an asset freeze that had been entered entered on an ex parte emergency foundation at the start of the case.”

On this case, the courtroom initially did what was anticipated: issued an asset freeze order in addition to put in a Receiver to run the corporate. However the truth that FES was allowed to re-open its doorways 30 days later as soon as the decide lifted the asset freeze and altered the Receiver to a Monitor is a departure and a constructive improvement for the channel.

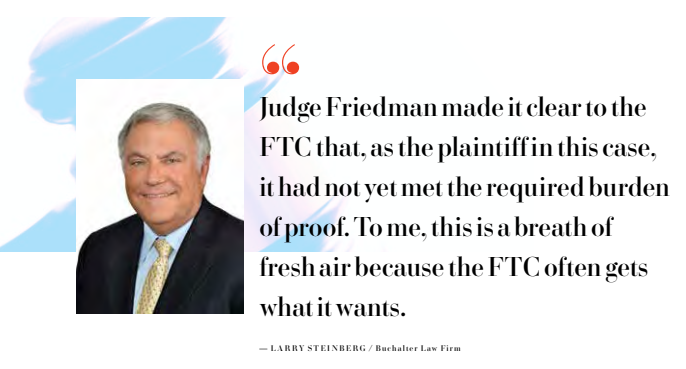

“Often, when the FTC brings a case to courtroom, the decide provides it the advantage of the doubt,” stated Steinberg. “A decide will assume that if the corporate in query was a respectable, law-abiding enterprise, the FTC wouldn’t be there losing its time and sources.”

Why is that this such a departure? As a result of traditionally, the judiciary has deferred to the FTC in direct promoting litigation. This may be as a result of the complexity of the enterprise mannequin is complicated. However on this occasion, the decide didn’t try this. “Decide Friedman made it clear to the FTC that because the plaintiff on this case, it had not but met the required burden of proof. To me, it is a breath of contemporary air as a result of the FTC typically will get what it needs,” shared Steinberg.

Steinberg did observe that the courtroom actually is permitting for the likelihood that the FTC will come again with extra proof. However for now, this decide denied the preliminary injunction and lifted the asset freeze, not as a result of it was validating the legality of FES’ enterprise mannequin—the courtroom didn’t go that far—however as a result of, with none precise proof, the FTC had not, as but, met its burden of proof.

So, What Led to the Decide’s Resolution?

After reviewing the June thirtieth preliminary injunction listening to transcript, it seems that FES’ authorized staff made a compelling argument that the FTC failed to supply ample proof and present sufficient due diligence, resulting in the decide’s determination.

Richard W. Epstein, a companion at Greenspoon Marder LLP and authorized counsel for FES, efficiently argued that, because the FTC offered no FES operational knowledge in its grievance, the courtroom couldn’t make the required discovering that FES emphasised the recruitment of brokers over the sale of merchandise.

In response to Epstein, what the FTC did present was a whole lot of financial institution data. However financial institution data solely present cash coming out and in. “It doesn’t inform them whether or not that is from prospects shopping for the product, which might point out that it is a respectable multi-level advertising plan, versus cash coming from the sale of the enterprise alternative, which is one ingredient of a pyramid scheme.”

Persevering with, Epstein went on to state that out of FES’ 160,000-plus brokers and roughly 420,000 prospects the corporate has serviced, to say in broad-sweeping phrases that this firm operates as a pyramid scheme is a stretch. “With out considering the precise knowledge that exists that might have allowed for an acceptable analysis of the advertising plan, there merely shouldn’t be a correct basis to proceed any kind of injunctive reduction in opposition to any of the company events on this motion.”

FES Brings in Third Occasion to Evaluation FTC Criticism

To additional analyze the FTC’s grievance in opposition to FES, Epstein requested Branko Jovanovic, Ph.D., principal with The Brattle Group, a world financial consulting agency with intensive expertise analyzing MLM compensation fashions, to present his opinion on the allegations concerning FES’ product choices. “As Dr. Jovanovic factors out in our skilled rebuttal to Dr. Givens, there isn’t any set customary. There is no such thing as a vibrant line that anybody has drawn… and extra importantly, the Federal Commerce Fee has not drawn,” Epstein asserted.

Here’s a quick breakdown of Dr. Jovanovic’s evaluation of the FTC grievance:

Credit score Restore Merchandise are Ineffective

The FTC targeted on a small subset of three merchandise that they said have been ineffective. Nevertheless, FES’ restoration providers have led to a removing of 500,000 out of date, unverifiable and inaccurate gadgets in buyer credit score data from 2019 to 2021.

No Proof of What Defines a Pyramid Scheme

Fairly than defining what a pyramid scheme is (or isn’t), Dr. Givens’ declaration merely asserts that FES is one. Nevertheless, his conclusions that FES’ compensation plan incentivizes recruitment over retailing; that almost all of brokers begin on the lowest rank inherently implies that FES function a pyramid scheme; and that there isn’t any return coverage are all demonstrably fallacious.

No Entry to Distributor Stage intelligence Information

Due to constraints imposed by the Receiver, Givens’ and Jovanovic’s choices have been reached with out direct entry to necessary knowledge that might have offered extra readability.

Decide Friedman’s Ultimate Take

When it got here time for Decide Friedman’s ruling he said that as he was listening to the arguments, he was searching for a preponderance of proof customary to base his ruling on. However all he had have been pleadings and affidavits which are disputed. “Pleadings, as everyone knows, are usually not proof,” stated Friedman. On the subject of the general public curiosity, the decide stated we should do all we are able to to implement laws and legal guidelines to guard customers, however we additionally want to guard companies. “…we even have a public curiosity in selling entrepreneurial endeavors and we’ve (a) public curiosity in permitting folks to conduct their enterprise in a lawful method.” He presumed FES would proceed to function lawfully as a result of “everybody’s going to be watching.”

What We’ve Discovered So Far

This case is simply getting began, and quite a bit can and can occur within the months and years to return as this case heads to courtroom. However right here are some things we are able to glean from this case to date that might have ramifications transferring ahead.

The FTC Should Substantiate Its Claims

The company can not assume judges will rubber stamp their complaints. This has been the most important grievance of many firms who get caught within the crosshairs of the FTC—that the company doesn’t have substantial proof to file its grievance.

The FTC Hung their Hat on Part 13(b)

For the reason that early Seventies the FTC has used Part 13(b) to say and procure extraordinary financial reduction, akin to freezing an organization’s belongings. After a unanimous ruling in April of 2021, the Supreme Court docket, in AMG Capital Administration vs Federal Commerce Fee, dominated that Part 13(b) doesn’t authorize the Fee to acquire court-ordered financial reduction. That’s precisely what Mr. Epstein argued that the one foundation cited within the short-term restraining order for the asset freeze was “rescission or reformation of contracts and refund of monies or property. That is financial reduction.”

Decide Friedman Did What Judges Ought to Do

He listened to either side, learn the whole lot fastidiously and stated that, with no substantial proof offered, the FTC had not met its burden.

A Sport-Altering Second?

“This lawsuit has the potential to be groundbreaking in terms of MLM and pyramid scheme litigation,” Steinberg stated. “Solely time will inform. With the injunction part of this case behind us, FES is ready to proceed in its enterprise for now. Proper now, the events are moving into discovery and movement preparation. I can be following this case very carefully.”

All of us recognize having our rights as a shopper protected. That’s what the FTC is for. However companies additionally want safety from authorities overreach. The harm that ensues from an FTC investigation will be devastating and much reaching, as many firms within the channel can attest to. We will solely hope all judges observe Decide Friedman’s lead and base their choices on the proof. That’s all that anybody can ask for.

FTC VS FES Timeline of Occasions

Might 23, 2022

FTC recordsdata a grievance alleging that FES and its homeowners, Parimal Naik, Michael Toloff, Christopher Toloff and Gerald Thompson, in addition to a variety of its associated firms, bilked customers for greater than $213 million, together with working an illegal credit score restore rip-off that has deceived customers throughout the nation, and alleging that FES’ funding alternative is an unlawful pyramid scheme.

The FTC included a declaration from Dr. David Givens, an economist within the Shopper Safety Division of the Bureau of Economics on the FTC, to help its declare that the corporate was working as a pyramid scheme, though Givens by no means noticed any firm knowledge. He stated that the FES info given to him by the FTC was per being a pyramid scheme.

Might 24, 2022

Decide Bernard A. Friedman, a federal district courtroom decide for the Japanese District of Michigan, points a short lived restraining order primarily shutting down the corporate and freezing all of its belongings.

June 30, 2022

After listening to oral arguments from either side, Decide Friedman points an order denying the FTC’s movement for preliminary injunction, vacating the short-term restraining order, terminating the beforehand ordered asset freeze and changing the receivership to a monitorship.

From the November 2022 problem of Direct Promoting Information journal.