Despite the fact that leisure journey seems to have largely recovered from the pandemic’s harm, company journey has been slower to return—and now that companies have discovered options, will it ever absolutely recuperate? Is there nonetheless a necessity?

New Deloitte analysis factors to a wide range of components which can be contributing to that decline, together with heightened worker security issues, a declining consumer curiosity in assembly in-person, the re-assessed worth of attending a convention, the sufficiency of digital conferencing platforms, and elevated issues about sustainability.

Though pandemic issues and testing rules usually waned within the second half of 2022, monetary issues at the moment are an even bigger uncertainty for the sector. The third version of Deloitte’s company journey examine, Navigating Towards a New Regular, examines why and when workers are anticipated to journey for enterprise, in addition to the dynamics creating headwinds—and alternative—for the sector.

Worldwide journey and occasions account for a lot of anticipated development in 2023

Whereas full restoration to 2019 ranges could also be attainable by late 2024 or early 2025, accounting for inflation and misplaced positive factors would probably depart the company journey market between 10-20 p.c smaller than it was previous to the pandemic. Amid increased airfares and room charges, the variety of journeys is prone to lag even additional behind. Nevertheless, worldwide journeys and reside occasions are set to account for a lot of anticipated development in 2023.

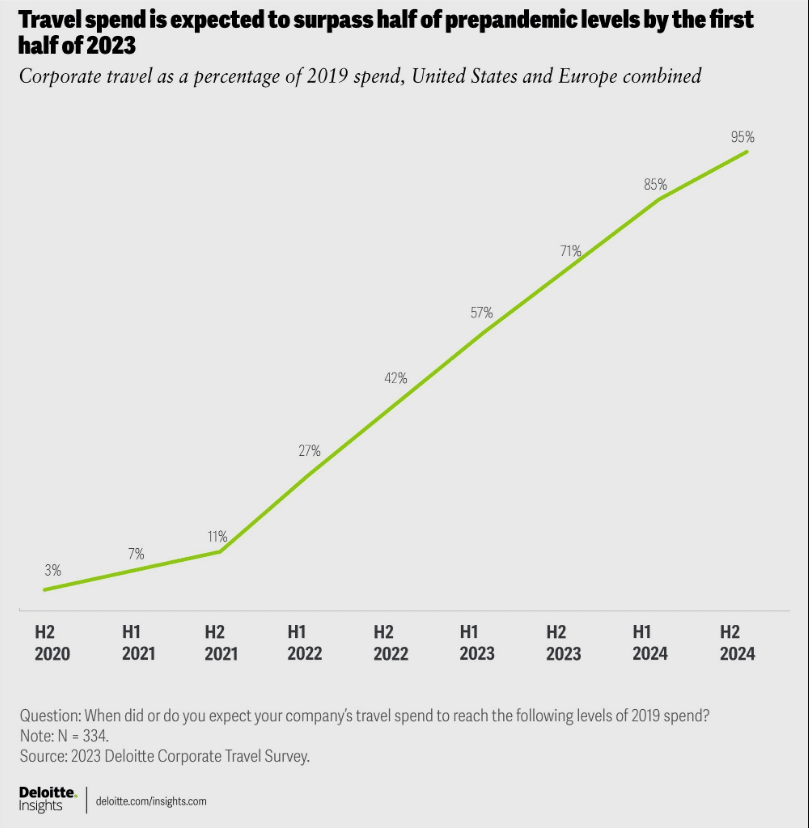

- Company journey spend throughout the U.S. and Europe is anticipated to rise to greater than half (57 p.c) of pre-pandemic ranges within the first half of 2023 and surge to 71 p.c by the tip of the yr.

- Most corporations surveyed (71 p.c of U.S. corporations and 68 p.c of these in Europe) count on a full restoration in journey spend by the tip of 2024.

- U.S. respondents count on worldwide journeys to account for 33 p.c of 2023 spend, up from 21 p.c in 2022 and just like 2019 ranges.

- The highest purpose reported for worldwide journeys includes connecting with shoppers and prospects: within the U.S., the principle drivers are to attach with world business colleagues at conferences and to construct consumer relationships; in Europe, consumer undertaking work, adopted by gross sales conferences are the most important causes for journeys past the continent.

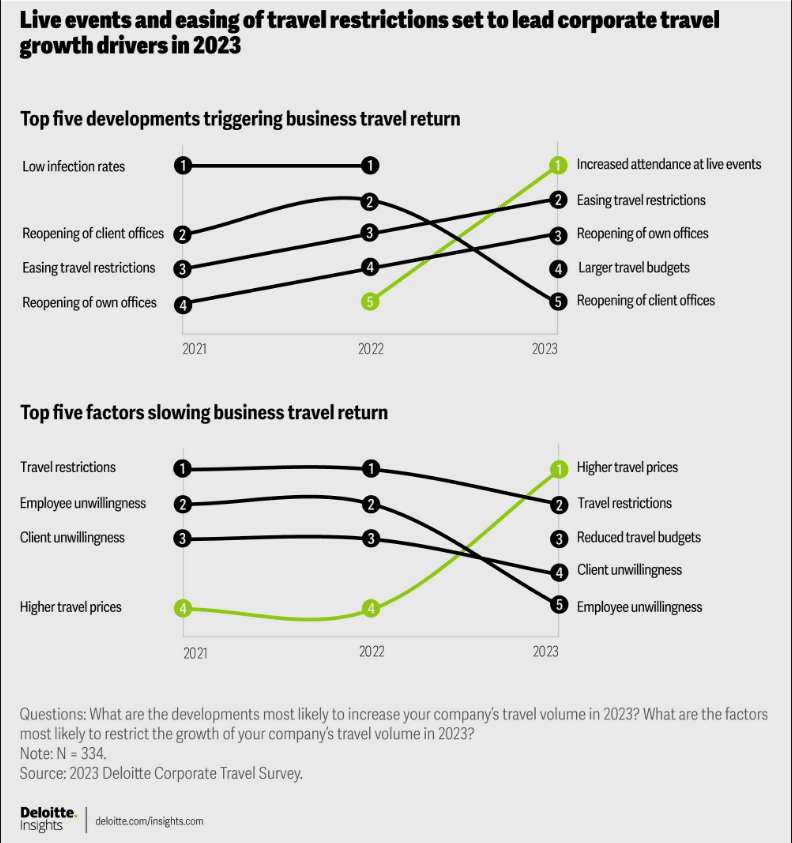

- Whereas increased journey costs are essentially the most important issue deterring corporations from journey, reside occasions are poised to be the most important driver of enterprise journey demand, leapfrogging to the highest purpose for worldwide journey from the U.S. in 2023, up from fifth in 2022.

- With occasions prime of thoughts, corporations are adjusting their inside plans: Half report splitting bigger gatherings into smaller, regional, nearly linked occasions, and 44 p.c have adopted a hybrid strategy. Additional, 42 p.c of these surveyed within the U.S. and 54 p.c in Europe plan to combine extra shoppers into inside occasions.

- A majority of corporations surveyed (70 p.c) strategically consider and weigh potential outcomes of enterprise journey, corresponding to income era, alongside the negative effects of price, well being dangers and emissions.

Office flexibility and know-how proceed to shift the course of enterprise journey

Though pandemic issues about journey usually declined amongst these surveyed, the flexibility to leverage know-how in lieu of journeys—which finally reduces prices—continues to influence enterprise journey’s development trajectory. In line with the survey, know-how can assist almost each enterprise want journey serves—to a point. As well as, the longer term work-from-home charge is anticipated to be 3.2 occasions increased than earlier than the pandemic. Collectively these components will proceed to influence how and when workers journey for work.

- Enterprise leaders are weighing the good thing about in-person interactions, as inside trainings and workforce conferences (44 p.c) are rated essentially the most replaceable by know-how, in comparison with consumer rapport constructing (11 p.c) and consumer acquisition (7 p.c).

- Two-thirds (67 p.c) of respondents say their workers are touring extra to cities inside driving distance of their location.

- Journeys to firm headquarters by relocated workers are additionally on the rise, most of which (70 p.c) are both fully or partially paid for by the corporate.

- U.S. corporations are more and more incorporating non-hotel lodging, together with non-public leases, into their company journey insurance policies. Almost half (45 p.c) of these surveyed have non-hotel lodging of their company reserving instruments, up from 9 p.c final yr, and 57 p.c have agreements with particular branded house or house rental suppliers, up from 23 p.c in 2022. Solely 10 p.c of U.S. corporations surveyed don’t reimburse for non-hotel lodging, down from half (49 p.c) in 2022.

“As enterprise journey continues its climb, increased airfare and resort prices are seemingly slowing the rise in journeys taken,” mentioned Eileen Crowley, vice chair, Deloitte & Touche LLP and U.S. transportation, hospitality and companies attest chief, in a information launch. “As enterprise leaders take a strategic view of their journey plans and the business adapts to a brand new regular, reside conferences and occasions particularly are proving they will provide efficient alternatives to attach in individual, particularly as distant and hybrid work stay fixtures of the company world.”

Contract negotiations intention to right-size journey prices

Firms seemingly garnered important price financial savings from not touring through the pandemic. Now, after three years of decreased journey, increased airfare and room charges pushed by inflation have many corporations working to accommodate shifting expectations from their workers.

- About half of respondents (51 p.c) report workers’ expectations of luxurious companies corresponding to first or enterprise class airfares and upscale lodges, in addition to the necessity for last-minute (45 p.c) or versatile bookings (52 p.c), are pushing prices increased.

- When negotiating contracts with suppliers, about 1 in 5 (19 p.c) corporations say lodges are much less accommodating on charges as a result of they count on decrease quantity, and 11 p.c report the identical for airways.

- Regionally, 63 p.c of U.S. journey patrons surveyed report favorable airline pricing on optimistic quantity expectations, in comparison with 54 p.c of these in Europe.

- Increased charges are having much less of an influence on the variety of journeys taken: 45 p.c of corporations say they restrict frequency to regulate prices, down from 72 p.c in 2022. As an alternative, they give attention to mitigating the price per journey with cheaper lodging (59 p.c) and lower-cost flights (56 p.c).

Sustainability drives some journey selections

Journey, usually, attracts consideration as a big contributor to carbon emissions. Nevertheless, 49 p.c of corporations famous that selecting sustainable suppliers drives prices up. Consequently, enterprise leaders are compelled to weigh the expense and environmental influence of journeys.

- One-third (33 p.c) of U.S. corporations and 40 p.c of European corporations surveyed say they should cut back journey per worker by greater than 20 p.c by 2030 to satisfy sustainability targets.

- To fulfill sustainability objectives, 42 p.c of these within the U.S. and 45 p.c in Europe say they’re within the means of implementing a construction to assign carbon-emission budgets to groups alongside monetary budgets.

- Journey suppliers’ sustainability efforts result in engagement with journey patrons to various levels. Mandated use by survey respondents is low, nevertheless, about one-third contemplate components like a resort’s sustainability certifications and rankings (32 p.c), an airline’s use of sustainable gas (31 p.c), or a automobile rental fleet’s availability of electrical automobiles (27 p.c) to calculate a visit’s carbon footprint.

“The return of company journey continues to take a winding highway as each enterprise leaders and journey suppliers contemplate not simply rising prices, however the necessity of sure in-person conferences amid the growing use of know-how to offset monetary and environmental objectives,” mentioned Mike Daher, vice chair, Deloitte LLP and U.S. transportation, hospitality and companies non-attest chief, within the launch. “Suppliers who take a long-term view of their relationships with journey patrons and talk with them about their sustainability progress must be higher poised to navigate ongoing shifts in journey priorities.”

The examine relies on a survey of 334 U.S.-based and European executives with journey price range oversight, fielded between Feb. 7 and Feb. 23, 2023.