The vacation season is a fancy time of 12 months for retailers in any financial system—however in 2022, record-high inflation, blowback from international provide chain disruptions, and an intensely aggressive labor market threaten to take the “glad” out of holidays earlier than the season even begins, new analysis from multinational tech agency UKG finds.

Within the agency’s new report, Retail’s 2022 Vacation Season Outlook, retailers say they’re dedicated to elevating the shopper expertise in shops for the vacations—it’s their #1 precedence for the season—and 91 p.c agree retailer staff are instrumental to bringing these experiences to life. Nonetheless, 84 p.c of shops acknowledge that buyer expectations as we speak are increased than what their shops can ship by way of service (up from 75 p.c in 2021).

The agency’s third-annual retail vacation season survey and pattern report finds many U.S.-based retail shops are struggling to satisfy gross sales objectives as a result of they’re brief staffed (80 p.c, up from 68 p.c in 2021) and say clients will doubtless really feel the influence of those labor challenges when looking for the vacations (72 p.c).

Nearly all retail shops might be understaffed at the least as soon as per week all through the vacations

Regardless of their finest efforts, 95 p.c of shops predict weekly understaffing in shops throughout the vacation season. One in 10 (11 p.c) say shops might be understaffed 5 days per week minimal, and almost 1 in 3 (29 p.c) are making ready to be short-staffed “most weekends.” To assist fill labor gaps throughout their busiest months, 77 p.c plan to faucet gig employees, and retailers estimate on-demand expertise may symbolize as much as 14 p.c of their whole in-store workforce for the 2022 season.

Do folks wish to work in retail anymore?

Wanting again, 36 p.c of shops needed to alter retailer hours in 2022 because of inadequate staffing, and almost 1 in 5 (19 p.c) stated their shops have been understaffed at the least half the time in August. Explosive turnover, worker ghosting, and unplanned absences are all partially accountable. The month-to-month UKG Workforce Exercise Report equally highlights a gradual decline in retail shift work all through 2022, together with a 3.1 p.c drop from August to September.

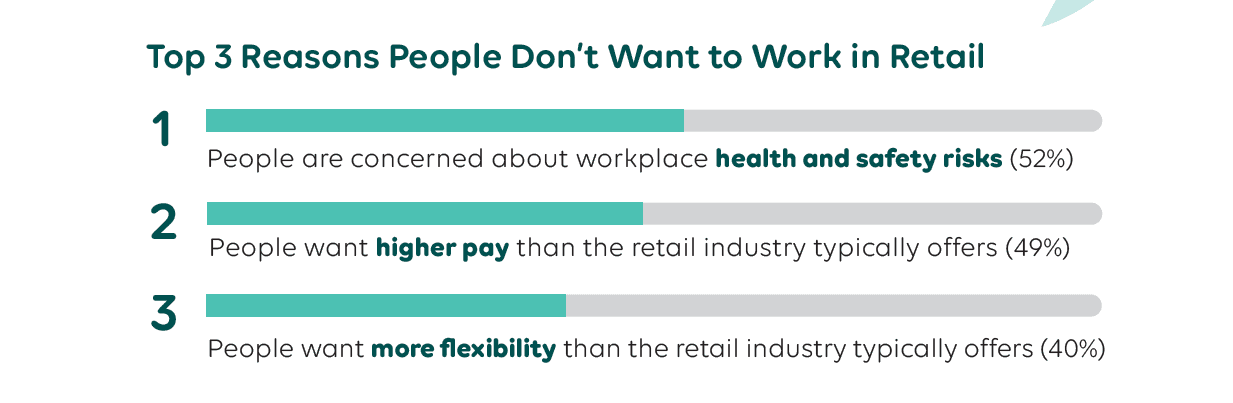

Taking inventory of current staffing patterns, near two-thirds of shops (63 p.c) get a vibe that individuals simply don’t wish to work in retail anymore—a choice they really feel is primarily motivated by issues about office well being and security dangers, equivalent to catching COVID-19 or coping with hostile clients (52 p.c), in addition to a want for elevated pay (49 p.c) and suppleness (40 p.c).

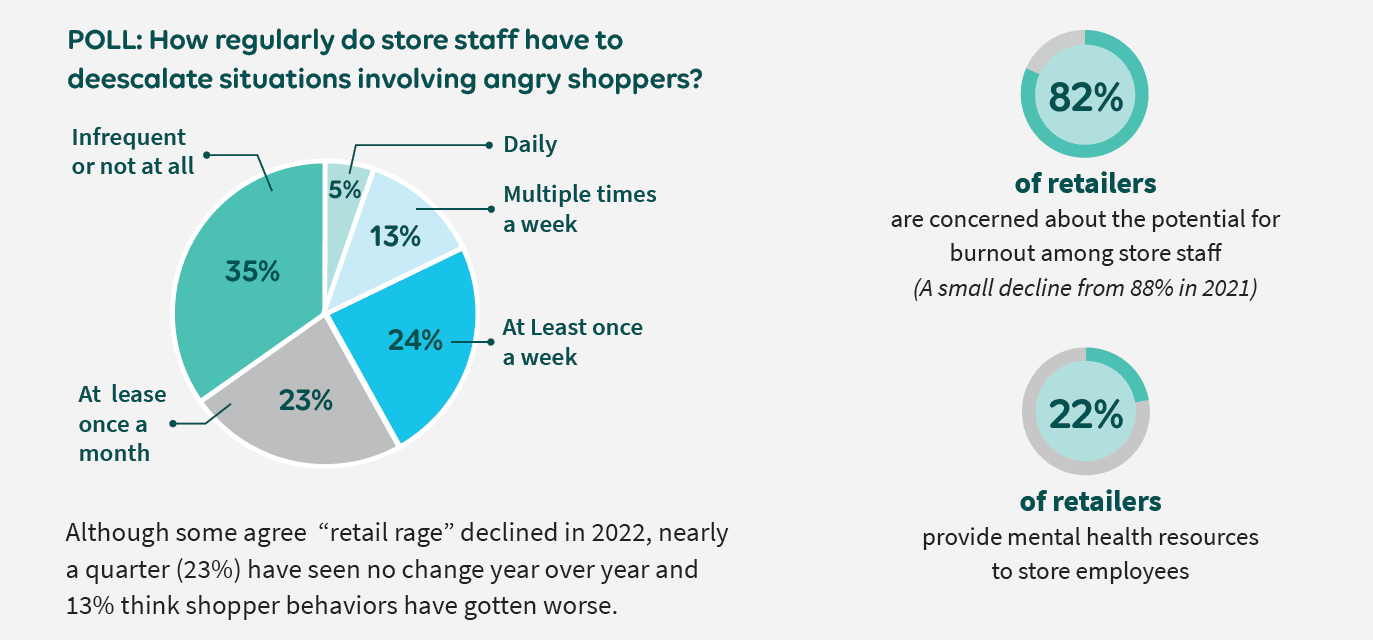

A pandemic-era rise in retail theft and guest-on-associate violence poses actual impacts to staff’ bodily and psychological well being. Retailer workers are responding to conditions involving offended consumers as soon as per week or extra, in response to 42 p.c of shops, and 13 p.c say shopper habits has gotten worse lately, not higher. Practically a 3rd of shops (31 p.c) stated retailer managers give up prior to now 30 days as a result of they have been mistreated by clients.

Retailer managers are additionally quitting in the hunt for higher schedule flexibility, in response to 50 p.c of shops. Jobseekers more and more need flexibility to work the shifts they need (39 p.c agree it is a prime consideration), and the survey reveals quite a few alternatives to capitalize on this unmet demand to draw and retain expertise (e.g., providing on-demand employment in home, permitting staff to self-schedule), as detailed in the report.

“Understanding why persons are gravitating away from retail work or leaving their employer in the hunt for a greater different is step one towards fixing the office expertise and growing a protected and comfy surroundings for workers to work and clients to buy,” stated Rob Klitsch, director of the retail, hospitality, and meals service follow at UKG, in a information launch. “Worker expertise determines buyer expertise, so to enhance the latter, retailers should handle their folks’s wants first.”

Retailers hesitant to rent amid financial uncertainty

Put in a troublesome place, retailers strategy vacation hiring with warning.

- Solely 40 p.c say their shops are hiring seasonal employees for the vacations, and 35 p.c will recruit fewer seasonal employees than final 12 months.

- A 3rd (33 p.c) are scaling again all hiring in shops for the rest of 2022, and greater than 1 / 4 say in-store hiring freezes are doubtless (26 p.c). One other 26 p.c are actively taking steps to scale back headcount as we speak.

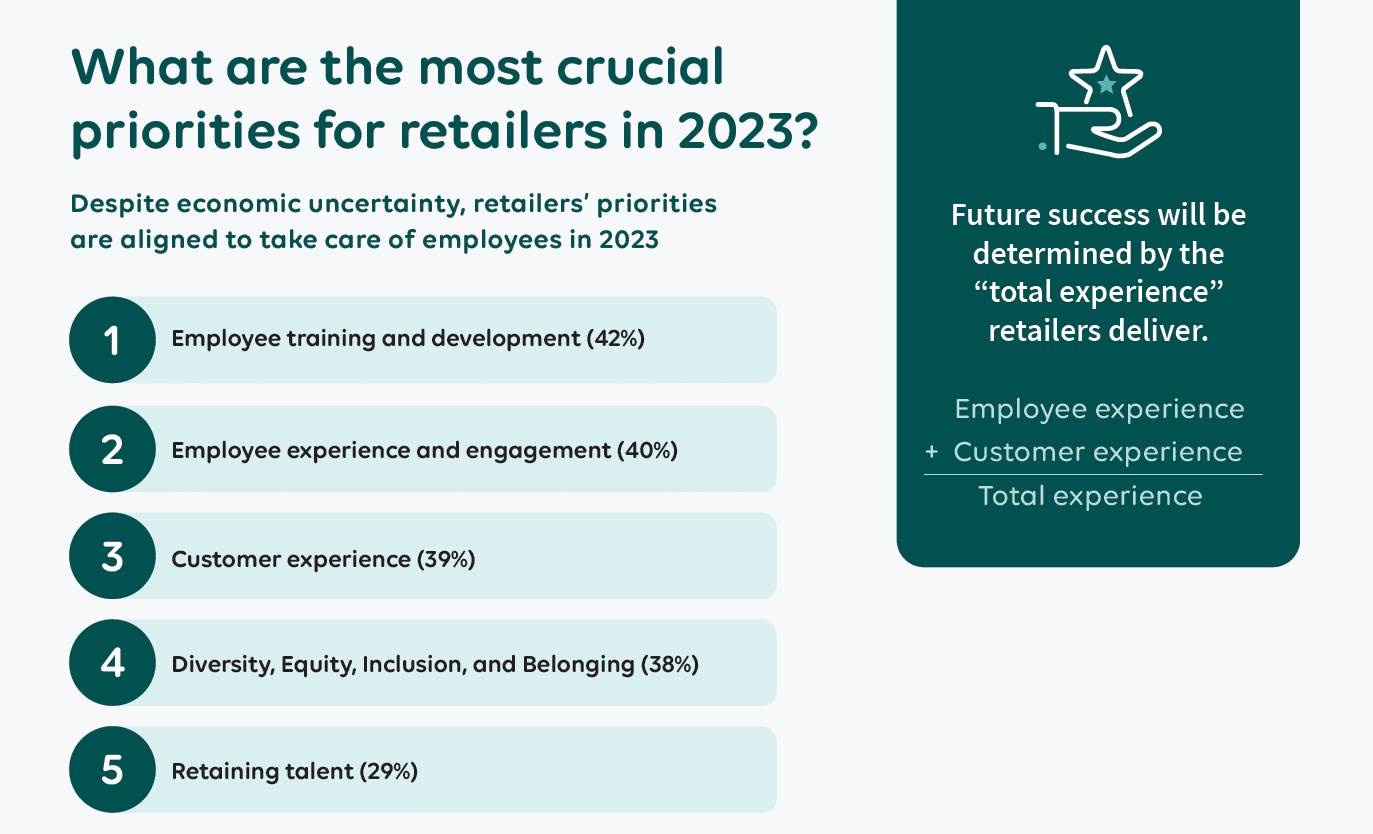

Future success might be decided by “whole expertise”

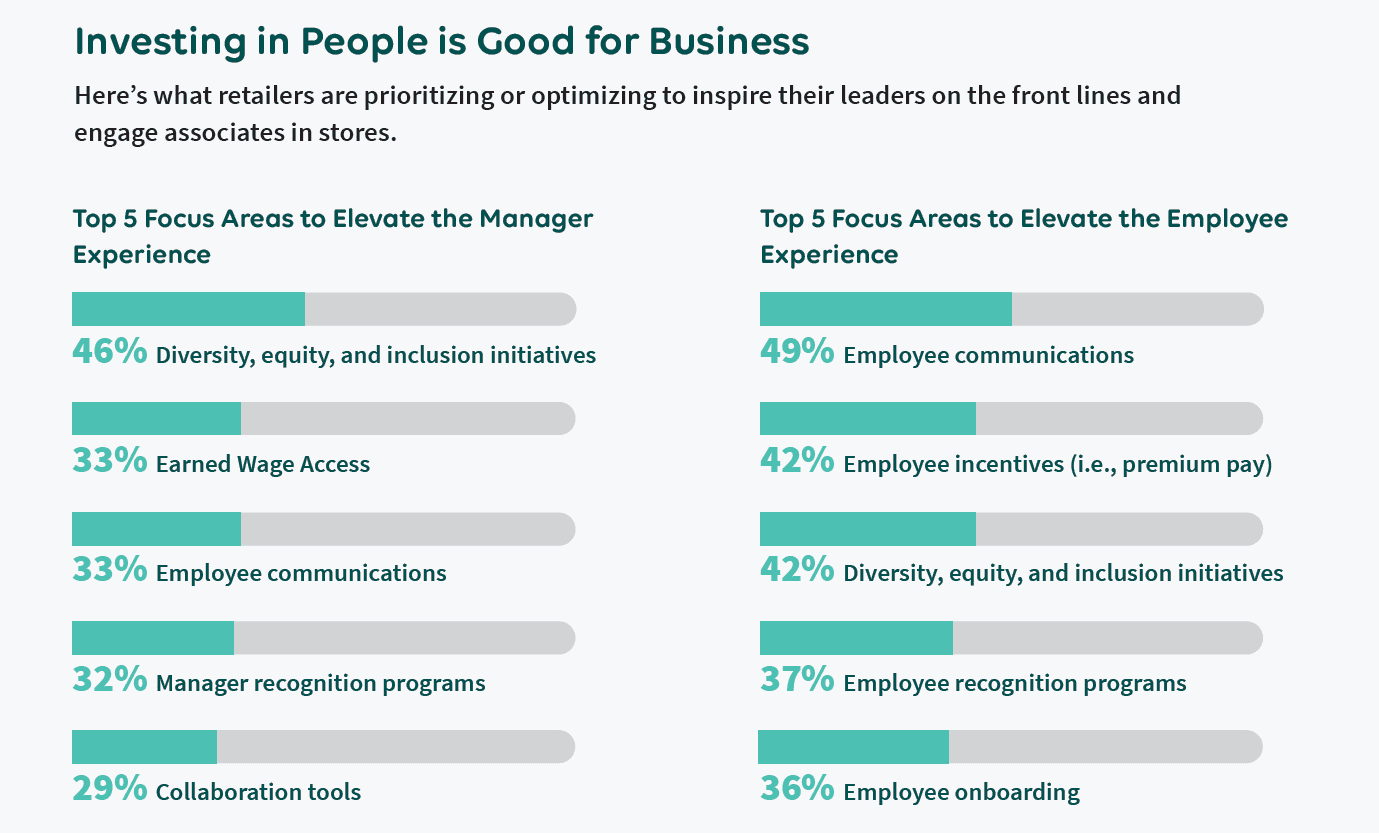

Priorities for retailers in 2023 are aligned to offer a strong whole expertise for folks to buy and work: their prime three initiatives span worker coaching and improvement (42 p.c), worker expertise and engagement (40 p.c), and buyer expertise (39 p.c).

“Bringing distinctive experiences to life for managers, staff, and clients concurrently is significant year-round. The secret’s to hear, undertake, and adapt rapidly, as a result of the way forward for work is now,” stated Klitsch.

Obtain the total report right here.

This survey was commissioned by UKG and carried out on-line between August 31 and September 9, 2022, amongst a pool of 305 retailer managers, homeowners, and executives representing U.S.-based retailers spanning quite a few business segments, together with big-box retailers, malls, drugstores, and others specializing in attire, electronics, furnishings, house, luxurious, low cost, and sporting items. Round one-third of shops surveyed (31 p.c) have greater than 25 shops, 56 p.c make use of greater than 500 staff, and 42 p.c % function a distribution heart or warehouse.