Your clients deserve the very best. Once they’re completely happy, what you are promoting will flourish.

So it’s vital to decide on a fee service that won’t solely enable your clients to pay conveniently — but in addition shield them from fraudulent transactions.

Shoppers have gotten extra assured in making each on-line and in-store purchases with their financial institution playing cards. This development is predicted to develop by 90% over the following few years — surpassing $1.6 trillion by the top of 2022.

From accepting credit score and debit playing cards to processing cardless transactions and in-store funds, the very best fee gateways may also help you maximize conversion charges and ship the very best buyer expertise.

On this in-depth information, I reviewed the ten most dependable fee gateways.

What Are The Finest Fee Gateways For 2023?

Listed under are the ten trusted fee gateways for what you are promoting:

- Paytm For Enterprise

- Stripe Join

- PayPal

- Payoneer

- Apple Pay For Retailers

- Flutterwave

- GoCardless

- RazorPay

- Authorize.web

- Smart

What’s a Fee Gateway?

A fee gateway is a expertise offered by an ecommerce software service supplier that lets retailers settle for debit or bank card purchases from clients.

Fee gateways are vital in ecommerce — when it comes right down to it, it’s about making buying out of your retailer safer and fewer of a trouble to your clients.

For instance, if a possible buyer trusts and likes utilizing PayPal, not providing that answer may flip a buyer in direction of one in every of your opponents.

It’s vital to do your homework and perceive precisely what every fee gateway brings to each your retailer and your clients.

Fortunately, we’ve achieved a part of that be just right for you.

The Finest Fee Gateways (Reviewed)

Right here’s the breakdown of the totally different fee gateways which can be utilized by each massive and small ecommerce companies:

1). Finest For On-line & In-Retailer Funds (Paytm For Enterprise)

Paytm for Enterprise gives a one-stop answer for each on-line and in-store funds, with options tailor-made to what you are promoting wants.

Paytm for Enterprise gives a one-stop answer for each on-line and in-store funds, with options tailor-made to what you are promoting wants.

Whether or not you’re a service provider or enterprise associate, this answer helps you develop what you are promoting, handle day-to-day funds, and disburse funds.

Use Paytm for Enterprise to gather recurring funds, generate fee hyperlinks, and ship invoices to your shoppers.

Paytm for Enterprise supplies you with a centralized ledger of funds. You may monitor settlements and obtain month-to-month statements.

You will even have entry to the service provider helpdesk. This lets you resolve buyer points and entry real-time reviews.

Along with this, you’ll be able to monitor your transactions with out ready for affirmation.

You may even manually switch cash to your financial institution accounts — with zero transaction value.

Execs

- A safe bank card processor

- Straightforward-to-use cell fee processing app

- Seamless integration with third celebration purposes

- Helpful UPI transaction on the go

- A number of fee choices

Cons

- The net interface will be extra intuitive

- Transactions will be quicker

- The On-line Comfort payment is a bit excessive in comparison with some fee gateways

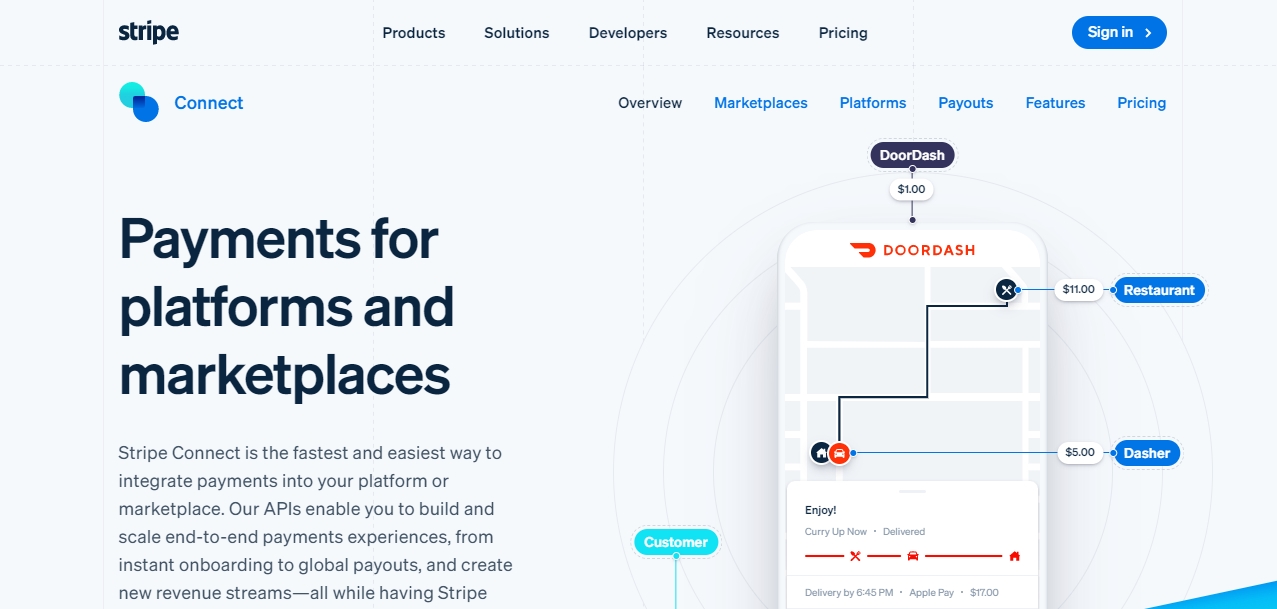

2). Finest Fee Gateway for Platforms (Stripe Join)

Stripe Join gives intuitive fee options for platforms and marketplaces.

Stripe Join gives intuitive fee options for platforms and marketplaces.

You may shortly construct and scale end-to-end fee experiences, with out going via the sophisticated backend.

In addition to enabling ecommerce purposes to just accept funds, Stripe

Join additionally supplies an easy-to-use API for integration with different programs and helps meet fee compliance necessities.

Its options embody fee logging, fee rollback, and payouts.

It additionally permits customers to set a separate cost for subsites and cost fee for paid subscriptions.

It helps one-to-many funds. It handles fee compliance, person onboarding, account administration, and payouts.

Its buyer assist is accessible across the clock. It additionally has an easy-to-use billing module that fosters recurring enterprise relationships.

Relying in your fee wants, you’ll be able to create a customized account.

The related account sort is probably the most simple route for many customers. It offers you full management over your person expertise.

Get began with the free customary plan, which gives zero platform charges. You get a co-branded dashboard to your clients. Paid plans begin at $2/month-to-month lively account.

Execs

- Straightforward integrations with pre-built ecommerce plugins

- Tremendous easy-to-use credit score and debit card processor

- Numerous fee choices — together with digital wallets, computerized funds, and so forth.

- Glorious buyer assist

Cons

- It may possibly’t solely be utilized by retailers within the U.S. and 44 different nations

- Restricted in-person transactions

3). Finest All-in-One Fee Answer (PayPal)

Whether or not you are a purchaser or a vendor, PayPal is a protected solution to obtain and ship cash on-line.

Whether or not you are a purchaser or a vendor, PayPal is a protected solution to obtain and ship cash on-line.

It has been round for practically twenty years. It is one of many largest on-line fee platforms on the planet, with over 450 million lively accounts.

Whereas you should utilize PayPal for private functions, the enterprise account gives strong options for retailers.

It’s simple to just accept bank cards or debit playing cards on the go together with your PayPal enterprise account. You may also entry your buy historical past, add new financial institution accounts, and do much more.

For private accounts, you’ll be able to select between three account varieties. These embody a free private account, a free “fundamental” account, and a “professional” account.

In the case of PayPal charges, they will differ rather a lot relying on the supply of the funds.

For example, there is no cost for getting or promoting objects, however you do must pay a 2.9% processing payment for sending cash. Worldwide transactions may incur as much as a 5% payment for worldwide transactions.

Execs

- A safe fee gateway that doesn’t reveal your bank card particulars

- Allows finish clients to pay over a number of months — supplying you with the liberty to robotically provide that choice.

- Quick on-line and in-person fee instruments

- Helpful service provider assist instruments

- Accepts fee from all over the world

Cons

- Disputes take time to resolve

- Annoying customer support

- Clients are shedding confidence in PayPal as a result of seizure of funds

4). Finest For Cross-Border Companies (Payoneer)

Payoneer is an all-in-one fee platform for cross-border companies.

Payoneer is an all-in-one fee platform for cross-border companies.

Together with your Payoneer account, you acquire entry to a wide range of providers similar to on-line cash transfers, worldwide funds, funding alternatives, and so forth.

Whereas Payoneer can be utilized by people, it is usually a well-liked software amongst companies.

Corporations and repair suppliers use Payoneer’s strong fee gateway to handle their working capital. It’s an effective way to obtain funds from clients from all around the world.

The Payoneer system is simple to make use of. You may monitor your account steadiness and transaction charges, and you’ll even obtain free cash transfers — through P2P.

Payoneer opens what you are promoting to the world. It permits you to ship and obtain cash throughout 200 nations.

You may also obtain a free pay as you go MasterCard bank card. This card can be utilized to withdraw cash from ATMs in most nations.

Execs

- Sooner processing of funds

- No setup payment

- Glorious buyer assist that listens to clients

- Distinctive U.S. and U.Ok financial institution accounts even for non-residents of those nations

- Cross border funds made simple

Cons

- Verifying accounts takes loads of time

- Frequent technical points when making funds

- Restricted integrations with third-party apps

5). Finest for Making Fee on the Go (Apple Pay for Retailers)

Offering your clients with a fee choice similar to Apple Pay for Retailers is an effective way so as to add worth to your retailer.

Offering your clients with a fee choice similar to Apple Pay for Retailers is an effective way so as to add worth to your retailer.

Apple Pay For Retailers is a handy solution to obtain funds on-line, in shops, and in-apps. It is easy to arrange, personal, safe, and quick.

It gives flexibility and personalization to your clients. They may really feel extra comfy making a purchase order and you will note improved conversions.

There are a couple of steps to take earlier than you’ll be able to start accepting funds utilizing Apple Pay.

First, you’ll need a fee processor that helps Apple Pay and an NFC-enabled POS terminal.

Subsequent, you’ll need to generate an Apple ID for what you are promoting. This might be used throughout a number of apps. Additionally, you will have to get a fee processing certificates.

These certificates are used to safe your transaction information.

As soon as you have accomplished these steps, you’ll be able to add Apple Pay to your web site or app.

Execs

- Handy and safe fee service

- No hidden charges

- No web connection is required to finish a fee

- Nice for in-store fee transactions

- Transactions will be accomplished shortly

Cons

- The setup course of is sophisticated

- Fundamental person interface (it may be improved).

- Potential safety breaches

6). Finest Fee Gateway for Rising Markets (Flutterwave)

Flutterwave is a strong fee gateway that provides limitless prospects for what you are promoting.

Flutterwave is a strong fee gateway that provides limitless prospects for what you are promoting.

It lets you promote services and products on-line, course of funds securely, construct monetary merchandise, and acquire entry to service provider instruments designed to enhance what you are promoting.

As a fintech firm, Flutterwave supplies fee infrastructure for international retailers.

It really works with a number of banks throughout a number of nations — with places of work within the US, the UK, and several other African nations.

It additionally helps cell funds, digital greenback playing cards, and internet funds.

Flutterwave focuses on rising markets. Its major operations are in 11 African nations.

Whereas its headquarters is positioned in San Francisco, it has plans to broaden to Canada and different Asian nations.

In the event you’re tight on funds, Flutterwave gives a free on-line retailer to assist companies handle their funds — particularly on the early development levels.

New customers can begin with a free trial to see how the fee software works earlier than upgrading to a professional plan with various transaction charges.

Execs

- Clear and fashionable person interface

- Integrates properly with PayPal for worldwide fee transactions

- A handy fee processor in rising markets

- An additional layer of safety protects buyer transactions

Cons

- It doesn’t assist all African nations

- Buyer assist will be extra responsive

- The KYC (know your buyer) course of will be irritating

7). Finest for Automated Funds (GoCardless)

GoCardless is a fee processing service that permits companies to just accept debit funds.

GoCardless is a fee processing service that permits companies to just accept debit funds.

With GoCardless, you’ll be able to settle for direct financial institution funds with no card charges or delays.

This methodology of fee isn’t solely cheaper than bank card networks, nevertheless it additionally eliminates the trouble of coping with banks. It’s fairly simple to make use of, and it is obtainable in over 30 languages.

The GoCardless fee service is primarily designed for corporations that invoice clients repeatedly.

They accumulate funds from buyer financial institution accounts and launch cash based on assortment dates.

The corporate gives totally different fee plans to swimsuit a wide range of wants. They cost a set share payment per transaction, however this may differ relying on the dimensions of what you are promoting.

Smaller companies may pay greater charges, as they’re much less more likely to course of as many transactions. There is no setup value, however a 1% + £/€ 0.20 transaction payment applies.

Execs

- The setup and onboarding course of is simple

- An intuitive and clear person interface

- Wealthy reporting of transactions

- Helps a number of languages and currencies

Cons

- Reconciliation of fee might be quicker

- Buyer assist is sort of non-existent

8). Finest For Monitoring Funds Effectively (Razorpay)

Razorpay is a fast-growing fee processing firm in India. It’s thought of the largest fintech success story in India.

Razorpay is a fast-growing fee processing firm in India. It’s thought of the largest fintech success story in India.

The corporate was began by a gaggle of younger entrepreneurs. They wished to create a easy fee gateway for companies. They contacted the RBL financial institution and acquired a license to course of funds.

With Razorpay, retailers can course of credit score and debit playing cards, eWallets, and UPI.

It helps main digital wallets similar to FreeCharge, OlaMoney, and PayZapp. Its API permits companies to simply combine its providers with different programs.

It’s additionally beneficial for automating and monitoring funds to distributors and staff.

Razorpay gives two totally different plans, one for rising corporations and the opposite for small and medium-sized companies. Every plan comes with a separate account supervisor.

The management panel is user-friendly and lets you entry key statistics. It may possibly allow you to to handle your funds, course of refunds, and generate invoices.

Execs

- Quick and safe fee processor

- Person-friendly dashboard

- Simply processes refunds in real-time

- Rapidly generate visually-appealing invoices to your shoppers

Cons

- It takes 8 to 10 days to get your service provider account accredited.

- Restricted pockets and EMI choices

- Flat fee fees are greater than a few of the opponents’

9). Finest for Clients Utilizing Cellular Units (Authorize.web)

Authorize.web is a trusted fee gateway for accepting bank cards, processing contactless funds, and facilitating eChecks in individual.

Authorize.web is a trusted fee gateway for accepting bank cards, processing contactless funds, and facilitating eChecks in individual.

Not like some fee options, Authorize.web has been round, weathered the storm, and helped thousands and thousands of retailers up to now many years to course of funds.

Utilizing a service similar to Authorize.web may also help you to receives a commission on time, each time.

Whether or not you are a start-up trying to develop, or a seasoned enterprise govt, you’ll be able to depend on their fee options to maintain the heavy lifting.

You will discover the corporate’s strong suite of fee providers to be each dependable and cost-effective, and their dedication to customer support is unmatched.

Because the go-to fee processor for most of the largest banks and credit score unions within the nation, you’ll be able to relaxation simple realizing that they will maintain the small print for you.

Based in 1996 as Authorize.web, Inc., the corporate is a subsidiary of Visa Inc.

There is no setup payment and month-to-month gateway pricing begins at $25.

Execs

- Straightforward to arrange

- Clients find earlier transactions with ease

- Superior fraud detection instruments

- Helps multi-currencies

Cons

- Poor buyer assist

- Reporting will be improved

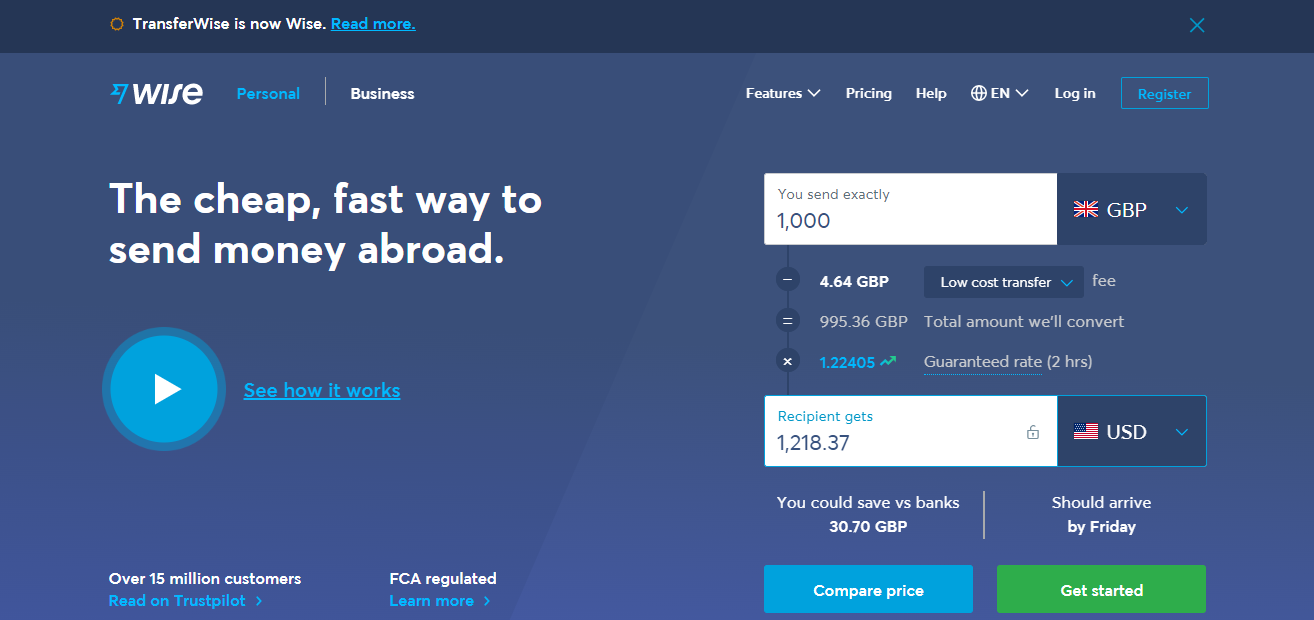

10). Smart (previously TransferWise)

Smart (previously TransferWise) gives an reasonably priced and quick fee answer.

Smart (previously TransferWise) gives an reasonably priced and quick fee answer.

It’s finest suited to sending or receiving funds overseas.

The service gives a fast and simple solution to earn a living transfers, and the funds normally arrive inside 1 enterprise day for wire transfers and 1 to three enterprise days for ACH transfers.

There aren’t any hidden charges.

Not like different cash switch providers, Smart makes use of an actual alternate price.

It fees a small share for fee, and the charges are calculated upfront, so you recognize what you might be paying.

Smart gives a multi-currency account that lets you maintain cash in over 50 currencies.

You may obtain funds from overseas nations with out paying any charges. It’s simple to fund your transactions with a bank card or debit card.

Execs

- Low transaction charges and cheap charges

- Quick and simple signup course of (with no complicated KYC verification)

- Simply pay for transfers in money or credit score

- Borderless and trusted fee answer

Cons

- Switch pace could also be low (generally)

- Account deactivations (with no prior warnings)

- Smart doesn’t settle for all kinds of credit score/debit playing cards (sadly)

Conclusion

Primarily, the price of utilizing a fee gateway will differ relying on what number of transactions you make, in addition to the worth of every transaction.

A few of these prices embody a set-up payment, a month-to-month payment, and a transaction payment.

Your fee gateway also needs to be PCI-compliant. This can be a safety customary developed to guard the privateness of your clients’ info.

Finally, it would be best to discover a fee gateway that’s simple to make use of and has a fast and handy checkout expertise.

It’s even simpler to decide on when you think about what your ecommerce tech stack already integrates with. You’ll desire a fee gateway that performs good and integrates seamlessly together with your ecommerce platform, in addition to your advertising and marketing automation answer.

Drip gives a whole bunch of integrations with the fee gateways and ecommerce instruments that you just’re possible already conversant in.

The most effective half? You may strive it free for 14 days!