With Amazon’s October Prime Early Entry Sale within the books, Amazon advertisers must fine-tune their technique for the core stretch of This autumn.

A part of that planning revolves round:

- Mapping out how budgets might be spent over the ultimate month and a half of the 12 months.

- Which days to push the pedal most on.

We dug deep into the greater than $400 million in Amazon advert spend underneath administration yearly at Tinuiti (my employer) to:

- Quantify what we’ve seen prior to now and higher estimate what may occur this go round.

- Assist manufacturers higher perceive how efficiency for Amazon adverts shifts over the course of the vacation purchasing season.

Let’s dive in.

Trying again on the 2020 vs. 2021 vacation seasons

It might be robust to recollect at this level, however means again in 2020 the vacation purchasing season seemed very totally different than any earlier 12 months for Amazon distributors and sellers.

First, there was the Oct. 13-14, 2020 Prime Day occasion, which was delayed from its typical mid-year timing. Because of the surge in ecommerce demand pushing Amazon’s success capabilities to the bounds within the early months of the pandemic, the change created a brand new This autumn “vacation.”

The gross sales per click on of sponsored merchandise adverts soared relative to what would sometimes be anticipated in the course of October. We noticed a sequel of this with the Prime Early Entry Sale this 12 months.

A lot of Amazon’s and different retailers’ efforts to kickstart the This autumn 2020 purchasing season sooner than traditional have been supposed to tug demand earlier within the quarter as:

- Transport delays have been inflicting large complications on the time.

- Final-minute consumers wouldn’t have the ability to reliably get packages as shortly late within the season.

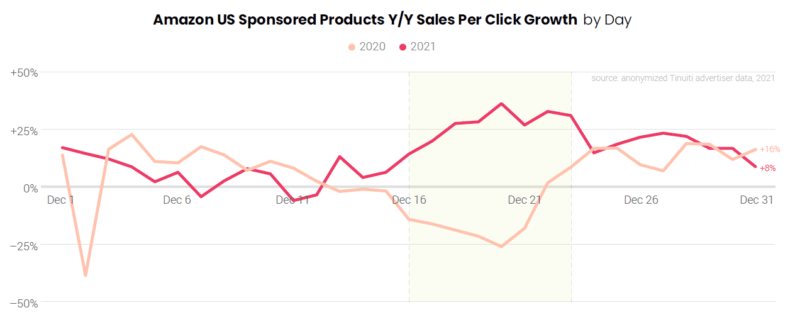

This additionally led to a lot earlier transport cutoff dates so as to get packages in time for Christmas, and our second key divergence for This autumn 2020 advert efficiency in comparison with different years – a significant drop in gross sales per click on within the third week of December in comparison with 2019.

By 2021, transport delays have been a lot much less obstructive than in 2020, and cutoff dates to obtain packages in time for Christmas returned to a extra typical schedule.

In flip, advertisers noticed gross sales per click on within the third week of December soar relative to 2020, the precise reverse of the development a 12 months prior.

Waiting for this 12 months’s vacation season, we count on transport cutoffs to be extra consistent with 2021 than 2020, such that advertisers ought to see the gross sales per click on of adverts maintain up later within the purchasing season.

Now, let’s check out how whole gross sales quantity trended on key days throughout the vacation season final 12 months.

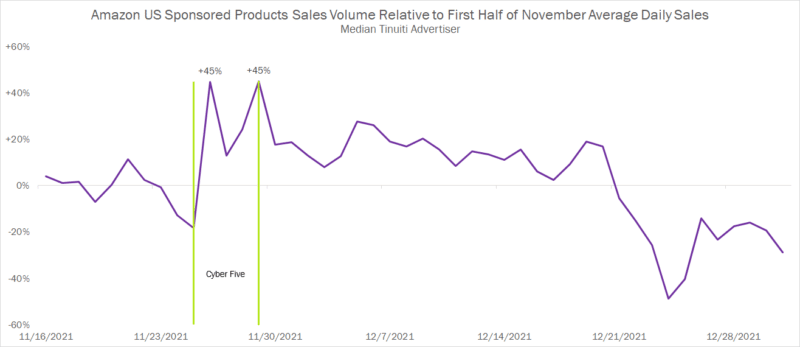

Black Friday and Cyber Monday are tops in quantity for many manufacturers

On the subject of the sheer quantity of gross sales attributed to adverts throughout the vacation purchasing season, Black Friday and Cyber Monday (BFCM) proceed to be pivotal elements of total success.

In 2021, the median advertiser noticed gross sales attributed to Sponsored Merchandise adverts rise 45% on each Black Friday and Cyber Monday in comparison with common each day gross sales for the primary half of November.

Whereas we’re utilizing median right here to convey how massive these two days are for middle-of-the-pack advertisers, the surge in gross sales was actually a lot bigger for some manufacturers than others.

35% of sponsored merchandise advertisers noticed Black Friday gross sales greater than double in comparison with the primary half of November, and 37% noticed the identical for Cyber Monday.

By way of pure quantity, no different day between mid-November and late December comes near the gross sales attributed to adverts on BFCM for many manufacturers.

It’s doable that the Prime Early Entry Sale in October pulled ahead a few of the quantity that might in any other case occur in November and December.

That mentioned, it’s unclear how that may play out by way of impacting particular days. It’s very probably we’ll nonetheless see Black Friday and Cyber Monday come out on prime in comparison with different days during the last month and a half of the 12 months.

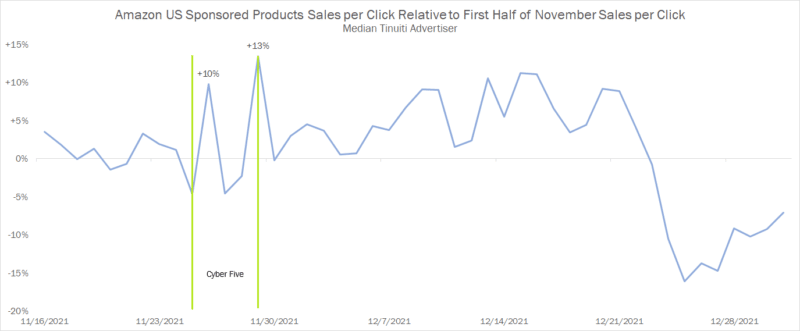

Nonetheless, whole gross sales quantity is just one measure of the chance out there to manufacturers. Gross sales-per-click traits present how extremely beneficial different days will be as effectively.

Get the each day e-newsletter search entrepreneurs depend on.

The worth of advert clicks in late December final 12 months neared Cyber Monday highs

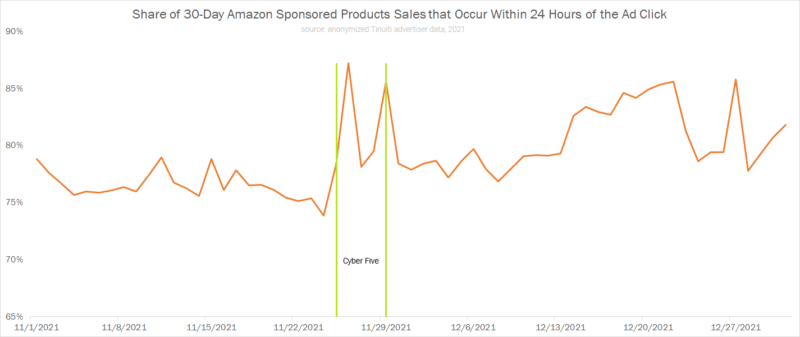

Shoppers are actually able to convert in the case of gross sales holidays like Cyber Monday and Black Friday.

However urgency additionally builds towards the tip of the season, when shoppers are right down to the wire and wish items in time for Christmas and different holidays.

That is clear when wanting on the share of whole gross sales attributed to sponsored merchandise utilizing a 30-day window that occurred inside the first 24 hours of the advert click on. This can be utilized as an indicator of how compelled consumers felt to transform at any given time.

As you’ll be able to see, the share of purchases that occurred shortly after an advert click on went up considerably on Black Friday and Cyber Monday, falling thereafter earlier than rising all through the remainder of the purchasing season till transport cutoffs for Christmas supply got here into impact.

The same development unfolds when taking a look at how gross sales per click on modified over the course of the vacation season final 12 months.

The worth of advert clicks peaked on Cyber Monday for the median advertiser, however a number of days in late December neared this excessive as the worth of advert clicks rose with consumers’ sense of urgency.

However right here’s the catch! A few of the conversions which are attributed to adverts on BFCM or to days simply earlier than the transport cutoff will be partially attributed to advertising efforts that occurred earlier than these key stretches.

For instance, search codecs like sponsored merchandise typically get a lift in efficiency from show campaigns that construct consciousness on and off Amazon previous to the ultimate advert interplay and conversion.

When evaluating alternative, advertisers must look past easy quantity metrics to information technique, particularly in setting bid changes to account for modifications within the anticipated worth of advert clicks.

However they additionally want to know that enhances in gross sales per click on on any given day is likely to be the results of advert interactions on different days that weren’t credited with the sale.

Given totally different sorts of consumers carry totally different lifetime values, manufacturers also needs to look past simply the direct gross sales per click on in assessing how a lot consumers are price throughout totally different durations of the vacation purchasing season. New-to-brand metrics may also help advertisers do exactly that.

New-to-brand clients supply one other incentive for manufacturers to be aggressive on massive days

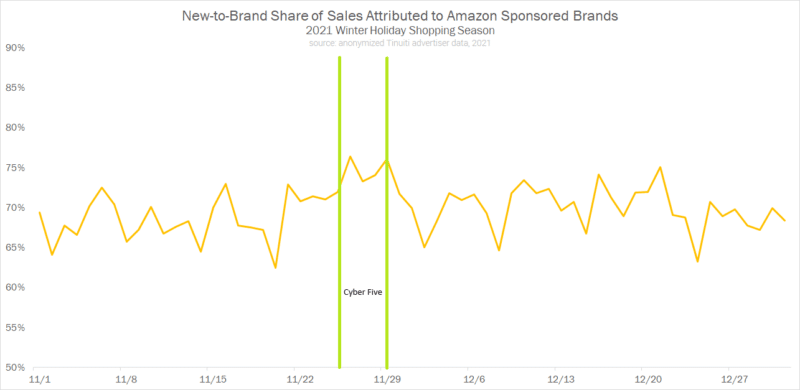

New-to-brand gross sales, outlined by Amazon as these gross sales that come from clients who haven’t bought from a model in at the very least a 12 months, permit advertisers to get a greater sense of what varieties of shoppers their sponsored manufacturers and Amazon demand-side platform (DSP) campaigns are attracting.

Trying on the share of whole gross sales attributed to sponsored manufacturers that got here from new-to-brand clients throughout the vacation purchasing season final 12 months, advertisers discovered the best share days between the start of November and the tip of the 12 months got here on Black Friday and Cyber Monday, which each noticed 76% of gross sales attributed as new to model.

A detailed third place went to Dec. 21 at 75% new-to-brand share, as consumers appeared extra prepared to buy from new manufacturers as they secured last-minute items.

New-to-brand share was the bottom (62%) over the last two months of the 12 months on Nov. 20, the Saturday earlier than Thanksgiving.

These traits differ by the advertiser, and swings will be rather more vital for some manufacturers than others.

Taking a look at how new-to-brand share has trended throughout previous vacation seasons ought to assist inform when manufacturers ought to alter technique this go round.

Vacation gross sales takeaways for Amazon advertisers

There are a variety of unknowns heading into the vacation purchasing season in 2022, particularly concerning how effectively the financial system as an entire will maintain up.

Even so, manufacturers ought to nonetheless perceive how current efficiency has trended throughout the core weeks of This autumn prior to now. 2021 is probably going a good indicator of how totally different days will evaluate to 1 one other in 2022.

Key days like Cyber Monday and Black Friday nonetheless play a significant function, with gross sales quantity for these two days far eclipsing that of different days throughout the vacation purchasing season.

As such, manufacturers ought to have a method in place for taking advantage of the surge in purchasing intent that comes with these gross sales holidays.

That mentioned, advertisers can discover gold within the type of larger gross sales per click on and elevated new-to-brand buyer share at different factors in This autumn.

Amazon entrepreneurs ought to look into 2021 knowledge as quickly as doable to get a way of when to hit the gasoline on promoting.

Opinions expressed on this article are these of the visitor creator and never essentially Search Engine Land. Employees authors are listed right here.

New on Search Engine Land