![]() In July thirteenth Coffe Community introduced one among Freeway’s “bridges” was compromised on July twelfth.

In July thirteenth Coffe Community introduced one among Freeway’s “bridges” was compromised on July twelfth.

Expensive group,

Sadly, one of many bridges of our mission was compromised yesterday.

Our companion, Freeway, was focused and a lot of FWT tokens have been faraway from our sizzling pockets and bought on trade.

Nonetheless, all funds have now been transferred to a brand new pockets, the place they’re protected.

We’ve got stopped all swap operations on bridges whereas we examine this incident and the bridges may be revised.

We’ll preserve you up to date as quickly as we all know extra. Thanks.

Aubit’s Sadie Hutton put out an replace on July sixteenth and effectively, issues don’t actually add up.

As per Hutton’s replace;

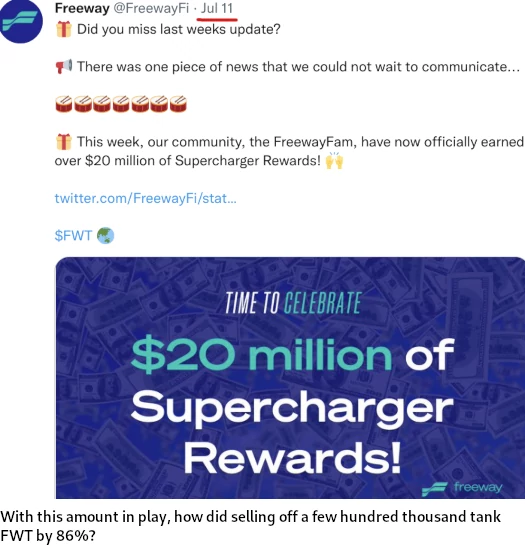

A lot of FWT tokens have been faraway from Coffe’s bridging pockets and have been subsequently bought, inflicting excessive worth volatility.

By “volatility”, Hutton means FWT collapsed:

On July thirteenth over a interval of 5 minutes, FWT went from $0.0074 to $0.001059 (0.007 to 0.001 in less complicated phrases).

In response to the collapse of its Ponzi scheme, Freeway

- “locked” the interior FWT worth;

- disabled FWT withdrawals, deposits and funding;

- pulled obtainable funds to withdraw; and

- requested exchanging itemizing FWT to “halt transactions”.

Freeway then set about plans to reboot its Ponzi scheme, by launching a brand new smart-contract.

And we took the choice to redeploy a brand new Freeway token smart-contract, based mostly on a snapshot previous to the exploit.

We anticipate to redeploy subsequent week.

The brand new smart-contract will create new Freeway tokens, distributed as they have been previous to the hack. The intention is to hold on just like the hack by no means occurred.

Nevertheless it did.

One factor neither Coffe Community or Hutton discloses is how a lot the alleged hacker made off with.

Somebody replying to Coffe Community’s announcement claimed “the exploiter bought away with 434 BNB and 348 ETH”.

If correct, that involves a paltry $651,525.

I’ve no method of verifying that determine – nevertheless it does make you assume.

If simply over half one million was all it took to tank FWT, what’ll occur as soon as buyers begin cashing out that a lot regularly?

When you’re unclear on Freeway’s enterprise mannequin, they pay annual returns of as much as 43%. That is accomplished by FWT, which Freeway creates out of skinny air.

Cashing out, just like the supposed hacker does, works so long as there’s invested funds to money out.

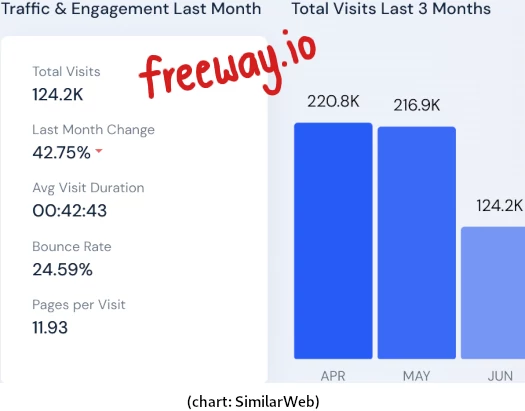

Visitors to Freeway’s web site plummeted by virtually half between Might and June:

Most of Freeway’s buyers are being recruited in Canada (45% of web site visitors). South Africa is simply 1 / 4 of that however is available in second.

The elephant within the room here’s what if this was all only a deliberate… effectively not fairly an exit-scam. A type of mini exit-scam, so to talk.

Freeway can’t money out something with out it being apparent to buyers. So why not simply promote tokens outdoors of the funding alternative…

These tokens have been by no means meant to be a part of the circulating provide and have been used completely for bridging between blockchains.

…money out a bit, give you “hackers!” malarkey after which reset every thing – minus the backend cash cashed out.

Freeway buyers will see it as a win. Freeway’s token will return as much as $0.008, as that’s what the reboot smart-contract will deploy FWT at (FWT was $0.0073 as of July thirteenth).

And like all Ponzi schemes, they don’t know how a lot precise cash is left to withdraw.

Freeway’s executives get to appear to be the great guys, whereas taking a bit bit further off the highest.

There could possibly be a real third-party hacker nevertheless it simply appears unusual. Coffe Community have up to now claimed solely Freeway was focused. That appears oddly particular.

If the issue was on Coffe Community’s finish, why wasn’t anybody else focused?

If the issue was with Freeway’s personal safety, has the exploit been mounted?

Do both Freeway of Coffe Community even know what the exploit is?

Appears rebooting Freeway’s Ponzi scheme is extra necessary than attending to the underside of something.

I suppose on the flipside it’s a number of effort to go to for comparatively little reward. You’re going to panic buyers when you take your admin minimize off the backend anyway – so the result is just about the identical.

Nicely, apart from the “don’t fear, we mounted it!” half. Nothing is extra necessary to a Ponzi scheme than investor confidence.