The true property market is in an attention-grabbing state proper now. Dwelling gross sales are slowing due to greater rates of interest, however costs in some areas have but to drop. Total, the median present residence gross sales worth in January 2023 was up 1.3% from the identical time final yr, however residence costs in costly areas have gone down, whereas costs in cheaper areas have gone up.

Contemplating that residence costs have been reaching report highs in 2021, one would anticipate them to have normalized with the slowing market, however that has but to occur. Nevertheless, if rates of interest proceed to rise, costs ought to proceed to drop.

However what does that imply to you and your funds? This text will discover how the present actual property market can impression you financially.

Actual Property Conditions that Can Have an effect on Your Funds

There are a number of conditions that you could be end up in the place the true property market could have an effect on your funds.

1. Shopping for a Dwelling

In the event you’re out there to purchase a house, you are going to pay a better rate of interest than you’d have in 2021. Nevertheless, the stock of properties is excessive and the variety of consumers is down. That implies that you will have extra negotiating energy with sellers. Costs could also be greater, however likelihood is, most sellers are very motivated which may put you within the driver’s seat.

However you may find yourself paying a better fee, however with a cheaper price level for the house, so it might even out for you financially. You may also refinance later if rates of interest go down and get forward of the sport.

Make sure to do your analysis into what is going on in your space by way of costs and the variety of gross sales which can be occurring. Each native market is totally different. Make it possible for your actual property agent talks to you about present comparable gross sales, and use your negotiating energy.

2. Promoting a Dwelling

In the event you’re planning to promote your private home within the close to future, you might be below a little bit of stress. Patrons are fewer in lots of areas because of the greater rates of interest, so the folks which can be shopping for have the negotiating energy. In the event you can, you might be higher off ready to promote till charges return down. Nevertheless, what’s going to occur with rates of interest and when is a good unknown.

If you might want to promote and also you wish to get a particular revenue on what you paid for the house or on what you owe in your mortgage, you may calculate right here what worth you might want to persist with.

Usually the most effective technique in this type of market is to cost your private home greater than what you really need. That manner the client can negotiate and really feel like they’re getting a deal. It can’t be harassed sufficient, nevertheless, that the most effective technique is determined by your native market.

Do your homework and discuss to your actual property agent about what is going on in your market and what comparable properties are promoting for. And if you might want to make a sure revenue on your private home, you may persist with your weapons and anticipate that purchaser that “should have” your private home.

Work along with your agent to make your private home as interesting to consumers as potential by making repairs or upgrades and staging the house properly. In a tricky market, you might want to make your private home stand out from the competitors.

Additionally, work along with your tax advisor when contemplating the worth that you might want to get. Promoting at cheaper price means much less in capital positive factors tax, so that can have an effect in your funds general.

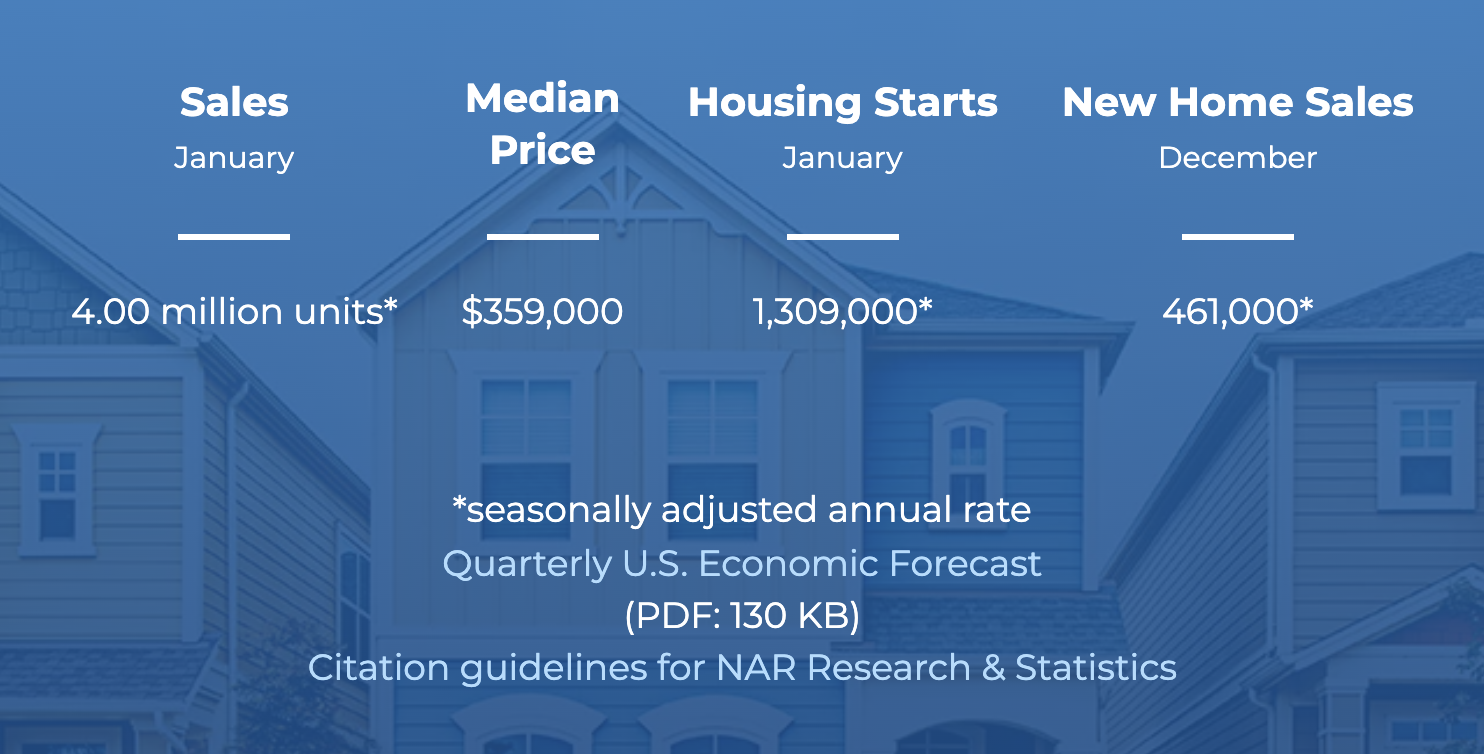

Particular observe: there was $400mm in gross sales in January 2023.

3. Investing in Actual Property

Investing in actual property proper now could be an attention-grabbing proposition. Warren Buffet stated “be grasping when others are fearful”. Actual property buyers proper now are afraid of financial and market instability; nevertheless, having that type of outlook is determined by your objectives and your threat tolerance.

In the event you’re seeking to flip homes as an funding, it is doubtless that you could find offers, significantly on distressed properties. However with the variety of residence consumers lowering, you might end up having bother discovering a purchaser and thus incur carrying prices. You’ll be able to nonetheless make a revenue, although, in the event you can put minimal cash into the property and worth it competitively based mostly on native actual property circumstances.

Your greatest wager if you wish to flip properties now, is to rigorously analyze every potential deal, together with what is going on within the particular space the property is in, and cherry decide solely the offers that take advantage of sense and have the least threat. With so many “fearful” buyers, you may have much less competitors, so you may afford to be picky.

In the event you’re contemplating shopping for rental properties, it is nonetheless a matter of every deal. The upper rates of interest imply that fewer consumers are shopping for and are renting as a substitute, which may drive rents up. That is nice if you could find an excellent deal and pay money for the property. If you might want to finance the property, nevertheless, you may be paying a better rate of interest which can scale back your money circulate.

The underside line is, in the event you’re contemplating investing, you need to actually perceive your native market. Do appreciable analysis earlier than making a choice.

5. Refinancing Your Mortgage

Clearly, in case your present rate of interest is decrease than present mortgage charges, refinancing your mortgage might not be a good suggestion, and vice versa. You even have to contemplate your closing prices when deciding if refinancing is financially helpful.

In case you are refinancing to a decrease fee and getting money out out of your fairness, you might discover that when the financial institution assesses your private home’s market worth, it might be decrease than you assume. Once more, it is determined by what’s occurring to costs in your native market.

If you wish to refinance to a shorter mortgage time period, you should still be capable of profit. Charges on 10 or 15 yr mortgages are usually decrease than 30 yr mortgages, however your fee should still be greater due to the shorter time period.

One other factor to contemplate is that lenders are usually extra conservative in a sluggish actual property market, so it might be tougher to qualify for the refinance. Credit score rating and earnings necessities will likely be tighter, so be ready to undergo a extra rigorous utility course of.

Your greatest wager is to buy round for the most effective charges and phrases, analyze your choices, and resolve which possibility, if any, is best for you.

Here’s a nifty refinance mortgage calculator that will help you.

6. Dwelling Fairness Loans

In the event you’re contemplating getting a house fairness mortgage, whether or not the true property market will impression you is determined by your objectives.

In order for you a house fairness mortgage to consolidate different debt, present mortgage charges are nonetheless doubtless decrease than the charges on different debt resembling bank cards. Nevertheless, much like a cash-out refinance, your fairness might not be as excessive as you anticipate based mostly on market values.

In order for you a house fairness mortgage to rework your private home, in the event you’re doing it simply since you need your own home to be good and you’ll afford the funds, go for it. You may wish to contemplate a house fairness line of credit score with a variable fee in order that the speed goes down when charges go down usually. Nevertheless, charges may go up.

In order for you a house fairness mortgage for reworking, however with the purpose of promoting your private home for a better worth within the close to future, you may want to present it cautious consideration. If charges proceed to rise and residential costs fall, you might not get your a reimbursement from the transforming you do and the curiosity you pay on the mortgage. Make sure to not overdo your enhancements.

7. Renting

Fewer folks shopping for properties means extra folks renting, which is making a rental scarcity resulting from excessive demand. In consequence, in 2023 many predict that rental worth development is prone to stay excessive, which is unhealthy information for renters.

Different financial components are additionally lowering the quantity of earnings that renters can spend on hire. What this implies is that leases in higher-priced areas will likely be much less in demand, which ought to begin to drive costs on these leases down a bit.

In the long run, rental costs are prone to begin to come again down, so in the event you’re discovering it troublesome to afford present rents, you might solely be struggling quickly.

As with all the opposite results of the true property market, how the present circumstances will have an effect on renters is location dependent. In the event you’re out there for a brand new rental, do your homework and store round, and do not be afraid to barter with landlords to attempt to get a greater fee.

In Closing

The actual property market is attention-grabbing proper now, and it is troublesome even for consultants to foretell precisely what’s going to occur in 2023 and past. Many components will have an effect available on the market’s path, so it’s best to keep knowledgeable about what’s occurring out there, significantly in your space.

In the event you’re in any of the conditions mentioned, make sure you do your market analysis and look to professionals, whether or not it’s an actual property agent or a monetary advisor, for recommendation. By doing so, you could find methods to efficiently navigate this unpredictable market and defend your funds.

The put up How the Present Actual Property Market Can Have an effect on Your Funds appeared first on Due.