Fandom is constructing out a full-funnel providing for entrepreneurs. And its acquisition of a number of media manufacturers from Crimson Ventures is the newest step ahead in that initiative.

On Monday, Fandom snapped up GameSpot, Metacritic, TV Information, GameFAQs, Large Bomb, Wire Cutters Information and Comedian Vine from Crimson Ventures.

Fandom paid within the “mid 50s” vary, or greater than $50 million, in money, in accordance with a Fandom spokesperson.

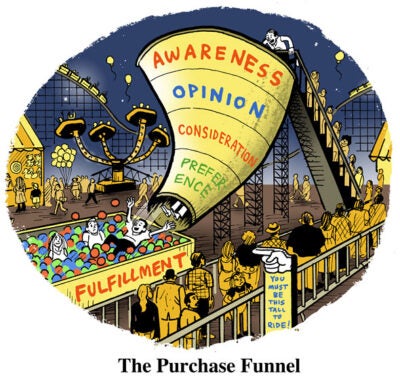

The acquisition improves Fandom’s attain amongst fan communities, which can complement its providing for entrepreneurs all through their journey by means of the advertising and marketing funnel, stated Fandom CEO Perkins Miller.

“We have now manufacturers that catch you at totally different factors of intent,” Miller stated. “We are able to meet a fan at totally different components of their journey and provide advertisers that 360-degree, full-user-journey bundle.”

For instance, avid gamers might go to GameSpot for the newest information on upcoming releases, then later go to Metacritic and Large Bomb to take a look at evaluations earlier than committing to creating a purchase order, Miller stated. Advert messages might be tailor-made to those customers relying on the websites they go to and the place they fall in that buy journey.

Fandom tasks that the power to do intent-based advertising and marketing will even enhance affiliate gross sales on Fanatical, an ecommerce platform Fandom acquired in February 2021, Miller stated.

“It looks as if a reasonably quick stroll to go from GameSpot, Metacritic or Large Bomb and into Fanatical to buy a recreation,” Miller stated. “So, we expect that connective tissue goes to be fairly robust.”

The brand new slate of web sites may have a “important influence” on the corporate’s backside line, Miller stated, though he declined to share specifics concerning the influence on Fandom’s total advert income.

Information-based segmentation

Fandom additionally plans to make use of the acquisitions to collect a broader array of first-party knowledge, which can span 350 million customers and 50 million to 60 million pages of content material, Miller stated.

Fandom will monitor on-site person conduct, together with the contextual knowledge on websites visited, and use that knowledge to energy its FanDNA first-party knowledge platform.

Fandom makes use of these knowledge factors to create contextual focusing on segments. These segments embrace typical fodder like “Harry Potter followers,” or they are often much more esoteric, focusing on people who find themselves usually keen on wizardry.

Entrepreneurs can use the FanDNA platform to search out lookalike audiences to focus on throughout Fandom’s portfolio of web sites, Miller stated. This may be useful for leisure manufacturers seeking to mitigate churn in a market saturated with subscription choices and media to eat, he stated.

It’s not but clear how Fandom will change the advert expertise on its new acquisitions. Fandom’s user-edited wikis characteristic distinguished “adhesive” video and show advert models that maximize viewability and video completion price (VCR).

These advert placements are the results of an in depth testing course of in cell and desktop environments to “get the best diploma of visibility with out impairing engagement,” Miller stated.

However adhesive models don’t essentially attraction to avid gamers, a key viewers phase for Fandom and one which’s typically stereotyped as finnicky and fast to make use of advert blockers. In response to the acquisition, critics of Fandom’s advert expertise posted their considerations that the corporate will saturate its newly acquired websites – like GameFAQs, which is lauded for its low advert influence and minimalist design – with takeover codecs and sticky advert placements.

Slightly than apply the Fandom wiki advert expertise throughout its newly acquired portfolio of manufacturers, Fandom will as an alternative conduct an identical testing course of for every of its media properties to search out an advert expertise that delivers in opposition to advertising and marketing KPIs with out interfering with finish person intent, Miller stated.

“Individuals discover the trail of least resistance to get to the content material they love,” he stated. “We undoubtedly don’t consider in ‘one measurement suits all,’ so we’ll be doing the identical analysis with the groups at GameSpot, Metacritic and the others to determine the appropriate construction to seize that intent.”

On the editorial aspect, Fandom plans to have a lightweight contact, Miller stated. He declined to invest about editorial adjustments, staffing cuts or additional M&A exercise.

“The objective is to proceed the nice momentum and the constructive work of those companies during the last yr,” Miller stated. “So, job one is don’t break something.”