Household First Life’s (former?) CFO, circa 2022, is alleged to have referred to the corporate’s compensation plan as a “Ponzi scheme”.

Household First Life’s (former?) CFO, circa 2022, is alleged to have referred to the corporate’s compensation plan as a “Ponzi scheme”.

Integrity Advertising Group (IMG) personal Household First Life, the insurance coverage area of interest MLM firm.

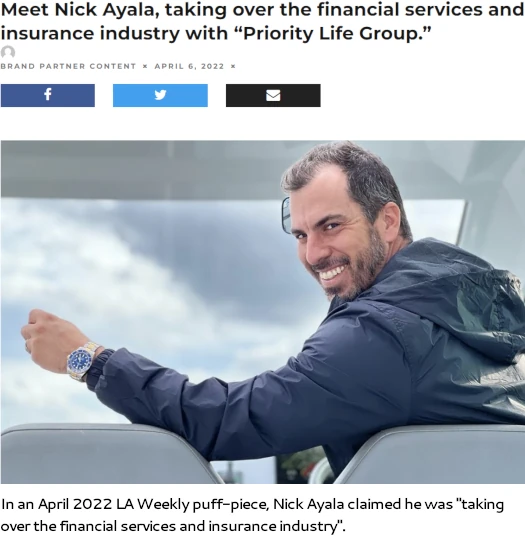

As alleged by IMG in a March third, 2023 filed lawsuit, defendants Nicholas Ayala, Michael Killimett, Ryan Montalto and Matthew Smith

wrongfully induced Integrity to pay them tens of millions of {dollars} in change for his or her companies, materials guarantees, and associated providers.

Defendants not solely didn’t reside up their guarantees; it additionally seems that they by no means supposed to take action.

Ayala, Killimett, Montalto and Smith are all cited as “former Integrity govt worker(s)”.

- Nicholas Ayala owned Precedence Life Insurance coverage Company LLC

- Michael Killimett owned FFL Southeast

- Ryan Montalto owned FFL United and

- Matthew Smith owned FFL Northwest

IMG claims it purchased the above entities from the Defendants in 2020.

These insurance coverage companies – Precedence Life, FFL Northwest, FFL Southeast and FLL United – then turned wholly owned subsidiaries of Integrity.

As a part of the acquisition, Ayala, Killimet, Montalto and Smith signed Employment Agreements with IMG.

Every Employment Settlement offered that every Defendant would “function President” of his respective Company after Integrity acquired that Company.

In a nutshell, IMG argues that, based mostly on ongoing month-to-month monetary stories, the Defendants didn’t uphold their finish of acquisition settlement.

On the time of Integrity’s acquisition of every Company, every Company was producing internet revenue of between $600,000 and $1.2 million yearly.

In 2023, every Company reported unfavorable annual internet revenue.

Integrity offered every Defendant with month-to-month monetary stories to asses the continuing efficiency of his respective Company.

Integrity recognized extreme and ongoing underperformance in reference to every Defendant’s administration of his respective Company.

On data and perception, every Defendant has didn’t commit his greatest efforts, full enterprise time, or consideration, or all of them, to the enterprise and affairs of his respective Company.

In an try to deal with the collapse of the 4 Household First Life companies, IML met with the Defendants in February 2023.

Integrity met with every Defendant to clarify the steps the Defendant should take, constant along with his Employment Settlement, to enhance his respective Company’s enterprise.

IMG adopted up with “required quick steps” calls for and a “Associate Motion Plan”.

On the time of submitting its lawsuit, IMG claims

on data and perception, no Defendant progressed in taking the quick steps required by the Associate Motion Plan to enhance his respective Company’s enterprise outcomes.

IMG asserts that every of the Defendants as a substitute have been targeted on “set up(ing) and operat(ing) his personal impartial advertising group”. This might allegedly be a violation of the Defendant’s Employment Agreements.

By the top of February 2023 the Defendants seem to have had sufficient. On February twenty seventh every of the Defendants “threatened to resign”.

IMG responded by terminating the Defendants later the identical day.

IMG’s filed lawsuit asserts

- breach of contract

- tortious interference with current contract

- civil conspiracy

- fraudulent inducement and

- unjust enrichment

IML is in search of damages in extra of $5 million, and a declaratory judgment confirming every of the Defendants was correctly terminated.

On June fifth, the Defendants filed an Amended Reply to the Criticism. The Reply is the same old denials however what’s attention-grabbing is the hooked up Counterclaims.

Versus them going off and constructing their very own “impartial” organizations, the Defendants declare the 4 entities failing is a results of “IMG’s conduct”,

IMG makes use of a extremely misleading, complicated, and convoluted compensation construction.

Though the Administration Members continued to supply vital development for IMG, IMG and (Shawn) Meaike started manipulating the Bonus Scheme by altering varied incentives and shifting credit score for brokers round to keep away from having to pay vital bonuses to the Administration Member’s companies.

Meaike would additionally use the cash that was purported to be paid to the Administration Members’ companies for his personal private pleasure and acquire.

Oddly sufficient, none of that is talked about in IML’s authentic lawsuit.

I ought to level out that Shawn Meaike is the unique founder and President of Household First Life. He bought the corporate to IMG in October 2019.

I ought to level out that Shawn Meaike is the unique founder and President of Household First Life. He bought the corporate to IMG in October 2019.

As a part of the acquisition, Meaike was given an possession stake in Integrity Advertising Group and different perks.

Meaike obtained a 5 p.c kickback for every FLL “companion” acquired by IMG.

Due to this kickback, Meike used the Bonus Scheme to shift cash to different FFL managed companies to inflate their income to make them extra enticing for IMG to buy.

As soon as acquired by IMG, Meike would then shift cash out of those companies to make them much less worthwhile.

The Defendants declare, upon studying of “the fraudulent scheme of manipulating their financials”, they confronted IMG’s CFO and Director of Gross sales Operations.

This govt shouldn’t be named within the Defendant’s Counterclaim. Household First Life’s web site fails to checklist a CFO.

In any occasion, Defendants go on to assert;

After assembly with Ayala and looking out into the difficulty intimately, the Gross sales Director known as the bonus construction a “Ponzi scheme,” and she or he stated they might work out an answer.

Nevertheless, nothing was carried out thereafter to rectify the issue.

As an alternative, Ayala was informed to “hold in there” and to proceed “doing what he was doing”.

As of November 2022, Matthew Smith claims his FFL Agent place earnings “have been minimize by greater than 75%, regardless that manufacturing considerably elevated”.

The IMG Gross sales Director additionally informed Smith the bonus program was a “Ponzi scheme”, and she or he confirmed that their bonuses have been being lowered so IMG and Meike may seem extra worthwhile.

Right here’s the beforehand referenced February 2023 showdown, this time as recounted by the Defendants;

On February 8, 2023, regardless of realizing every Administration Members’ financials have been merely incorrect, IMG despatched a letter to every Administration Member falsely accusing them of getting decrease “monetary consequence … for the 2022 fiscal yr, as in comparison with the monetary outcomes of [their agencies] when Integrity acquired the enterprise …”

The Defendants go on to allege they got directions that “would make it almost not possible to achieve the objectives of the motion plan”.

At the moment, it turned clear that IMG was making an attempt to manufacture a for “Trigger” termination so it will not need to pay FMV for the Administration Members Rollover Models.

The Defendants keep they didn’t threaten to resign however did in reality resign on February twenty seventh.

Thereafter, IMG acknowledged receipt of the Administration Member’s resignation letters, however claimed IMG was now terminating all of them – after the very fact – “for trigger”.

In the identical termination letter, IMG’s actual motivation was revealed, as IMG acknowledged that it will be exercising its proper to repurchase every Administration Members Rollover Models, ensuring to emphasise the for “Trigger” language of their Employment Agreements.

“Rollover Models” are a part of a monetary association reached when IMG purchased the Defendants’ FFL companies.

Every Administration Member offered capital contributions in change for “Class A Widespread Models” and/or “Class A Most well-liked Models” (Rollover Models).

The Defendants argue that FFL was adamant it terminated them for “Trigger”, to be able to get out of paying out regardless of the Rollover Models have been price on the time.

The Defendant’s Counterclaim alleges breach of contract and customary regulation fraud.

Declaratory judgment pertaining to the Defendants resigning, and IMG not terminating them for “Trigger” can also be sought.

BehindMLM reviewed Household First Life in November 2021. I didn’t see a Ponzi scheme however I additionally wasn’t conscious Meaike was allegedly manipulating Agent positions.

Firstly, an govt manipulating an MLM compensation plan for their very own profit is a due-diligence purple flag. It’s additionally in all probability proof of fraud ought to the FTC ever file swimsuit.

Taking a step again from each IMG’s authentic lawsuit and the counterclaim, it seems revenue within the 4 Defendant’s positions dried up.

This was seemingly a mix of Meaike’s alleged manipulation and that resulting in a scarcity of effort. Why work more durable when the man working the corporate is simply going to screw you out of more cash?

Ultimately the positions bumped into the purple, bringing us to the February 2023 showdown.

I’m additionally curious as to what particularly led Household First Life’s CFO to consult with the corporate as a Ponzi scheme. Both the time period was misused interchangeably to explain a pyramid scheme, or there’s some funding shenanigans occurring Household First Life I’m not conscious of.

A CFO would by definition be in-charge of and totally conscious of Household First Life’s financials. They’d in fact additionally find out about unlawful manipulation of Agent’s revenue to learn Meaike and anybody he was working with.

That Household First Life at present doesn’t seem to have a CFO, or at the very least publicly acknowledge having one, is ominous.

That stated, personally I’m leaning to “Ponzi scheme” getting used to consult with a “pyramid scheme”. Within the absence of additional clarification nonetheless, I can’t verify.

Sadly IMG’s lawsuit and the Defendant’s Counterclaim have been filed in a state-level Texas District Court docket.

This implies I can’t observe them on Pacer and, consequently, BehindMLM received’t be capable of observe the case. Unique filings coated on this article have been courtesy of NAAIP.

Pending any updates we’re capable of share, we’ll maintain you posted.