How we profited from the ability of the POWR rankings with a robust pairs commerce philosophy on VAL and HP.

Alfred Winslow Jones is broadly credited with creating the primary hedge fund, or extra precisely “hedged fund”, within the late Forties.He supposedly bought the concept whereas researching a markets article for Fortune journal.

The thought was fairly basic-create a hedge, or pairs commerce, by shorting shares he thought would drop in worth whereas shopping for shares he thought would head greater. It’s known as a pairs commerce since each the bullish and bearish commerce are performed simultaneously-or paired collectively.

For instance, shopping for Ford (F) and shorting Normal Motors (GM) could be a basic pairs commerce if you happen to anticipated Ford to outperform GM.

This basically dampens down total market danger. Even higher if the brief and the lengthy inventory have been in the identical business to significantly cut back sector danger.

This can be a core technique we have now employed from inception within the POWR Choices Portfolio, however with a couple of extra advantageous options.

- We use choices, not inventory, to take the offsetting brief and lengthy positions. Shopping for bearish places on the “dangerous” shares and bullish calls on the “good” shares. This can be a a lot inexpensive approach to create a hedged commerce. It additionally has outlined danger.

- The portfolio depends on the POWR rankings to assist establish the best rated shares to purchase with bullish name purchases and the bottom rated shares to brief with bearish put purchases. Since inception, the Sturdy Purchase (A Rated) and Purchase Rated (B Rated) POWR Shares have outperformed the S&P 500 by over 3x. The F Rated Sturdy Promote and D Rated Promote POWR Inventory have fallen by practically 4X the S&P 500.

- Look to uncover conditions the place the decrease rated shares have briefly outperformed the upper rated shares to supply extra edge from the anticipated imply reversion.

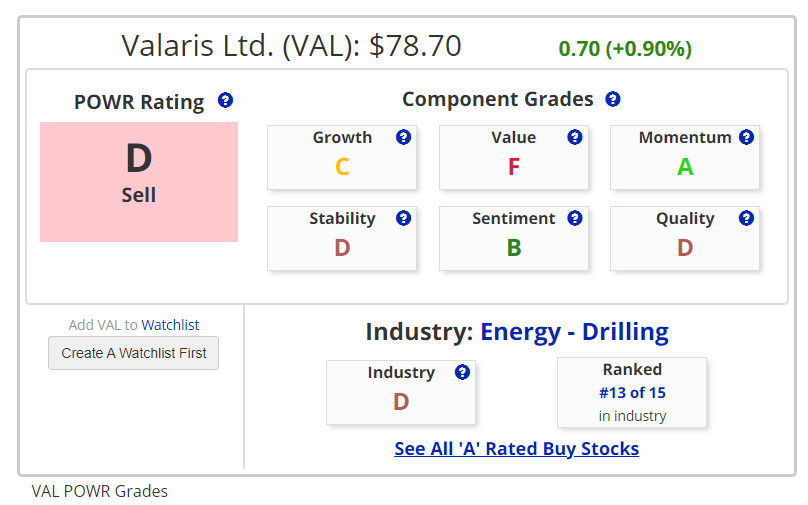

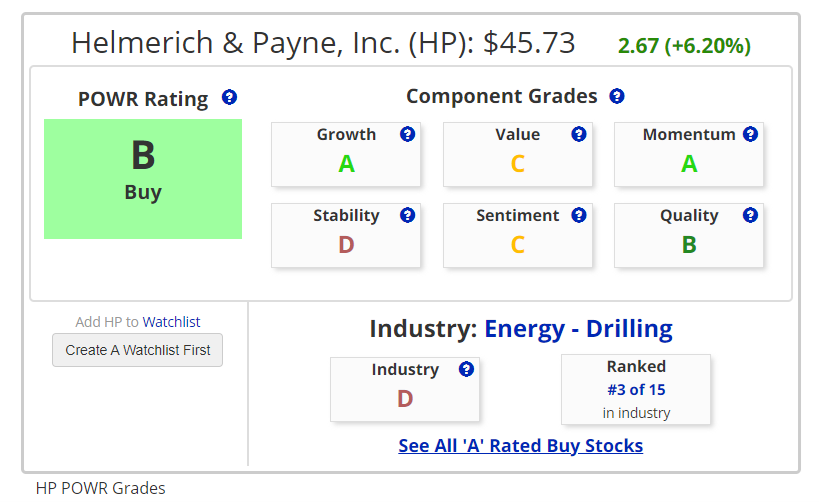

Let’s take a stroll by way of a pairs commerce lately performed within the POWR Choices Portfolio to assist shed some gentle on the method. It was a mixture of a put buy on the decrease D rated Valaris (VAL) and a name buy on the upper B rated Helmerich & Payne (HP). Each shares have been within the Vitality-Drilling Trade.

The comparative chart beneath from February 10 reveals how decrease rated Valaris (VAL) had dramatically outperformed greater rated Helmerich & Payne (HP) by over 50% up to now 12 months, with most of this outperformance starting in early December. Earlier than that point, you’ll be able to see that the 2 shares have been extra extremely correlated-or moved extra in tandem collectively.

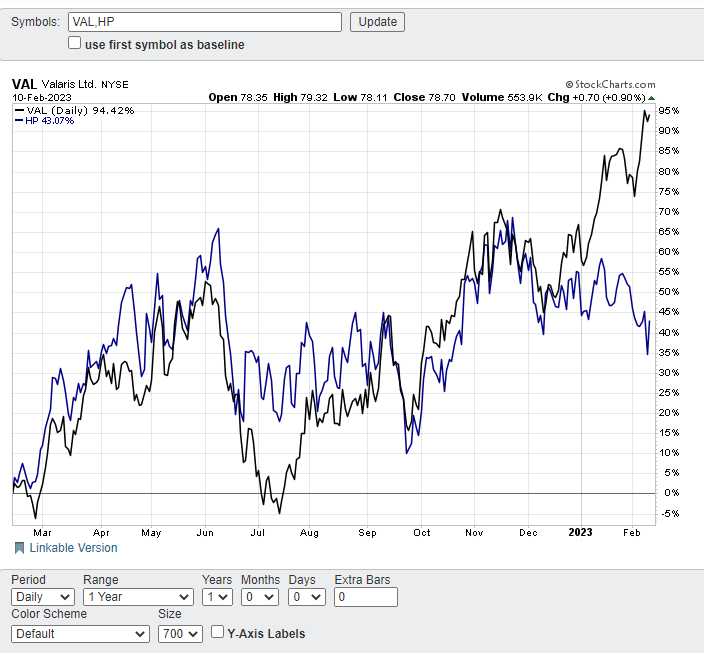

On February 21 the comparative efficiency differential converged by roughly 10%. Each shares fell, however VAL dropped at a far quicker tempo than HP.

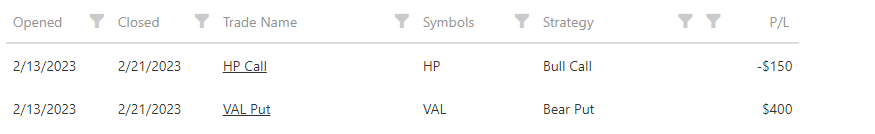

Initially, on 2/13, the POWR Choices Portfolio purchased the HP Calls at $5.50 and the VAL places at $5.00 for a mixed outlay of $1050.

One week later, the convergence generated a revenue. POWR Choices bought the HP calls at $3.50 and the VAL places at $9.50 for a complete mixed credit score of $1300, or a web achieve of $250 .

Total achieve, as proven, was $250 complete web revenue on $1050 invested. This equates to a web return of 23.8% in every week. Not a nasty short-term return for a low danger commerce.

All achieved by taking an outlined danger bullish name place on the upper rated,however underperforming, Helmerich and a bearish put place on the decrease rated, however outperforming, Valaris.

The particulars are proven beneath:

2023 could also be shaping up as a 12 months the place shares go nowhere. That is very true given the red-hot begin to the 12 months following such a dismal 2022.

Buyers and merchants alike could also be properly served placing the POWR Choices pairs commerce philosophy to work as a part of their buying and selling toolbox. Decrease danger with nonetheless sizeable potential returns is a viable technique in any market, particularly the one we discover ourselves in at present.

POWR Choices

What To Do Subsequent?

For those who’re searching for one of the best choices trades for right this moment’s market, it is best to take a look at our newest presentation Methods to Commerce Choices with the POWR Scores. Right here we present you constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you need to study extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

Methods to Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices E-newsletter

VAL shares closed at $65.30 on Friday, up $0.36 (+0.55%). Yr-to-date, VAL has declined -3.43%, versus a 3.65% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Reside”. His overriding ardour is to make the complicated world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Study extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit How To Pare Down The Danger And Pump Up The Income With A Pairs Commerce Method appeared first on StockNews.com