![]() The Merchants Area isn’t an MLM firm. It’s nonetheless linked to a number of MLM corporations, all of which have since collapsed.

The Merchants Area isn’t an MLM firm. It’s nonetheless linked to a number of MLM corporations, all of which have since collapsed.

On this article we go down the The Merchants Area rabbit gap and hyperlink all the things collectively.

The Merchants Area is run by Ted Fredirick Joseph Safranko (aka UncleTed, proper).

The Merchants Area is run by Ted Fredirick Joseph Safranko (aka UncleTed, proper).

Safranko is a Canadian nationwide and was a registered FINRA dealer till 2013.

So the story goes, The Merchants Area origins date again to 2017. The Merchants Area is purportedly a white label providing run by B2Broker.

B2Broker is run by CEO Artur Azizov out of Dubai.

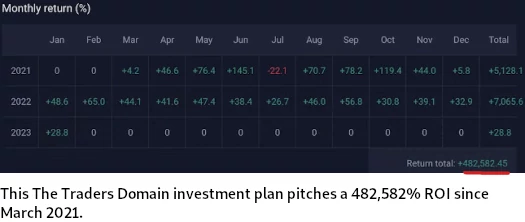

Varied buying and selling alternatives have been made by The Merchants Area through the years. Beginning in 2021, Safranko started providing month-to-month “excessive danger” funding alternatives.

Within the instance above The Merchants Area represents that in the event you invested again in March 2021, you’d have a 482,582% ROI right now.

Whereas The Merchants Area does solicit funding in USD, as I perceive it the overwhelming majority of buyers have invested by cryptocurrency.

For causes we’ll shortly get into, The Merchants Area’s web site site visitors has fallen of a cliff since late 2022.

SimilarWeb at present tracks prime sources of site visitors to The Merchants Area’s web site because the US (35%, down 44% month on month), Canada (28%, up 41% month on month), and Australia (10%, up 1063% month on month).

Whole The Merchants Area web site site visitors was pegged at 29,200 visits for January 2022.

With a clearly majority US investor base and the providing of month-to-month passive returns, purportedly derived by way of foreign currency trading, The Merchants Area is required to register with each the SEC and CFTC.

Neither The Merchants Area or Ted Safranko are registered with both regulator.

To that finish, the CFTC added The Merchants Area to its RED Checklist in July 2022.

A agency is added to the RED Checklist when the CFTC determines, from investigative leads and public inquiries, that it’s not registered with the Fee and seems to be appearing in a capability that requires registration, equivalent to buying and selling binary choices, international forex (foreign exchange), or different merchandise.

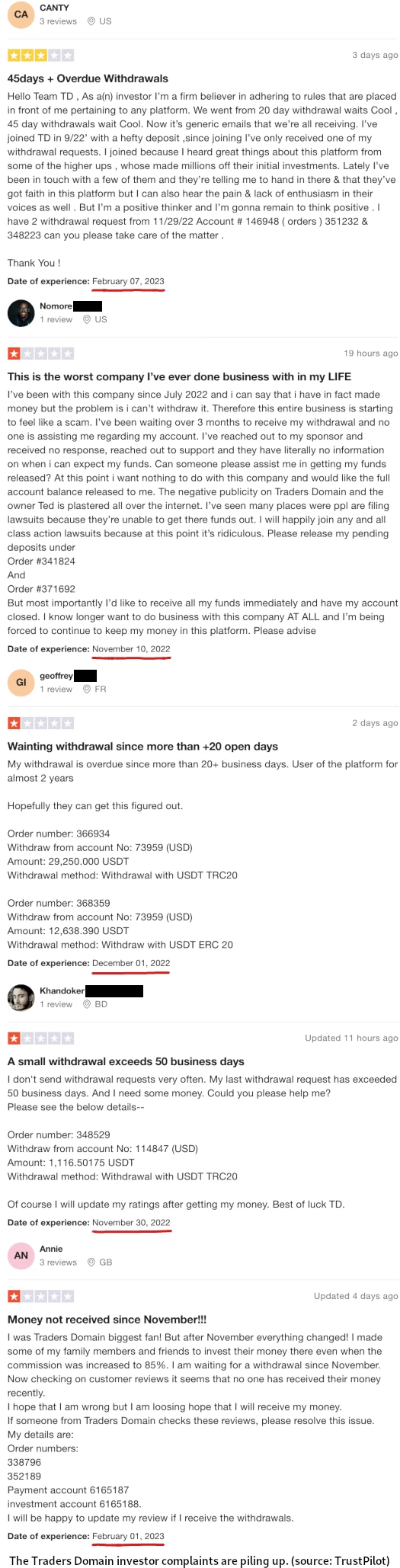

A number of months after the CFTC added The Merchants Area to its RED Checklist, buyers started reporting withdrawal issues.

From what I’ve been capable of peace collectively, The Merchants Area withdrawals started slowing down in late Q3 2022. Withdrawals stopped altogether on or round November 2022.

Since then just a few selective withdrawals seem to have gone by, albeit principally small quantities.

In the present day The Merchants Area web site remains to be on-line and soliciting new funding, regardless of nothing a lot being paid out on the again finish.

Whereas it’s not an MLM firm, The Merchants Area does have an associates program. This financially incentivizes recruitment of recent buyers.

That brings us to the MLM corporations which can be tied to The Merchants Area.

Batched is a collapsed Ponzi scheme that launched as Uulala in late 2021.

Oscar Garcia (proper) relaunched Uulala following an SEC securities fraud settlement just a few months prior.

Oscar Garcia (proper) relaunched Uulala following an SEC securities fraud settlement just a few months prior.

By the top of 2021 the Uulala model had been dropped, with Garcia opting to proceed the scheme as Batched. Up till that time Batched had been offered as a cost processor service inside Uulala.

Following months of dramatically declined returns and withdrawal delays, Batched collapsed final month.

Within the lead as much as Batched’s collapse, Garcia claims he was hospitalized with appendicitis in October 2022.

Whereas he was in hospital, Garcia claims Batched COO Frank DiCrisi (proper) “bought the corporate”.

Whereas he was in hospital, Garcia claims Batched COO Frank DiCrisi (proper) “bought the corporate”.

I don’t totally perceive the particulars of this declare as I don’t have entry to the state-level lawsuit filed in Orange County Superior Court docket.

With respect to The Merchants Area nonetheless, an excerpt posted to the TradersDomain subreddit suggests funds have been laundered by Batched.

Keep in mind the context for this excerpt, as informed by Oscar Garcia, is Batched collapsing in late 2022.

Frank and our compliance workforce (Tracey Wallace and Maria Garcia) saved having commissions and communication points.

These points boiled over after September 2022 when myself and certainly one of our prime brokers saved asking for a full audit and report of the accounting.

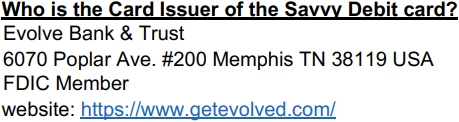

I saved asking for the audit and financial institution information however Frank claimed he couldn’t get the checking account statements from Evolve (Financial institution). He claimed they didn’t present that to him, solely studies.

This was clearly not the case as soon as I reviewed his emails exhibiting that he had been capable of pull digital financial institution statements earlier within the yr.

I saved telling Frank on textual content messages and on the telephone that we have to resolve the accounting points (i.e. what we owe and to whom) quick.

I defined to him that I used to be afraid that a number of individuals have been going to sue us for all these delays.

Throughout these textual content exchanges in or round October 28, 2022 I discovered about “The Merchants Area” program.

In that textual content trade, Frank informed me had a strategy to generate income and repay our obligations to sale brokers. After I requested how, he defined this system to me.

He claimed that if I place $20,000 into this system I may take out 1% to 2% a day virtually instantly.

In my textual content message I informed him that it sounded unsustainable and like quite a lot of the unlawful applications that have been shut down earlier than.

He claimed that he was already seeing nice outcomes together with his household participation. He claims on textual content that he managed $4 million of their cash and will make us entire if one thing went improper.

I informed him I’d name him later to speak about it.

In the course of the name he defined that his son and he, together with Plaintiff Gregory “Tuffy” Baum and his son, have been having nice outcomes.

Bear in mind the title Gregory Baum. We’ll revisit the Baums as a part of one other MLM firm tied to The Merchants Area.

After I requested about who introduced “The Merchants Area” in (to Batched), Frank knowledgeable me that Mr. Baum and Plaintiff Savvy Pockets introduced within the shopper.

I informed him I used to be not prepared to danger involvement in an unlawful program. I used to be frightened about my SEC settlement and the SEC present investigation request.

By November, throughout a evaluate of my emails I discovered an odd electronic mail from Frank to Fireblocks, our crypto pockets supplier.

In sum, throughout my investigation I discovered that Batched system was modified by Plaintiffs to permit the Merchants Area to conduct enterprise in america.

This exercise is confirmed with among the transactions we’ve uncovered that over $20,841,697.519 in USDT alone was transferred out and in of our Fireblocks service inside November and December of 2022.

Fireblocks is cited in Garcia’s submitting as a “crypto pockets supplier”.

As soon as I discovered of the Ponzi scheme, I had no alternative however to close down exercise on the Fireblocks account.

I did it to cease the illegality that had been occuring tand to guard Plaintiffs’ shoppers’ funds that have been wrapped up within the Ponzi scheme.

By deactivating the platform, we have been capable of quickly cease the illegal use of Plaintiffs’ shoppers’ funds within the Ponzi scheme and permit for an audit.

Based mostly on Garcia’s purported investigation, Batched and The Merchants Area investor funds have been co-mingled by Batched’s Fireblocks account – to the tune of at the least $20 million.

Frank DiCrisi seems to be knee-deep in crypto Ponzi fraud, each by Batched and The Merchants Area.

We’ll swap gears now and transfer on to Gregory Baum, his son and Savvy Pockets.

Savvy Pockets pitches itself as a crypto offramp;

With the press of a button you’ll be able to convert your Crypto to Fiat to spend at over 53 million retailers worldwide the place ever Visa is accepted.

As per a FAQ offered on Savvy Pockets’s web site, its VISA playing cards are issued by Evolve Financial institution & Belief.

This is similar Evolve Financial institution Garcia referenced in his submitting. Whether or not Batched and/or The Merchants Area investor funds have been laundered by Savvy Pockets and Evolve Financial institution & Belief is unclear.

Gregory Baum is predicated out of Utah and, whereas his son isn’t named by Garcia, I imagine it’s Jake Baum. If not then Gregory and Jake Baum are in all probability nonetheless associated.

In October 2012 Gregory Baum signed on as COO of the defunct MLM firm Ocean Avenue. Jake Baum, who can be primarily based out of Utah, labored as a Model Specialist for Ocean Avenue.

Each Baums then labored at Hyten International. Gregory Baum’s LinkedIn profile has him signing on as President of Digital Revenue in March 2020.

Digital Revenue was a quad-layer mega Ponzi run by Travis Bott, Jeremy Reynolds and Dan Putnam.

Digital Revenue predictably ended after the buying and selling bot it was constructed round collapsed in August 2021.

That very same yr BehindMLM reader Theo Morton claimed Gregory Baum was behind the Onyx Life-style Ponzi scheme.

BehindMLM linked Onyx Life-style to Dan Putnam’s and Jean Paul Ramirez’s Eyeline Buying and selling and WealthBoss Ponzi schemes in 2019.

The SEC sued Putnam and Ramirez for Ponzi associated securities fraud in 2020.

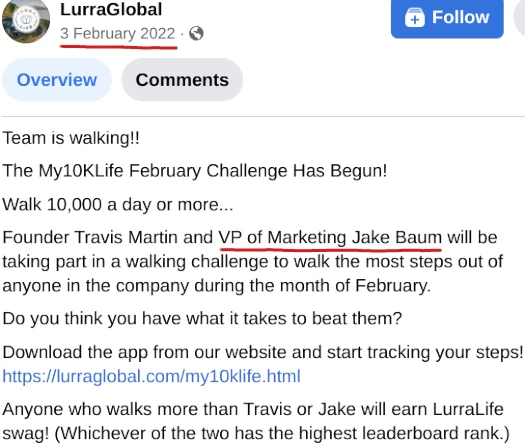

Jake Baum and Dan Putnam are tied collectively by LurraLife. Putnam launched LurraLife in late 2019.

There’s no point out of LurraLife on Jake Baum’s LinkedIn profile, however in some unspecified time in the future he signed on as Vice President of Advertising and marketing.

LurraGlobal was a rebranding try as LurraLife headed in the direction of collapse in mid 2022. On July nineteenth 2022 Putnam introduced he was merging what was left of LurraLife into B-Epic, one other MLM firm he owns.

That finally fell by, leaving Putnam to strive once more with In opposition to All Odds in January 2023.

Enjoyable Truth: Putnam settled his SEC securities fraud lawsuit final month – however we’ll in any other case depart him there.

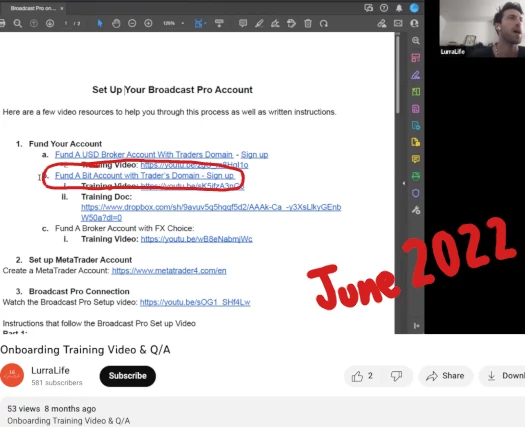

In LurraGlobal’s dying months, Jake Baum was busy funneling associates into The Merchants Area.

Baum appeared on two The Merchants Area “onboarding” movies, uploaded to LurraLife’s official YouTube channel in June 2022.

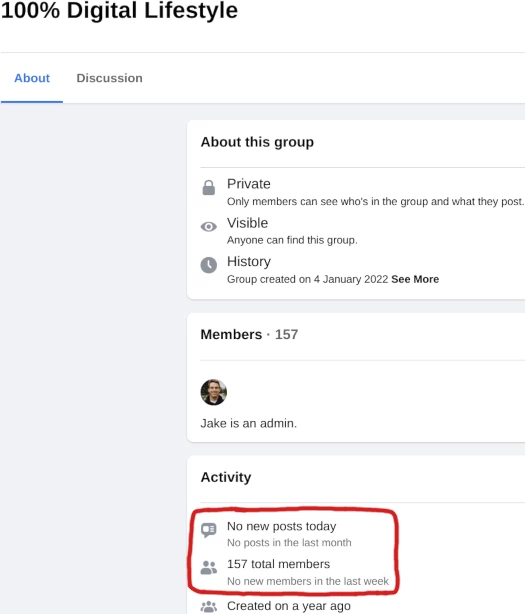

LurraLife associates have been instructed on learn how to deposit into The Merchants Area. On FaceBook Baum coordinated LurraLife associates within the FaceBook group “100% Digital Life-style”.

Cross referencing Garcia’s OC Superior Court docket submitting, Baum (and his father Gregory?) have been nonetheless invested and selling The Merchants Area circa October 2022.

I’d assume the rationale the “100% Digital Life-style” is useless right now pertains to The Merchants Area’s collapse.

The third MLM firm we are able to tie to The Merchants Area is Holton Buggs’ Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes.

Buggs is believed to have launched his Meta Bounty Hunters and Huntresses Ponzi schemes with the assistance of Travis Bott.

That’s the identical Travis Bott behind the beforehand referenced Digital Revenue quad-layer mega Ponzi (humorous how the identical names maintain popping up hey).

Meta Bounty Hunters/Huntresses are constructed round cartoon NFTs that rip off Star Wars. Associates invested $2000 and $2500, and in return obtained a weekly ROI – known as a “reflection”.

In October 2022 BehindMLM reader Shiraz claimed that Holton Buggs was pumping Meta Bounty Hunters and Huntresses investor funds into The Merchants Area.

What their not telling you is the funds within the liquidity pool are being traded by 2 companies. The merchants area & FX Successful.

There are protecting nearly all of the income and paying out a small fraction as reflections.

I didn’t suppose an excessive amount of of this on the time. Meta Bounty Hunters and Huntresses have been clearly a Ponzi schemes – and I couldn’t confirm The Merchants Area attachment both method.

What rang a bell in my memory was a put up on the TradersDomain subreddit I got here throughout right now. Hooked up to that put up, representing how Ted Safranko runs The Merchants Area, was this slide:

Buggs isn’t talked about by title however I clearly acknowledged the face. That prompted me to revisit our Meta Bounty Hunters and Huntresses and revisit Shiraz’s remark.

Apparently sufficient in the event you observe the linked remark thread, on October thirty first Daz posted;

Merchants Area are delaying withdrawals. it will now have an effect on Meta Bounty hunters paying out to the members quickly.

On January twenty eighth Sam confirmed that Meta Bounty Hunters and Huntresses weekly returns have been “slowed down” in the direction of the top of 2022.

This was in response to “Only a man”, who on January twenty seventh reported that weekly returns stopped altogether about two weeks prior.

This suits The Merchants Area’s collapse timeline (withdrawal issues all through This fall 2022 after which the January 2023 collapse).

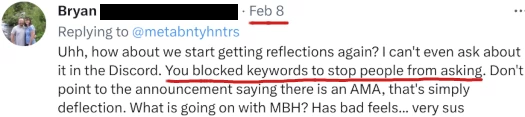

Since Meta Bounty Hunters’ and Huntresses’ collapse, there was a coordinated effort to dam complaints from buyers.

I can’t verify this however I additionally imagine The Merchants Area may need been pushed immediately onto iBuumerang associates by their Elev8 foreign exchange providing (particularly Diamond and better ranked associates in a non-public WhatsApp group).

iBuumerang is one other MLM firm Holton Buggs owns. Though not particularly a Ponzi scheme itself, lately iBuumerang is used as a car to push crypto associated securities fraud onto unsuspecting associates.

Whether or not, like Frank DiCrisi, Holton Buggs and Travis Bott have been concerned within the cash laundering facet of The Merchants Area is unclear.

What is evident is we’ve documented MLM firm house owners profiting off funneling their associates into The Merchants Area Ponzi scheme – thus committing securities fraud themselves.

Batched is a little bit bit questionable, but it surely’s doubtless Frank DiCrisi was additionally pitching buyers. On the very least he seems to be a part of The Merchants Area’s cash laundering chain.

As a result of I do know it is a hell of a rabbit gap to observe (I’ve the headache to show it), listed here are the bullet level takeaways from this Ponzi mess:

- Batched investor funds seem to have been commingled with The Merchants Area investor funds, by Savvy Pockets, Fireblocks and presumably Evolve Financial institution accounts;

- Oscar Garcia, while committing securities fraud by Batched, is claiming ignorance of The Merchants Area integration;

- Batched COO Frank DiCrisi seems to have been operating the cash facet of Batched and overseeing the Ponzi facet of the enterprise (what Garcia refers to as “accounting”);

- Gregory Baum and (son?) Jake Baum have been/are knee-deep in The Merchants Area Ponzi fraud;

- by advantage of being a plaintiff within the OC Superior Court docket Batched case, Gregory Baum seems to have ties to the Batched Ponzi scheme;

- Jake Baum is/was in mattress with Dan Putnam’s Ponzi exploits, going as far as to recruit whoever he may into The Merchants Area as LurraLife collapsed;

- Holton Buggs and Travis Bott, an affiliate of Dan Putnam, used The Merchants Area to run their very own Meta Bounty Hunters and Huntresses Ponzi schemes by;

- iBuumerang associates (Diamond and better) have doubtless been recruited into The Merchants Area immediately;

- The Merchants Area, which pitched returns as excessive as 482,582% in beneath two years, started to break down in mid to late 2022; and

- The Merchants Area collapse in flip collapsed Oscar Garcia’s Batched, Jake Baum’s LurraLife recruitment efforts and Holton Bugg’s and Travis Botts’ Meta Bounty Hunters and Huntresses Ponzi schemes

The regulatory fallout from The Merchants Area and related MLM corporations and house owners has but to play out. All we all know for certain at this level is the SEC is actively investigating Batched and Oscar Garcia.

I think in some unspecified time in the future Frank DiCrisi might be a named defendant, or voluntarily begin cooperating with the SEC. That can doubtless present an inroad to The Merchants Area, which in flip may kickstart a broader investigation into Holton Buggs and the Baum household of scammers.

Dan Putnam may additionally get a revisit, though his Ponzi fraud SEC settlement post-dates Jake Baum’s LurraLife crossover with The Merchants Area.

And naturally this assumes the SEC and/or CFTC aren’t already investigating The Merchants Area, which we are able to’t verify.

Exterior of the Ponzi schemes, Evolve Financial institution & Belief may additionally have a case to reply to in the event that they didn’t detect and report suspicious exercise.

There’s no timeline for what occurs subsequent however we’ll maintain you posted on any updates.