![]() There have been rumblings that OmegaPro’s collapse is tied to The Merchants Area, a non-MLM Ponzi scheme that additionally collapsed in late 2022.

There have been rumblings that OmegaPro’s collapse is tied to The Merchants Area, a non-MLM Ponzi scheme that additionally collapsed in late 2022.

The implication being that OmegaPro investor funds have been commingled into The Merchants Area, which was working its personal Ponzi.

I haven’t been capable of confirm something, and I nonetheless can’t – a minimum of not definitively.

However a not too long ago filed regulatory lawsuit has now revealed one concrete hyperlink between OmegaPro and The Merchants Area.

The CFTC has filed swimsuit in opposition to Yas Castellum LLC, Yas Castellum Monetary LLC, Saeg Capital Common Administration, and several other particular person defendants.

- Yas Castellum LLC – defunct shell firm integrated in Colorado, registered with the NFA as a commodity pool operator in October 2020, completely barred from NFA membership in September 2022 for fraud

- Yas Castellum Monetary LLC – shell firm arrange in Hawaii

- Saeg Capital Common Administration LP (SAEG GM) – shell firm integrated in Delaware, registered with the NFA as a foreign exchange and swap agency and commodity pool operator

- Marcus Todd Brisco – Hawaii resident and proprietor of Yas Castellum and Yas Castellum Monetary

- Tin Quoc Tran (aka Tin Quac Tran) – Texas resident and convicted felon, co-owner of Saeg Capital Common Administration and a number of fraudulent commodity buying and selling swimming pools

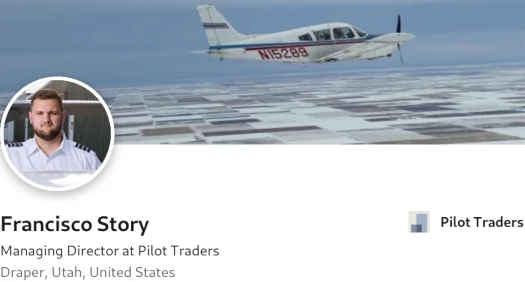

- Francisco Story – Utah resident and co-owner of Saeg Capital Common Administration

- Frederick Safranko (aka Ted Safranko) – Ontario, Canada resident and co-owner of Saeg Capital Common Administration and The Merchants Area Ponzi scheme

- Michael Shannon Sims – Florida and/or Georgia resident, Marcus Brisco’s brother-in-law, CEO of Yas Castellum and co-owner of OmegaPro

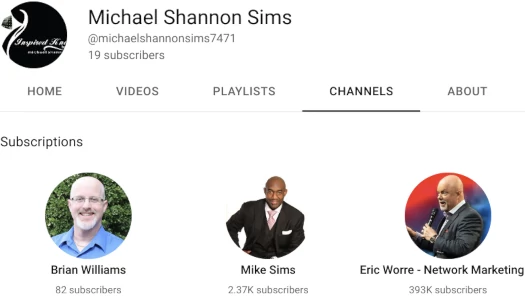

At first I wasn’t 100% certain Michael Shannon Sims was OmegaPro’s Mike Sims.

With a little bit of poking round I used to be capable of confirm it’s the identical man:

Apparently earlier than entering into monetary fraud, Sims ran a menswear enterprise.

In any occasion, Mike Sims is the hyperlink between OmegaPro and The Merchants Area.

Sims can be a possible direct hyperlink between Holton Buggs’ and Travis Bott’s collapsed Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes.

Within the picture above, taken on February twenty sixth, 2022, Mike Sims might be seen heart again row.

If I’m not mistaken, that’s additionally Marcus Brisco second from the suitable entrance row. I’m not 100% on this, however you’ll be able to examine to Brisco’s Twitter profile screenshot beneath (I imagine it’s an older {photograph}).

The CFTC’s January thirty first lawsuit particulars quite a lot of fraudulent schemes, by way of which Sims labored with The Merchants Area proprietor Ted Safranko.

As alleged by the CFTC;

From a minimum of April 2020 by way of the current, Marcus Brisco, Yas Castellum LLC, Yas Cestellum Monetary LLC, Tin Tran, and Michael Sims, operated three interconnected fraudulent schemes by which they solicited and/or accepted funds, from people and entities.

The three fraudulent schemes cited by the CFTC promised returns, purportedly through foreign currency trading and “margined gold-U.S. greenback pair transactions” (XAUUSD).

Marketed returns have been based mostly on fabricated historic buying and selling outcomes, averaging 10.95% a month.

OmegaPro launched in early 2019 and pitched a 200% ROI over 16 months, additionally purportedly derived through foreign currency trading.

Like with OmegaPro, there was in fact no buying and selling going down within the cited fraudulent schemes.

In truth, Yas Castellum LLC, Yas Castellum Monetary LLC, Brisco, and Tran didn’t ship any funds to a agency that trades foreign exchange or XAUUSD.

As a substitute, almost all the funds have been directed to commodity swimming pools managed and operated by Tran, and Tran Yas Castellum Monetary LLC, and Brisco misappropriated a portion of the funds for different functions.

Issues get a bit sophisticated in terms of the three cited fraudulent schemes. The CFTC sadly doesn’t title the corporations.

Nonetheless, right here’s how the primary one was arrange;

Within the first of three schemes, which operated from a minimum of October 2020 to Might 2022, Yas Castellum LLC and Brisco, the agency’s CEO, fraudulently solicited potential pool contributors to switch funds to Yas Castellum LLC for the ostensible function of collaborating in a purported Yas Castellum Monetary LLC commodity pool.

Amongst different issues, Yas Castellum LLC and Brisco made materials representations and omissions relating to the place they might keep Pool Participant funds, how they might commerce with these funds, and who would do the buying and selling.

Additionally they supplied potential Pool Individuals with false details about Yas Castellum LLC’s historic buying and selling income.

Brisco didn’t direct and Pool Participant funds to a agency that trades foreign exchange or XAUUSD or keep funds in a Yas Castellum LLC commodity pool account as promised.

As a substitute, Brisco transferred a lot of the Pool Participant funds to the Tran Swimming pools and a small portion to a different agency.

Brisco did so on the course and with the help of Mike Sims, his brother-in-law and the purported CEO of the agency that was alleged to commerce on behalf of Yas Castellum LLC.

Sims instructed Brisco to disguise the transfers as funds for “companies” so the scheme wouldn’t be found.

To additional conceal the scheme, Yas Castellum LLC supplied Pool Individuals with false weekly account statements created by Brisco that confirmed their purported buying and selling income.

The second scheme:

The second fraudulent scheme started within the wake of a March 2022 examination by the Nationwide Futures Affiliation (NFA), which recognized “critical considerations” about Yas Castellum LLC’s “lack of oversight and management of investor funds”.

In response, Brisco informed the NFA that Yas Castellum LLC was ceasing operations.

Nonetheless, with out notifying the NFA, Brisco relaunched Yas Castellum LLC as a brand new entity, Yas Castellum Monetary LLC, and created a brand new purported commodity pool.

Brisco informed potential Pool Individuals that Yas Monetary LLC would use the identical brokers, platform, and buying and selling methods as Yas Castellum LLC.

Yas Castellum Monetary LLC misappropriated Pool Participant funds by transferring a lot of the funds to (one of many commodity swimming pools managed by Tran).

Brisco additionally misappropriated Pool Participant funds by paying himself for purported buying and selling income that didn’t exist.

The third scheme was operated by Tin Tran;

Tran operated a 3rd fraudulent scheme from a minimum of April 2020 to current by way of which he immediately accepted funds meant for buying and selling foreign exchange or XAUUSD into certainly one of (his) swimming pools that he managed.

Tran didn’t ship any Pool Participant funds to a agency that trades foreign exchange or XAUUSD.

As a substitute, he misappropriated a few of the Pool Participant funds by utilizing them to pay invoices, unrelated people, repay a “mortgage”, and to subsidize his unrelated companies.

Tran additionally commingled pool funds with non-pool property in financial institution accounts that he managed.

Funds invested into Tran’s swimming pools by way of the fraudulent schemes are over $470,780, $1,585,261 and $144,043,883 respectively.

Francisco Story, Ted Safranko and SAEG Capital Common Administration LP, have been a part of the conspiracy to cover the fraudulent schemes from regulators.

To hide Tran’s scheme from regulators, Francisco Story and Ted Safranko, of their roles as administrators and officers of SAEG Capital Common Administration LP, knowingly submitted falsified financial institution statements to the NFA for (Tran’s first pool) accounts throughout an examination of SAEG GM.

Safranko and Story described the (Tran’s first pool) accounts as operational accounts that contained seed capital for SAEG GM which the agency used to pay invoices.

Additional, they recognized Tran as a enterprise affiliate who helped them with the operational and organizational setup for SAEG GM, and supplied seed funding to the agency.

Story and Safranko altered (Tran’s first pool) financial institution statements to, amongst different issues, omit multiple million {dollars} of deposits in (Tran’s first pool) accounts that have been made for the aim of buying and selling foreign exchange or XAUUSD.

The CFTC alleges that the conduct of the defendants represent violations of Commodities and Trade Act.

The CFTC’s case in opposition to Brisco and the opposite defendants was filed on January thirty first beneath seal. After securing a Short-term Restraining Order in opposition to the defendants on February third, the case was unsealed on February 14th.

A “present trigger” listening to relating to the TRO is scheduled for February twenty second.

Suffice to say Brisco is screwed and I wouldn’t be shocked if prison costs are pending, I don’t intend to report on the case as I usually would.

Primarily based on what’s presently recognized, events of curiosity within the case are Mike Sims and Ted Safranko. Which brings us again to OmegaPro.

Mike Sims is certainly one of OmegaPro’s co-founders. Beneath all of the unnamed entities, and certain past the scope of the CFTC’s lawsuit, it’s extraordinarily doubtless Sims commingled Omega Professional funds along with his different fraudulent schemes.

These would primarily be cryptocurrency transactions tied to OmegaPro. Pending additional regulatory investigations, I can’t present any specifics.

Safranko (proper) supplies the hyperlink between Sims and The Merchants Area. If Sims was working with Safranko on these Tin Quoc Tran Ponzi schemes, I can all however assure you Sims can be concerned in some capability with The Merchants Area.

Safranko (proper) supplies the hyperlink between Sims and The Merchants Area. If Sims was working with Safranko on these Tin Quoc Tran Ponzi schemes, I can all however assure you Sims can be concerned in some capability with The Merchants Area.

Supporting it is a variety of different MLM Ponzi schemes that fed invested funds into The Merchants Area.

Extra particular to OmegaPro is it’s collapse timeline. The primary signal of cash issues inside OmegaPro was it’s failed PulseWorld XPL token exit-scam, initiated in early November 2022.

By the top of November BehindMLM known as OmegaPro’s collapse, following full non-payment of withdrawals for 3 weeks.

After that we had nonsense about hackers and Dealer Group, which I’m assuming Mike Sims and/or associates have been behind.

Given all of this, I don’t assume The Merchants Area and OmegaPro each collapsing across the similar time was a coincidence. It matches the collapse sample of the opposite MLM firms feeding into The Merchants Area too properly (naturally they’ve additionally all collapsed).

Sim’s present standing is unknown. His Instagram profile was public up till a couple of weeks in the past.

Following BehindMLM confirming Sims was nonetheless in Florida as of September 2022 final month, Sims made his Instagram profile personal.

Sims’ OmegaPro companions in crime, Dilawar Singh (Germany) and Andreas Szakacs (Sweden)…

…are believed to be laying low within the UAE. The pair fled to Dubai as OmegaPro took off early on.

Observe OmegaPro’s fraud continues at this time by way of Go International, headed up by US nationwide A.Ok. Khalil and Dutch nationwide Nader Poordeljoo.

Past Sims, we seem to have two main culprits liable for focusing on MLM distributors; Holton Buggs and Eric Worre.

Along with his Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes, Buggs is believed to have immediately recruited iBuumerang associates into The Merchants Area by way of ellev8.

iBuumerang is a journey low cost themed MLM firm Buggs launched in 2019. As COVID-19 hit, Buggs added foreign currency trading and shady funding schemes by way of ellev8.

I linked to 1 very early reference of the ties between The Merchants Area and Sims at first of this text. It’s important as a result of speak of OmegaPro’s ties to The Dealer’s area primarily surfaced after OmegaPro collapsed.

Right here’s the related quote;

Eric Worre is rumored to be a ten% proprietor of Omega Professional. Sure he probably had a place like he does in a number of different Community Advertising and marketing firms!

The previous 12 months everyone seems to be speaking concerning the deal of the century!

The Travis Bot, Lisa Grossman Eric Worre Mile Simms [sic] “Uncle Ted Foreign exchange Gold Deal”! This can be one of many greatest Ponzi scheme since Madoff.

Eric Worre tapped into his ($20k per 12 months interior circle group ) advising them to take a position $500k or extra! After all now there isn’t any minimal To open a Merchants Area Pamm account with Crypto!

The tales are in all places. Like Jessie Lee put $1.3M in and now has over $23m ! Eric put in $8m and is making $500k per week! He purchased a $20-25M customized G550 jet!

The promise of creating 50-70% of the income month-to-month! Eric and Mike making 10-20 % on everybody’s cash!

-BehindMLM reader Dennis James, July 2022

I can’t confirm any of these figures however James tied Worre, Sims and Safranko (aka Uncle Ted) collectively way back to July 2022.

The place there’s smoke there’s most likely hearth.

If all of this matches collectively as I feel it does, given the quantity of individuals concerned and the thousands and thousands laundered (I’d guess over a billion by way of OmegaPro alone, if not excessive tons of of thousands and thousands), this convoluted internet of Ponzi schemes locations Sims, Safranko, Worre and Buggs on the heart of the most important US-based “in home” MLM Ponzi empire I’ve seen in years.

Past the CFTC’s already-filed lawsuit I can’t converse to every other ongoing investigations. If something additional surfaces I’ll depart an replace word beneath.