Like top-notch weatherpeople, savvy enterprise leaders are additionally accountable for correct forecasting. A run price, which exhibits how a lot income your organization will generate within the close to future, is one instrument that may assist.

It’s important to calculate your run price precisely to make choices about your enterprise’s future. On this article, you’ll be taught what a run price is and the best way to calculate it. You’ll additionally see examples of how run charges are utilized in the actual world. Let’s dive in.

The Run Fee Formulation

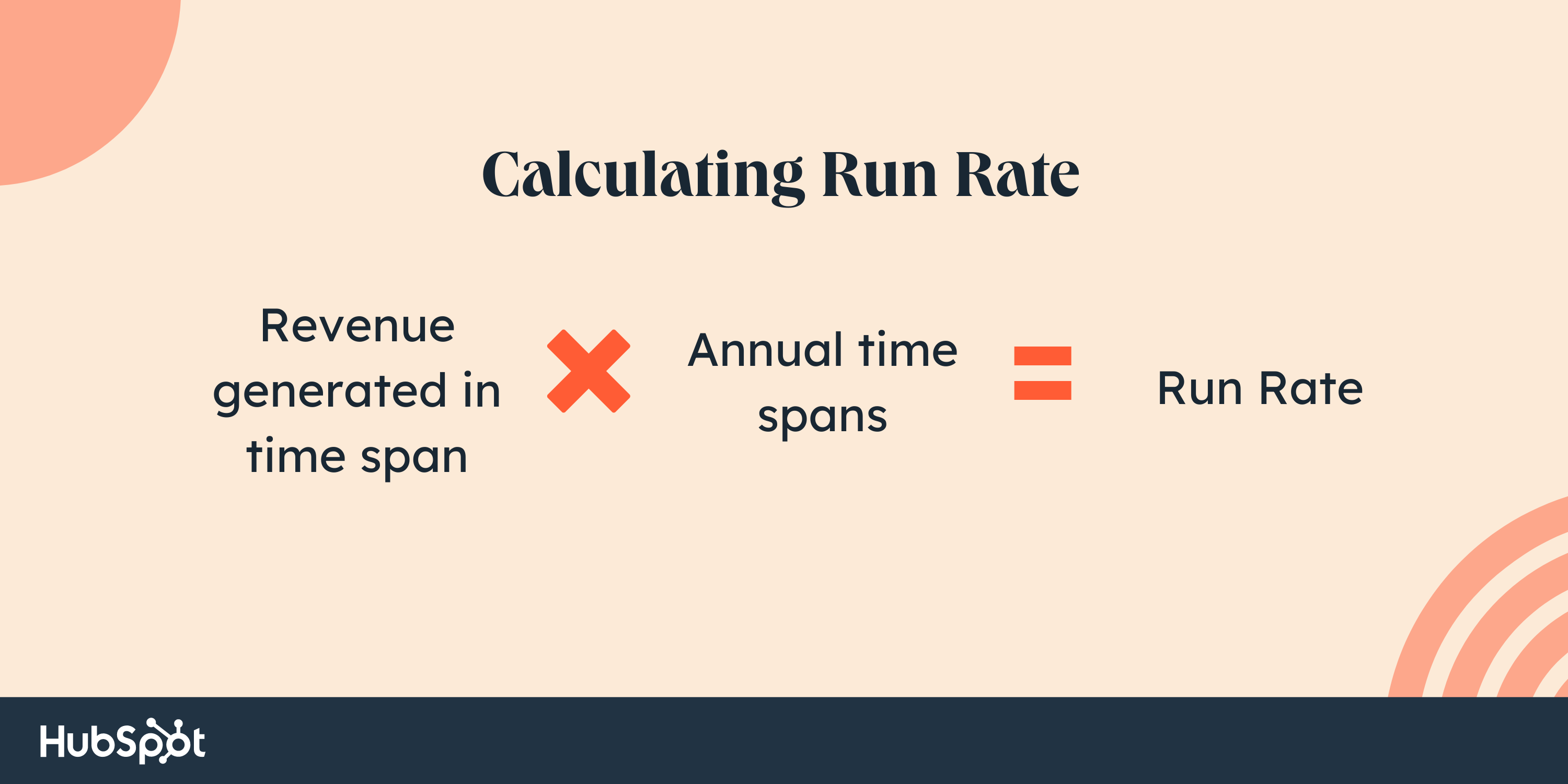

Now that you already know what a run price is, let’s focus on the best way to calculate it. The run price calculation is comparatively easy and solely requires two items of data:

- Your organization’s gross sales over a sure time frame.

- The variety of days in that point interval.

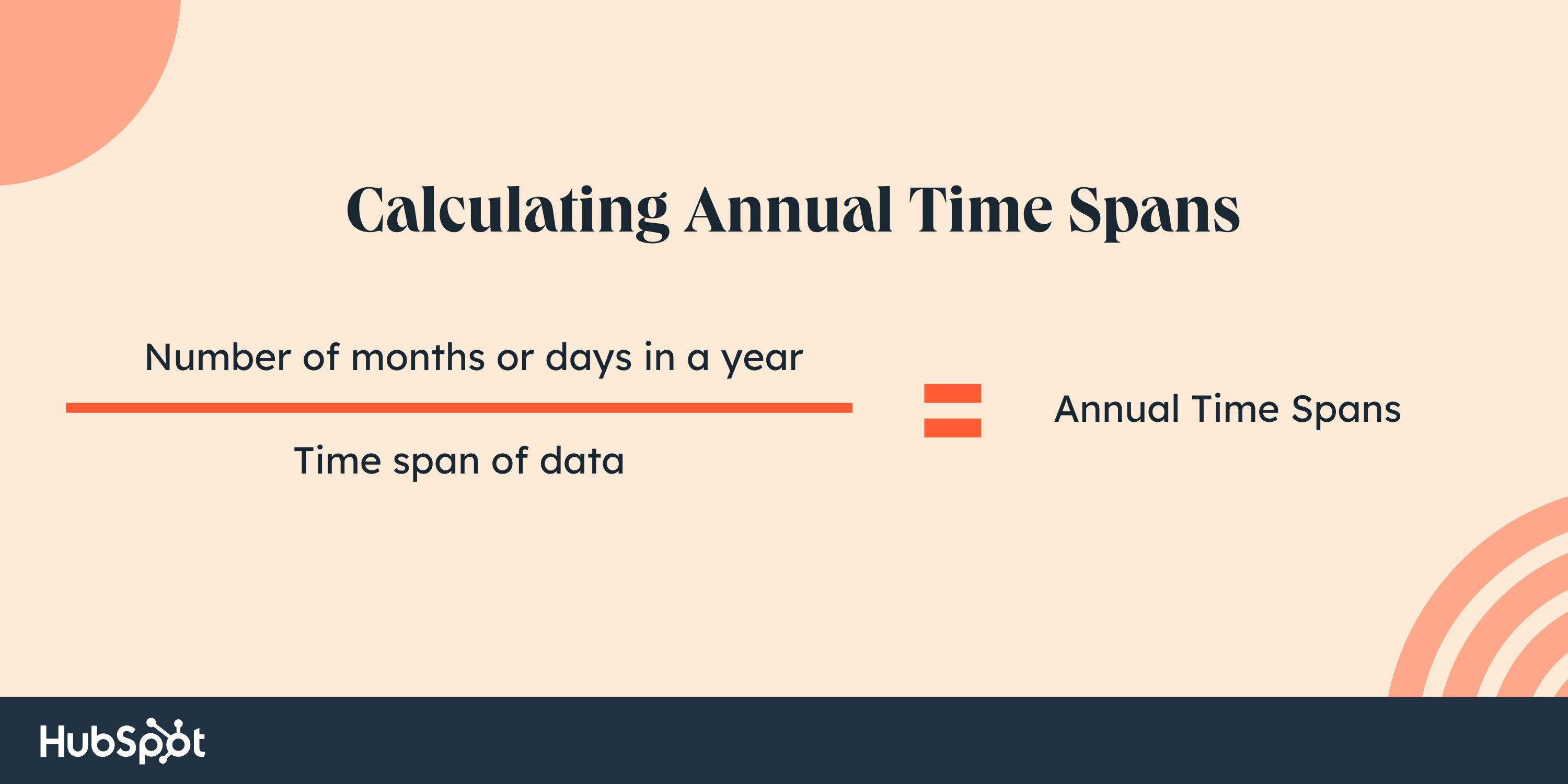

Calculating run price is a two-step equation. First, you will have to find out how typically your chosen time span happens in a yr. This quantity turns into your annual time spans. To calculate annual time spans, use the next equation.

The following step is to make use of your annual time spans to calculate your run price.

How one can Calculate Run Fee

- Take your income over a selected size of time.

- Decide nevertheless a lot of these lengths of time happen in a single yr (i.e., one yr is 12 months).

- Multiply these two figures.

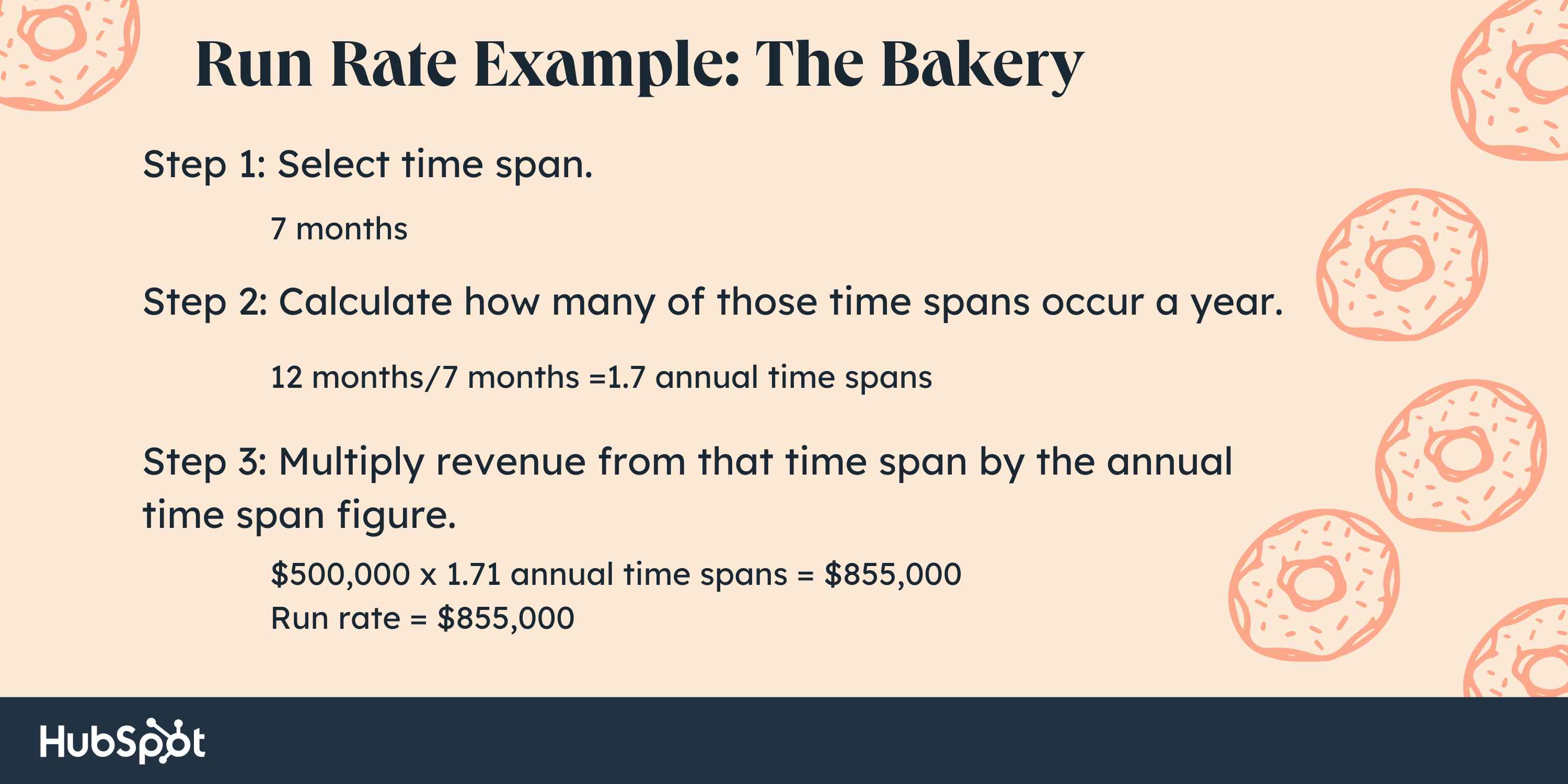

Right here’s an instance of what that may appear like. Let’s say you’re working a bakery. The corporate has solely been in enterprise for seven months. It has generated $500,000 in income up up to now and is now trying to gauge its future efficiency based mostly on this present information.

The gross sales workforce then decides to calculate the enterprise’ run price for the subsequent seven months.

Firms typically calculate their run price on an annual foundation. You may as well measure your run price month-to-month or quarterly.

Why is your run price necessary?

The run price is necessary as a result of it offers you a snapshot of your organization’s present gross sales and helps you expect future gross sales. This data is efficacious when making choices about your enterprise’ progress technique.

For instance, when you’re contemplating opening a brand new retailer, the run price will help decide whether or not the enterprise is possible. In case your run price is $274.32 per day and that you must generate $300 per day to interrupt even, then you already know that opening a brand new retailer isn’t a good suggestion.

Professionals of Calculating Run Fee

- Run charges are helpful for brand new corporations. The run price generally is a great tool for brand new corporations that don’t have quite a lot of historic gross sales information to work with. It is because the run price relies on present gross sales and can be utilized to foretell future gross sales.

- Run charges can precisely venture long-term gross sales. The run price can also be an correct projection for long-term gross sales. It is because it considers all the firm’s gross sales over a sure interval, not only one month or one quarter.

Cons of Calculating Run Fee

- Your run price may be deceptive. The run price may be deceptive if your organization’s gross sales fluctuate drastically from month to month or quarter to quarter. Run price doesn’t account for these fluctuations and can provide you an inaccurate projection of your organization’s future gross sales.

- Run price solely seems at previous information. Your run price solely seems at previous information and doesn’t contemplate any exterior components that might affect your organization’s future gross sales. For instance, if a recession is coming, your run price won’t take this into consideration. This might provide you with a false sense of safety about your organization’s future gross sales.

How one can Use the Run Fee

Now that you already know what a run price is and the best way to calculate it, let’s focus on the best way to use this data.

Run charges may be invaluable instruments for forecasting your organization’s future gross sales. When you’re contemplating making a serious resolution for your enterprise, comparable to increasing your product line or opening a brand new retailer, your run price will help you establish whether or not now could be the correct time to behave.

Nevertheless, don’t depend on your run price alone. Think about your run price along side different components, comparable to your organization’s historic gross sales information and data of the present market situations. This holistic image will help information your ultimate resolution.