Estimated learn time: 16 minutes, 3 seconds

Zuora is a recurring billing and monetization answer for:

- Subscription administration

- Income recognition

- Fee assortment

- Quotes

- And extra…

Nevertheless, Zuora has one essential shortcoming — it doesn’t deal with gross sales tax or transaction legal responsibility for you.

Most nations, states, and provinces have particular laws for a way transactions should be dealt with. For instance, for any enterprise that transacts in India, the Reserve Financial institution of India limits automated funds to ₹15,000 (roughly $180) — something over that quantity needs to be manually accepted by the client. Utilizing a platform like Zuora, you’ll be by yourself to find out about and cling to those legal guidelines and laws.

Plus, most states and nations have particular laws in regards to the kind and quantity of oblique tax (e.g., gross sales tax, VAT, or GST) that must be collected and the way these taxes get remitted. For instance, nations comparable to Taiwan, Indonesia, Nigeria, Vietnam, and others require you tofile earnings tax as well as to oblique tax for those who do enterprise in that nation. Once more, Zuora leaves you by yourself to determine and comply with these tax legal guidelines.

Associated: Can SaaS Corporations Afford to Ignore Gross sales Taxes and VAT?

If your organization sells bodily merchandise and/or providers, you’ll want further software program and headcount to handle gross sales tax and transaction legal responsibility. So, within the following listing, we share how simply every answer integrates with different software program.

However, if your organization sells digital merchandise, our fee platform, FastSpring, supplies an answer for every thing from fee processing to subscription administration — and takes on transaction legal responsibility for you.

On this information, we begin with an in-depth assessment of FastSpring. Then, we cowl 5 extra Zuora opponents.

Zuora Options

FastSpring handles the complete fee lifecycle from subscription administration to remitting end-of-year taxes for software program corporations. To be taught extra about how FastSpring will help you scale shortly, join a free account or request a demo at this time.

FastSpring: Finish-to-Finish Fee Platform for SaaS

FastSpring has been serving to software program corporations broaden globally for almost 20 years. We’re greater than a software program answer, we’re the Service provider of File for software program corporations. As a service provider of document, we tackle transaction legal responsibility and deal with gathering and remitting gross sales tax, VAT, and GST for you.

Listed here are a number of examples of how different SaaS and digital items corporations have benefited from working with FastSpring:

Within the following sections, we dig into what it seems prefer to work with FastSpring.

Let FastSpring Acquire and Remit Gross sales Tax, VAT, and GST for You

Software program corporations haven’t at all times been required to gather and remit gross sales tax, VAT, and GST, nevertheless, that’s shortly altering. An increasing number of nations are requiring software program corporations to gather and remit some type of oblique tax. For instance, in the previous couple of years, Canada, Thailand, Puerto Rico, Ukraine, Israel, and Pakistan (simply to call a number of) have all handed new tax legal guidelines that particularly goal non-resident corporations promoting digital merchandise.

This implies software program corporations now should:

- Keep up-to-date on the tax legal guidelines of every jurisdiction they do enterprise in. These tax legal guidelines are continually altering so it may be very tough to maintain up with all of them.

- Implement processes for calculating and gathering the correct quantity and sort of oblique tax. There may be SaaS tax software program that will help you do that, nevertheless, most options have limitations and most are insufficient for gathering worldwide tax.

- Remit these taxes within the right means and on the right time. Remitting gross sales tax (or VAT and GST) is never so simple as filling out a kind and wiring a fee. For instance, some jurisdictions will solely settle for the fee when you’ve got a neighborhood consultant dealing with your taxes for you.

Plus, many jurisdictions have further necessities for staying compliant past merely gathering and remitting the correct quantity and sort of oblique tax. For instance, some nations require you to:

Maintaining with all of the processes and necessities to remain compliant is a big chore and most corporations want a complete division devoted to the duty.

This isn’t a problem for FastSpring purchasers as a result of we take the lead on all of it for you.

We acquire the correct quantity (and sort) of oblique tax at checkout (together with tax-exempt transactions within the US and 0% reverse prices, when relevant).

We remit these taxes for you on the proper time and guarantee all essential components are in place for full compliance.

Lastly, if a rustic or state approaches you about tax compliance, our group will usually present copy and paste responses.

Handle All Subscriptions from One Platform Whereas Staying Compliant with Transaction Legal guidelines and Rules

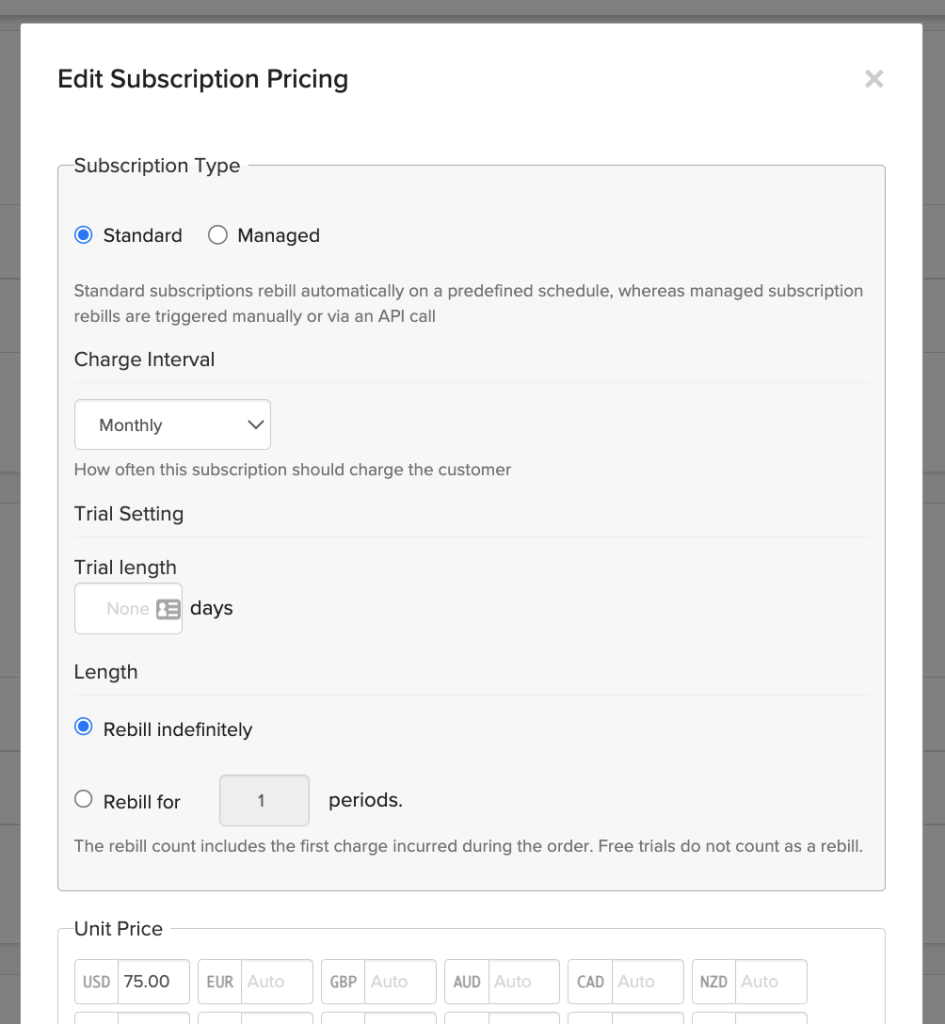

FastSpring supplies all kinds of subscription administration fashions particularly for SaaS corporations — and your group received’t have to jot down code to make use of them. (Additionally, you will have entry to our API and webhooks library for much more customized choices.)

You’ll be able to arrange:

- Automated weekly, month-to-month, or yearly recurring billing.

- Prorated billing to accommodate upgrades and downgrades mid-cycle.

- Free or paid trials of any size.

- Trials with or with out amassing fee particulars (by not amassing fee particulars, you’re decreasing friction at checkout, which generally results in increased conversion charges).

- Automated or guide renewal.

- Upsells, cross-sells, one-time add-ons, and reductions.

- And way more…

Associated: 8 Finest Chargebee Options and Rivals (And How They’re Totally different)

When selecting your subscription mannequin, one main consideration that always will get uncared for is whether or not or not your recurring billing mannequin follows native transaction legal guidelines and laws.

As we talked about earlier, some nations require guide approvals for sure transactions, particular privateness insurance policies to be in place, and extra. For instance, in Canada and Korea, clients are eligible by legislation for a prorated refund in the event that they cancel their subscription earlier than the top of the fee interval.

When you don’t comply with these legal guidelines and laws, you possibly can face fines or be banned from doing enterprise in that jurisdiction. Some fee options declare that will help you sustain with these legal guidelines and laws, nevertheless, they usually solely assist by publishing group updates if/after they find out about new legal guidelines — you’re nonetheless the one finally liable for compliance.

At FastSpring, we take it a step additional and assume transaction legal responsibility for you by:

- Staying up-to-date on all related legalities.

- Guaranteeing all the required procedures are in place.

- Taking the lead on audits.

- Providing particular person steerage on keep compliant.

Associated: Worldwide Recurring Funds (How We Deal with It for You)

Simply Handle B2B Quotes and Billing with Digital Invoicing

Some corporations find yourself needing further software program to handle B2B transactions along with B2C transactions.

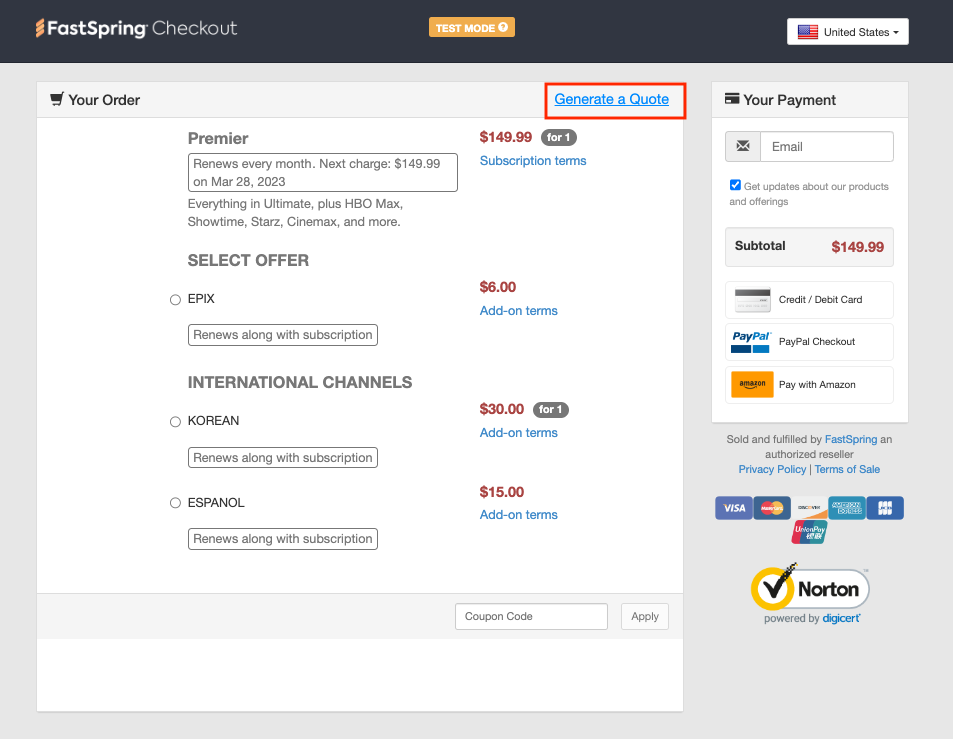

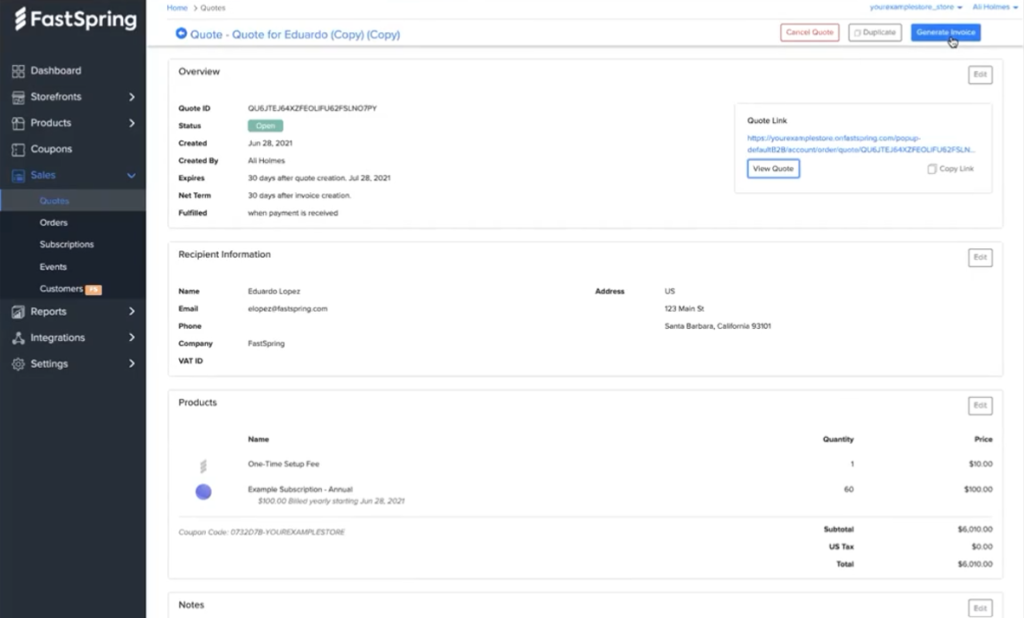

FastSpring helps you to handle B2B orders alongside B2C transactions with one platform by offering the subscription administration options coated above and our Digital Invoicing function.

Our Digital Invoicing function helps you to:

- Create quotes from inbound leads and customise costs. You’ll be able to even create customized reductions, set expiration dates, and extra.

- Present your clients with a self-serve quote portal. That is notably helpful when clients want administration approval earlier than buying.

- Give your clients the choice to generate an bill as an alternative of coming into fee particulars. That is helpful when corporations have an accounts payable process that requires an bill.

With all of those choices, you’ll be able to monitor the acquisition course of, automate order achievement, make updates, and way more in real-time.

Develop Globally In a single day with a Localized Checkout and A number of Fee Gateways

Every fee processor can have particular nations, fee strategies, and currencies that they assist. For instance, a fee processor might assist Amazon Pay in the USA however they received’t course of funds from Brazil. Or a fee processor might assist Union Pay in China however received’t supply any fee strategies which can be generally utilized in Canada.

Finally, SaaS corporations find yourself needing a number of fee processors in an effort to:

- Settle for extra fee strategies.

- Enhance authorization charges for worldwide transactions.

- Settle for funds from extra nations.

With most fee platforms, you need to handle and manually join to every fee gateway individually. Then, you additionally usually should code automated processes that ship funds by the fee gateway with the perfect authorization charges for that area. Not solely is that this a drain in your group’s time and sources, nevertheless it additionally makes it tough to broaden shortly.

There are a number of ways in which FastSpring makes it easy to broaden globally:

- You routinely have entry to a number of fee gateways. Our group handles the complete setup and administration of every fee gateway so that you don’t should. Every fee routinely will get routed by the fee gateway with the best authorization charges for that area. (Observe: If the fee fails for any variety of causes, it routinely will get re-routed by a unique fee gateway, decreasing the variety of failed funds.)

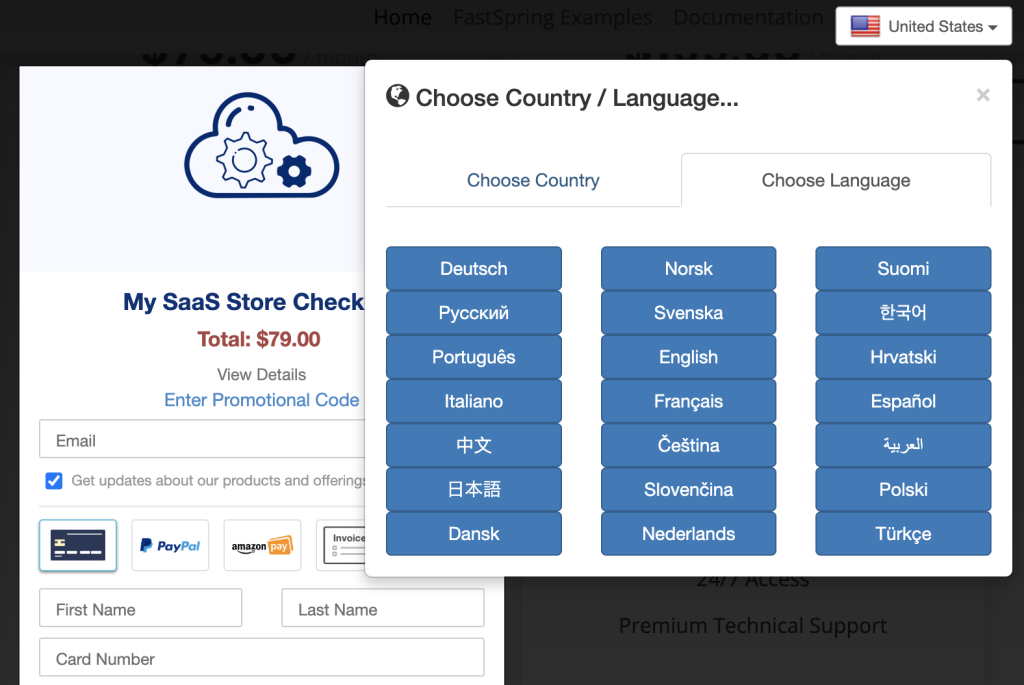

- Checkout is localized to cut back friction. You’ll be able to set the language and forex for particular areas, let the client select, or let FastSpring routinely select the suitable forex and language primarily based on the client’s location.(Observe: You even have a number of choices for customizing the appear and feel of your FastSpring checkout, together with the choice for a popup or embed checkout or an internet storefront managed by our group. You’ll be able to even customise the client journey main as much as checkout with FastSpring’s JavaScript Retailer Builder Library.)

- Transactions are filtered by Sift for superior fraud detection. Worldwide funds include elevated threat, which is why it’s vital to work with an organization that understands and has expertise combatting the extra threat. Sift is a world chief in threat evaluation and fraud prevention. They use machine studying and AI to investigate hundreds of thousands of worldwide transactions every month to establish dangerous transactions with increased accuracy.(Observe: FastSpring takes the lead on chargebacks and resolving any fraudulent conditions that do come up.)

Associated: High 10 Worldwide Fee Gateways: An In-Depth Information

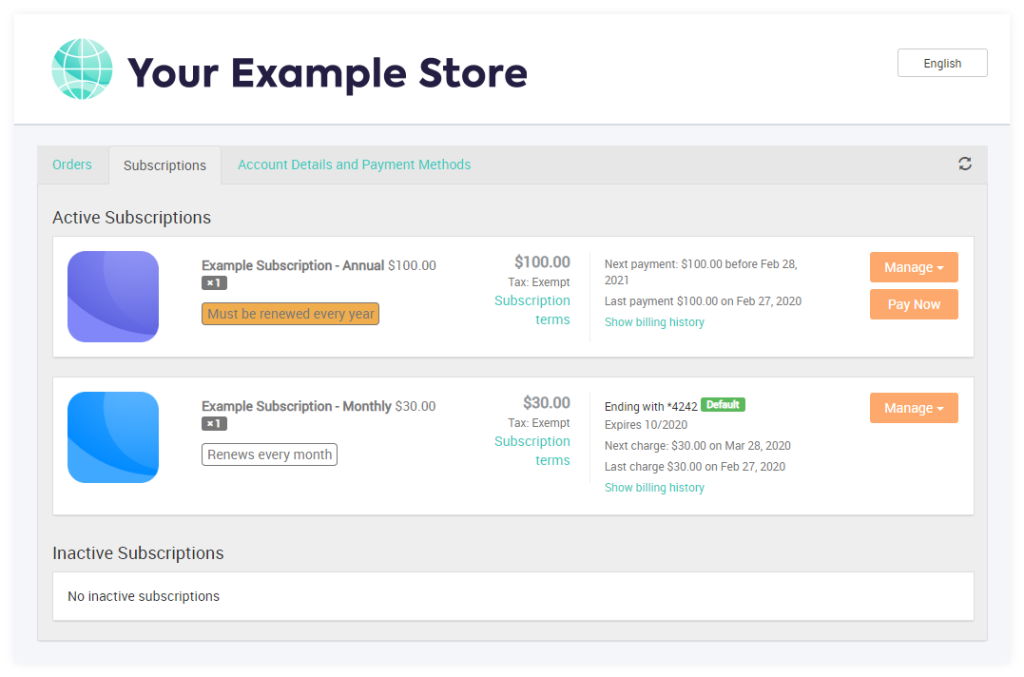

Cut back Involuntary Churn with an Intuitive Buyer Portal and Proactive Dunning

It’s straightforward for corporations to lose clients just because their subscription lapsed and it was too tough for them to restart the subscription. For instance, let’s say a buyer’s fee methodology expires with out them figuring out and the fee fails to undergo. They go to repair the problem and notice they’ll solely replace the fee information by contacting a gross sales rep. They maintain pushing off the telephone name and finally neglect about it totally.

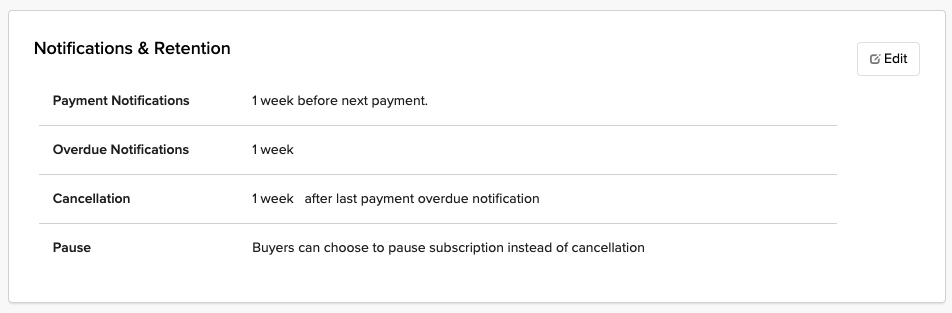

FastSpring helps you keep away from these conditions and stop clients from churning with:

- Proactive reminders. With FastSpring, you’ll be able to configure automated electronic mail reminders that notify clients of upcoming funds and soon-to-be-expired fee strategies. This offers clients the chance to prepare for upcoming funds in order that the subscription by no means lapses.

- A number of follow-up reminders. Some buyer administration options will allow you to ship out an automated notification after a failed fee, nevertheless, we’ve discovered sending out a number of reminders is simpler. With FastSpring, you’ll be able to arrange automated reminders to be despatched out two, 5, seven, fourteen, and twenty-one days after a fee methodology fails.

- Self-serve portal for patrons. A self-serve portal reduces friction and makes it very easy for patrons to replace their fee info and handle their account with out contacting your gross sales group. B2B purchasers may even handle quotes and invoices from this portal.

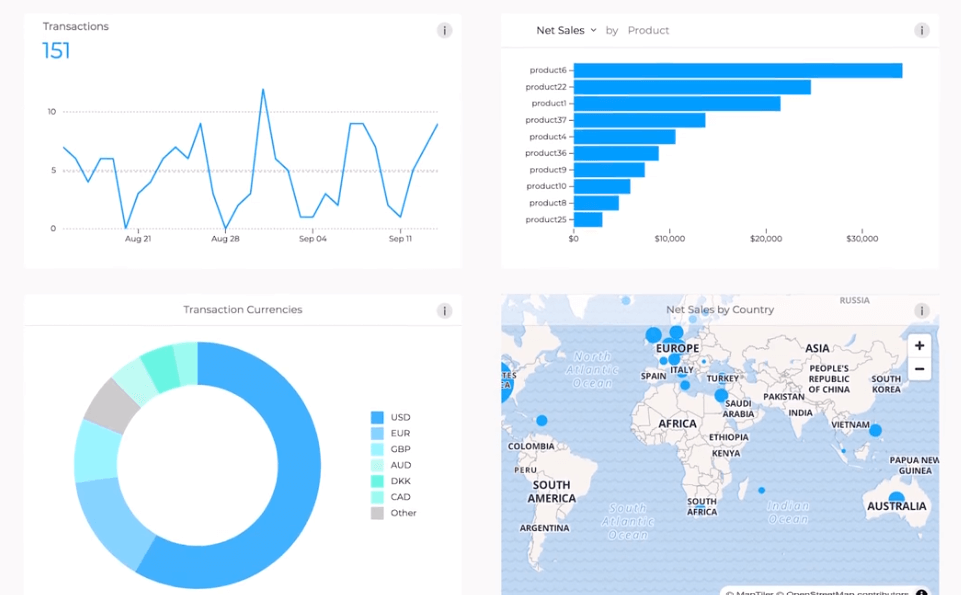

Make Knowledgeable Choices with Detailed Experiences and Analytics

FastSpring Reporting and Analytics is a strong function constructed into your FastSpring dashboard. It routinely tracks key efficiency indicators and places them into significant studies that will help you perceive:

- How varied merchandise contribute to your month-to-month and yearly income.

- When within the lifecycle clients are almost certainly to churn.

- What coupons or promotions are working (or not working).

- Which subscription fashions generate the best conversion charges.

- The place the vast majority of your clients and your highest paying clients are positioned.

- What currencies and fee strategies clients desire throughout the board.

- And way more…

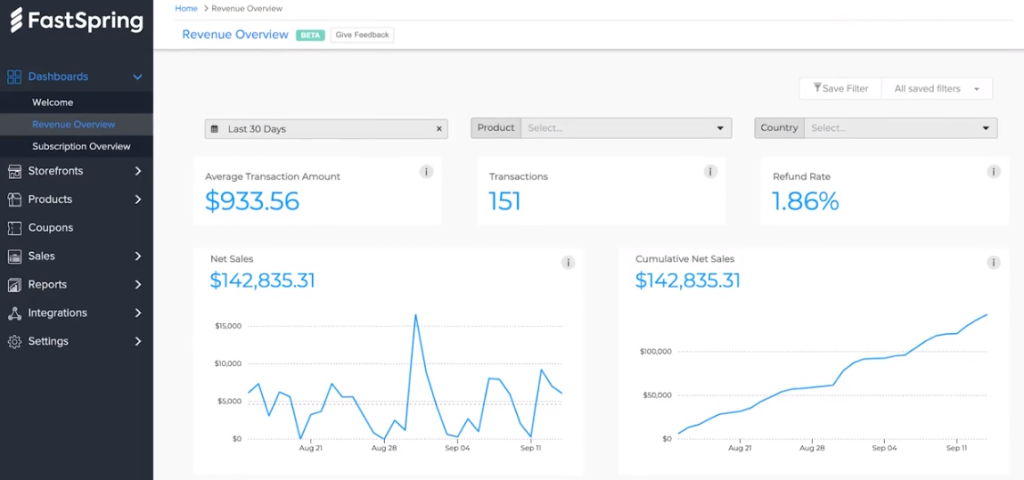

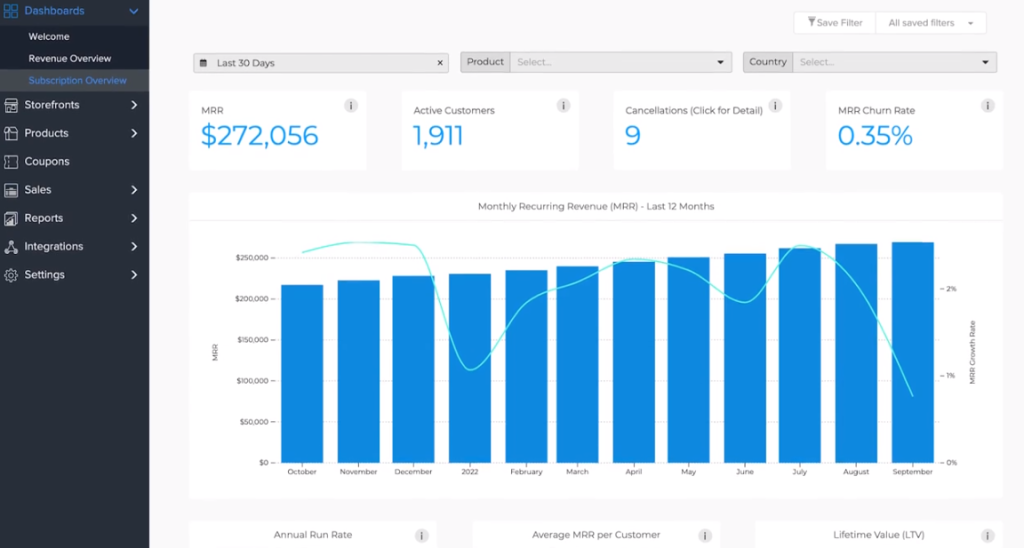

There are two essential analytics dashboards — the Income Overview dashboard and the Subscription Overview dashboard — nevertheless, there are a lot of totally different studies and views out there. When you don’t see the precise report you want in these dashboards, you’ll be able to create and save customized studies. Or, you’ll be able to attain out to our group and we’ll enable you to discover (or construct) the report you want.

Any report will be seen in your dashboard or downloaded as a CSV, PNG, or XLSX file.

Handle Your Whole Fee Lifecycle for One Flat-rate Payment

With most fee platforms (like Zuora), software program corporations should pile on software program after software program to construct out the entire items they want for an entire fee answer. Plus, many of those fee platforms have tiered pricing or cost additional for some options. All of this could add as much as a hefty invoice. Plus, it makes it tough to scale and know what you’ll be paying.

However, FastSpring’s pricing is easy: All options talked about above — a number of fee gateways, transaction legal responsibility assist, and so forth. — are provided for one flat-rate payment primarily based on the quantity of transactions you progress by FastSpring. And, you’ll solely be charged when transactions happen.

Plus, we provide customized assist (at no further value). Our group will help you configure FastSpring to be the fee answer you want and is at all times completely satisfied to reply any questions you might have.

Some corporations solely present customized assist to their largest purchasers and virtually ignore small companies. At FastSpring, we consider each firm deserves the identical consideration and care.

Observe: FastSpring supplies an API to simply combine with different software program.

Attain out to our group to seek out the speed that works for you. You may as well preview FastSpring options by establishing a free account.

5 Different Zuora Options

Zoho Subscriptions: Different for Zuora Billing

Zoho provides cloud-based options for many features of your corporation from social media administration to on-line funds. Zoho Subscriptions is their answer for subscription administration.

Zoho has so many alternative options that corporations might discover they don’t must combine with as many further software program options. That being mentioned, you’ll be able to combine Zoho with most software program.

It’s additionally value noting that every side of the Zoho platform is priced individually, together with Zoho Subscriptions. So, it may be tough and expensive to construct an end-to-end fee answer.

Corporations already utilizing the Zoho platform might profit from utilizing this answer, nevertheless, many new customers discover it has a steep studying curve.

A number of highlights of Zoho Subscription billing are:

- A number of pricing fashions

- Customizable, tax-compliant invoices

- Multi-currency conversions

- 30+ pre-built studies to trace every stage of the subscription lifecycle

- Help for in-person money and verify funds (along with bank card funds)

- Out-of-the-box integrations with different billing options (e.g., PayPal)

- Instruments to create customized workflow guidelines

Salesforce Income Cloud: Different for Zuora CPQ

Income Cloud by Salesforce is designed to allow you to handle the complete income lifecycle from the identical platform your gross sales group makes use of to handle leads and offers. Salesforce supplies out-of-the-box integrations with fee gateways so to course of bank card and ACH transactions. Additionally they supply options for subscription administration, configuring worth quotes, and billing.

Salesforce is one other platform that provides a number of software program options for companies. Additionally they supply an API for integrations.

Highlights of Income Cloud embrace:

- Step-by-step course of for serving to gross sales reps construct the correct deal.

- Automated renewal, upsells, and cross-sells.

- The power to drag a number of prices onto one bill.

- Metrics for monitoring the lifetime worth of a buyer.

- Help for one-time and subscription-based merchandise.

Associated: SaaS Billing Software program: 7 Instruments in 3 Classes & Select

Stripe: Different for Zuora Acquire

Stripe is a fee processing and billing platform utilized by many SaaS and non-SaaS corporations (from startups to legacy corporations). Whereas it really works fairly properly for a lot of corporations promoting bodily items and providers, it will not be your best option for corporations promoting digital items.

We cowl why Stripe will not be the perfect answer for SaaS corporations on this article on Stripe options and this text that compares Stripe vs. Paddle vs. FastSpring. Nevertheless, the principle cause is that the majority software program corporations find yourself including tons of software program on prime of Stripe in an effort to settle for international funds (and Stripe additionally leaves you by yourself to deal with tax and transaction legal responsibility).

Stripe provides a number of built-in integrations with different software program and will be manually built-in with most different software program.

In case you are considering Stripe, listed here are a number of of Stripe’s functionalities:

- Customizable UI and pre-built checkout flows

- Easy subscription administration

- Fraud prevention and threat administration

- Versatile billing logic automation

- On-line invoicing

- In-person funds

Chargify: Different for Zuora Income

Chargify is within the technique of merging with SaaSOptics in an effort to supply subscription administration software program and income administration as an all-in-one billing platform (nevertheless, they don’t supply fee processing on their platform, as an alternative they combine with Stripe billing to course of funds).

Chargify seems to focus extra closely on their billing software program for B2B SaaS corporations, nevertheless, they do assist B2C transactions. Additionally they promote the power to assist any ecommerce go-to-market technique.

Chargify provides a library of different software program they combine with and an API.

Listed here are a number of highlights of Chargify’s platform for subscription companies:

- Utilization-based and international billing

- Income recognition and billing administration instruments

- Billing system analytics and metrics

- Constructed-in integrations with varied different software program (e.g., accounting software program like QuickBooks and Xero)

- Worldwide fee gateways

Associated: An In-Depth Information to Subscription Billing Platforms (+ 5 Choices)

Oracle NetSuite: Different for Zuora Monetization Platform

Oracle NetSuite is greater than a subscription administration platform. They provide options for accounting, B2B and B2C ecommerce, ERP, CRM, and way more.

Oracle NetSuite could also be a great choice for corporations seeking to exchange the complete Zuora platform (nevertheless, SaaS corporations will nonetheless should deal with transaction and gross sales tax legal responsibility on their very own).

NetSuite makes it doable for builders to combine their software program with almost any third-party software program.

Listed here are a number of highlights of Oracle NetSuite’s fee providers:

- The power to mix flat, tiered, and consumption-based subscriptions with promotions and reductions

- Help for a number of pricing fashions

- Billing consolidation and automation

- Income recognition for compliance

- Help for B2B and B2C funds

As a substitute of managing a big software program stack, let FastSpring deal with the complete fee lifecycle for you. When you suppose FastSpring could possibly be the perfect Zuora different for your corporation, join a free account or request a demo at this time.