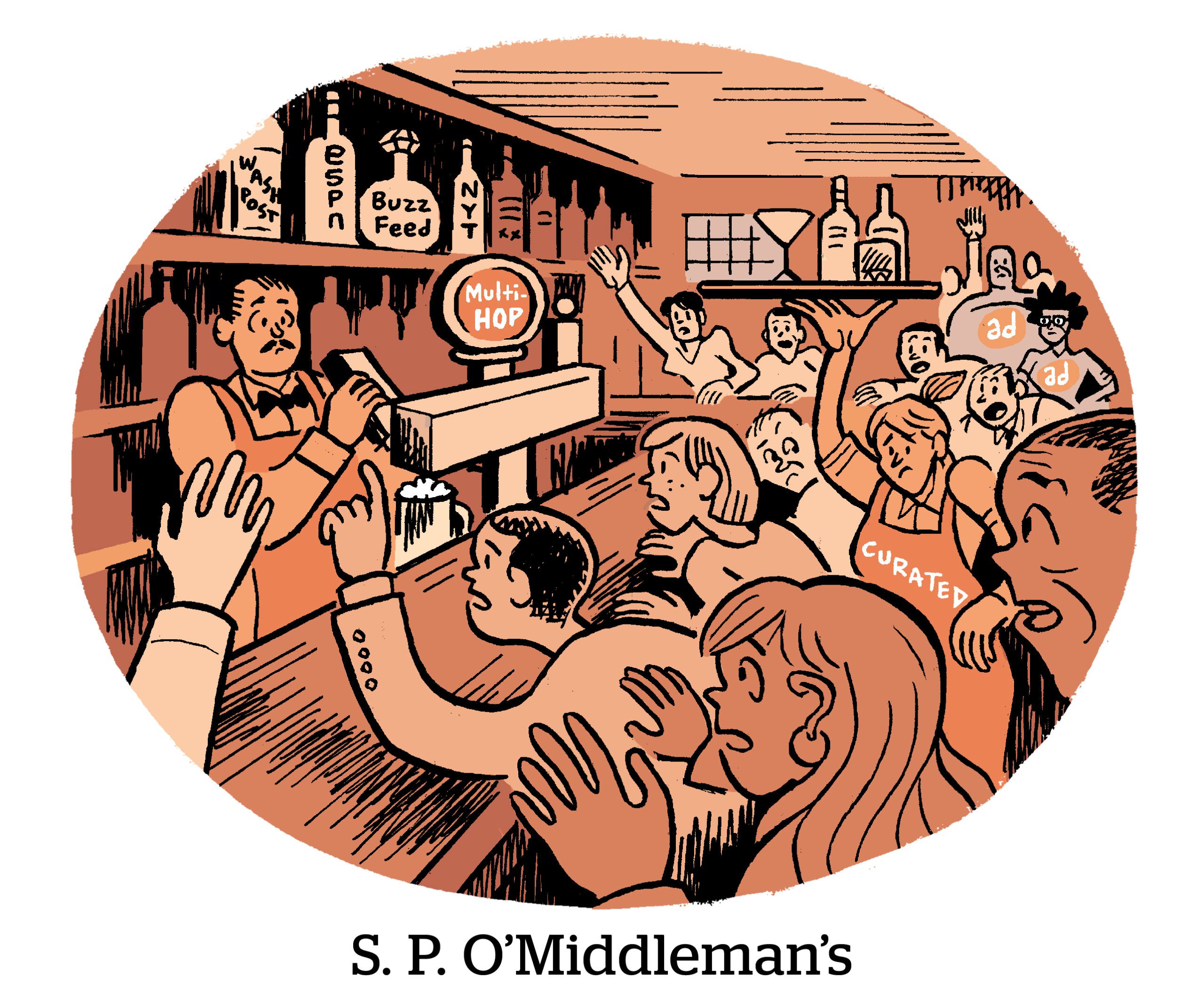

Disintermediation is within the air.

If The Commerce Desk’s OpenPath cuts out SSPs (whereas claiming to not), Magnite’s ClearLine cuts out DSPs (whereas claiming to not).

ClearLine will permit businesses to purchase video stock instantly from Magnite. GroupM, Camelot, and MiQ are the launch companions.

“There was a market ask” from consumers for a video-specific direct-buy product, stated Sean Buckley, chief income officer at Magnite.

The corporate examined its current supply-side expertise and located they may repurpose its current tech, significantly round its SpringServe video advert server, for consumers.

A buyer-direct platform required “actually minimal adaptation” of current instruments, which had been supplied to consumers who had been involved in, say, dealing with their conventional direct gross sales, activating “actually delicate first-party knowledge that sits on the availability facet” or structuring carriage offers with media homeowners to handle stock sharing.

By solely utilizing an SSP to purchase video stock, consumers can decrease their tech tax.

As video budgets migrate to the programmatic streaming ecosystem, Buckley stated, “consumers are actually targeted on maximizing working media.” There’s larger demand for an auditable, environment friendly provide chain.

Shopping for direct gives different advantages apart from lowered charges, famous Andrew Meaden, international head of funding at GroupM. The direct connection to publishers supplies a laundry checklist of advantages: extra transparency, a lowered danger of advert fraud, precedence entry to publishers’ stock and decrease expertise prices. With ClearLine, GroupM pays one negotiated price, somewhat than fielding charges from each a DSP and an SSP.

“Our purpose is to not take away the DSPs from the programmatic equation however to offer extra shopping for choices to suit the wants of our purchasers,” Meaden stated.

Magnite says it’s nonetheless firmly staking its declare in SSP territory, however adhering to the market development the place DSPs and SSPs join with consumers and publishers, as an alternative of only one facet of the ecosystem. “In case you take a look at all the main gamers, it’d be exhausting to seek out somebody who doesn’t present some form of service to each consumers and sellers,” Buckley stated.

Magnite says its loyalties stay to the promote facet: “We view every little thing, together with the event of ClearLine, by the lens of serving to make our supply-side clients profitable of their promoting enterprise,” Buckley stated.

The launch of ClearLine exemplifies how, in recent times, Magnite has pivoted towards CTV, prioritizing the fast-growing channel over cell and desktop. The SSP partnered with streaming firm Brightcove in January and cultivates a long-running partnership with Disney. It formally merged with Telaria in 2020, then acquired video SSP SpotX in February 2021 and SpringServe in July 2021.

And final June, the corporate inked a cope with LG Advertisements to develop into LG’s most well-liked SSP and advert server, which additionally netted its consumers entry to ACR knowledge from LG’s sensible TVs. This primary-party viewership knowledge, “all housed and refined on the availability facet,” in accordance with Buckley, permits consumers to higher plan and measure their campaigns programmatically. By means of ClearLine, LG can allow and share its ACR knowledge to carry publishers and advertisers nearer collectively.

A buyer-to-SSP product might have felt unprecedented a number of years in the past, however the winds of change are blowing within the programmatic house.

Occasions have been robust these days for SSPs. The Commerce Desk’s OpenPath direct-to-publisher product probably cuts out SSPs, which not have unique direct connections to publishers.

To date this 12 months, Yahoo disbanded its SSP and EMX filed for chapter as collectors got here knocking. Magnite laid off 6% of its workforce in January and reported slowed income development in its This autumn earnings in February.