VidiLook’s collapse has gone from unhealthy to worse, following information over 10,000 investor accounts have been disabled.

VidiLook’s collapse has gone from unhealthy to worse, following information over 10,000 investor accounts have been disabled.

KYC has additionally been carried out to maintain disabled accounts inactive.

VidiLook collapsed on April twenty first, following disabling of withdrawals. Proprietor Sam Lee’s preliminary ploy was buying VidiLook from himself.

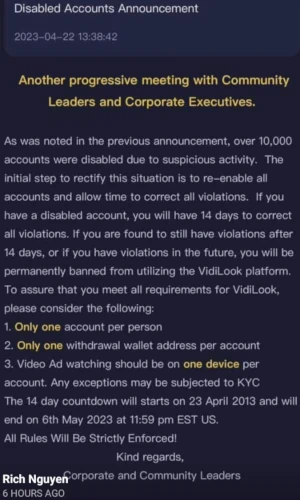

To that finish an audit was introduced, with an open ended timeframe. In an April twenty second announcement, VidiLook moreover knowledgeable traders it had disabled 1000’s of accounts.

Over 10,000 accounts have been disabled as a consequence of suspicious exercise.

You probably have a disabled account, you should have 14 days to right all violations.

In case you are discovered to nonetheless have violations after 14 days, or when you’ve got violations sooner or later, you may be completely banned from using the VidiLook platform.

VidiLook’s claimed “violations” seem to pertain to traders having a number of accounts. This wasn’t an issue till VidiLook started operating out of recent funding to pay withdrawals.

VidiLook’s claimed “violations” seem to pertain to traders having a number of accounts. This wasn’t an issue till VidiLook started operating out of recent funding to pay withdrawals.

Additionally not an issue is KYC, which VidiLook has solely now carried out for traders wanting to assert an “exception”.

Beginning April twenty fourth, VidiLook has given traders 14 days to both lose their accounts or present KYC.

Handing over private credentials presents its personal issues, as VidiLook is run by Sam Lee and scammers in Dubai.

My tackle VidiLook’s current announcement is that they’re hoping to chop out a piece of withdrawals connected to disabled accounts. The intention might be to reboot VidiLook sooner or later.

The issue for Sam Lee is disabling accounts doesn’t clear up new funding not coming in quick sufficient to pay out. Like all Ponzi schemes, VidiLook is juggling an not possible mathematical equation that inevitably results in collapse.

Pending any additional developments on VidiLook’s collapse we’ll hold you posted.