Increase your hand for those who’ve ever gotten a invoice, after which needed to dig by way of the corporate’s web site simply to learn the way or the place to pay it.

Think about for those who may simply teleport straight to the fee display screen, with all the acquisition particulars already crammed in. That’s precisely what fee hyperlinks do.

If you happen to’re a buyer questioning for those who can belief a fee hyperlink, or a enterprise fascinated with including pay-by-link to your website, put your hand down and browse on. We’ll cowl the best way to use fee hyperlinks, the best way to inform in the event that they’re protected, and the most effective fee hyperlink suppliers.

What’s a fee hyperlink?

A fee hyperlink is a URL or QR code that begins a web-based transaction. Clicking or scanning the hyperlink opens a fee portal or web page that’s pre-loaded with the small print of your buy. You merely enter your fee particulars, and fee is made.

Cost hyperlinks are one of the vital helpful checkout strategies as a result of they’re so versatile. A hyperlink will be particular to at least one transaction or at all times tied to a selected services or products. They are often customized to at least one buyer, or obtainable for anybody to click on. You’ll be able to even determine whether or not the hyperlink is one-time use, time-limited, or a everlasting hyperlink for recurring funds. This makes them particularly useful for subscriptions, invoices, and quotes.

And in contrast to a buying cart or fee kind, a hyperlink can go wherever your prospects go. You’ll be able to add URLs to textual content messages, emails, chats, and even embed them instantly into your quotes. Whereas QR codes will be added to print advertisements, product shows, menus, and extra.

Are fee hyperlinks protected?

Actual fee hyperlinks hook up with safe fee gateways run by third-party fee processors. You’re in all probability already aware of processors like PayPal or Sq.. These fee service suppliers (PSPs) use encryption and tokenization to guard your fee knowledge.

That stated, a hyperlink is barely as safe as the corporate offering it, so it’s necessary to make use of your greatest judgment earlier than clicking something. Clients ought to at all times persist with trusted companies. And companies ought to select a fee supplier that follows Cost Card Business knowledge safety requirements (PCI DSS).

How do I do know if my fee hyperlink is protected?

- Solely click on on fee hyperlinks you’re anticipating to obtain.

- Test for HTTPS at first of the URL.

- Be sure the enterprise makes use of fraud prevention.

- By no means enter monetary knowledge when on a public WiFi community.

How can I create a fee hyperlink?

Identical to accepting bank cards or ACH funds, you’ll first must discover a fee providers supplier or PSP. The precise steps will depend upon the supplier, however you’ll nearly at all times need to:

- Create an account. This will likely contain a credit score verify or underwriting course of, so it’s greatest to get it accomplished earlier than you want to begin accepting funds.

- Create a fee web page or product web page. Some PSPs might require you to attach your hyperlink to a services or products, whereas others will solely want you to assign a greenback worth.

- Create the fee hyperlink. That is the place you’ll add particulars like billing phrases and who can entry the hyperlink.

- Ship the hyperlink. Your safe fee hyperlink is now shareable.

Finest Cost Hyperlink Suppliers

- HubSpot Funds

- Stripe

- Sq.

- PayPal

- QuickBooks On-line

1. HubSpot Funds

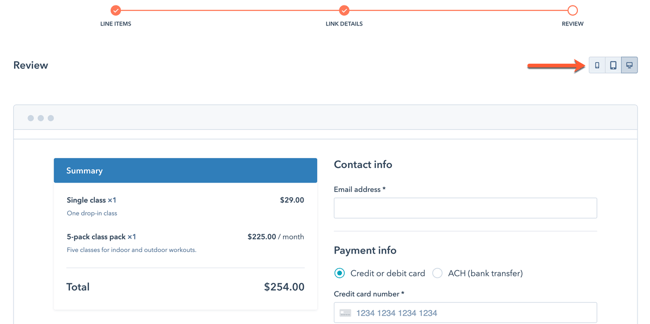

HubSpot Funds is a multi-purpose fee device that integrates along with your CMS. Meaning you may securely join fee hyperlinks to your web site, chatbot, gross sales workflows, advertising and marketing emails, and extra.

However the most effective half is that it additionally integrates along with your CRM, so it might probably mechanically replace your buyer information with buy historical past, fee exercise, and so on. This enables your gross sales, advertising and marketing, and repair groups to at all times have essentially the most up-to-date data.

Cost strategies: Bank card, debit card, ACH

Price: 0.5% per transaction for ACH (capped at $10), 2.9% per transaction for bank cards

2. Stripe Cost Hyperlinks

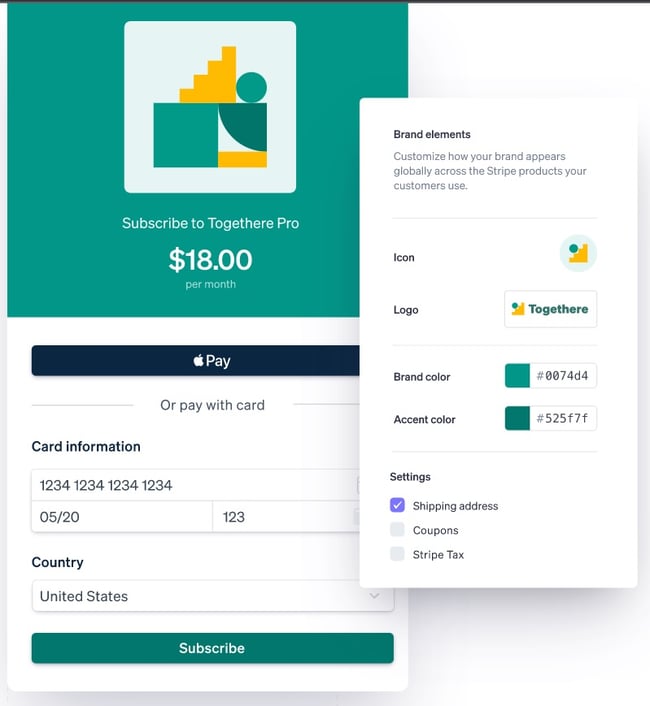

Stripe is a globally-known fee platform, and gives every part from cellular apps to bank card terminals.

For fee hyperlinks, it provides the simplicity of pre-built fee pages and checkout carts, so you will get began rapidly. You can even customise these portals along with your brand and model colours.

Cost strategies: Bank card, debit card, ACH, Google Pay, Apple Pay

Price: 2.9% + $0.30 per transaction

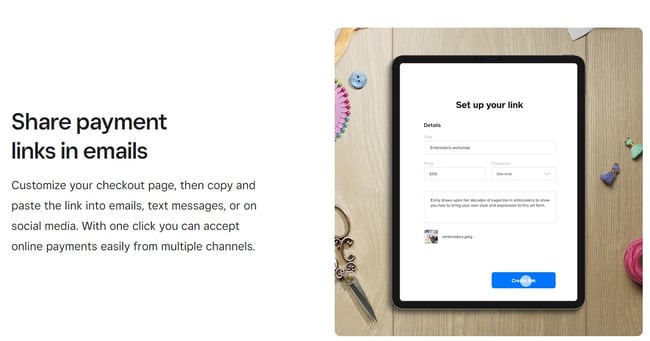

3. Sq. On-line Checkout

Most individuals know Sq. for its cellular card readers, but it surely additionally has a collection of on-line checkout options.

It’s additionally one of many quickest methods to get began with fee hyperlinks. You don’t even must have an internet site. Simply join a free vendor account and you can also make easy hyperlinks with their fee hyperlink generator.

Cost strategies: Bank card, debit card, Google Pay, Apple Pay

Price: 2.9% + $0.30 per transaction

4. PayPal.Me

PayPal is among the most widely-known fee suppliers on Earth. Meaning your prospects know they will belief your fee hyperlinks.

PayPal.Me works a little bit in a different way from the opposite entries on this record. As an alternative of sending your prospects to a fee web page, it directs them to your PayPal account.

PayPal.Me additionally permits works with private accounts, so you need to use fee hyperlinks for issues like splitting payments or sending money.

Cost strategies: Bank card, debit card, PayPal, Venmo

Price: 2.9% + $0.30 per transaction

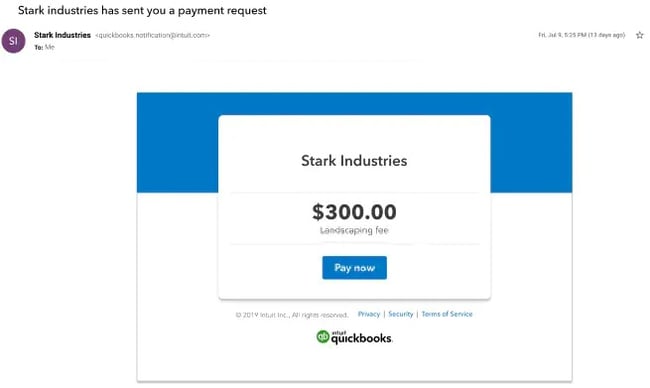

5. QuickBooks On-line

If you happen to’re already utilizing QuickBooks to your accounting, it’s best to know that fee hyperlinks are a built-in characteristic. That stated, they’re extra restricted in operate than the opposite choices on this record.

QuickBooks solely provides single-use hyperlinks, in order that they’re solely good for one buyer and one buy at a time. This makes them an ideal alternative for companies that do bill billing, however not excellent for retail.

Cost strategies: Bank card, debit card, ACH

Price: 1% per transaction for ACH (capped at $10), 2.9% + $0.25 per transaction for bank cards

Only a Click on Away

Cost hyperlinks cut back friction by making it straightforward to make a fee. And once you make it simpler to your prospects to make a fee, you make it simpler so that you can receives a commission.