In some ways, 2020 was an uninvited visitor who overstayed their welcome into 2021. Three earlier fiscal quarters of widespread lockdowns and hiding from COVID gave option to a 12 months of adaptation for the worldwide direct promoting {industry}.

Direct sellers throughout the globe emerged into the daylight to face ever-changing, mid-pandemic operational environments and in some markets, post-pandemic enterprise climates that introduced pretty massive swings in gross sales efficiency—some for the higher and a few for the more serious.

Well being-related COVID considerations, provide chain disruptions, manufacturing shortages, stalled shipments, ever-increasing prices—these have been industry-wide hurdles confronted all over the place, however not essentially all over the place on the similar time. That depended upon native authorities priorities, which ranged from transferring swiftly to re-open economies to additional lockdowns with the intention to beat the virus, which in flip continued financial strain.

This varieties the context round which the World Federation of Direct Promoting Associations performed its 2021 world gross sales survey. This cooperative survey reveals an annual snapshot of a whole 12 months’s direct promoting exercise internationally, in a single set of figures, submitted by native DSA member firms. Then compiled by the DSA to replicate nation gross sales efficiency, it’s later extrapolated into regional and world gross sales information. In some cases the place DSAs don’t exist or lack staffing, WFDSA’s CEO Council performs an advisory function in estimating market gross sales.

WFDSA’s report, introduced earlier this summer time and legitimate by Might 2023, reveals slim world {industry} growth made up of some pretty huge positive factors and losses, which World Analysis Subcommittee Co-Chair Tim Sanson believes was reflective of the social and political method to the pandemic.

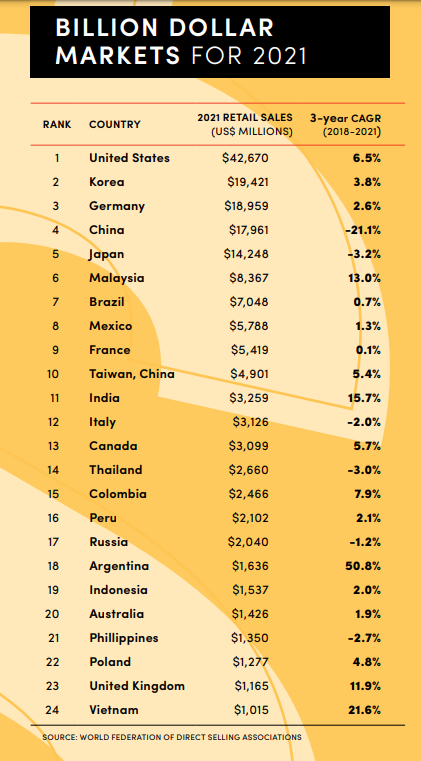

It’s in these positive factors and even these losses that Direct Promoting Information constructs its 2021 checklist of Billion Greenback Markets, which expanded this 12 months to a complete of 24 with the addition of Vietnam. WFDSA information reveals that 78 p.c of world gross sales manufacturing comes from the highest ten world markets, of which america sits atop.

The Information

Observe: All WFDSA information have been rounded all through.

WFDSA reviews world estimated retail gross sales of $186.1 billion (Fixed U.S. {Dollars}) for 2021, a rise of 1.5 p.c over 2020.

This determine contains information from the China market; nevertheless, resulting from its sheer dimension, lack of transparency and continued COVID struggles, WFDSA opted to announce twin figures—with and with out China—to make seen the results this market has on regional and world information.

Subsequently, excluding China, world estimated retail gross sales for 2021 have been $168.1 billion with a three-year compound annual progress charge (CAGR) of three.8 p.c for the interval 2018-2021.

Regional gross sales efficiency was a combined bag in 2021. Estimated retail gross sales in The Americas was up 5.8 p.c and Europe gained 2.8 p.c. Nonetheless, Asia/Pacific was impacted by important losses in China, its largest market, and reported regional losses of two.2 p.c consequently. Rising markets in Africa/Center East reported losses of 10 p.c.

World {industry} progress, measured by the 3-year CAGR signifies a static environment for the 2018-2021 interval.

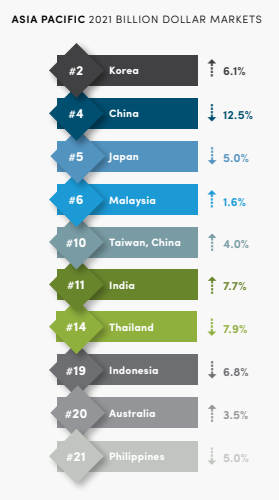

Important positional shifting inside DSN’s Billion Greenback Markets checklist passed off this 12 months, most notably the autumn of China to fourth place on account of compounded multi-year losses, and the following rise of Korea to quantity two. Total, the Asia/Pacific Billion Greenback Markets struggled, as Japan, Indonesia, Australia, the Philippines and Thailand all suffered losses. Nonetheless, the image within the Americas and Europe was considerably brighter as each Billion Greenback Market, except for Brazil and Russia, gained floor.

Of the 24 Billion Greenback Markets, america leads world retail gross sales at 23 p.c, adopted by Korea, 10 p.c; Germany, 10 p.c; China, 10 p.c; Japan, 8 p.c; Malaysia, 4 p.c; Brazil, 4 p.c; Mexico, 3 p.c; France, 3 p.c; and Taiwan, China 3 p.c. All different reporting markets comprise the remaining 22 p.c of world gross sales.

128.2 million impartial representatives participated in direct promoting worldwide in 2021. These impartial representatives affiliate with a direct promoting firm however benefit from the freedom of constructing a enterprise on their very own phrases and time.

Many be part of as a result of they love the corporate’s services or products and wish to buy them at a reduction. Forty p.c of world markets reported energetic most popular buyer applications in 2021, in keeping with 2020’s statistic. Nonetheless others work both full- or part-time to earn supplemental revenue. Essentially the most profitable of those sponsor different impartial representatives and mentor them into constructing profitable companies, too.

/ AMERICA /

The Americas—North and South/Central—mixed to put up $68 billion in estimated retail gross sales in 2021—36 p.c of direct promoting’s world market gross sales. This was a rise of 5.8 p.c and resulted in a three-year CAGR of 5.4 p.c.

There have been seven Billion Greenback Markets throughout the North and South/Central America area for 2021, duplicating 2020. A surge in Wellness product reputation has for the second 12 months ranked primary at 30 p.c. Cosmetics comprised 28 p.c with Family Items and Durables a distant third at 13 p.c for the second 12 months. The variety of impartial representatives within the Americas primarily ran even in 2021 at 32.4 million, however confirmed a acquire of some 3.6 million representatives since 2018.

Regional information for the Americas reported collectively; nevertheless, the Americas are cut up right here to higher perceive every of the distinct markets.

North America

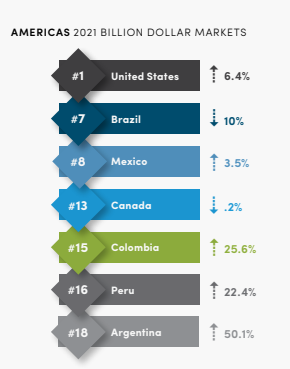

On the heels of a pandemic-related gross sales spike of 14.7 p.c in 2020, the North America market continued its growth in 2021, reporting $46 billion in gross sales and year-over-year progress of 5.9 p.c, even because the {industry} started an anticipated post-pandemic normalization.

The US’ 23 p.c share of worldwide gross sales for 2021 was as soon as once more a reminder of its world {industry} dominance. The U.S. market rapidly normalized conducting enterprise amid a pandemic throughout 2020 and additional sorted out any remaining kinks final 12 months to generate $42.6 billion in gross sales in 2021, progress of 6.4 p.c year-over-year and a 3-year CAGR of 6.5 p.c.

The 26 p.c gross sales progress registered by Canada in 2020 slipped in 2021 to -0.2 p.c, but generated estimated retail gross sales of $3.3 billion, rising 3-year CAGR to five.7 p.c.

Wellness merchandise have been by far the preferred in North America garnering 36 p.c of all {industry} estimated retail gross sales in 2021. Family Items and Durables ranked second at 15 p.c and Cosmetics third at 14 p.c.

Unbiased consultant numbers for North America fell by greater than 600,000 in 2021, which returned this statistic to 2019, pre-pandemic ranges. 16.2 million impartial representatives resided in america—almost a half million fewer than 2020—and the remaining 1.3 million referred to as Canada house.

South/Central America

Brazil, Mexico, Colombia, Peru and Argentina comprise the South/Central America area. Their gross sales performances in 2021 produced astounding nation market expansions, a rally to beat earlier 12 months losses, in addition to typical incremental will increase and regional disappointments.

Argentina’s notable 90.3 p.c 2020 gross sales progress was adopted in 2021 by a 50.1 p.c enhance, increasing this market’s CAGR to 50.8 p.c. Whereas it’s necessary to notice the extremely inflationary elements of Argentina’s market, these will increase proceed to face out.

Colombia additionally skilled important growth as they added almost half a billion in gross sales, which equaled a 25.6 p.c year-over-year enhance. Peru, one other of 2021’s gross sales winners, rallied after a 2020 downturn to mark a 22.4 p.c enhance in gross sales over the earlier 12 months, which bounced their CAGR into constructive territory at 2.1 p.c.

Brazil, nevertheless, skilled a sizeable downturn in gross sales efficiency in 2021, dropping almost $800 million in gross sales. That’s a market lack of 10 p.c year-over-year.

Regionally, estimated retail gross sales for South/Central America have been up 5.6 p.c, reporting in at $22 billion in 2021 with a CAGR of three.5 p.c.

Particular person nation market statistics are: Brazil ($7.0 billion, 3.8 p.c of world market, 0.7 p.c CAGR), Mexico ($5.8 billion, 3.1 p.c of world market, 1.3 p.c CAGR), Colombia ($2.5 billion, 1.3 p.c of world market, 7.9 p.c CAGR), Peru ($2.1 billion, 1.1 p.c of world market, 2.1 p.c CAGR), and Argentina ($1.6 billion, 0.9 p.c of world market, 50.8 p.c CAGR). Inflationary economies like Argentina sometimes report restated information later within the 12 months.

Cosmetics and Private Care merchandise as soon as once more dominated regional gross sales at 58 p.c however continued trending slowly downward since 2017’s 67 p.c excessive. Wellness ranked second at 17 p.c, whereas Clothes and Equipment slotted third at 11 p.c. After a 2020 surge in recruitment that noticed 14.4 million impartial representatives, 2021’s figures as soon as once more elevated to 14.9 million.

/ ASIA PACIFIC /

The Asia/Pacific area—comprised of 10 Billion Greenback Markets—generated 42 p.c of world retail gross sales in 2021. Estimated retail gross sales of $77.9 billion in 2021, a lower of two.2 p.c, marked the fourth consecutive regional gross sales constriction for a market that boasted 48.7 p.c of world retail gross sales in 2018. The Asia/Pacific area’s three-year CAGR stands at -5.0 p.c in 2021.

Practically 74.5 million impartial direct sellers represented services within the Asia/Pacific area, a 2.6 p.c enhance over 2020 and accounted for greater than 58 p.c of all direct sellers on the planet. The Wellness product class captured 44 p.c of the market with Family Items and Durables, in addition to Cosmetics and Private Care tied at 20 p.c.

It is important to notice the affect China has on Asia/Pacific’s regional statistics. China is the biggest and most influential Asia-Pacific market, however numerous financial and regulatory situations have been made worse by COVID and the market’s issue rebounding from pandemic.

China’s gross sales fell in 2021 for the third straight 12 months, down 12.5 p.c. Their estimated retail gross sales stood at $18 billion, down from $37 billion in 2018. Their positioning as a constant second place within the general Billion Greenback Markets rankings slipped to quantity 4 and their CAGR sharply declined, posting in at -21.2 p.c. Equally, impartial consultant numbers fell for the fourth straight 12 months to three.1 million.

The Asia/Pacific area feels reverberations from something that takes place within the China market. To get an insider’s look and enhance the consistency and confidence on this market’s information assortment, WFDSA labored with the Direct Promoting Analysis Heart at Peking College for a 3rd 12 months.

Maybe, the largest information out of the Asia/Pacific area was the addition of Vietnam to the Billion Greenback Markets checklist. Whereas the Vietnam market accounted for under 0.5 p.c of the worldwide market, the direct promoting {industry} has incubated there and estimated retail gross sales almost doubled since 2018. 4 consecutive years of double-digit progress culminated in hitting the $1 billion mark in 2021 and reporting a CAGR of 21.6 p.c.

Vietnam joins the ranks of 9 different Asia/Pacific international locations on the Billion Greenback Markets checklist for 2021. The enormity of the Asia/Pacific market ends in volatility because of the intricacies, personalities and environments of every nation market. The impacts of COVID solely accentuated this regional market attribute.

As direct promoting misplaced momentum in China, inflicting it to slide in its Billion Greenback rating, the Korea market noticed a pointy 6.1 p.c rise in gross sales, producing $19.4 billion in gross sales for 2021, which elevated them to the quantity two spot. Whereas progress within the India market slowed after a 28.3 p.c enhance year-over-year in 2020, their 2021 7.7 p.c progress represented a fourth consecutive 12 months of market growth. The Australian market reported its second 12 months of progress in 2021, posting 3.5 p.c year-over-year change and rebounding CAGR of 1.9 p.c after three years within the unfavorable area. Taiwan-China didn’t expertise the identical market constriction as mainland China. In actual fact, the Taiwan market grew by 4.0 p.c over 2020 and indicated a 5.4 p.c CAGR.

There have been, nevertheless, a number of struggling markets within the Asia/Pacific area. Japan’s slide continues for a 3rd 12 months, as estimated retail gross sales dropped 5.0 p.c and their CAGR dipped to a low of -3.2 p.c. The Philippines and Thailand skilled related losses, as did Indonesia—all dropping between 5.0 and seven.9 p.c in 2021.

Asia/Pacific Billion Greenback Markets information reviews as follows: Australia ($1.4 billion, 0.8 p.c of world market, 1.9 p.c CAGR), China ($17.9 billion, 9.7 p.c, -21.2 p.c CAGR), India ($3.3 billion, 1.8 p.c, 15.7 CAGR), Indonesia ($1.5 billion, 0.8 p.c, 2.0 p.c CAGR), Japan ($14.2 billion, 7.7 p.c, -3.2 p.c CAGR), Korea ($19.4 billion, 10.4 p.c, 3.8 p.c CAGR), Malaysia ($8.4 billion, 4.5 p.c, 13 p.c CAGR), Philippines ($1.4 billion, 0.7 p.c, -2.7 p.c CAGR), Taiwan-China ($4.9 billion, 2.6 p.c, 5.4 p.c CAGR), Thailand ($2.7 billion, 1.4 p.c, -3.0 p.c CAGR), and Vietnam ($1 billion, 0.5 p.c, 21.6 p.c CAGR).

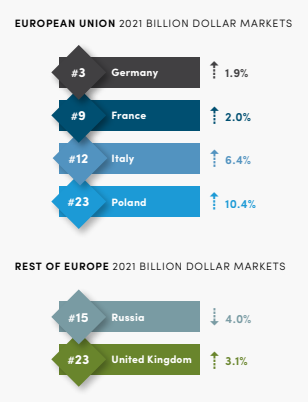

/ EUROPE /

Europe, as an entire, which incorporates nation markets inside and out of doors the European Union, represented 21 p.c of estimated retail gross sales throughout the world {industry}. WFDSA reported direct promoting inside in Europe continued to develop in 2021, posting a 2.8 p.c enhance over the earlier 12 months with estimated retail gross sales totaling $38.4 billion. The area’s CAGR was 2.0 p.c.

An estimated 15.7 million impartial representatives labored in direct promoting all through Europe—6.6 million contained in the European Union and 9.1 million within the Remainder of Europe. Wellness accounted for 31 p.c of market gross sales, adopted by Cosmetics and Private Care at 23 p.c, and Family Items and Durables, 18 p.c.

European Union

European Union nation markets, of which the UK is now not an element, reported $33.2 billion in estimated retail gross sales, a rise of three.3 p.c over 2020. France, Germany, Italy and Poland make up the EU Billion Greenback Markets.

Large information within the EU sub-region got here from Poland, the place a ten.4 p.c enhance resulted in almost $1.3 billion in gross sales. Germany claimed 10.2 p.c of world market and retained its quantity three rank on the 2021 Billion Greenback Markets checklist with $19 billion in estimated retail gross sales. Italy and France each rebounded from slumping gross sales in 2020, up 6.4 p.c and a pair of.0 p.c, respectively.

Remainder of Europe

Segmented into the Remainder of Europe, the UK and Russia are the one two Billion Greenback Markets. This sub-region generated $5.2 billion in estimated retail gross sales, a rise of 1.9 p.c that maintained a 3.3 p.c CAGR for 2021.

Rising strain from the pandemic and financial drivers, which have solely intensified this 12 months resulting from worldwide sanctions, the struggle in Ukraine and the introduced exit of a legacy direct promoting firm from the market, contributed to a 4.0 p.c gross sales drop within the Russian market in 2021. They reported simply over $2 billion in estimated retail gross sales with a CAGR of -1.2 p.c.

The UK skilled 3.1 p.c progress and recorded $1.2 billion in gross sales in 2021. However maybe the largest information right here was the U.Okay.’s 11.9 p.c CAGR. After devastating CAGR’s hovering round -40 p.c in 2018 and 2019, this nation market surged again to report back-to-back years of 8.9 p.c CAGR or greater.

As an entire, the Remainder of Europe didn’t report product class gross sales information. U.Okay. information indicated Cosmetics and Private Care comprised 46 p.c of gross sales, whereas Family Items and Durables and Wellness have been 22 and 21 p.c, respectively. Russia information reported a tie of 36 p.c for Wellness and Cosmetics and Private Care.

Hybrid Attraction Drives 2021 U.S. Development

US DSA Bullish on Direct Promoting’s Future

Regardless of the world gravitating towards eCommerce over the past decade and particularly so throughout COVID instances, direct promoting stays at a aggressive benefit in america as a result of folks aren’t prepared to surrender the private contact fully.

Adolfo Franco, US DSA government vice chairman, believes it’s this marriage that works in direct promoting’s favor as customers get more and more comfy making purchases exterior conventional brick and mortar shops, but additionally need the assistance of trusted advisors after they buy cosmetics and well being, wellness and dietary merchandise.

It’s this hybrid shopper enchantment, together with an more and more common customer-centric, product-focused enterprise mannequin amongst U.S. direct promoting firms, that drives annual {industry} progress.

In 2021, america, the world’s most profitable world direct promoting market, produced $42.7 billion in estimated retail gross sales, a rise of 6.4 p.c year-over-year. The U.S. market decidedly ranks to start with world gross sales markets, based on the World Federation of Direct Promoting Affiliation’s 2021 statistics, launched earlier this summer time.

Wanting again on 2021, the U.S. market was not resistant to pandemic and economic-related points that involved the remainder of the worldwide market.

“The state of affairs, notably in China has been extraordinarily problematic. The variety of containers leaving Shanghai diminished by one thing like 60-70 p.c coming into Los Angeles. Provide chain points are an actual severe concern they usually affect anyone that’s in enterprise, not simply direct sellers. Transport prices are by the roof, and that may be a huge concern too,” Franco shared.

Nonetheless, one benefit that some direct sellers have over different non-direct promoting firms is their means to fabricate their very own merchandise. Some bigger U.S. direct promoting firms management—to some extent—a lot of the provision chain and, as such, a number of the prices.

In spite of those challenges—of which so many nonetheless stay problematic, 2021 gross sales efficiency was good and signifies a wholesome U.S. direct promoting {industry}.

“There’s no query that it’s remarkably higher in comparison with retail and others. So, I believe that we’re very happy with the course that we’re going,” Franco mentioned.

The U.S. gross sales forecast for 2021 was progress between 4 and seven p.c. They hit that mark at 6.7 p.c. Nonetheless, don’t confuse Franco as a Pollyanna voice. He realizes COVID spikes in gross sales have been dramatic and won’t be sustainable year-in and year-out, particularly because the phrase “recession” looms over 2022.

However direct promoting historically does properly amid financial tumult, which traditionally brings extra folks to the ranks as direct sellers. So, it’s a query of taking 2021 progress and bringing it to a stage which stays wholesome, then transferring ahead by this 12 months and subsequent.

“We’re completely bullish on direct promoting. We expect the general substances for direct promoting on this financial local weather are favorable and favor us,” Franco shared.

Zoom Calls Improve Dialogue

Readability—that’s the objective of most information assortment tasks, and particularly so of WFDSA’s annual world gross sales report that compiles statistics from direct promoting associations the world over to summarize the power of the {industry} in any given 12 months.

It’s not stunning {that a} mission this dimension faces many challenges. There are logistical and cultural hurdles related to posing questions in readily understood codecs and utilizing sufficiently outlined and translatable terminology, in order that collected information represents the identical issues in all markets.

“Whenever you ask a query of firms, you do must just be sure you ask broad and broad varieties of questions. There are a variety of terminologies that can be utilized you probably have a direct buyer, for example, and it won’t be perceived as what they decide that to be and what we’re defining as a direct buyer,” Garth Wyllie, WFDSA Chair of the Affiliation Providers Committee, defined.

But it surely’s the matter of context that poses the best problem for these wanting readability about world, regional and nation market efficiency. Admittedly, WFDSA information assortment shouldn’t be meant to dive deep the way in which particular person firms may.

“We solely get to see the tip outcomes, not each nuance or trivialities of what created these finish outcomes,” shared Josephine Mills, WFDSA’s World Analysis Subcommittee Co-Chair.

“So, we now have to attempt to interpret what we’re seeing within the information by additionally what occurred within the exterior atmosphere to assist present context,” mentioned Tim Sanson, WFDSA’s World Analysis Subcommittee Co-Chair.

Zoom calls opened new traces of communication for the subcommittee in 2020, as they related “face-to-face” with far-flung DSAs who may present a lot wanted context for what was taking place on the bottom in nation markets.

In 2021, WFDSA elevated their dialog with DSAs utilizing Zoom, and Mills mentioned, “They appear to be much more comfy with us doing this. They’re studying from us. We’re studying from them. And it’ll solely enhance the method alongside the way in which.”

Depleted inventories, provide chain pressures and even authorities restrictions on the manufacture of non-essential merchandise affected many international locations, Tamuna Gabilaia, WFDSA government director/COO, shared.

“At first of 2021, we have been nonetheless looking for our approach with COVID and beginning to roll out in most elements of the world. What we did discover in our talks with areas, notably Latin America, is that they have been scuffling with lockdowns and restrictions on what they might or couldn’t promote, and truly getting merchandise to or from producers in these markets,” Wyllie mentioned.

“Prices of delivery actually escalated in 2021, and that hasn’t gone away,” Wyllie added.

Anecdotally, they discovered there was a rush to get inventories again in inventory as 2021 progressed however as soon as markets began to open, subject engagement arose as the following problem.

“Individuals had been locked down for a 12 months and a half. They obtained just a little distracted on the enterprise,” Sanson mentioned.

By spending much more time on Zoom calls with DSAs, WFDSA gained higher readability in regards to the statistics and will present higher training and escalate help when vital.

“We wish to try this extra…It’s rather more priceless having a face-to-face dialog exhibiting them how we interpret the info and what we’re seeing and with the ability to present extra context each methods round that,” Sanson defined.

Adaptive, Resilient, Versatile

World direct promoting responds in 2021

2021 was a dynamic time in direct promoting and proved to be a superb 12 months for the worldwide {industry}. Regardless of being one other 12 months influenced by the pandemic—producing deep lows in China, which compounded unrelated challenges from 2019 and triggered ripples of strife all through the Asia/Pacific Area—the worldwide direct promoting {industry} responded with adaptability, flexibility and resilience to maneuver ahead.

“We’ve gotten used to the state of affairs with COVID. We’ve tailored to it higher, and we’ve discovered tips on how to run very well within the COVID atmosphere,” Josephine Mills, WFDSA’s World Analysis Subcommittee Co-Chair, shared.

An enormous differentiator in adaptability in 2021 concerned the distributors’ interface with their prospects and the flexibility of markets to shift and transact remotely, moderately than face-to-face. This largely utilized to much less developed, rising markets in locations like South Africa and Southeast Asia, the place money transactions and residential supply remained the norm.

However all over the place the resistance to eCommerce dissipated as expertise curves have been flattened and direct sellers confronted few choices throughout COVID, based on Tamuna Gabilaia, WFDSA government director/COO. Then got here the conclusion that they might attain much more folks than earlier than.

“The {industry} as an entire could be very resilient and adaptive, has modified when it comes to expertise and expertise use and was able to develop even with all of the challenges they have been dealing with,” Garth Wyllie, WFDSA chair of the Affiliation Providers Committee, mentioned.

Some markets swung excessive leading to a major shuffling of DSN’s Billion Greenback Market Listing. Tim Sanson, WFDSA’s World Analysis Subcommittee Co-Chair, says, “It’s onerous to pinpoint whether or not that’s steady progress or motion of nations up and down merely due to the distinction within the dynamics from market to market.”

Regardless, he felt that, “Total the {industry} is robust. I’m undecided what number of industries confirmed progress throughout that interval, however the general outcomes say a lot.”

Concerning the Analysis

This ANNUAL GLOBAL DATA COLLECTION is an effort initiated and funded below the administration of the World Federation of Direct Promoting Associations (WFDSA) in collaboration with its native member direct promoting associations and their member firms world wide, for the good thing about the DSAs and the worldwide direct promoting {industry}.

Compiled yearly, it is a assortment of particular person market information in native foreign money figures, that are transformed into U.S. {dollars} utilizing present 12 months fixed greenback change charges to eradicate the affect of foreign money fluctuation. All statistics are primarily based on estimated retail gross sales and in some cases could also be restated utilizing precise gross sales information as they develop into obtainable. Statistics for some markets symbolize direct promoting affiliation member firms solely and never all the {industry} in that nation. Different statistics are WFDSA analysis estimates.

From the September 2022 concern of Direct Promoting Information journal.