Following the collapse of its authentic WEWEX Ponzi scheme in mid 2021, WeWe International launched LyoFI and LyoPay in late 2021.

Following the collapse of its authentic WEWEX Ponzi scheme in mid 2021, WeWe International launched LyoFI and LyoPay in late 2021.

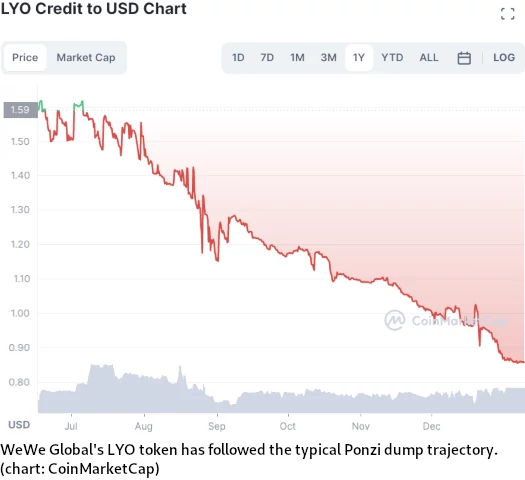

Hooked up to LyoFI and LyoPay was LYO, a token used to run a brand new 300% ROI Ponzi scheme.

As of January 2023, right here’s how LYO token goes:

As LYO Ponzi dumps in direction of $0, WeWe International has now launched L-Finance Ponzi scheme.

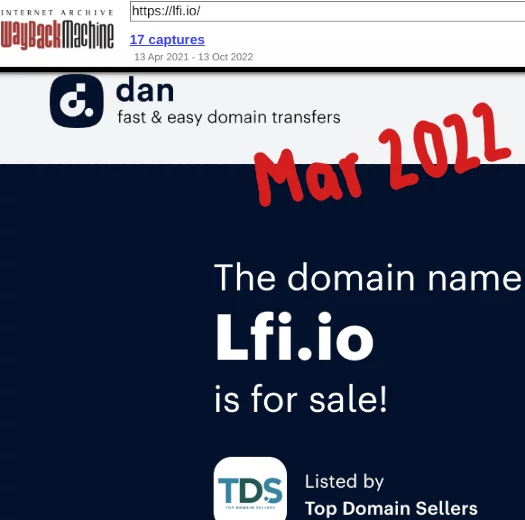

WeWe International has arrange L-Finance on the area “lfi.io”.

“Lfio.io” was initially registered in 2020. The personal registration was final up to date on September fifth, 2022.

By means of the Wayback Machine we will see “lfi.io” was on the market in early 2022.

So it seems WeWe International bought the area on or round September 2022.

A go to to L-Finance’s web site reveals LFI is a BEP-20 token. These take a couple of minutes to arrange at little to no value.

Hooked up to L-Finance is the same old slew of cryptobro stuff no person cares about:

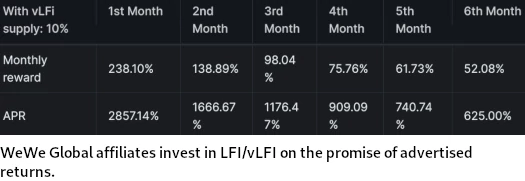

What buyers are right here for is marketed annual returns of as much as 2857.14%.

L-Finance and LFI is the outdated “staking” grift, besides WeWe International calls it “vesting” now.

Associates join, spend money on LFI (or convert their nugatory LYO to LFI), park the tokens with the corporate and gather extra tokens.

The intention is to money out subsequently invested funds. The issue is, as LYO bagholders are realizing, is that this depends on a relentless stream of latest victims to steal from.

SimilarWeb at the moment tracks negligible visitors to L-Finance’s web site. WeWe International web site is as much as 605,000 visits as of December 2022, up from 405,000 in November.

Outdoors of Seychelles nonetheless, recruitment has collapsed (Italy, Bulgaria, Argentina and Greece are all down).

In any occasion, it must be apparent that, earlier than pleb buyers can money out, LFI will comply with the identical trajectory as LYO.

WeWe International are touting LFI’s dumping on public exchanges as vLFI someday in January 2023.

Starting January 2023, LFi will probably be listed on a number of exchanges and price-tracking web sites. It is going to be used for trades and transactions and to be vested as vLFi.

Count on a potential fourth WeWe International reboot when vLFI inevitably collapses.

WeWe International is believed to be run by Luiz Goes (aka Luiz Goez) out of Dubai.

Believed to be a Brazilian nationwide, Goez might also be working with accomplices in Italy.