Estimated learn time: 7 minutes, 56 seconds

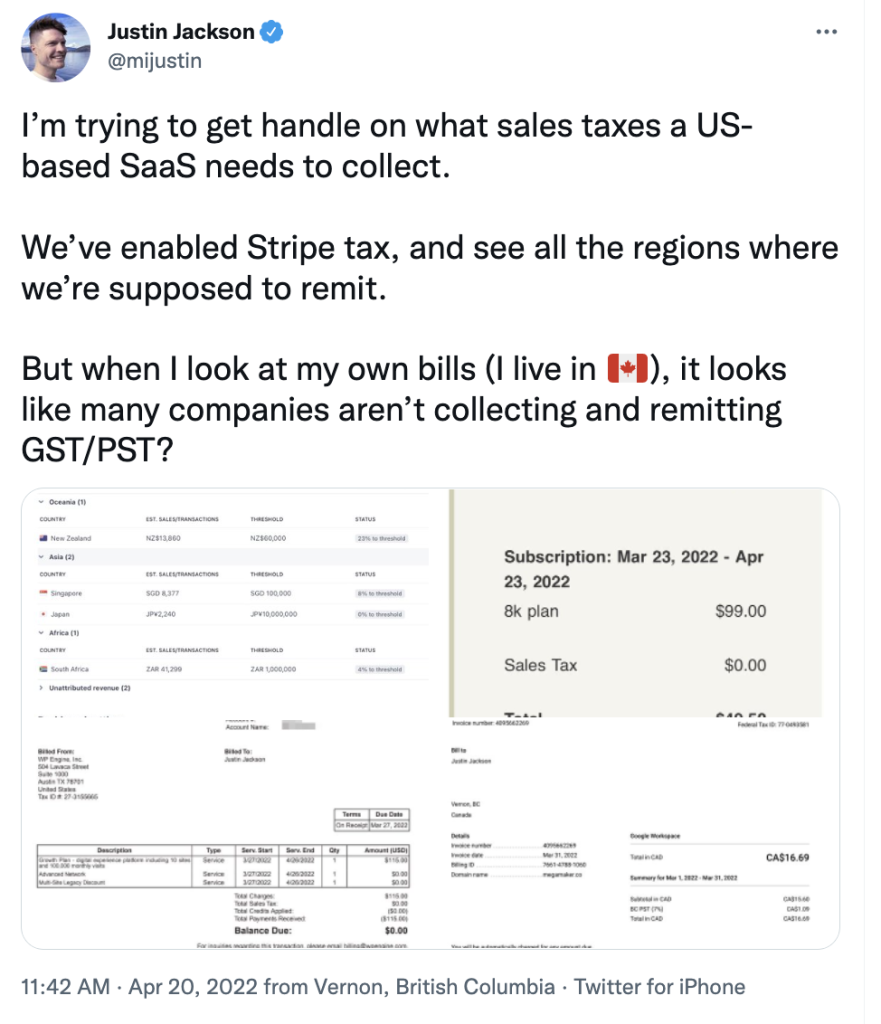

One of many issues I’ve realized whereas working at FastSpring is how widespread it’s for SaaS and software program corporations to disregard transaction-related taxes (gross sales taxes, VAT, GST, and many others.).

And I get it.

Gross sales taxes, VAT, and GST are sophisticated, complicated, and never what software program leaders need to spend their time on.

But in addition, you need to know that ignoring transaction-related taxes has dangers nicely past paying some again taxes at a while sooner or later.

Throughout certainly one of my conversations with FastSpring’s International Tax Director Rachel Harding, essentially the most educated particular person I learn about this subject, she informed me about:

- 40% curiosity and penalties she’s seen software program corporations accrue after they’ve ignored state gross sales tax necessities.

- Multi-million greenback valuation changes from historic gross sales tax noncompliance throughout acquisition due diligence.

And far more.

So to reply our personal query: No, you shouldn’t ignore taxes in 2022.

On this piece, we cowl 5 issues SaaS corporations want to grasp about taxes. A lot of it’s taken from my conversations with Rachel. Beneath, you can even stream two of our conversations to listen to extra.

5 Issues SaaS Corporations Have to Perceive About Gross sales Taxes

1. Gross sales, VAT, and GST Taxes Can Have an effect on SaaS Valuations

When Rachel was engaged on a mergers and acquisitions tax workforce for small software program corporations, she noticed million-dollar buy worth changes because of tax noncompliance.

“In the event you’re seeking to have any form of possession change, majority or minority funding, folks need to look into your organization,” Rachel defined. “They will have a look at all of your processes, like do you’ve gotten a deal with on the place your merchandise are taxable? Are you watching these guidelines, amassing and remitting? Are you compliant? As a result of if not, you’ll need you to repair it earlier than they purchase it, or they’ll simply dock the acquisition worth.”

“In the event you do it proper, technically, it’s net-zero to you,” Rachel defined.

Gross sales tax is a consumption tax — a tax on the patron, not on your small business. It shouldn’t be one thing you’re paying out of pocket. However it’s as much as you to acquire gross sales tax on the client’s behalf — and remit it to the appropriate authorities company. It’s a purchaser’s legal responsibility, however a vendor’s obligation.

“It’s once you’re doing it improper that it turns into an expense and legal responsibility in your stability sheet. Feasibly, you’re not going to evaluate a buyer gross sales tax two years after it was due. So then it’s all out of pocket.”

3. Consumption Taxes Are Calculated Primarily based on the Location of the Purchaser, Not the Vendor

Gross sales taxes are sophisticated (particularly in locations just like the U.S.), however normally, the factor to know is that gross sales tax is collected the place the advantage of the merchandise is consumed (aka the place your buyer is situated). It isn’t calculated based mostly in your location, or the placement of your organization’s headquarters.

In observe, essentially the most significant information for sourcing gross sales is the billing and pc IP handle. Because the identify implies, SaaS is taxed equally to companies and never items, that means solely 20 of 45 U.S. states with gross sales tax regimes truly tax SaaS. And since 2018, when you have sufficient taxable gross sales in a area that exceeds the desired threshold, then you might be deemed to have financial nexus (a giant shoutout to South Dakota v. Wayfair for this idea!).

A gross sales threshold is the quantity of gross sales you’ve gotten in a particular jurisdiction earlier than you must file taxes. Every tax area (whether or not it’s on a state, territory, or nation stage) has distinctive methods of defining a threshold.

4. Tax Legal guidelines and Rules Have Modified Dramatically within the Final 10 Years

Gross sales taxes, VAT, and different transaction-related taxes have modified so much prior to now ten years. Some modifications are extra necessary than others and have modified the panorama completely.

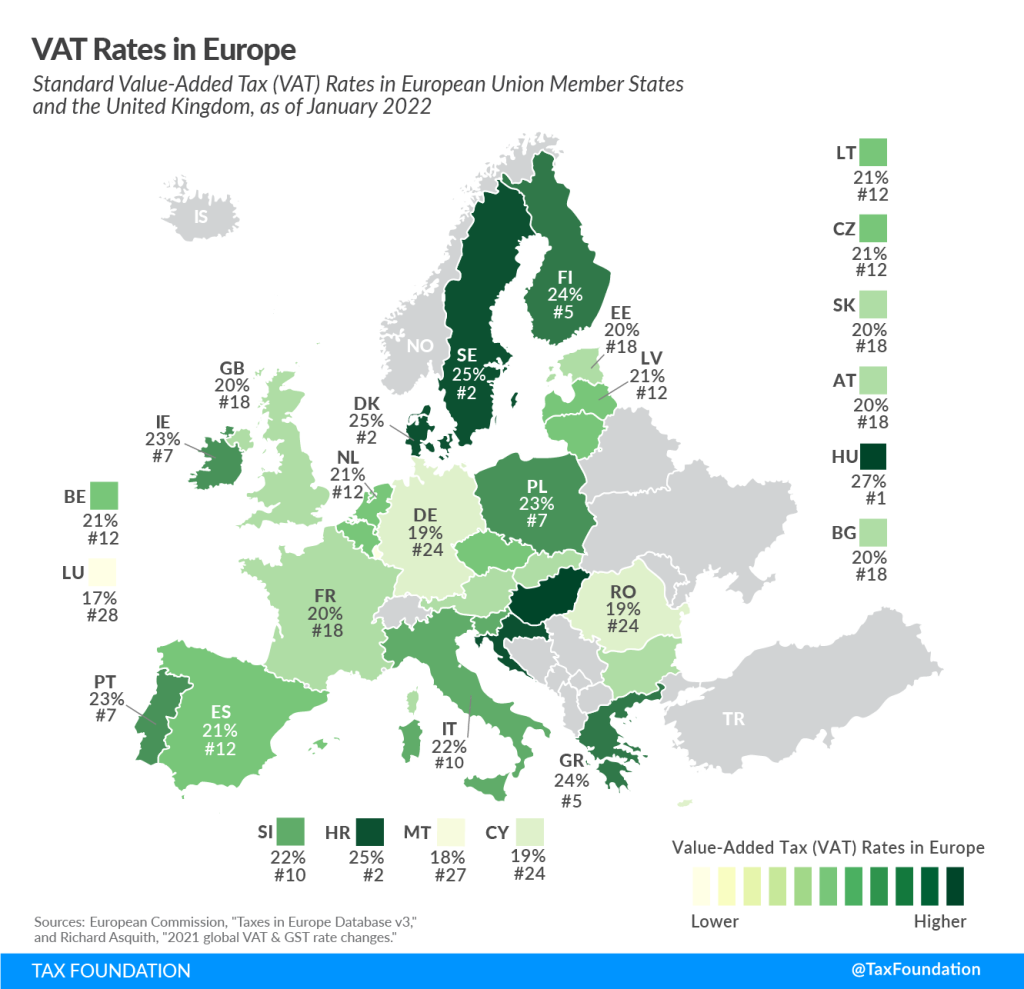

2015: EU Requires VAT Assortment From Non-EU Software program Corporations

On January 1, 2015, the EU started requiring software program sellers to gather and remit VAT based mostly on the placement of the customer — not the placement of the vendor’s firm or workers.

VAT charges are set by the nation, that means nations are liable for maintaining with modifications to those charges on a rustic stage.

2018: U.S. Votes That States Can Accumulate Gross sales Taxes From Non-Resident Companies

In 2018, the U.S. Supreme Courtroom dominated that states could cost gross sales tax on purchases created from out-of-state sellers (together with on-line sellers), even when the vendor doesn’t have a bodily presence within the taxing state (South Dakota v. Wayfair, Inc.). (A.ok.a. the explanation we’re writing this text since now nonresidents and small companies want to grasp gross sales tax and its software.)

Within the U.S., gross sales tax laws differ from state to state. Florida and California don’t require assortment of gross sales taxes on SaaS subscriptions. However New York and Pennsylvania do.

Simply in 2020, Massachusetts reclassified SaaS charges as “private tangible property,” that means SaaS subscriptions are actually topic to gross sales taxes inside the state.

In our interviews, Rachel gives different examples of how tax legal guidelines are altering for SaaS corporations world wide:

“We’re seeing, throughout the globe, nations creating guidelines that particularly goal non-resident companies offering digital items and companies. Some can have a threshold of gross sales, a few of them say each greenback is taxable.”

5. International Consumption Taxes Hold Getting Extra Sophisticated

New tax mandates are being handed that instantly affect SaaS. Very quickly, in nations world wide, SaaS corporations working digital platforms could also be required to report all sellers utilizing their platform.

Why are tax legal guidelines getting extra sophisticated?

International locations know they’re dropping tax income on digital gross sales that software program corporations aren’t disclosing.

Because of this, they’re discovering new methods to trace the circulation of cash of their state or nation and implement assortment.

The 4 Methods SaaS Corporations Can Handle Gross sales Taxes and VAT

So how do SaaS corporations work out all of the taxes they should withhold and remit world wide?

There are 4 approaches that we see SaaS corporations take to meet their obligations for transaction-related taxes:

1. Ignore It

As we’ve described on this article, ignoring gross sales taxes is a quite common method — but one that may go away your organization chargeable for years of again taxes, charges, and penalties. The times the place this method can work is shrinking. As on-line commerce continues to develop, so does the drive and skill to manage it.

2. Do It Themselves

Doing taxes by yourself is an effective choice for bigger corporations with the sources to handle it successfully with an in-house workforce.

But it surely’s not as straightforward as plugging an automatic tax instrument into your gross sales platform.

SaaS corporations additionally want to consider:

- Ensuring your information is clear and accessible.

- Understanding what’s taxable and the charges to cost.

- Monitoring tax thresholds to know the place you’ll must remit taxes and file tax returns.

- Remitting the right quantities and submitting returns on time for all tax jurisdictions the place you’ve gotten an obligation. This may be month-to-month, quarterly, or yearly.

- Preserving updated about altering tax legal guidelines and laws.

- Responding to notices and inquiries from tax authorities. Are they phishing, or is it actionable?

This may be burdensome for a finance division with out technical experience and trigger resentment and turnover.

3. Rent an Accounting Agency

Whenever you outsource your taxes, there are fewer inside sources wanted, however it’s going to value extra. And relatively than a personalized method, hiring an accounting agency normally means they’ll take a conservative method with most compliance — even should you would like one thing extra personalized.

There’s a perspective that basically solely an in-house tax skilled can present — one which requires understanding the enterprise, its methods, tax legal guidelines, and the way all of them intersect.

4. Use a Service provider of Report (MoR) and Outsource the Legal responsibility

A service provider of file is a strong gross sales method that may reduce the pressure on firm sources and funds.

At FastSpring, we act because the service provider of file for all transactions in your web site, making us liable for amassing and remitting taxes in your behalf. Whether or not you’re making an attempt to handle diminished tax charges, personalized taxation, tax-exempt transactions, B2C or B2B — all the things is dealt with for you.

A service provider of file can also be at your facet if any tax audits or inquiries come up. If an audit occurs, we intervene and take the lead — so you may keep targeted on constructing and rising your SaaS enterprise.

What’s the Greatest Answer for Your Firm?

Perhaps that is all overwhelming, however the worst factor you are able to do is nothing.

As Rachel put it, “I can by no means promise that you’ll or received’t get audited. What I can promise is that small actions now can set you up for a a lot brighter future.”

To determine what’s finest to your firm, she recommends assessing your sources and your choices.

“It’s actually figuring out the enterprise, your footprint, international tax legal guidelines (duh), and what dangers you might be prepared to tackle.”

As a service provider of file, FastSpring collects and remits taxes in your behalf, so that you by no means have to fret about it. Be taught extra about our tax companies.